AI: Appreciating AI Infrastrucure Depreciation Curves, RTZ #904

This year of course has been a flashing green lights period this AI Tech Wave. With unprecedented, big tech, ‘circular’ AI Infrastructure spend across AI GPUs (mostly from Nvidia), AI Data Centers, Power and Talent. With accelerating sums totaling up to over a trillion just for leading LLM AI company OpenAI alone. Number 2 Anthropic today announced its $50+ billion AI data center project.

And as I’ve discussed, these deals have been ‘bending’ the business models of even the biggest big tech companies, as they add massive Infrastructure investments to their direct and indirect balance sheet driven partnerships.

So of course sophisticated financial investors are taking a closer look at these financing deals. Especially as these AI capex deals are being compared to previous tech infrastructure spending sprees from railroads in the 19th century to the internet/telecom boom in the late 20th century.

The AI spending boom of the last couple of years offer some deep bottoms up technical differences that some of the smartest investors are taking a closer at with deeper financial analysis. A key one has to do with depreciation assumptions underlying these financial arrangements. And it’s a subject worth examining in this AI Tech Wave.

Bloomberg lays it out well in “The AI Bubble Is Ignoring Michael Burry’s Fears”:

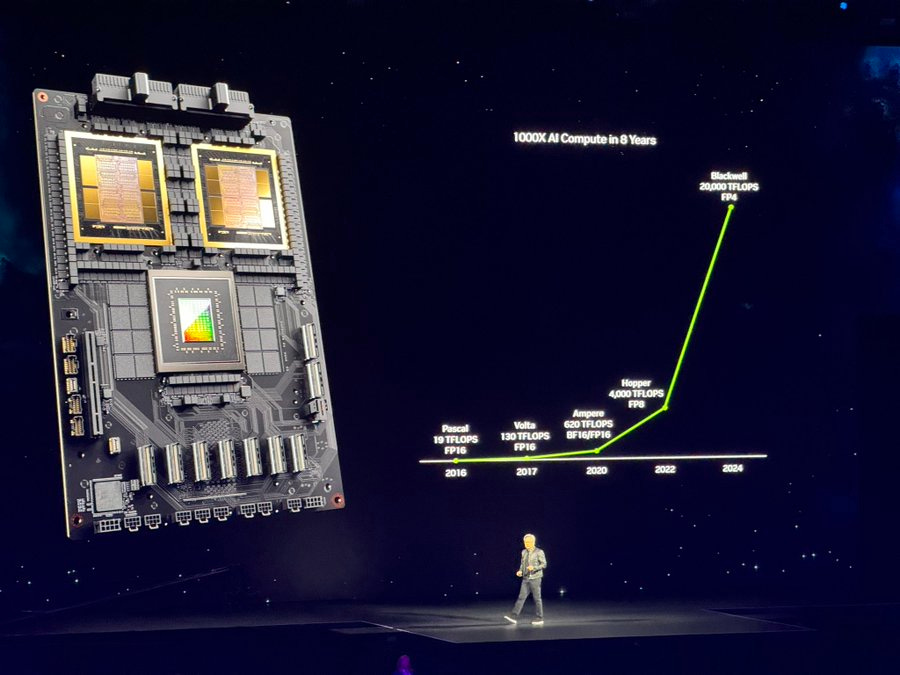

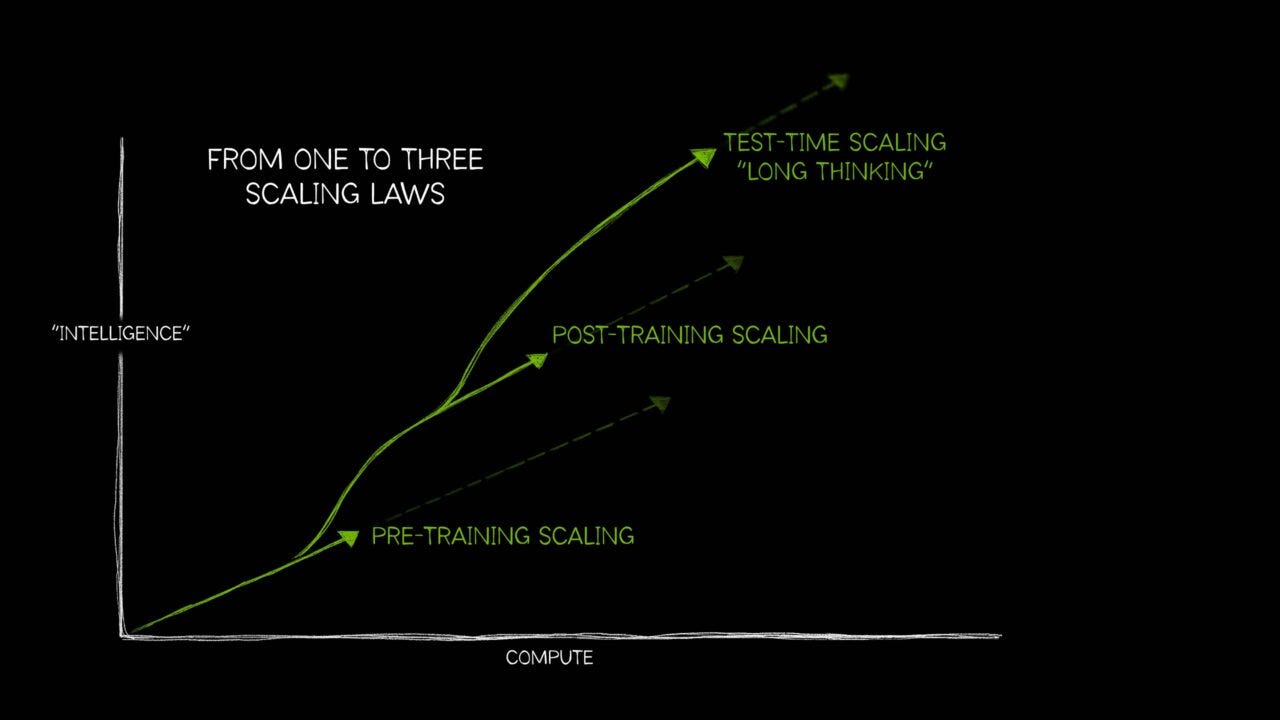

“Nvidia Corp.’s AI chips have a shelf life of perhaps five years and lose value over time, requiring customers to upgrade regularly to stay competitive.”

“The brief useful life of the chips and generous accounting assumptions underpinning investment in them are causing concerns, with warnings that AI capex could become a huge recurring expense.”

“There is a danger of a depreciation tsunami, with private credit funds using GPUs as collateral to finance loans, and tech investors potentially forgetting how much depreciation can hurt their earnings.”

“Costing tens of thousands of dollars each, Nvidia Corp.’s pioneering AI chips make up a hefty chunk of the $400 billion that Big Tech plans to invest this year — a bill expected to hit $3 trillion by 2029.”

