AI: A shrunken era for global US AI/Tech prosperity. RTZ #679

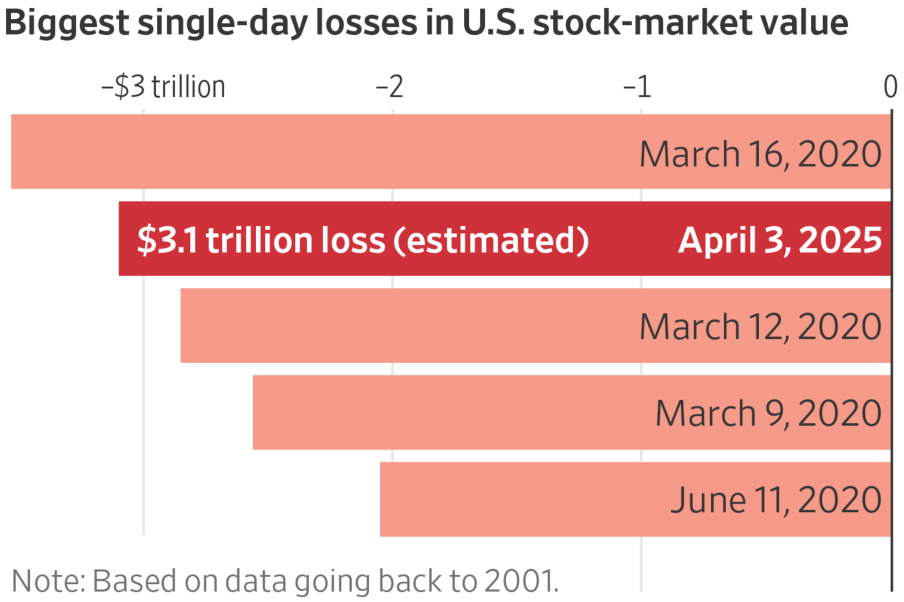

As the world now knows after the new President’s McKinley inspired ‘Liberation Day’ yesterday, with global tariffs higher than markets and hundreds of countries expected. Roiling markets both public and private.

And the world is now embarking on a deglobalization experiment not tried since the extraordinary decades of global prosperity since WWII.

Helped of course by several technology waves from the PC to the internet to cloud to mobile and now of course AI.

