AI: AI investments from the Mideast. RTZ #485

If Isaac Newton had some financial background, he might have expanded his Theory of Gravity beyond bodies on earth and in the heavens around us. One could argue that bodies that have money (aka capital) also have gravity of its own. Especially in concentrated forms.

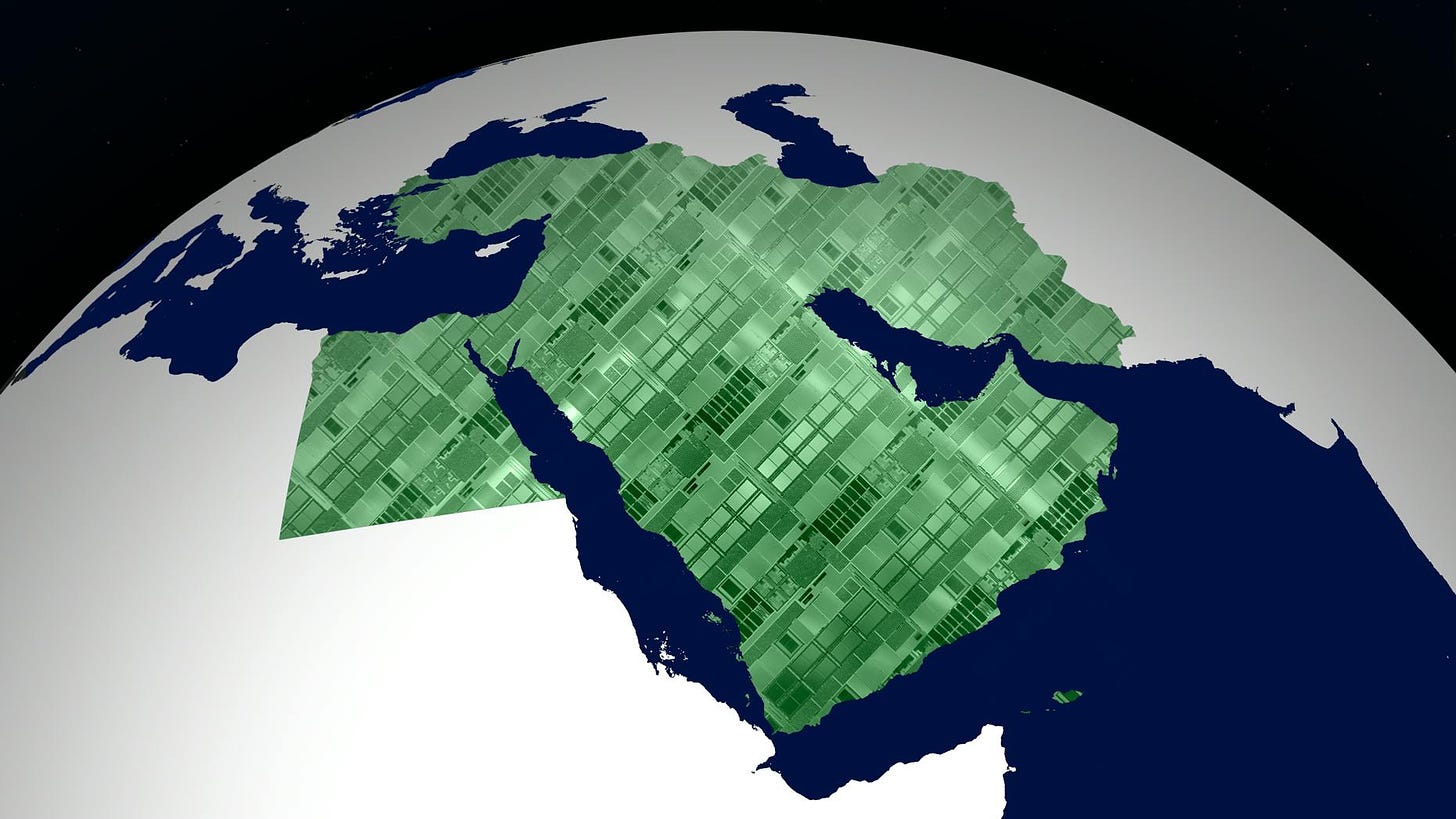

As I’ve discussed before, the Middle East right now is showing the force of that gravity in this AI Tech Wave. Particularly as the need for AI Scaling necessitates capital going from tens to hundreds of billions in a very short period of time.

