✍️ Maverick Charts – Macro & More – August 2023 Edition #10

Dear all,

your monthly Top 20 Macro & More charts from around the world + 5 Bonus!

-

GDP is expected to be +positive in all G7 countries in the third quarter of 2023

-

Fund Manager Survey: expectations for the global economy are fading

👉 after in 2022 we had ‘the most anticipated recession ever’ that never came …

👉 more on that in case you missed it ✍️ The State of the US Economy in 35 Charts ✍️

-

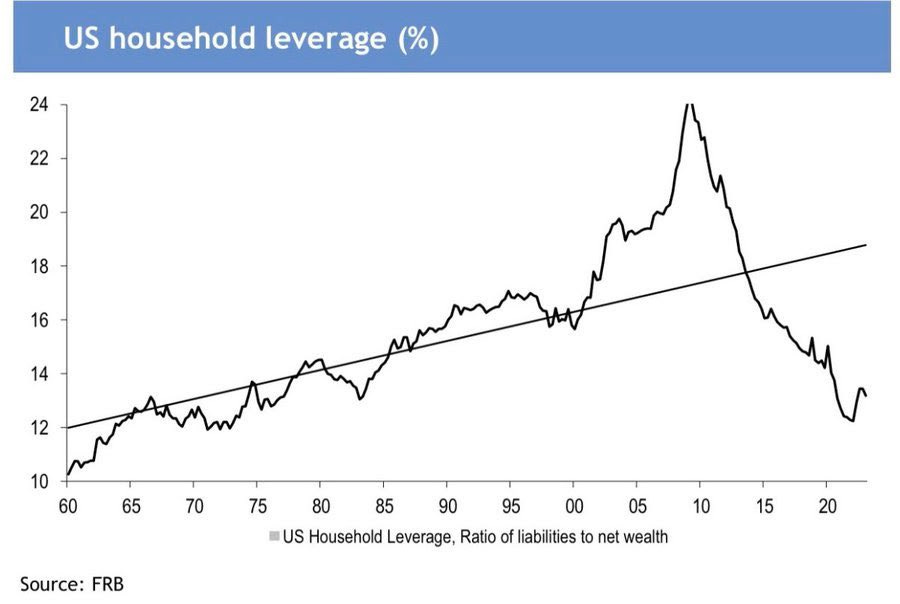

US Households Leverage:

👉 Liabilities to Net Wealth is down to 13%

👉 = lowest since the 1980 and materially below the trendline … not bad at all to see …