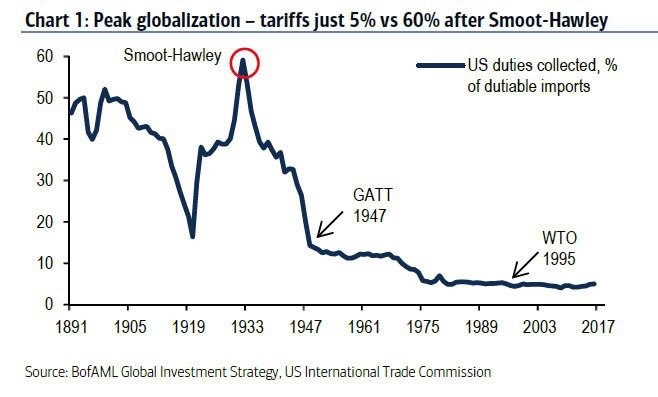

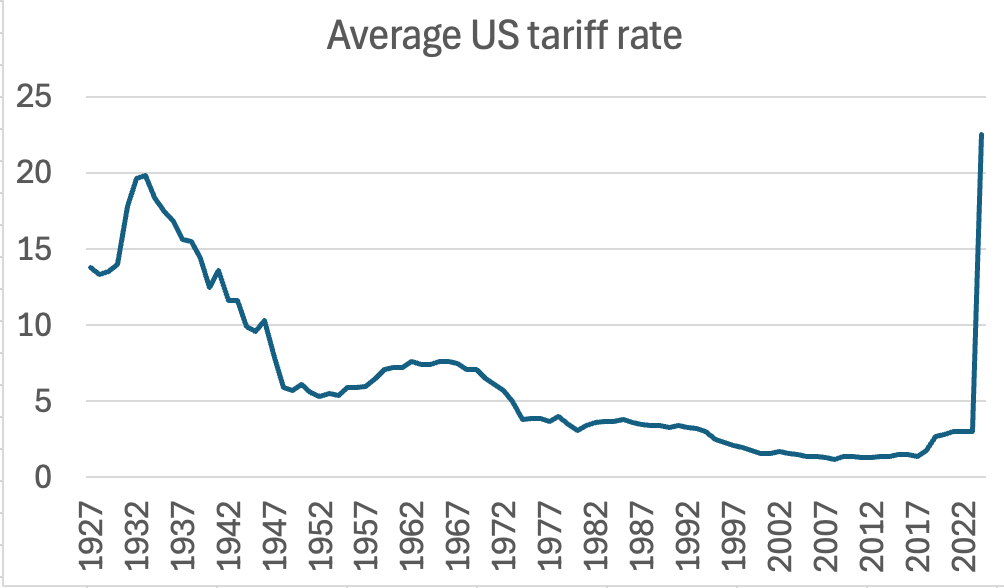

And hasty actions both political and economic not seen since the early 1930s, where the main actors tried a new tariff war with Smoot Hawley, than then resulted in accelerating the Great Depression for a decade.

Here’s a pithy recap of 1930s Smoot Hawley from the iconic 1986 ‘Ferris Bueller’ that’ll take less than forty seconds.

The Great Depression wasn’t turned around until the advent of World War II.

Nobel laureate and Economist Paul Krugman updates the chart below with the latest tariffs here, with a discussion worth reading.

His pithy take:

“The tariffs Trump announced were higher than almost anyone expected. This is a much bigger shock to the economy than the infamous Smoot-Hawley tariff of 1930, especially when you bear in mind that international trade is about three times as important now as it was then.”

“The size of the tariffs, however, wasn’t the only shocking thing about the Rose Garden announcement. Arguably what we learned about how the Trump team arrived at those tariff rates — the sheer malignant stupidity of the whole thing — was even worse.”

As Krugman continues on the tariff methodologies used:

