AI: Charging into higher Global AI Capex. RTZ #667

The Bigger Picture, March 23, 2025

As we approach the end of the first quarter this year, the global AI Tech Wave is charging into the next gear of unthrottled AI capex infrastructure spending. And as I’ve outlined before, it approaching unprecedented levels relative to previous tech waves, this early into their growth curves.

The pros and cons of this trend are relatively well understood thus far as I’ve outlined before. And the unknowns are still just that. But the revving up to the next level despite these possible concerns, is the Bigger Picture I’d like to unpack this Sunday.

Axios summarizes it all well in “AI infrastructure’s all-out spending spree”:

“Chipmakers, cloud providers, energy producers and AI companies are all flooring the pedal on infrastructure spending to support an AI-driven world that doesn’t yet exist.”

As I’ve outlined, one after another big tech companies have been anteing up in this political environment:

“Why it matters: Investors are placing hundred-billion-dollar bets that demand for AI is about to explode, while the technology has yet to persuasively demonstrate its mass consumer appeal or its business-efficiency benefits.

“Driving the news: The AI Infrastructure Partnership announced Wednesday that it was adding Nvidia and xAI as new partners in its fund, which aims to build data centers and energy facilities supporting AI, mostly in the U.S.”

-

“Microsoft, BlackRock and UAE-based MGX were already key investors in what was announced last September as a $30 billion fund that could be leveraged up to $100 billion.”

-

“Thursday, Nvidia CEO Jensen Huang told the Financial Times he expects his company will manufacture “several hundred billion” dollars’ worth of electronics in the U.S. over the next four years.”

-

“The Abu Dhabi-based wealth fund ADQ and U.S. heavyweight Energy Capital Partners intend to invest over $25 billion in projects to power data centers and other industrial consumers, Axios’ Ben Geman reported Wednesday.”

“These deals and announcements all follow the high-profile launch of Stargate, a partnership — including OpenAI, Oracle, SoftBank and MGX — that’s raising an initial $100 billion (toward an aspirational total of $500 billion) to build U.S. data centers for OpenAI.”

-

“The Stargate announcement came straight from President Trump in the Oval Office the day after his inauguration.”

It’s technology and theatrical political gamesmanship at the highest levels:

“The big picture: The new deals also further extend an AI spending spree that saw massive capital-expenditure growth from tech giants Microsoft, Alphabet/Google, Amazon and Meta in 2024 — a trend the companies say will continue.”

“The intrigue: The Trump administration is touting all this domestic investment as a win for its efforts to boost domestic manufacturing and growth.”

-

“But much of the investment would likely have happened no matter who was in the White House.”

And note the biggest knowns driving this gamesmanship:

“Two key forces are driving the spending: AI euphoria and geopolitical risk.”

-

“The euphoria is the tech industry’s certainty that AI is destined to be the underlying technology for a new, bigger-than-ever wave of digital growth.”