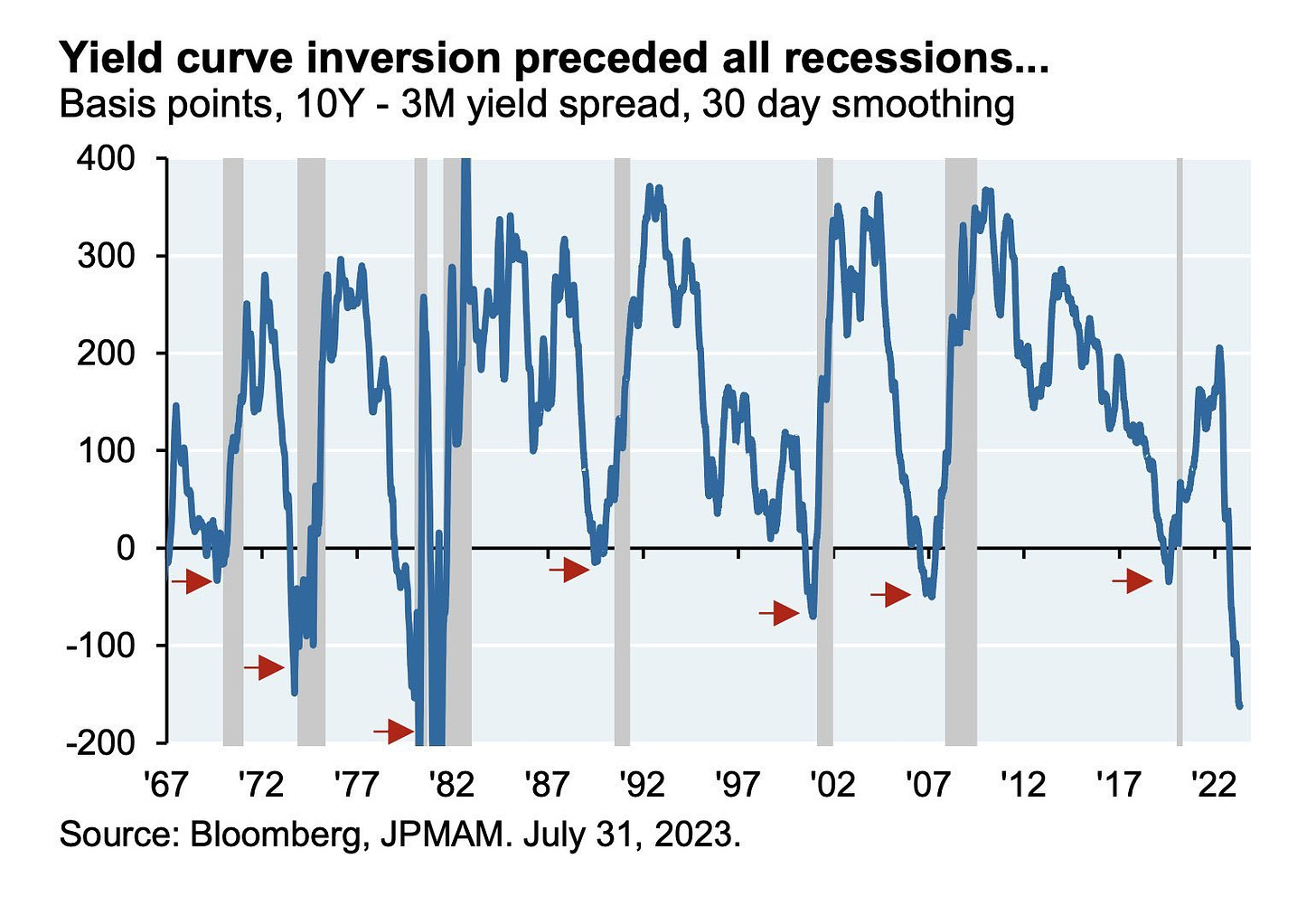

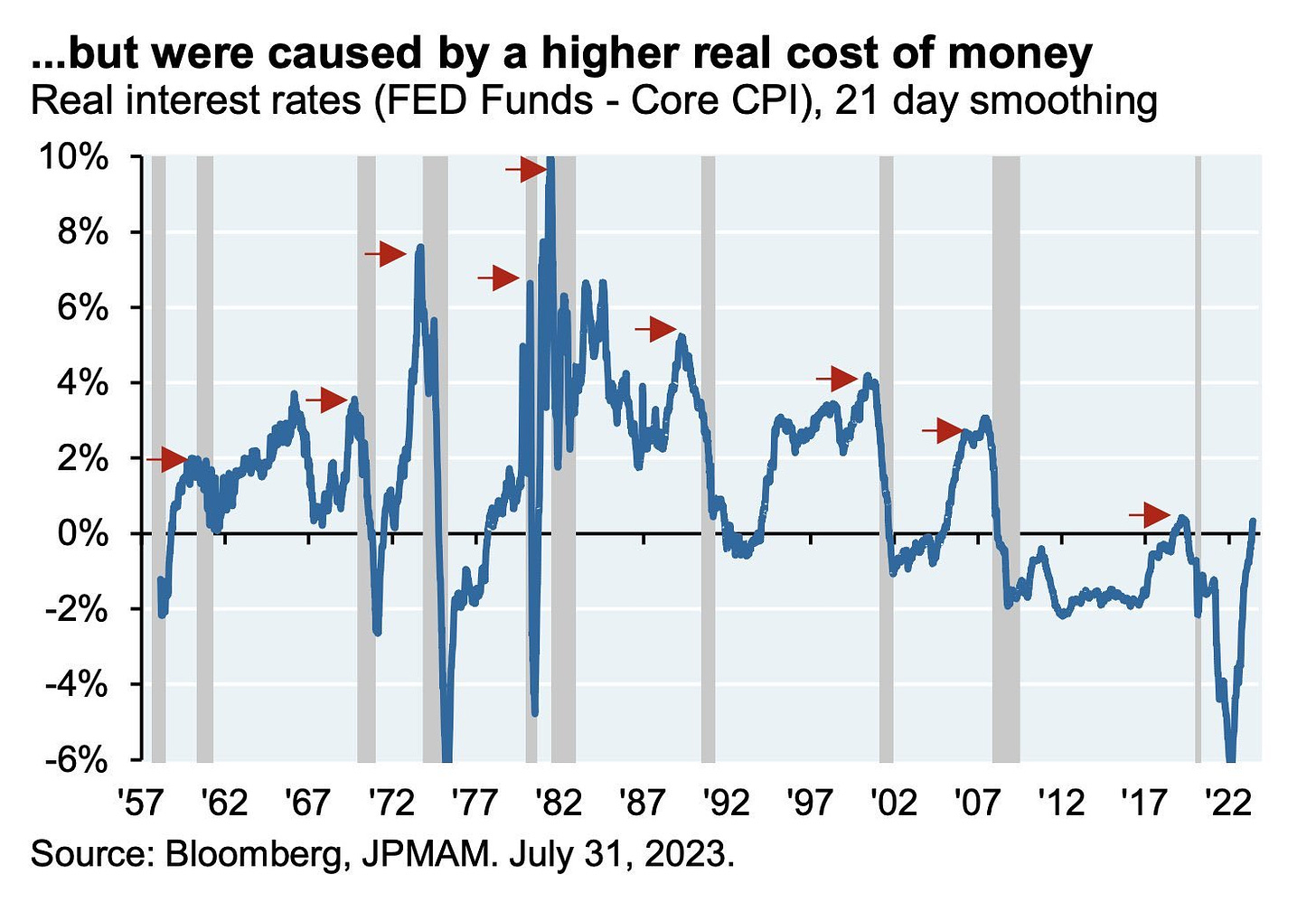

4 & 5 & 6. Magic magic Yield Curve, what are you telling us these days?

👉 a recession is coming this time also, or

👉 you inverted this time like Maverick in Top Gun and showing us the birdie?

Why am I asking? That is because Yield curve inversions preceded all recessions since the 1960s

👉 THOUGH a very important note here which you do not see much around

-

they were caused by a higher real cost of money (FED funds – Core CPI)

-

which ain’t high these days, right?

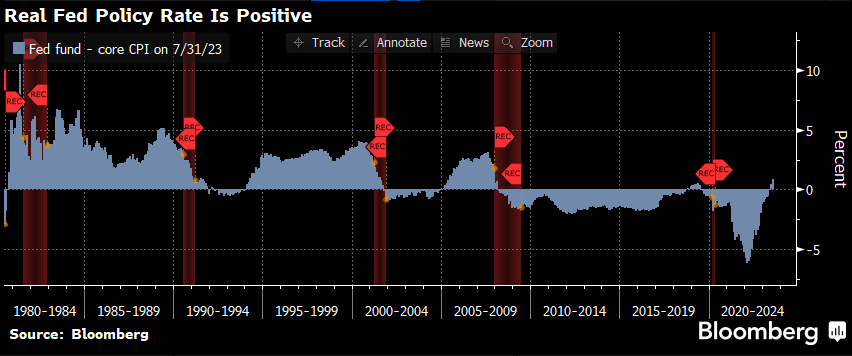

Bloomberg complementary view for the Real FED policy rates since 1980:

-

And yes, Bonds Are Back and they pay investors:

👉 US 10-year real yield at 2% pay over inflation

👉 highest levels since 2009

N.B. working currently on Special Report entirely dedicated to Bonds, stay tuned…

-

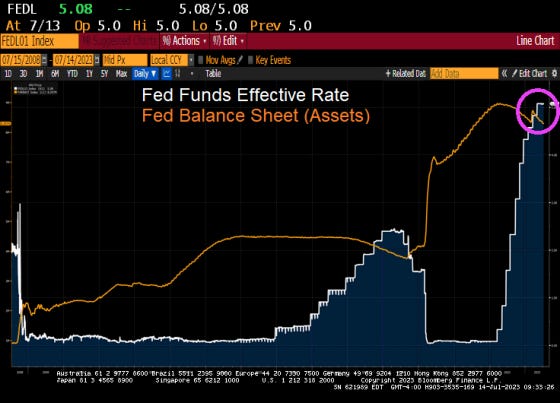

FED Balance Sheet & Fed Funds Effective Rate:

👉 still about $8.3 Trillion in monetary stimulus sloshing around the monetary system

👉 likely heading south and going inverted … like Maverick in Top Gun 😉

-

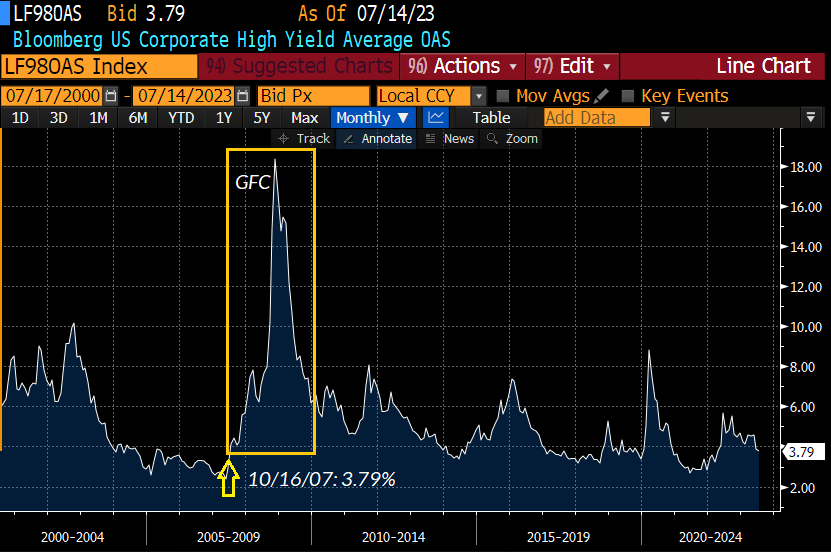

Now this is a funny & popular chart that I kept getting asked to have my take on:

👉 Corporate High Yield at 3.79% and at the exact level from 2007 right before yields spiked and we had the Great Financial Crisis when Lehman imploded

-

3.79% is not some magic indicator, but a value that we were bound to have naturally in 15 years+ since Lehman imploded

-

it’s not the first time since we have the 3.79% value, hence why it did not spike before and ‘foresee’ a recession or ‘cause’ it?

-

recall: banking system is way more solid today than back then, no comparison

Overall, it’s a headlines nice looking chart, but no informational/research value imho.

