AI: AI both dead and alive, and 'giddy promoters'. RTZ #491

I’ve long been a deep believer in the ‘two opposing things can be true at once’ mindset. It’s a core part of my frameworks to analyze the world of technology. And it applies to the AI Tech Wave discussed in these pages for almost 500 days.

Especially when trying to assess the probabilities of rapidly developing technologies. And what tenacious entrepreneurs can do with them. It’s a core foundation of the tech stack framework analysis I’ve worked with for decades now, described yesterday (see end of this post for the excerpt).

F. Scott Fitzgerald wrote about the ability to hold two opposing ideas in the mind at the same time, saying,

“the test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”

This is critical when assessing nascent technologies from an investment perspective. It’s been a key part of how I’ve approached being a technology analyst for over three decades. Particularly in the context of its ‘disruptive’ impact on industries and society at large.

The idea also has roots in quantum physics, which fundamentally describes,

“a quantum system that can exist in two distinct quantum states.”

Examples of course being:

“Quantum superposition: A qubit can be in a coherent superposition of multiple states simultaneously.”

It’s the foundation of all the energies currently being expended around ‘Quantum Computing’, a subject for another time.

(A variation of this in physics, both classical and quantum of course is the ‘Observer Effect’, which also applies here).

The famous thought experiment for all this of course is ‘Schrodinger’s Cat’, which has enormous implications for day to day AI applications to come. A rich subject for future posts.

The catalyst for this philosophical rabbit hole for AI today, are the follow on reactions to OpenAI’s Sam Altman essay just published, ‘the Intelligence Age’. A topic I discussed in detail a couple of days ago. (The essay is worth reading in full).

In particular, Axios summarized some of the reactions in “Altman’s hazy AI utopia”. I’d like to highlight the following part, given the ‘two things can be true at once framework’, discussed above:

“OpenAI CEO Sam Altman sees AI producing “massive prosperity” in a future that is “so bright that no one can do it justice by trying to write about it now.”

“Why it matters: That sounds pretty great, but “now” is where we all live and work — and right now, the tech industry is locked in an epic debate about whether AI can deliver on its flood of promises.”

Yes, an extension of the debate of course raging on Wall Street, Silicon Valley and beyond.

But it’s also important to consider how Axios ends their piece:

“Today’s AI might really usher in a promised land of plenty, and that’s a gamble many in the industry believe is worth the risk.”

-

“But for those who study the history of technology, Altman’s lofty rhetoric carries echoes of similar forecasts that have accompanied every wave of technical innovation — from steam power to electricity to cars, and from phones and TV to the internet.”

-

“Yes, each of those changed the world, but none of them solved the world’s stubborn problems the way their giddy promoters predicted.”

The last bullet of course a bit gratuitously directed at ‘giddy promoters’.

Most major new innovations would not have been possible without ‘giddy promoters’.

Thomas Edison over a century ago, is famous for having extolled the virtues of his light bulbs for years, to both the media, investors, and public at large, while feverishly actually developing a light bulb that worked in the real world beyond his lab.

A ‘giddy promoter’ if ever there was one, that Thomas Alva Edison. Likely not equalled until perhaps Steve Paul Jobs, whom I discussed also a couple of posts ago.

And Edison had the same challenges then as Samuel Harris Altman today.

Least of which of course, are the extraordinary investments Edison needed to build the electricity generating and wiring infrastructure with then unimagined amounts of capital over stages. (Kind of like what Sam is focused on promoting today).

What Edison did was a fundamental necessity to make electricity at one’s finger tips, a daily reality the world over. It took some time. But it of course lead to GE (General Electric). Kinda like trillion dollar AI data centers powered by nuclear and other power sources today. And again, Sam’s efforts to raise billions for AI infrastructure around the world.

Coming back to Edison, he had to keep alive two opposing ideas alive at the same time. The promise of light bulbs (and omni-present delivery of electricity), and barely functioning technologies that made that dream BARELY possible at that moment in time. It’s a gripping story.

As the Smithsonian explains:

“In the autumn of 1878, Thomas Alva Edison had a problem. He hadn’t invented the light bulb—yet. Or, to put it more precisely, he had invented a light bulb, but he couldn’t keep it lit for more than a few minutes at a time. He still hadn’t figured out how to regulate the temperature of the light bulb’s internal filament, meaning the incandescent bulb would immediately overheat, and the filament would promptly melt down.”

“Unfortunately, Edison was running out of time. All over North America and Europe, inventors like him were working on—and patenting—their own electric projects. Sooner or later, somebody would wind up harnessing electricity. The English chemist Joseph Swan, Edison knew, was hard at work on a rival light bulb. Two Canadians, Henry Woodward and Mathew Evans, had already patented an inefficient design four years before.”