“But unlike 19th-century railroads, or the Dotcom boom’s fiber-optic cables, the graphics-processing units (GPUs) fueling today’s AI mania are short-lived assets with a shelf life of perhaps five years.”

“As with your iPhone, this stuff tends to lose value and may need upgrading soon because Nvidia and its rivals aim to keep launching better models. Customers like OpenAI will have to deploy them to stay competitive.”

And it’s bringing investors like Michael Burry, of ‘The Big Short’ fame, who made their mark in the 2008 housing crisis:

”So while it’s comforting that the companies spending most wildly have mountains of cash to throw around (OpenAI aside), the brief useful life of the chips and the generous accounting assumptions underpinning all of this investment are less consoling. Michael Burry, who made his name betting against US housing and who’s recently turned to the AI boom, waded in this week, warning on X that hyperscalers — industry jargon for the giant companies building gargantuan data centers — are underestimating depreciation.”

“Far from being a one-off outlay, there’s a danger of AI capex becoming a huge recurring expense. That’s great for Nvidia and co., but not necessarily for hyperscalers such as Google and Microsoft Corp. Some face a depreciation tsunami that’s forcing them to be extra vigilant about controlling other costs. Amazon.com Inc. has plans to eliminate roughly 14,000 jobs.”

I’ve discussed how these AI Job loss concerns are likely overdone.

“And while Wall Street is used to financing fast-depreciating assets such as aircraft and autos, it’s worrying that private credit funds are increasingly using GPUs as collateral to finance loans. This includes lending to more speculative startups known as neoclouds, who offer GPUs for rent. Microsoft alone has signed more than $60 billion of neocloud deals.”

“Magnetar Capital, Blackstone Inc. and Macquarie Group Ltd. are among those providing such financing. Nvidia, meanwhile, is reportedly looking at using special-purpose vehicles to raise debt to buy and rent chips to customers such as OpenAI and Elon Musk’s xAI.”

“The problem is we’re about to go from tens of billions of debt that’s funding quickly depreciating GPUs, to hundreds of billions of dollars. And then there could be serious trouble,” Gil Luria, head of technology research at DA Davidson, tells me.”