-

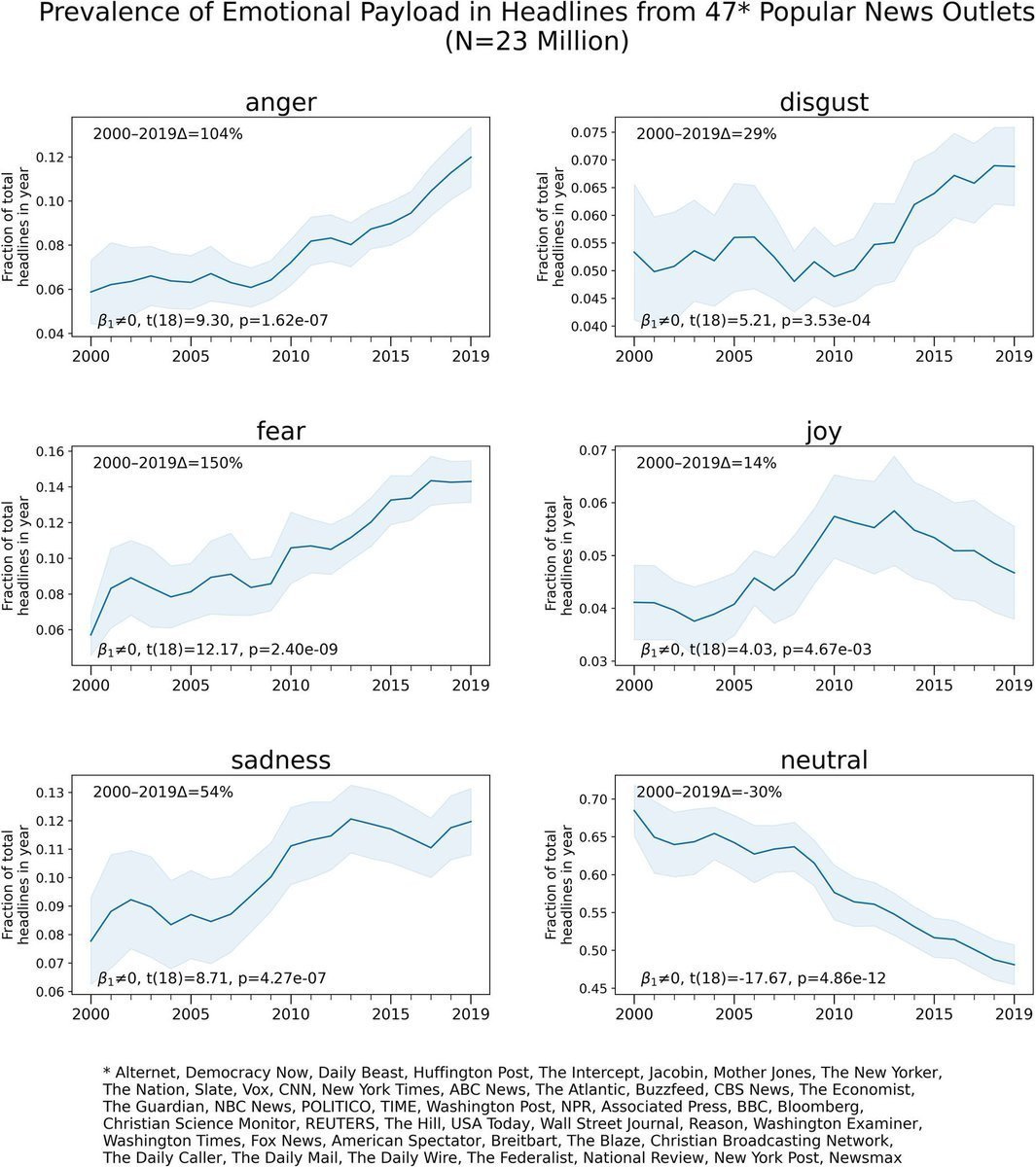

The Media chasing clicks & eyeballs for money = The Rise of NEGATIVE Media

👉 since 2000, the media massively increased headlines that use fear, anger, disgust, and sadness: anger +104%, fear +150%, disgust +29% & sadness +54%

👉 and in the same time it has also decreased articles of neutrality and joy

= the media is deliberately pushing your buttons as humans around the world are more activated by negative news coverage, hence creating a perverse incentive to spread gloomy content; no surprise no/few media outlets are covering this key point

N.B. don’t be ‘the product’ via spread fear, anger, sadness & disgust coverage of all kind because it = them making $ money on you, it’s the new ‘normal’ nowadays

-

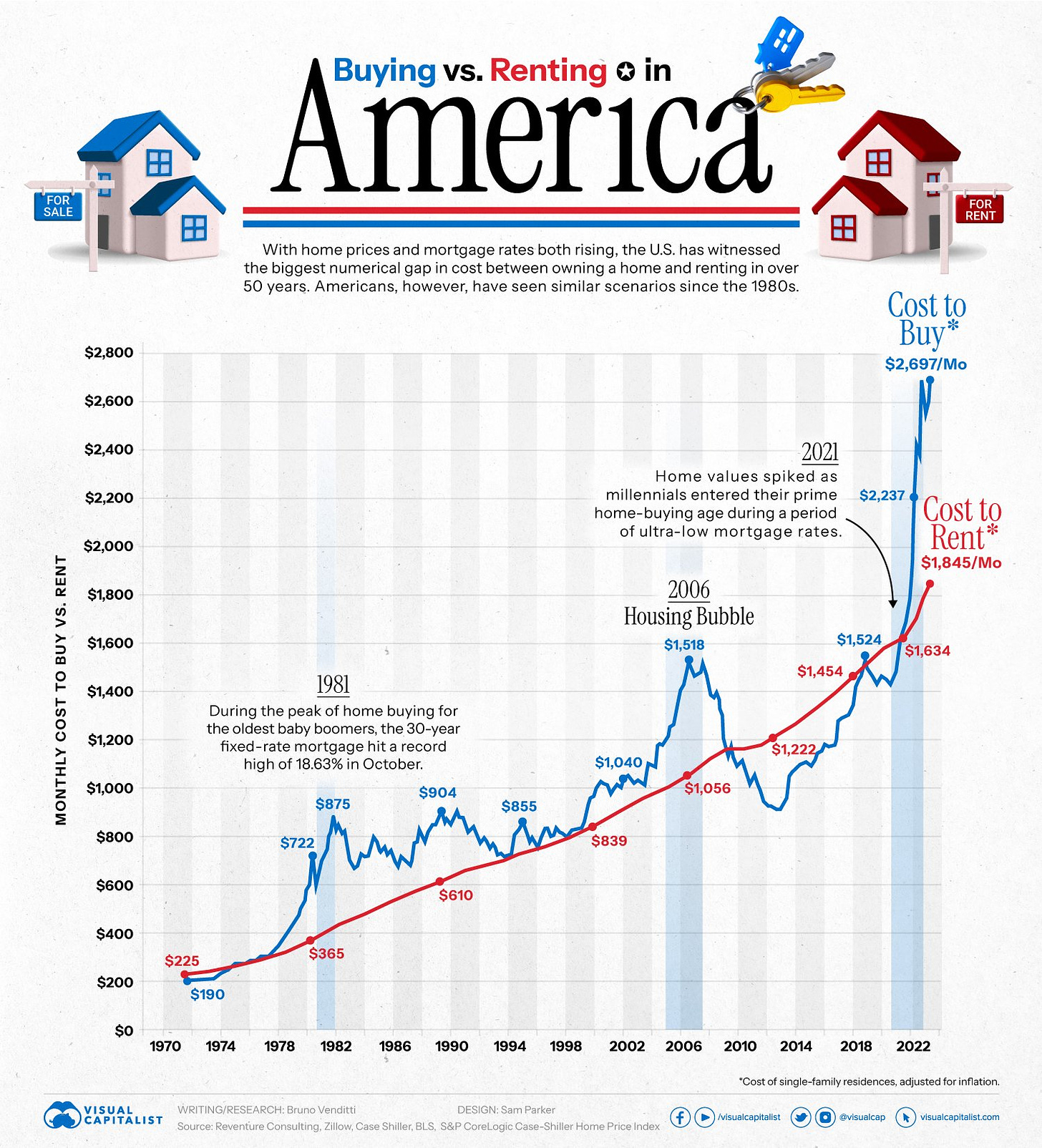

US Housing – Monthly Cost of Buying vs. Renting:

👉 median rent about $1,850/m = 30% cheaper than the median cost to buy at $2,700/m 👉 gap = the largest historical difference between renting & buying, let that sink in!