Yesterday, I wrote about Microsoft/OpenAI partnering with Blackrock private equity to assemble capital pools for potentially a hundred billion dollarsj, with investments from mideast countries and related entities. They’re starting with a near-term $30 billion target.

The region led by the UAE, Saudi Arabia and other oil-rich countries have already expressed a keen interest to invest those kinds of sums and more in AI technologies and infrastructure in particular. Top US VCs and investors have been spending increasing amounts of time cultivating and building on these capital sources, both at the State and private investment entity levels. As have the founders and CEOs of leading US tech companies large and small.

And the region is expected to generate investable capital of $7 trillion plus over the next decade, much of it looking for a long-term investment home.

So the US government has been trying to thread the needle between attracting this capital to invest in US tech and AI companies large and small, despite geopolitical concerns about their ongoing relationships with China.

I’m personally very familiar with the region, having grown up in Kuwait before I came to the US in 1977, and having spent my early career at Goldman Sachs in the 1980s building the Firm’s business in the region with family groups and sovereign wealth funds.

The region has come a long way since then in investment scale, sophistication and acumen. And they’re very clear-eyed about what they want beyond good risk-adjusted financial returns on their long-term investments.

One of the prerequisites for investment from the region by many countries, especially Saudi Arabia, has been that US companies invest and build their presence in country. It’s of course viewed as a way to diversify their economies away from energy over the long-term. As the NYTimes notes in a recent piece “‘To the Future’: Saudi Arabia Spends Big to Become an A.I. Superpower”,

“For the tech industry, Saudi Arabia has long been a funding spigot. But the kingdom is now redirecting its oil wealth into building a domestic tech industry, requiring international firms to establish roots there if they want its money.”

“If Prince Mohammed succeeds, he will place Saudi Arabia in the middle of an escalating global competition among China, the United States and other countries like France that have made breakthroughs in generative A.I. Combined with A.I. efforts by its neighbor, the United Arab Emirates, Saudi Arabia’s plan has the potential to create a new power center in the global tech industry.”

“I hereby invite all dreamers, innovators, investors and thinkers to join us, here in the kingdom, to achieve our ambitions together,” Prince Mohammed remarked in a 2020 speech about A.I.”

This call has been more than heeded since then.