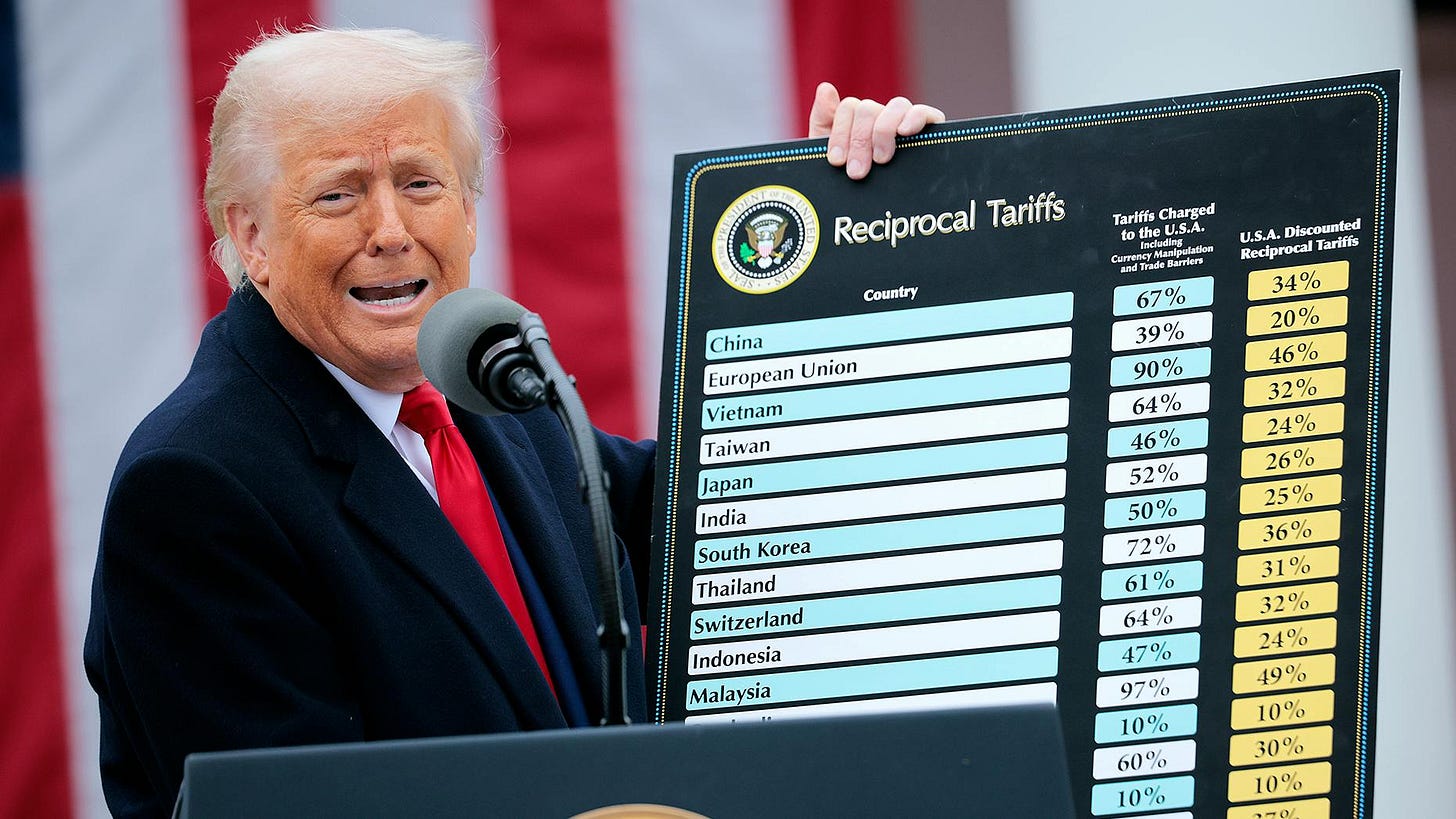

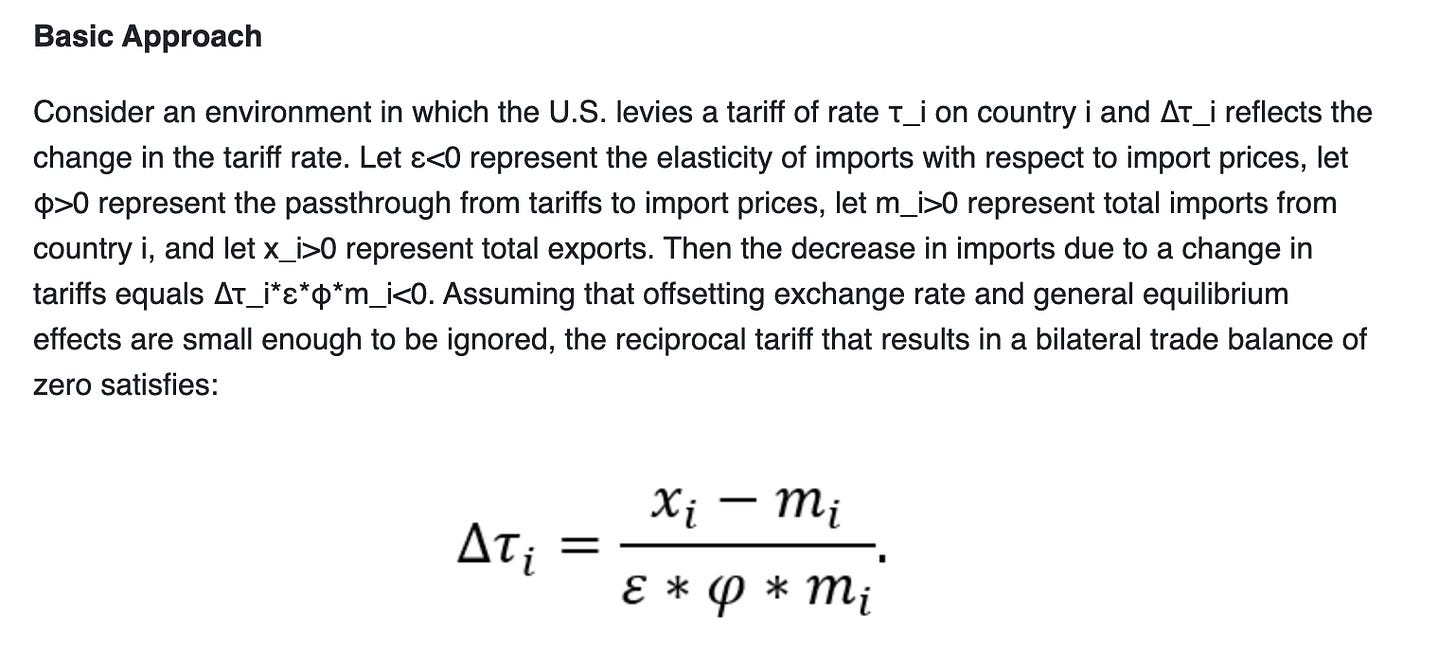

“So what do we know about how the Trumpists arrived at their tariff plan? Trump claimed that the tariff rates imposed on different countries reflected their policies, but James Surowiecki soon noted that the tariffs applied to each country appeared to be derived from a crude formula based on the U.S. trade deficit with that country. Trump officials denied this, while at the same time the Office of the U.S. Trade Representative released a note confirming Surowiecki’s guess. Here’s their explanation:”