“But that fall, Edison had an even more pressing deadline to face: The journalists were coming. In September, he’d assured the popular press that his latest invention, the incandescent light bulb, was complete. “I have it now,” he told the New York Sun, boasting that “everybody will wonder why they have never thought of it, it is so simple.”

“He’d already made his sales pitch: “When the brilliancy and cheapness of the lights are made known to the public” (which would, he promised the Sun, be in just “a few weeks”), America would undergo another scientific revolution.”

Echoes of Sam Altman today in his essay:

“If we want to put AI into the hands of as many people as possible, we need to drive down the cost of compute and make it abundant (which requires lots of energy and chips). If we don’t build enough infrastructure, AI will be a very limited resource that wars get fought over and that becomes mostly a tool for rich people.”

“We need to act wisely but with conviction. The dawn of the Intelligence Age is a momentous development with very complex and extremely high-stakes challenges. It will not be an entirely positive story, but the upside is so tremendous that we owe it to ourselves, and the future, to figure out how to navigate the risks in front of us.”

“I believe the future is going to be so bright that no one can do it justice by trying to write about it now; a defining characteristic of the Intelligence Age will be massive prosperity.”

And Sam is doing his best also to provide pragmatic context the long-term aspirations, as Axios describes:

“”I think, you know, intelligence ‘too cheap to meter’ is not a literal statement, but it’s a nice aspiration,” he told Axios’ Ina Fried in a Monday onstage interview.”

This is the perennial burden on entrepreneurs, and their long-term investors, since the dawn of fire and the wheel.

‘Giddy promoters’, and Extraordinary Entrepreneurs at the same time. Founders, in other words, always in ‘Founder Mode’, as penned by Paul Graham.

Keep the dream alive, while navigating and communicating the near-term challenges vs long-term aspirations and possibilities. Do it with stamina, grit, and wit.

Always living ‘two opposing realities’ in their minds at the same time. 24/7. For ‘thousands of days’ most of the time.

Echoes certainly of the current AI Investment world of ‘two opposing realities’ indeed.

A quantum state of affairs, and certainly the ‘AI cat’ in a Schrodinger context, it’s both dead and alive, depending on its viewing (and indeed existential imagining).

So the AI Tech Wave is likely to go through a similar set of ‘dual realities’.

But as we live through the current ‘Intelligence Age’, likely for years to come, it’s important for us to keep more than ‘two things possible’ about it all in our minds, as much as possible. The AI cat is both dead and alive.

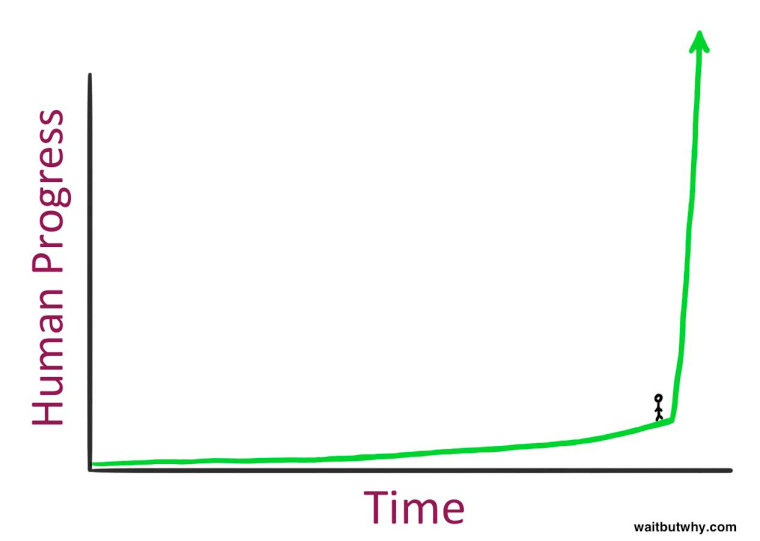

Important this time particularly, because it’s all going to happen faster than past tech cycles. Imagine multiple curves like the one above, all happening at the same time to over 8 billion souls over the next ‘few thousand days’. Stay tuned.