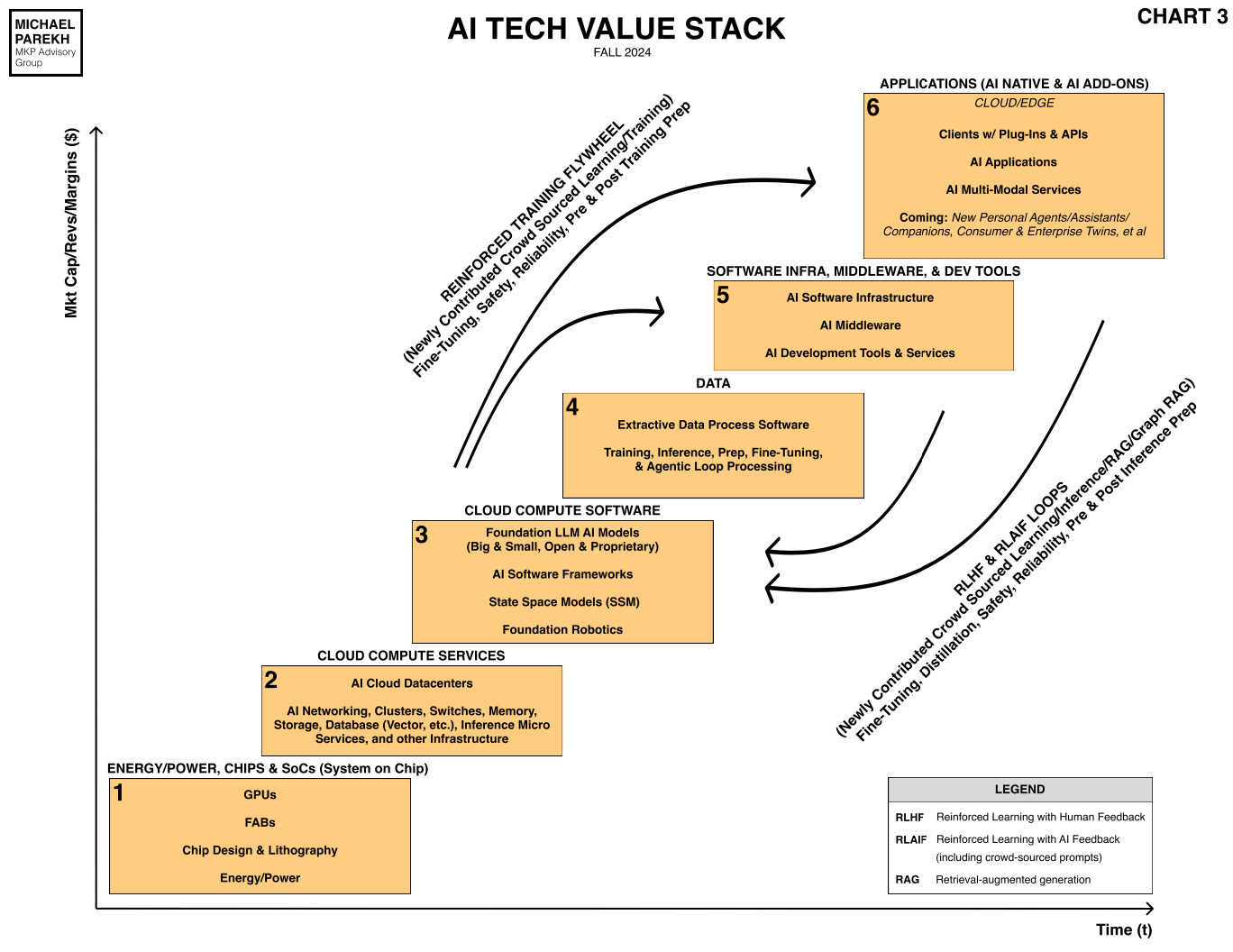

Besides investors like VCs and private equity firms, most companies large and small in the AI Tech Stack below, from Boxes 1 through 3 especially, have been attracted to the middle east over the last couple of years.

One of the core groups attracted to the region are the up and coming AI chip companies (in boxes 2 and 3 above), who are ramping to compete with AI chip and infrastructure leader Nvidia. As the Information notes in “As AI Chip Startups Sell to Mideast, More Hire in Region”:

“Chip startups SambaNova, Cerebras and Groq, trying to carve out a sliver of the $71 billion market for AI chips, are selling to Middle Eastern countries that have deep pockets and big ambitions in AI.”

“Startups that design artificial intelligence chips are eyeing the Middle East as a lucrative market where they can gain an advantage on market leader Nvidia.

“SambaNova Systems, Cerebras and Groq—three of the dozens of startups developing AI chips—in the past year have announced deals to supply semiconductors and computer systems for AI efforts in Saudi Arabia and the United Arab Emirates. Now, these startups are hiring staff or opening offices. The presence could lead to deeper commercial ties, as well as investments from the region’s wealthy investment funds.”

The whole piece is worth reading, as it details the challenges and opportunities these and other AI chip companies face in their ambitions in the region.

We have similar focus on the AI data center side as well (Box 2 above), with Amazon AWS recently signing a $5 billion plus dollar deal to build AI infrastructure in the region. And Microsoft, Google and other US cloud companies are not far behind. But they want these investments to bear fruit locally, as this CIO piece highlights:

“All of this investment is buoying cloud strategies across not just Saudi Arabia but the entire region, noted Phil Dawson, vice president of research for cloud infrastructure at Gartner.

“If I go back three years, there was limited cloud adoption in Arab states,” he said. “Now things are improving immensely … and I’m seeing more mature modernization projects [in part] because of that local investment by cloud providers.”

“While technology companies are each taking their own approach to how to get a foothold in the region, it behooves dedicated cloud infrastructure providers like Microsoft and Amazon to build data centers and have in-country infrastructure due to the culture of technology in the region, Dawson said.”

““Sovereignty, ownership, and governance are big issues for local markets like Saudi, which want things in country and want things accessible,” he said. To build infrastructure in country, then, makes it easier for them to do business in the Arab states, Dawson said.”

“The more the cloud vendor invests in the Gulf country, the more they can partner and sell services in that country,” he said.”

That’s the quid pro quo implicit in many of these AI investment deals. And something that US investors and companies will have to navigate, wherever they sit in the AI tech stack. It’s the cost of doing business in the region, even at AI Scale of chips and power. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)