-

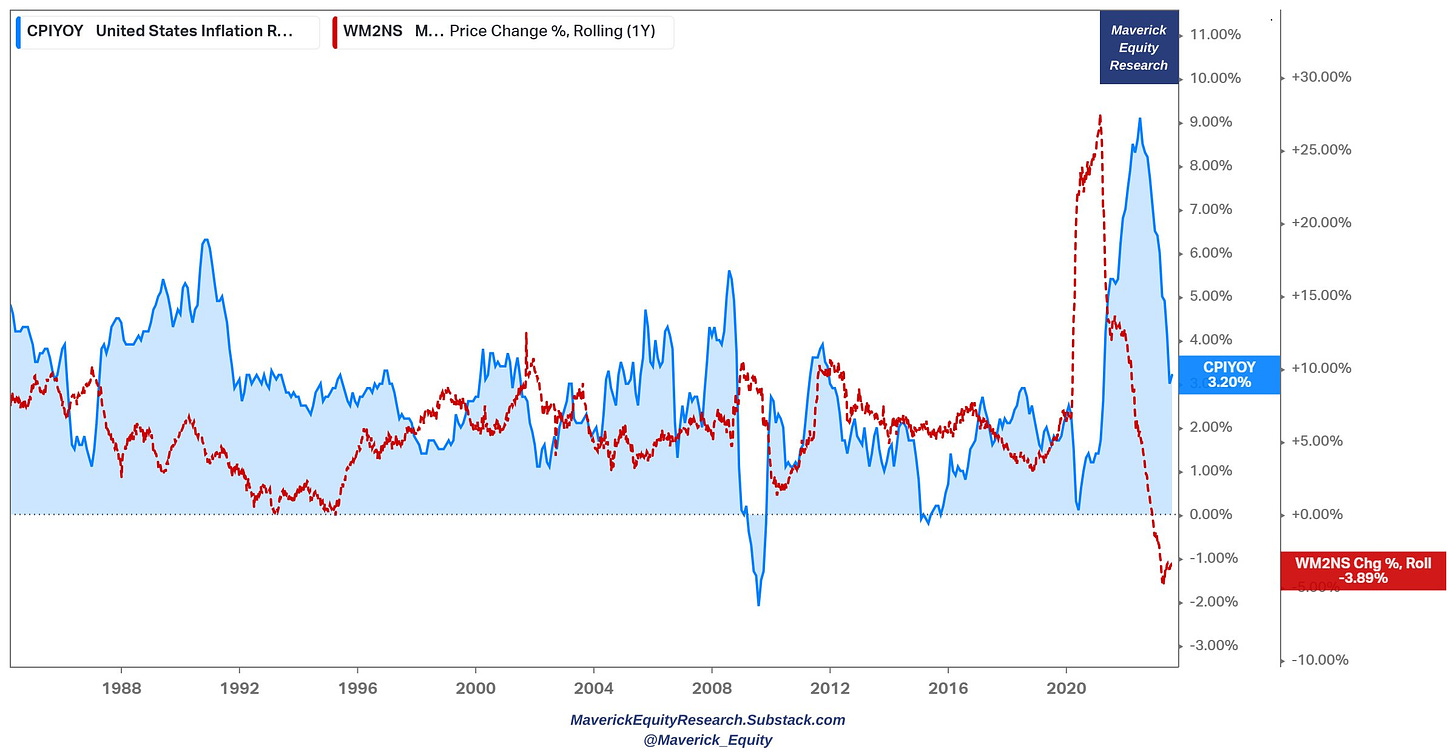

US Inflation:

👉after peaking in June 2022 at 8.9%, inflation reversed and fell to 3.2% following the key driver M2 money supply growth rate at -3.89%. The latter turned negative in Q4 2022 for the first time since 1933. Yes, almost a century! Let that sink in! …

👉 therefore, if inflation is primarily monetary phenomenon (which is in my opinion), how could it not keep going down? US CPI Y/Y (blue) & M2 growth Y/Y (red):

-

EuroZone inflation:

👉M2 (money supply) growth: negative at a -1.4% which = historical record low

👉 and yes, how could it not keep going down as well?

-

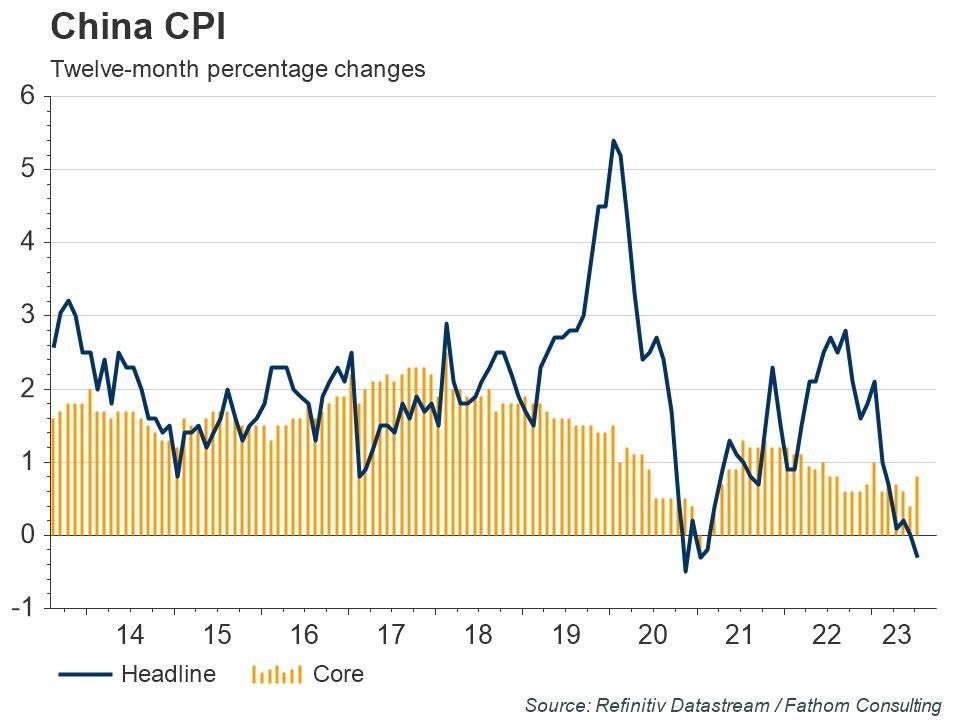

China inflation:

👉 China town into deflation – yes, de not i …

👉 Now that disinflation process was fast … Last time it was during the Covid times ..