“Ignore the Greek letters, which cancel each other out. This says that the assumed level of a country’s protectionism is equal to its trade surplus with America divided by its exports to America.”

“Trump also set minimum tariffs of 10 percent on everyone, which means among other things imposing tariffs on uninhabited islands.”

And likely even used AI Chatgpt to determine tariffs on parts of the world with just penguins as residents.

And they conveniently ignored Services in the US and global economies that tells a far different story on trade disparities:

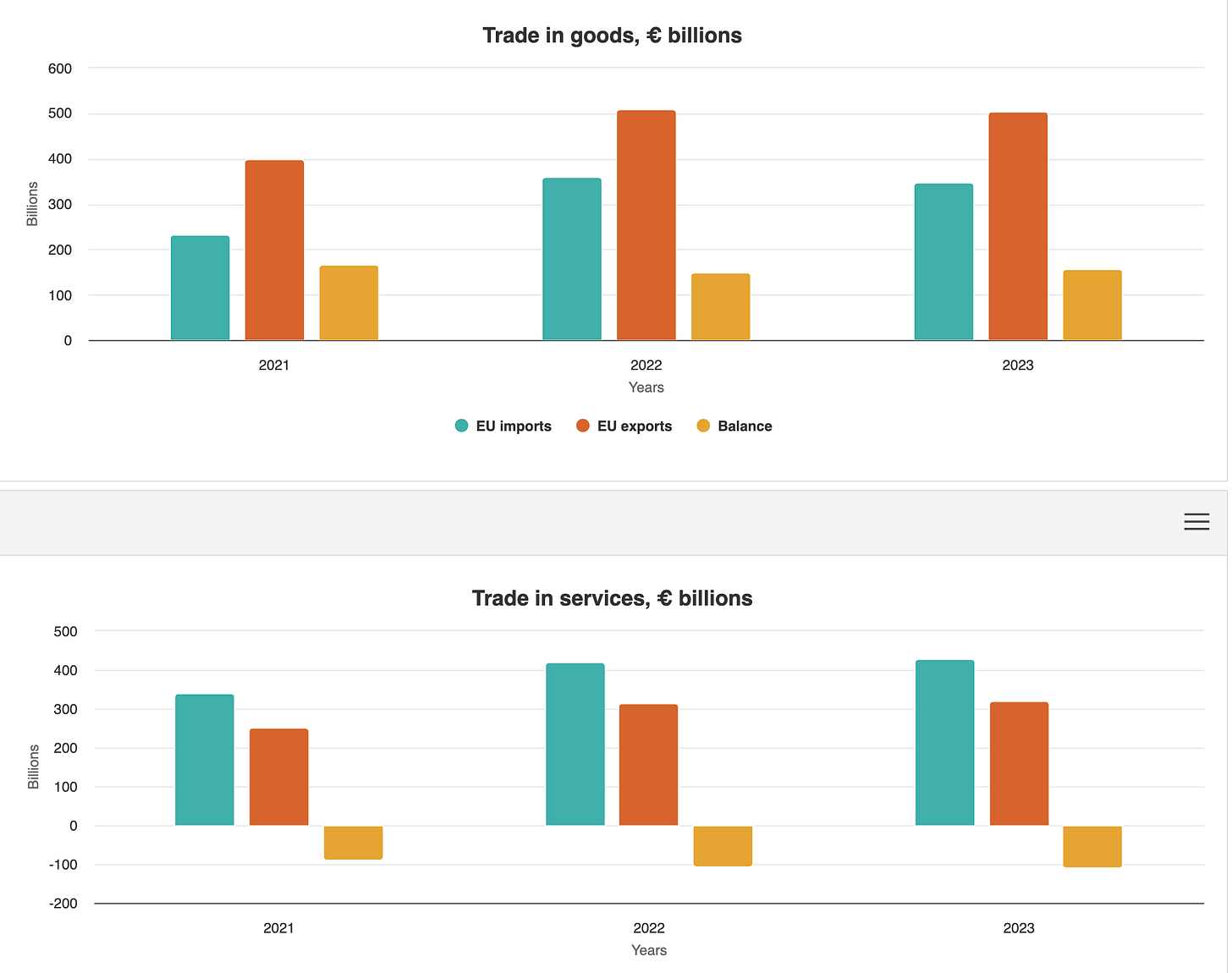

“There’s so much wrong with this approach that it’s hard to know where to start. But one easy thing to point out is that the Trump calculation only considers trade in goods, while ignoring trade in services. This is a big omission. Notably, the European Union runs a substantial surplus with us if you only look at trade in goods — but this is largely offset by an EU deficit in services trade.”

“So if Trump’s people had plugged all trade with the EU, not just trade in physical goods, into their formula they would have concluded that Europe is hardly protectionist at all.”

There are relevant charts as receipts in the post.

It gets worse:

“Where is this stuff coming from? One of these days we’ll probably get the full story, but it looks to me like something thrown together by a junior staffer with only a couple of hours’ notice. That USTR note, in particular, reads like something written by a student who hasn’t done the reading and is trying to bullshit their way through an exam.”