—

APPENDIX:

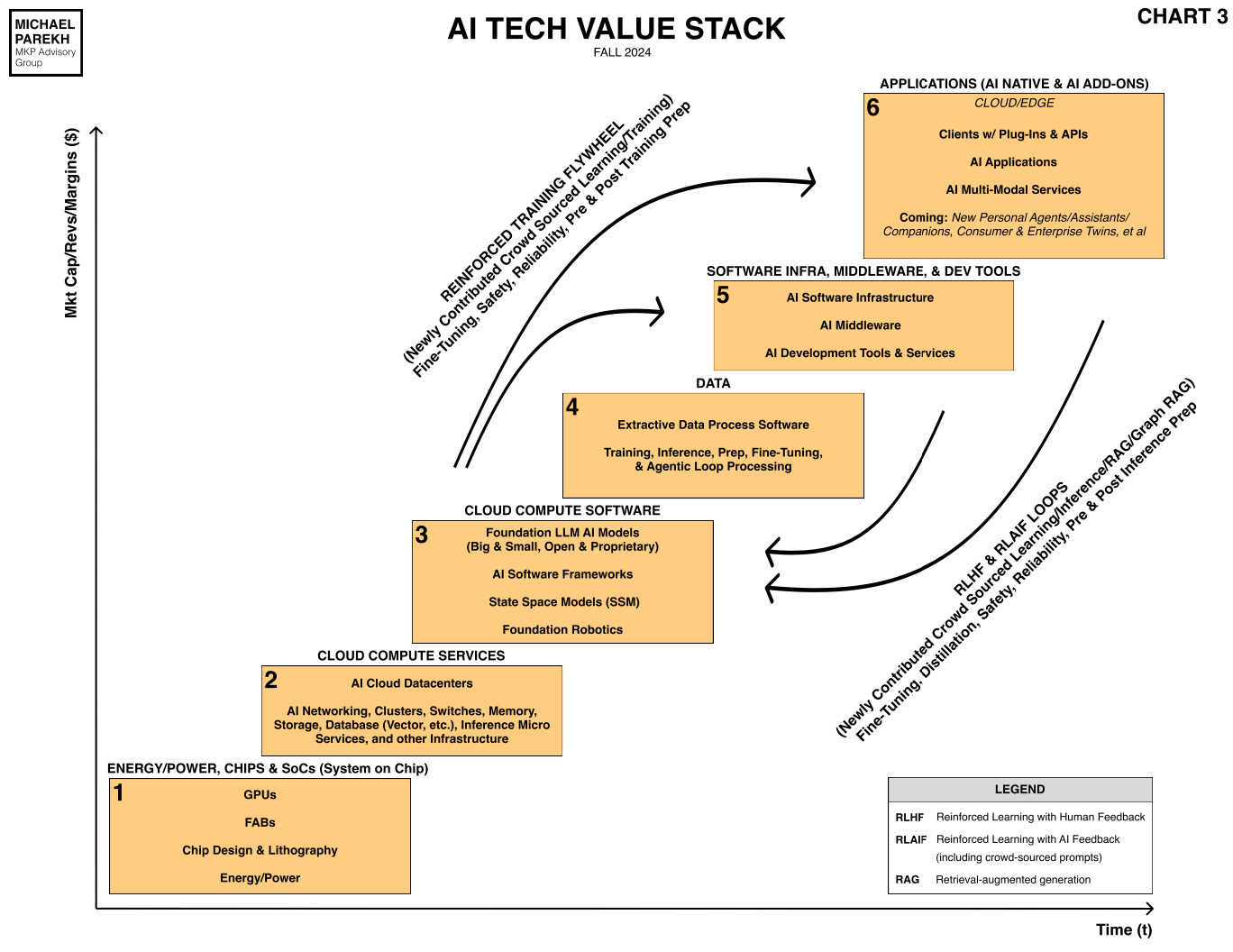

Here is my tech investment framework again at a high level excerpted from yesterday’s post, while of course keeping in ‘more than two things’ possible at every step and stage:

“The key from my perspective is to follow where the underlying technologies are heading on a bottoms up basis. Deep in the tech weeds, up and down the Tech Stack. And then follow the ongoing AI research and engineering innovations.”

“That then determines the “AI Table Stakes” involved, and their scaling requirements in hardware and software. Leading on to clearer probabilities on value creation across the AI Tech Stack. Along with investment directions and timing. Of course all the while keeping a sharp eye on the strategic and tactical moves across the tech stacks amongst incumbents, rapidly evolving startups, and competitors of all types.”

“Also these days closely tracking geopolitical and regulatory headwinds that are uniquely global and local. And then be prepared for the inevitable volatility on all these variables that makes it all calculus rather than algebra.”

“Then finally determine the probabilities of the operational metrics that of course drive the ultimate financial rewards. In many cases, inventing those metrics for new realities.”

“Those of course almost always lagging the massive financial investments by years at times. Oh, and be ready to modify and communicate one’s conclusions and conclusions constantly to all types of investment constituents.”

“Thus my core conviction stated at the end of yesterday’s post that AI technologies in this AI Tech Wave will likely both disappoint at times and delight at the right times.”

“They are going to likely disappoint in the timing of their promises vs their potential, and yet be totally worth the exponential equity, energy and effort being expended today. The discussion of course on the ongoing debate on Wall Street and beyond around the investments in AI in the near-term vs the timing of potential returns.”

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)