It’s a depreciation distinction worth appreciating:

“Such worries may seem arcane when tech firms boast of colossal revenue and sizeable productivity gains from AI investments. But tech investors may have forgotten how much depreciation can hurt.”

“Starting from around 2020, hyperscalers began extending the depreciable life of servers to about six years from as little as three years, meaning the earnings hit from their heavy spending was more spread out. At the time this seemed justified because the pace of computing advances, known as Moore’s Law, appeared to be slowing. And tech companies found ways to keep their equipment running longer.”

“These changes have certainly helped profit. Meta Platforms Inc.’s January decision to adopt a 5.5 year useful life for most of its servers and network assets, up from four-to-five years previously, boosted its net income by close to $2 billion in the nine months to September.”

Important to note is that older GPUs have lots of other downstream users for a wide range of applications and end-users:

“Of course, GPUs don’t suddenly become useless when a new version arrives. Not everyone needs leading-edge kit to train frontier AI models. Processors can be repurposed for less demanding AI inference and other computing tasks, or they can be resold in emerging markets. And software innovations can extend their economic life. The head of Alphabet Inc.’s AI and infrastructure team, Amin Vahdat, has said that its seven- and eight-year-old custom chips, known as TPUs, have “100% utilization.”

“You won’t always need a Porsche 911 engine to run these workloads, a VW engine will do fine,” says Anurag Rana, senior technology analyst at Bloomberg Intelligence.”

And the deeper analysis is complicated, by an ever changing environment of new and old AI applications and relative cost efficiencies:

“As GPUs become an asset class, their residual value will depend on a “cocktail of unknowables,” warns short-seller Kerrisdale Capital. This includes future semiconductor architecture shifts, hyperscalers developing their own custom silicon, and trade politics such as the US export ban on advanced chips to China. I’d add that electricity constraints holding back data-center construction could make it less economic to operate older, less efficient chips.”

“It was striking, then, that early this year Amazon reverted to a more conservative five-year useful life estimate for a subset of servers and networking equipment (from six years). It saw “an increased pace of technology development,” particularly in AI and machine learning.”

“Unfortunately, there’s little agreement about the durability of such equipment.”

Complicating matters are the variability in the assumptions that can be made:

“CoreWeave Inc., a publicly traded neocloud with a roughly $50 billion market value, says it’s “incredibly comfortable” with its six-year GPU depreciation policy, pointing to its success in re-contracting processors after the initial rental term ends, which on average is after four years. However, Amsterdam-based rival Nebius Group NV uses a four-year depreciation schedule. Paris neocloud Scaleway thinks three years is more realistic.”

“If tech companies underestimate how rapidly processors lose value and technological relevance, they may have to book impairments. In the short term you’d expect to see reported profit much higher than cash flows, because the former doesn’t include all the upfront capital spending. But if this gap persists, it could be a sign that replacement costs are starting to bite and earnings are overstated.”

“The onus is now on the companies who own GPUs to quickly jack up their AI revenues. Otherwise they risk being swamped by higher depreciation costs and they may not be able to afford the next round of capex.”

Also important is how these depreciation assumptions are managed by the Neocloud AI data center companies, who typically have less robust balance sheets:

“But neoclouds lack Big Tech’s vast profits and cash piles, so they’re borrowing billions instead. CoreWeave has $16.9 billion of net debt including lease liabilities, according to data compiled by Bloomberg. It’s using the money to fund as much as $14 billion of capex this year and more than double that in 2026. That will take it beyond the usual spending of an oil major like Shell Plc.”

“Although CoreWeave has made progress in lowering borrowing costs, some initial loans have double-digit interest rates. Hence its interest expenses exceed operating income.”

“Such risks should be manageable if neoclouds can recoup spending via multi-year contracts with reliable renters of their services, rather than relying on spot markets or revenue from less tested startups. CoreWeave said this week that more than 60% of its $56 billion revenue backlog relates to “investment-grade” customers. It echoed Microsoft by saying its infrastructure is fungible.”

But one can expect volatility with rapidly changing underlying AI technologies as they scale.

“Still, rose-tinted neocloud financial models may be undone if GPUs lose value quicker than expected. A lack of demand or AI breakthroughs that are less thirsty for computing power could create a need to offload chips en masse.”

“Nvidia’s soaring stock price is the simplest barometer for AI mania. But it’s the more opaque, more complicated world of debt finance and accounting depreciation that could yet puncture the AI bubble.”

The whole piece is worth a closer read, especially for the charts and graphs that illustrate the core points.

But it all highlights why this AI Capex wave is very different than railroads and telecom Tech Investment booms of the past. And will require adroit management both technically and financially for all the parties involved. And all in just the very opening days of this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)