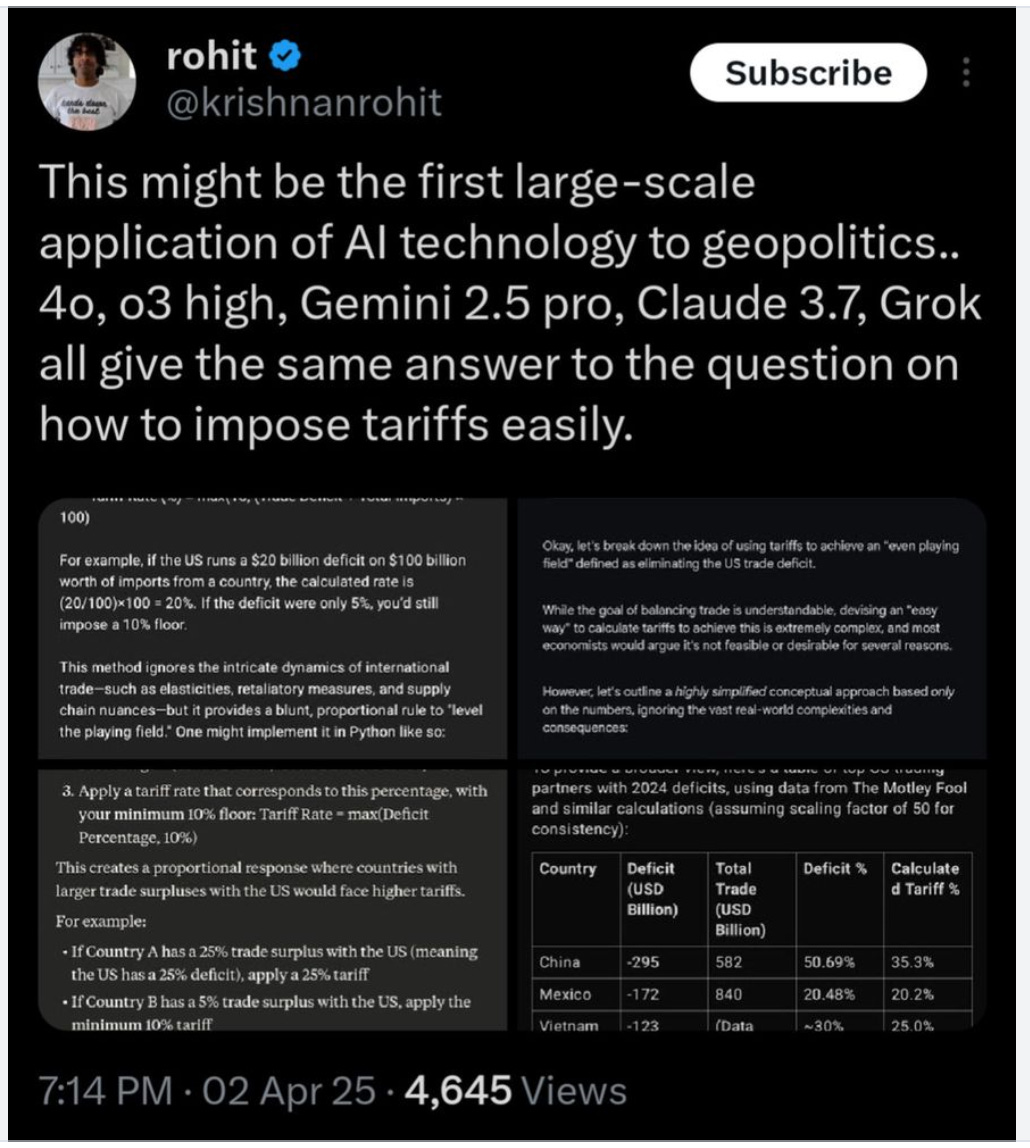

“But it may be even worse than that. The Trump formula is apparently what you get if you ask ChatGPT and other AI models to make tariff policy:”

It’s not a laughing matter.

It took decades on the slow globalization path that saw America nurture global prosperity after WWII. It was hard earned by an America working together despite political divides. Unlike today, two years before the America’s 250th birthday.

Who knows how Smoot Hawley 2.0 unfolds, but the gun has definitely gone off.

One filter to understand it all in these pages is through the impact of these actions on US tech companies impacted writ large.

I’ve talked about the possible repercussions for one of the two most valuable US companies, Nvidia, seeing some unprecedented tail winds to date on its secular AI roadmap ahead.

And then there’s Apple.

It’s useful to look at the near and mid-term fortunes of the other former $3 trillion market cap company Apple.

As CNBC notes in “Tech stocks sink after Trump tariff rollout—Apple heads for worst drop in 5 years”:

‘“Technology stocks sold off Thursday after President Donald Trump announced a slew of global tariffs and a baseline 10% duty.”

-

“Apple led the declines among the so-called “Magnificent Seven” group, dropping more than 8%.”

-

“The tariffs come on the heels of a rough quarter for the tech-heavy Nasdaq and the worst period for the index since 2022.”

“The drop in technology stocks came amid a broader market selloff spurred by fears of a global trade war after Trump unveiled a blanket 10% tariff on all imported goods and a range of higher duties targeting specific countries after the bell Wednesday. He said the new tariffs would be a “declaration of economic independence” for the U.S.”

“Companies and countries worldwide have already begun responding to the wide-sweeping policy, which included a 34% tariff on China stacked on a previous 20% tax, a 46% duty on Vietnam and a 20% levy on imports from the European Union.”

“China’s Ministry of Commerce urged the U.S. to “immediately cancel” the unilateral tariff measures and said it would take “resolute counter-measures.”

The New York Times zooms in on Apple in particular, discussing “Trump’s New Tariffs Test Apple’s Global Supply Chain”: It’s a topic I’ve discussed especially in terms of Apple’s efforts to build more iPhones in India and beyond.

The NYT provides context:

“On Wednesday, Mr. Trump said that the United States would put tariffs of 46 percent on Vietnam and 26 percent on India. The White House has said the tariffs are effective immediately, but some trade experts consider them to be preliminary and designed to be a starting point for negotiations to reduce overseas tariffs.”

“The proposed tariffs threaten to compound the pressure on Apple’s business. The company is already dealing with 20 percent tariffs on products imported from China, where Apple makes about 90 percent of the iPhones it sells around the world. Mr. Trump said that the rate would go to 34 percent under his new tariff plan.”

“The iPhone maker spent years trying to move production of some products out of China to avoid tariffs. But now that may not matter.”

And of course Apple’s recent announcements on spending hundreds of billions in the US to boot that I also discussed recently.

The impact of these tariffs as announced are meaningful for Apple alone:

“The costs of “reciprocal tariffs,” as Mr. Trump calls them, could put Apple’s business in a jam. The iPhones, iPads and Apple Watches that the company sells deliver three-quarters of its nearly $400 billion in annual revenue. With Mr. Trump saying he won’t allow products to be exempted from tariffs, Apple will have to either pay those fees, which will reduce its profit, or indirectly pass those added costs on to customers by raising prices.”

“The tariffs on iPhones and other devices imported from China will increase Apple’s annual costs by $8.5 billion, without any relief from the Trump administration, according to Morgan Stanley. That would reduce the company’s profit next year by $0.52 per share, or about $7.85 billion. That would be a roughly 7 percent hit on next year’s profits.”