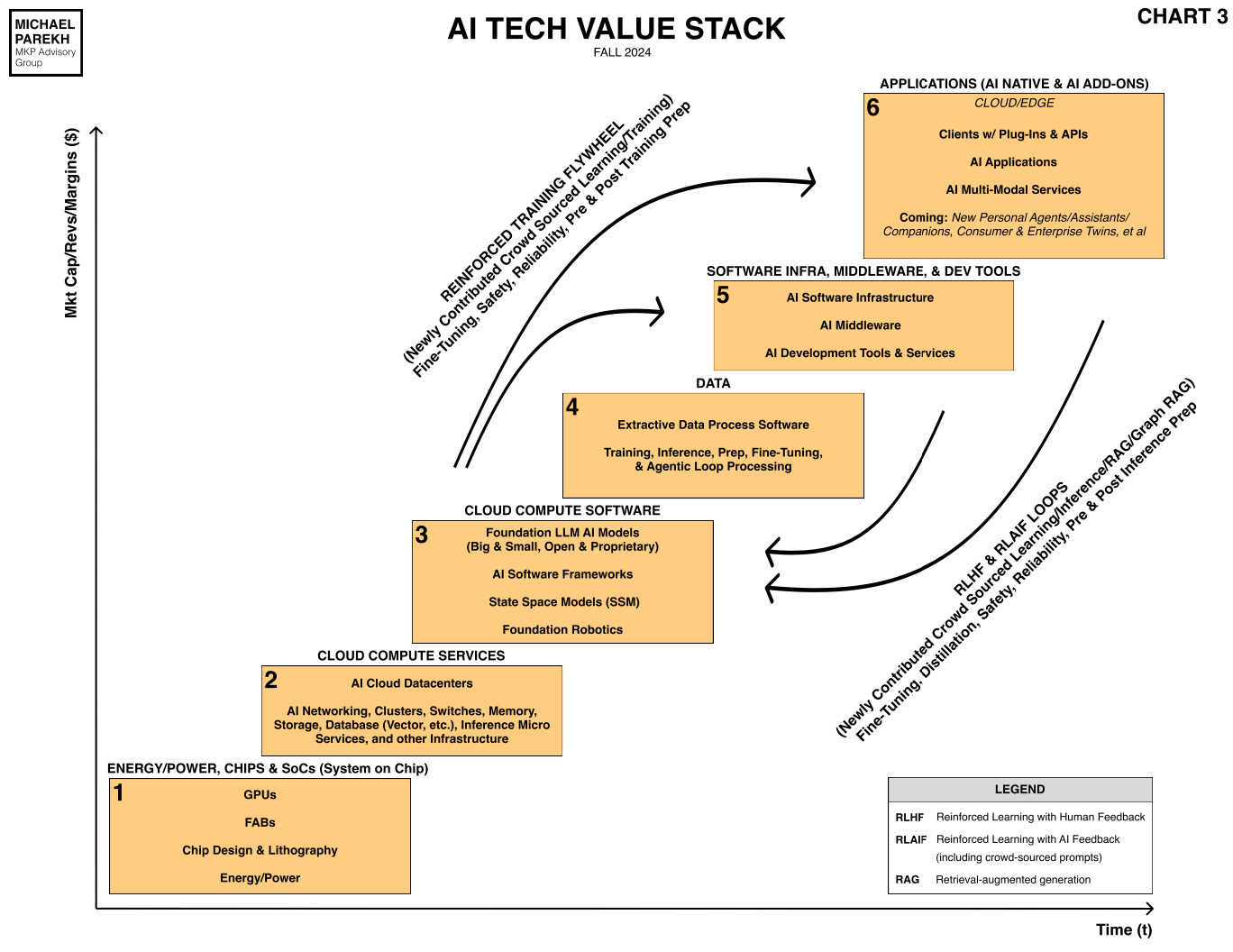

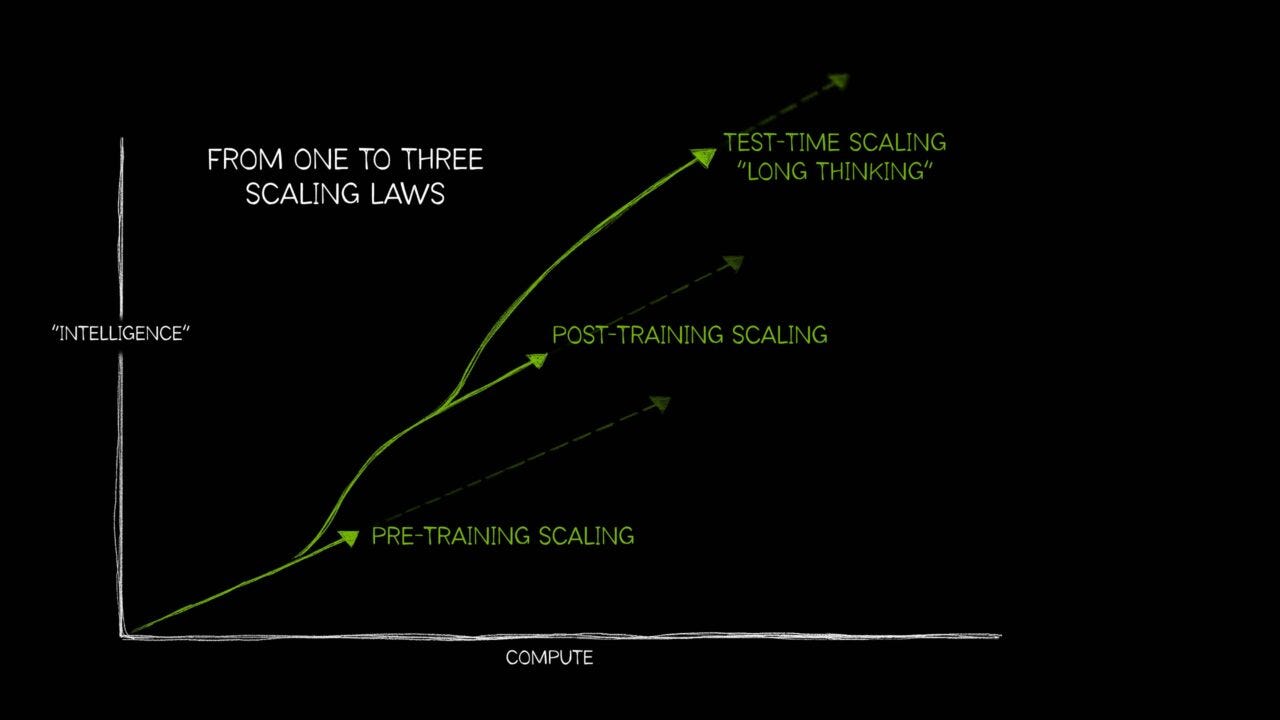

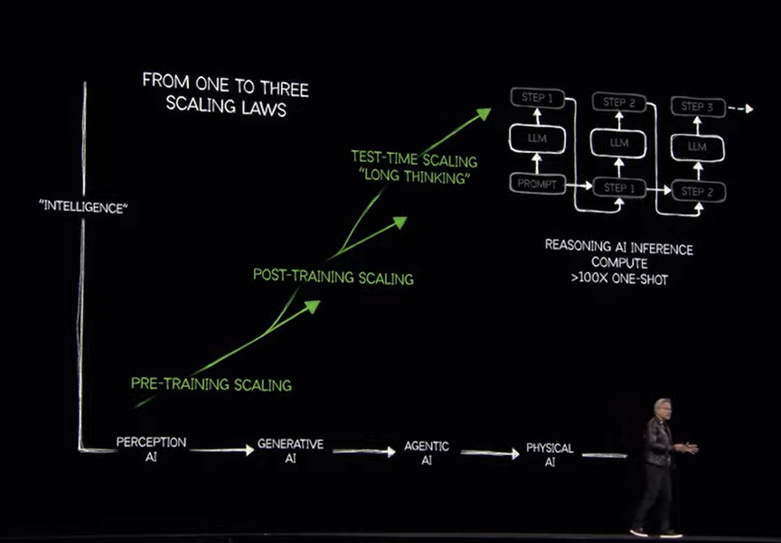

I’ve discussed the underlying AI techwaves ‘trifurcating’ to produce higher numbers of secular growth opportunities for the Mag 7s and beyond:

-

“The risk is that the AI industry is dependent on a handful of dominant monopolies — U.S.-based Nvidia (which designs chips), Taiwan-based TSMC (which manufactures chips) and Netherlands-based ASML (which makes the machines that make chips).”

-

“This wildly profitable global semiconductor supply chain is vulnerable in the event of an attack on Taiwan by China, which has long claimed the island, or a major earthquake in Taiwan.”

And of course, the impressive technology roadmap by Nvidia, driven by its partners TSMC, ASML and other key semiconductor stalwarts around the world:

“The other side: This week Nvidia announced the next generation of its advanced AI chips, called Rubin, and promised it would be twice as fast as today’s top-of-the-line Blackwell.”

-

“But The Information reports that Blackwell is only now beginning to arrive in most companies’ data centers.”

-

“While “Nvidia’s biggest customers like Google, Meta and OpenAI are dying to receive clusters of Blackwells as they race to develop cutting-edge AI, no one else seems as interested,” the Information’s Anissa Gardizy writes.”

-

“That’s a striking contrast to the scramble for, and shortages of, Hopper chips — the generation that preceded Blackwell — in the period after ChatGPT’s debut more than two years ago.”

And that’s all under traditional ‘known’ risks of the semiconductor industry over decades, it’s inherent cyclicality:

“The bottom line: Tech in general, and semiconductors in particular, have always been cyclical businesses. First you overbuild, then you suffer through a glut, then there’s a shortage — and then you overbuild again.”

-

“It happened with memory chips at the start of the ’90s, and it happened with internet connectivity during the dotcom boom and bust.”

“Plenty of people in the AI industry believe this time is different. History suggests they’re headed for a letdown.”

But all that pales against the AI scaling law implications just over the next three years. For AI companies big and small. Existing ones, and new ones yet to come.

The Mag 7s and the rest of the AI tech industry, led by the AI infrastructure roadmaps by Nvidia and others, have unprecedented visibility into their own roadmaps, DESPITE the uncertainty on the timing and magnitude of ultimate customer adoption at scale. And at what levels of pricing.

That nonwithstanding, the secular, bottom up waves of tech innovations, at annual improvement rates far exceeding Moore’s Law are too large for the technologists and investors to ignore. Despite the uncertainties of ultimate timing and scale of the monetized returns. And the political unknowns.

And that is the Bigger Picture to keep in mind approaching the first quarter of 2025 in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)