-

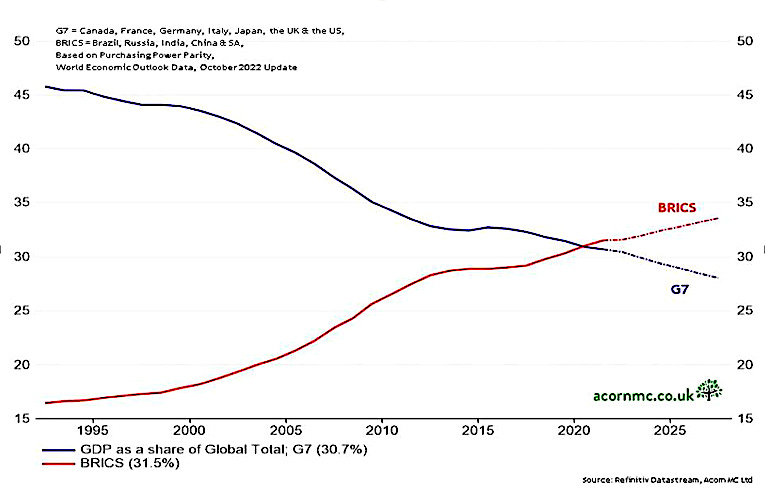

The rise of the BRICS vs G7: BRICS are now 31.5% of global GDP vs the G7’s 30%

👉 BRICS = Brazil, Russia, India, China & SA

👉 G7 = Canada, France, Germany, Italy, Japan, UK & US

-

Guess what’s there below? North Korea & South Korea by lights activity at night

👉 now guess which one is communism and which one capitalism? You got it 😉

👉 old adage goes like: socialism is even distribution of poverty, capitalism is uneven distribution of wealth (there is a lot more to the subject naturally, one day maybe…)

-

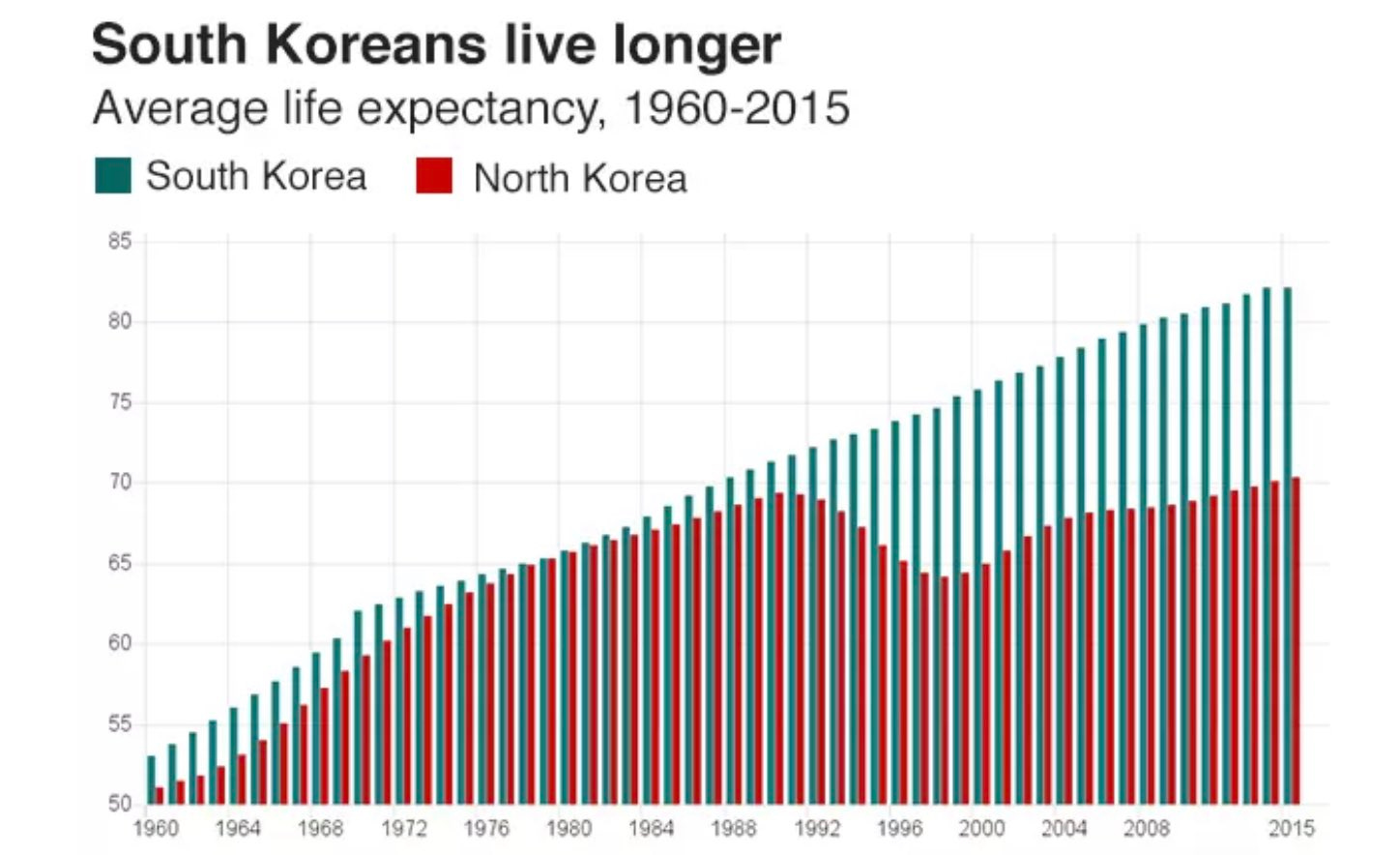

Lights activity during night is not just about playing video games and going out. Check the big gap in terms of live expectancy … not much to comment further …