And building more in the US is really tough to do in a reasonable time frame, despite the announcements that Apple and many others are making in earnest:

“Apple has struggled in the past with U.S. production. The Texas plant that made Macs had problems as some workers walked off the job after their shift but before their replacements had arrived, forcing the company to shut down the assembly line. It also struggled to find suppliers that could make components it needed like a custom screw.”

“Mr. Cook has said that the United States doesn’t have enough skilled manufacturing workers to compete with China. At a conference in late 2017, he said that China was one of the few places where Apple could reliably find people capable of running the state-of-the-art machines that make its products.”

“In the U.S., you could have a meeting of tooling engineers, and I’m not sure we could fill the room,” Mr. Cook said. “In China, you could fill multiple football fields.”

What’s true for Apple is true for most other tech and non-tech companies being pressured to build manufacturing capacity in the US. The actual plants are just the tip of the ecosystem iceberg.

It’s being able to build the ecosystem with hundreds of thousands of trained people that is the real bottleneck. With its attendant array of thousands of supporting companies, all needed in the US.

It took Apple over two decades and half a trillion plus dollars in investments to build the iPhone/iPad/Mac manufacturing ecosystem in Shenzen China, since the introduction of the iPhone in 2007.

Apple has employed over 33 million Chinese citizens, men and women from rural China through its Hukou system, to build its products there over the last 15 plus years. That number, with its embedded high turnover, is a population greater than the 23 million souls in Taiwan. It’s almost an impossible ask of Apple to do it again just in the US. And of almost every other US company large and small.

A comparable number of trained and untrained folks does not exist within US borders. And that’s not to consider the millions more likely needed for the AI driven robots, self driving cars and all the other cool ‘Physical AI’ products that the AI industry and investors are excited about.

We need to keep this bigger context in mind, regardless of the political and economic motivations. Especially the McKinley idolization by the current President.

History here is particularly sharp and pointed, especially in the party driving these changes. Again. As the Washington Post reminds us in this must read historical review with spellbinding statistics:

“Whatever the theoretical economic benefits of major tariffs, history shows they have coincided with huge losses for the Republicans — and it has almost always been Republicans — who pursue them.”

“That history looms large right now as a Republican Party that has defined itself by free trade in recent decades has suddenly been confronted with Trump’s historic protectionism — and the apparent economic shock it is primed to cause.

“After the McKinley Tariff was enacted in 1890, Republicans lost 93 seats in the House that year — losses that included McKinley’s own reelection defeat. (He was then a congressman, but would later become president.) They also lost an 1892 presidential election in which the tariffs remained a major issue.”

“After the Smoot-Hawley Tariff Act was signed into law in 1930 — and, according to many historians, worsened the Great Depression — House Republicans lost 52 seats in the 1930 midterm elections and then 101 more in the 1932 election. Part of that was undoubtedly due to the Depression rather than merely the tariffs, but Democrats focused on the tariffs in both campaigns.”

After Smoot Hawley tariffs passed, as Republican Senator Rand Paul reminds us today:

“Republicans lost the House and Senate for 60 years”.

The other notable political point of both the McKinley and Smoot Hawley eras, was that it was Congress that drove and voted for the tariffs back then.

Unlike the current ‘Liberation’ Day event yesterday, driven far more unilaterally by the President via Executive Action, mostly unopposed by a Republican driven House and Senate. The Vox has some notable context around this worth reading as well.

Politics and history aside, the one thing to keep in mind today, is that like in the 1890s and 1930s, we’re taking the wrong actions at the wrong time in this AI Tech Wave.

The other thing to note about tariff wars is that it gets personal pretty fast, especially as people in countries react to the perceived lack of RESPECT. Note the responses in Canada to the administration’s preemptive trade and Trump’s ‘51st State’ comments.

And then the ‘tit for tat’ responses get more emotional than the rational negotiations the instigators were hoping for. For business people especially, it’s important to understand this and not expect everything to be dealt with in a transactional way.

Never under-estimate the universal craving for respect.

For now, these ‘liberation’ moves are likely throwing away some of the net economic gains of the AI era in the coming year. The $7 plus trillion dollars in AI driven economic gains in global GDP of over a $120 trillion, forecasted by Goldman Sachs and others, is likely to be more muted in a shrunken era for AI Tech driven global prosperity.

And those are the unintended consequences of these unforced errors to keep in mind. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)