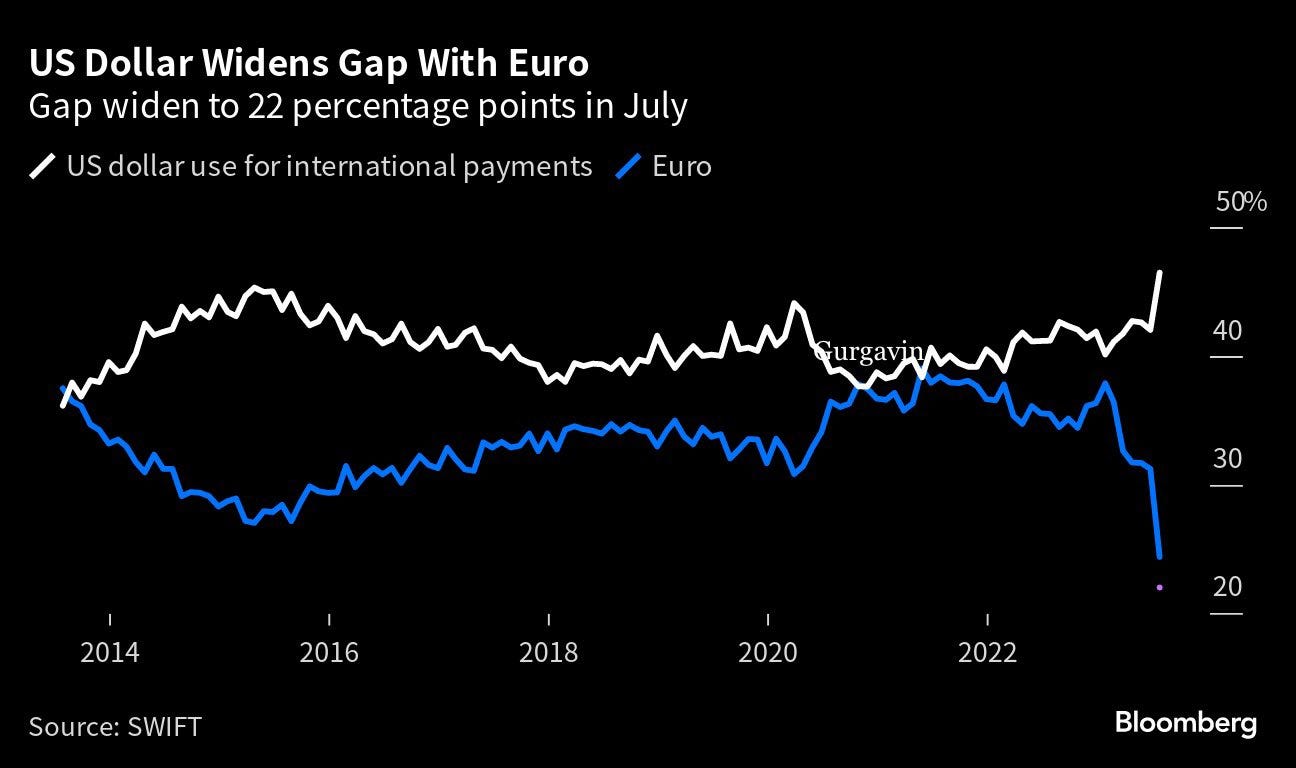

18, 19 & 20. It is soon 20 years since I keep hearing ‘The Death of the US Dollar’

👉 US dollar use for international payments VS the Euro: 22% gap

👉 US dollar role globally with a new all time high at 46%

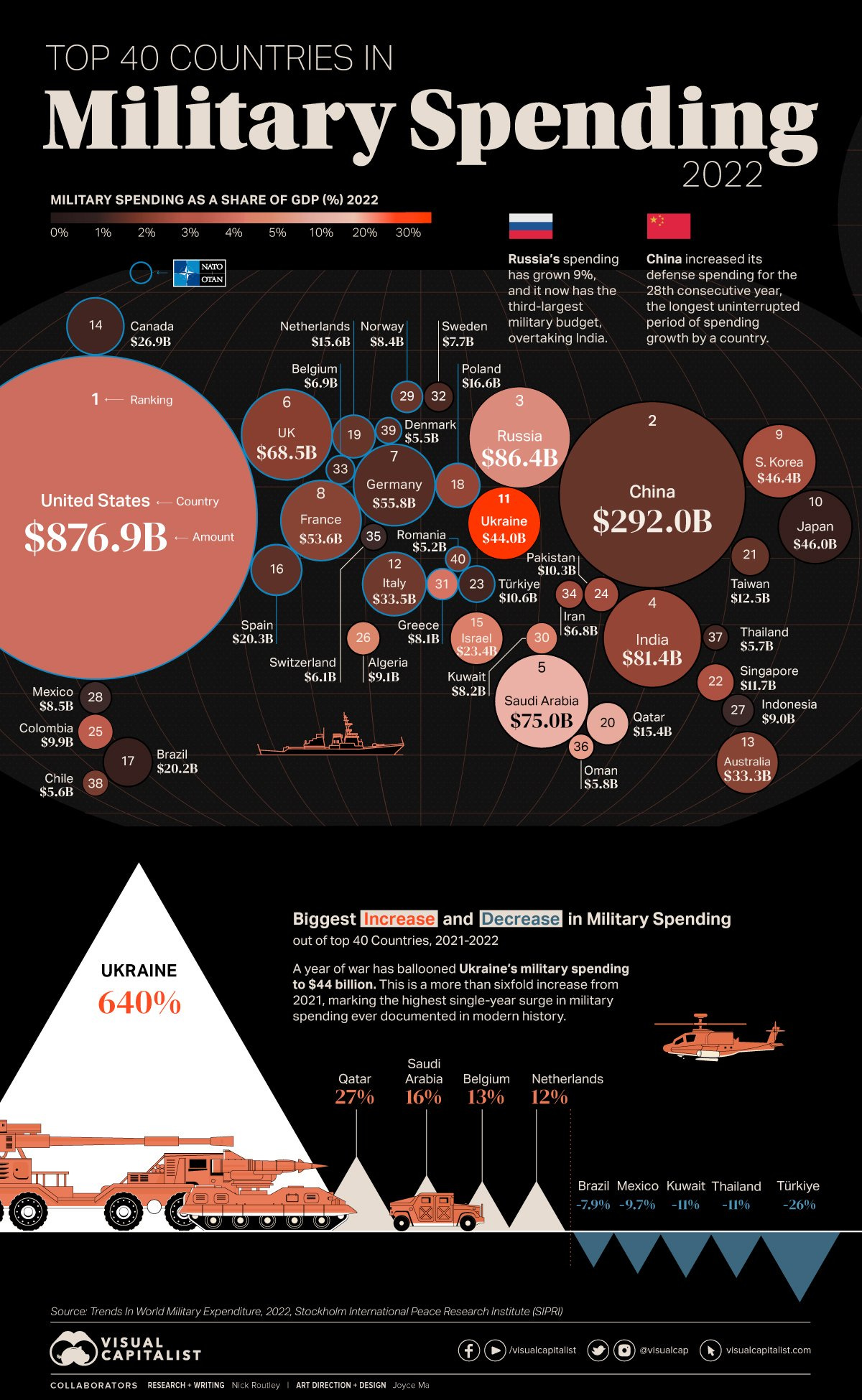

World’s Top 40 Largest Military Budgets: US #1 matters for US dollar world status

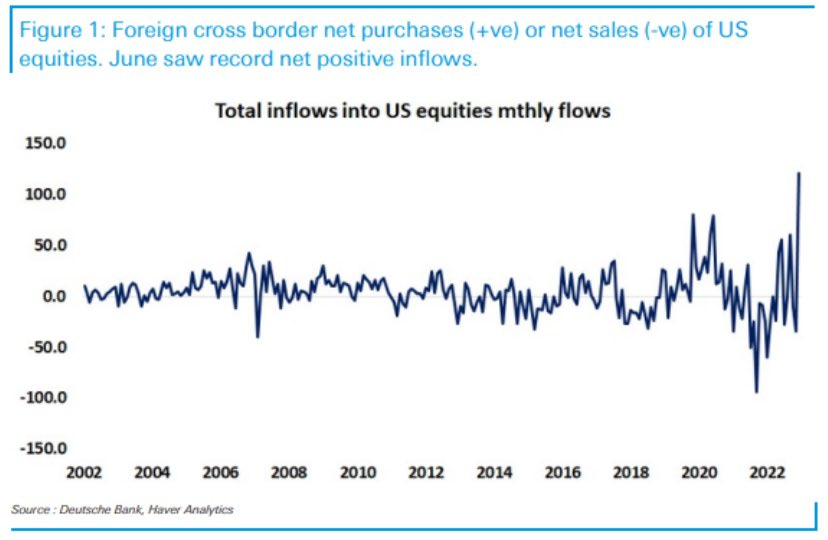

Also, record positive inflows into US equities: and yes, they are priced in USD 🙂

Add also the last 5 years since cryptocurrencies came to town & suddenly overnight macro monetary experts are born (sarcasm alert) when they realise the $ (any currency btw) is fiat currency … while cryptocurrencies ‘are real’ and will replace the dollar … not saying there is no use case for crypto, but to say it’ll replace the $ is bananas imho

By the way, the only few people that make money (real dollars, euros the irony) via cryptocurrencies are:

-

the scammers and grifters pumping the thousandths of cryptocurrencies out there

-

a very few that bought early without knowing what they bought, but even those that bought early sold too soon … then started to ‘trade’ in & out … I know many and nope, they did not do well as many headlines kept saying across the years … for clicks, views, chasing eyeballs for sensationalism = advertising revenue

-

the ones that own the crypto infrastructure, mine it etc & maybe one day I will do an investment research (Special Situations section) piece on it – preview = simple: ‘Don’t go to Las Vegas to gamble, you will lose, but own a small part of Las Vegas (infrastructure) and you have a good chance to win … you just need many many players joining your infrastructure … let them play, have fun … tails you win, heads you win …’

5 Bonus charts:

-

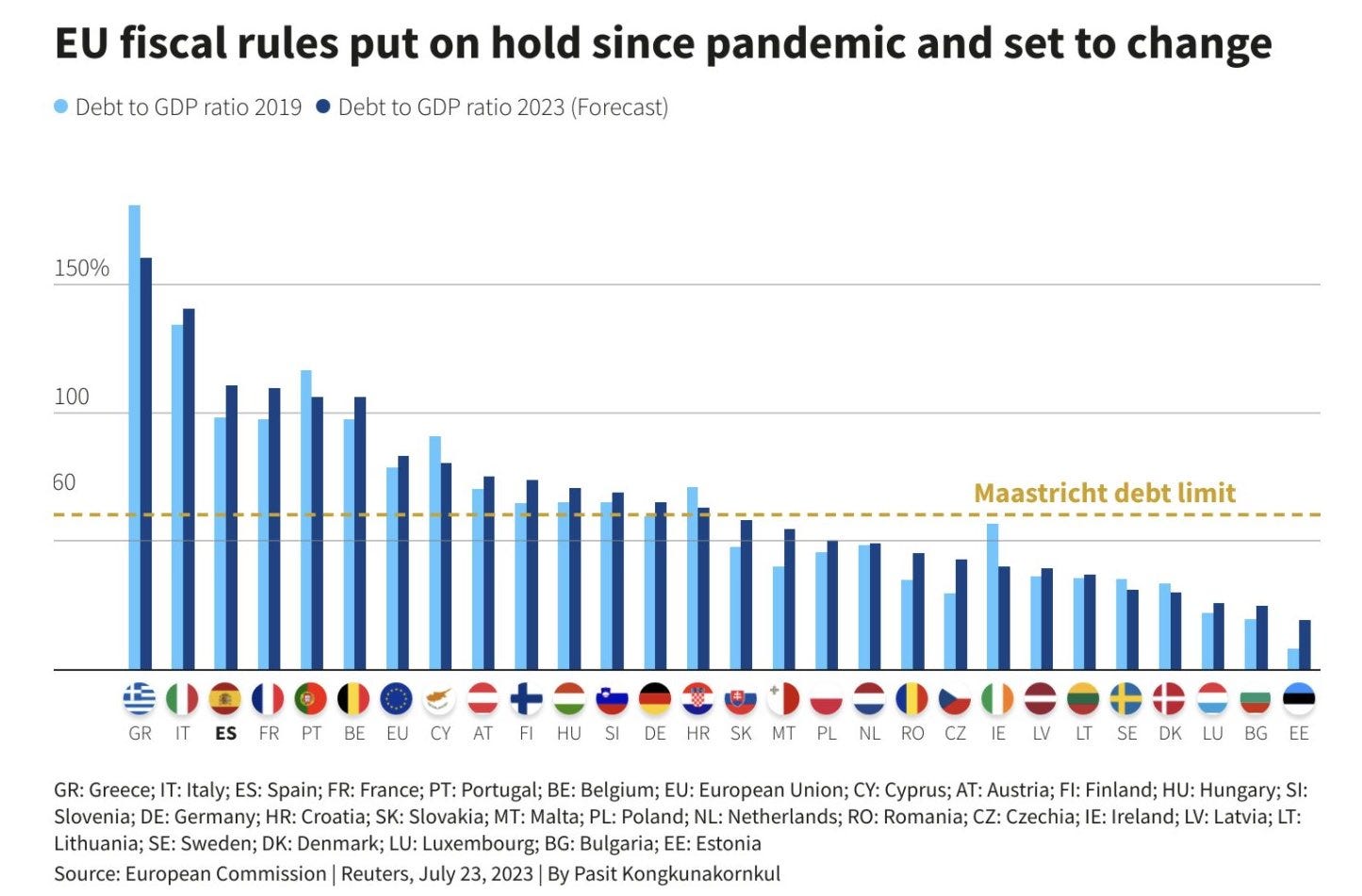

EU Maastricht Debt/GPD limits on hold since the pandemic and set to change … no wonder given many are above the Debt/GDP ratio limit …

-

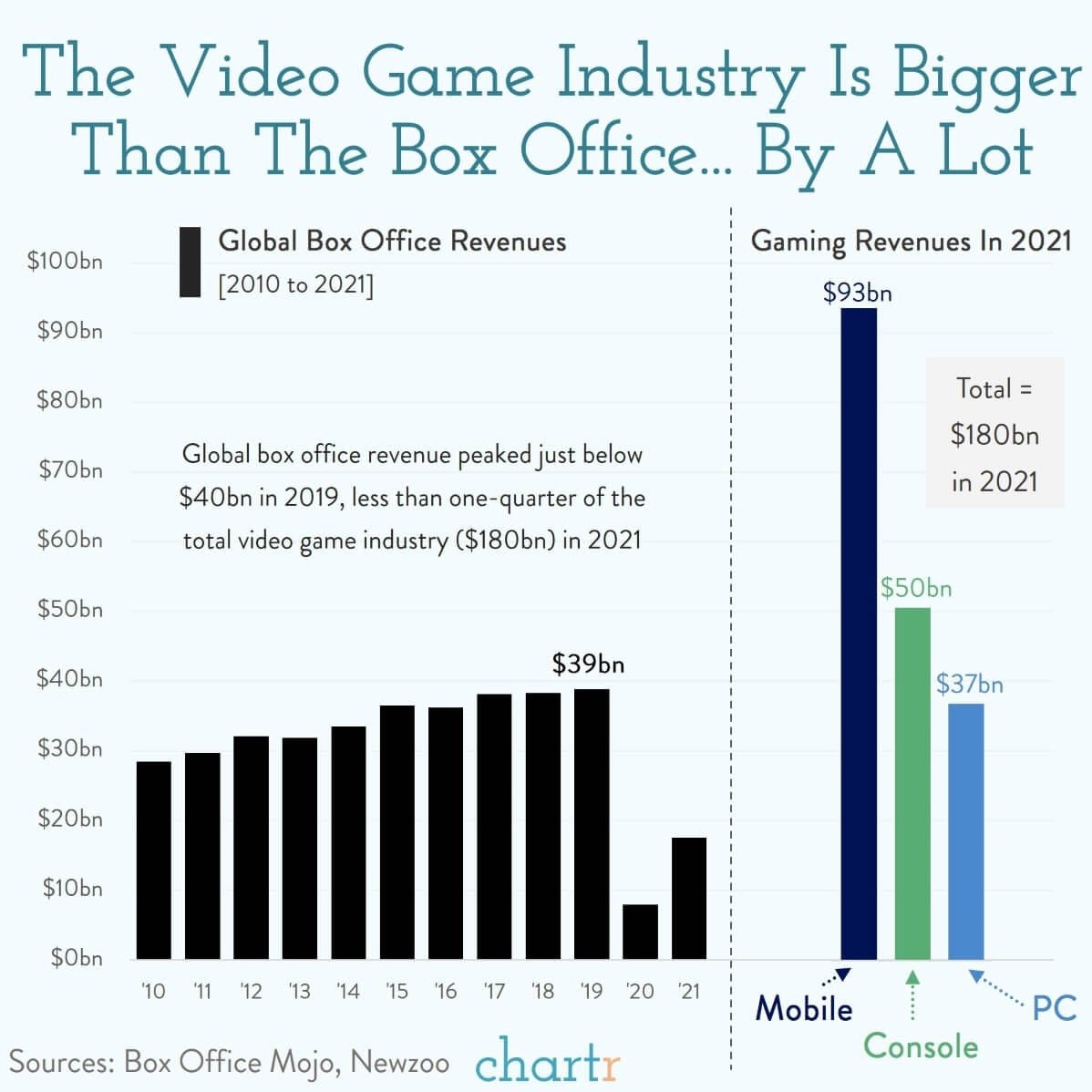

The Video Game Industry Is Bigger Than You Think

-

bigger than all music, TV, and film combined aka ‘The Box Office’

-

it has out-earned music and entertainment for the last 8 years!

-

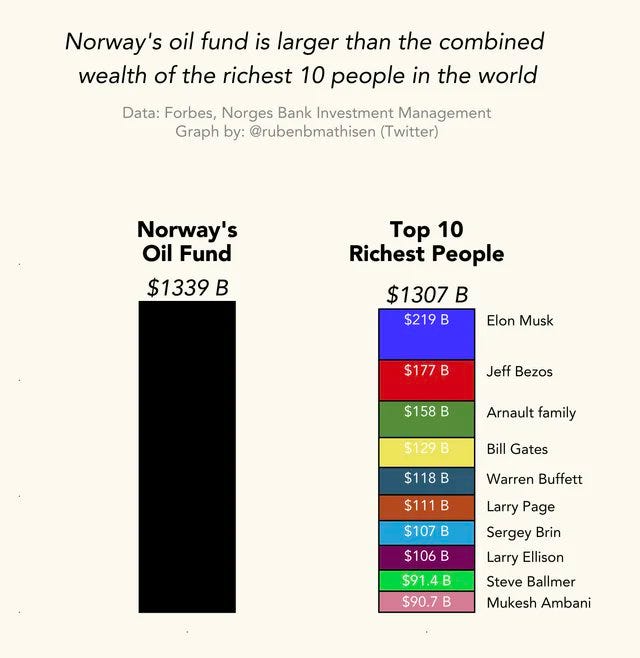

Norway’s oil fund fun fact:

-

It makes $1 billion per week and holds 1.4% of the world’s shares

-

larger than the combined wealth of the 10 richest people in the world

-

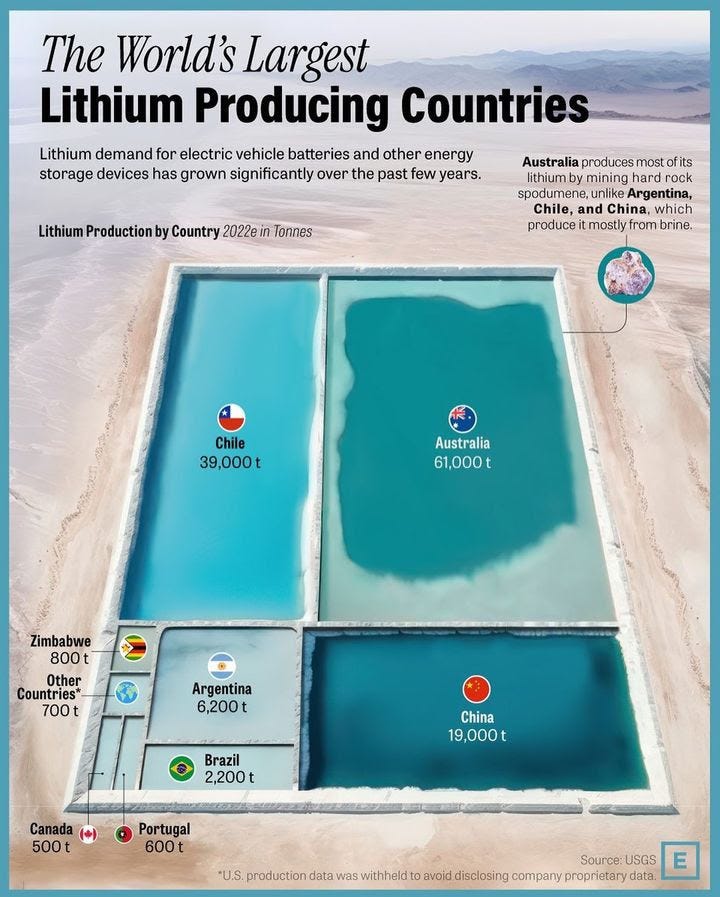

Guess the biggest lithium producer country (EV batteries key part)? Australia!

-

In 2022-2023, Australia made $16 billion in Lithium which is up from $5 billion the previous year

-

who bought that and how much of it? China bought 96% of it

-

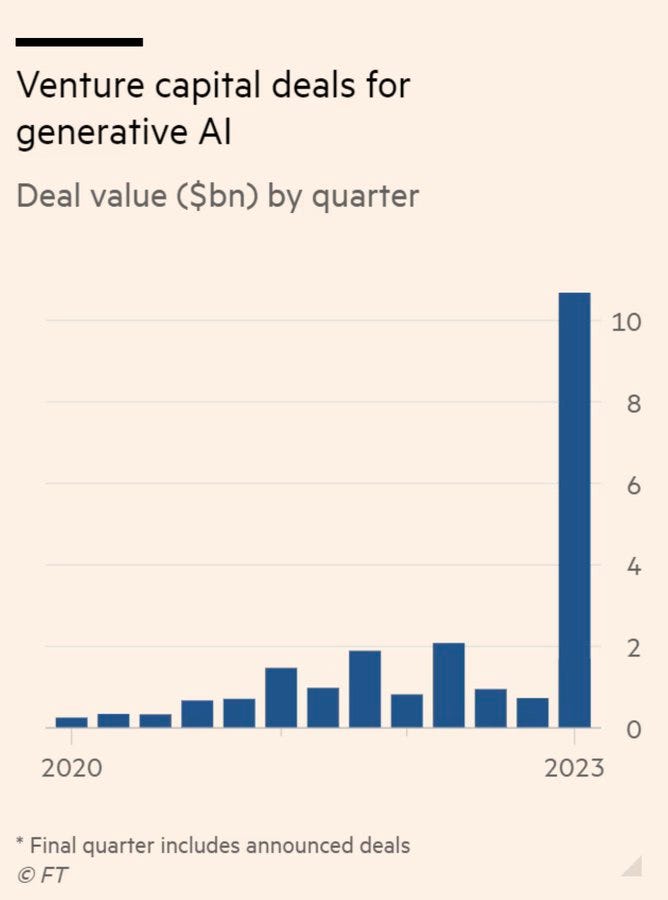

VC money seems to be flowing out of crypto to you guessed it, AI!

Research is NOT behind a paywall & no pesky ads here. What would be appreciated?Just sharing it around with like-minded people. In case not already, subscribe to get all the future research straight to your inbox. Twitter thread can be read here.

Thank you & have a great weekend!

Mav