AI: Elon merges xAI and X/Twitter as first step to AI platform. RTZ #675

Elon Musk played an old playbook with his companies and platforms in his long-term AI ambitions. xAI which is his main AI data center company for powering Grok, his LLM AI that competes. with nemesis OpenAI, Anthropic, Google et al, got merged with X/Twitter in a headline grabbing fusion with an eye-popping $113 bilion valuation for the two private companies. He made time for it amidst his Washington DC ‘DOGE’ activities.

And given his long-term ambitions with AI Robotaxis, Robots and more, it’s logical that the next likely merger is with his public vehicle, Tesla. It’s a roadmap that needs to be digested by all the stakeholders and investors around Elon’s ecosystem.

First, a brief look at the transaction. As the WSJ explains in “Musk Merges His AI Company With X, Claiming Combined Value of $113 Billion”:

“Combination values xAI at $80 billion and X at $33 billion, the tech entrepreneur said on X”.

“Elon Musk’s artificial-intelligence startup xAI has acquired X, the social-media platform he also owns, in an all-stock transaction that fuses two of the billionaire’s biggest technology bets and assigns the new enterprise a lofty value.”

“The combination values xAI at $80 billion and X at $33 billion, Musk said in a social-media post announcing the acquisition. The new valuations were determined during negotiations between the two Musk arms, which both had the same advisers, people familiar with the matter said.”

“The deal combines a Musk-controlled AI company racing to create powerful new tools that could transform the economy, with a social-media platform that holds a fire hose of chatter from around the globe. X can serve as a powerful distribution tool for xAI’s products, including its AI chatbot Grok, and provide a valuable feed of real-time data to power the startup’s models.”

Rationale is of course future capital raises:

“Executives at the companies, which share personnel, believe it will be easier to raise money for the combined businesses under xAI than it would be separately, a person familiar with the matter said. They worked on the combination for several months.”

“Today, we officially take the step to combine the data, models, compute, distribution and talent,” Musk said. He announced the deal to xAI staff around the time his X post was published, sources familiar with the company said.”

“All shares of X and xAI will be exchanged for shares in a new holding company, named xAI Holdings Corp, according to materials shared with investors. A new xAI entity was registered in Nevada on Thursday, listing Musk as president.”

There is a template here being reused:

“Musk has combined two of his companies before. He used his Tesla stock in 2016 to buy his solar-energy company SolarCity. Musk’s other closely held businesses include SpaceX, the rocket startup; Neuralink, the brain-implant chip firm; and Boring Co., the tunnel maker.”

He made time for the transaction from his responsibilities in DC:

“His role as an adviser to President Trump has added to his influence and appeal for some investors. At the same time, Musk has seen the polarizing effects of his politics hit Tesla’s value.”

The deal follows other transactions for the underlying pieces in recent days:

“Earlier this month, X raised roughly $900 million from new and existing investors at a valuation just above its $44 billion takeover price in 2022, according to a person familiar with the fundraise. That valuation effectively set a new benchmark for what X is worth.”

“X’s revenue plummeted after Musk’s takeover in 2022, when brands fled the platform because of concerns about his efforts to loosen content-moderation restrictions and the turmoil that ensued from management changes. Some advertisers have returned to X as Musk’s influence and power in the Trump administration has risen.”

“The social-media site is expected to see ad-revenue growth for the first time since the takeover this year, according to research firm eMarketer.”

And of course there’s xAI and its valuation as a private entity:

“In the months leading up to the merger announcement, xAI gauged investor interest in a new funding round that would value it at $75 billion, people close to the talks said. The startup was last valued at around $50 billion.”

“X and xAI share many of the same investors, including Sequoia Capital, Vy Capital and Valor Equity Partners. X already owned a roughly 10% stake in xAI before the acquisition.”

And like with most of Elon’s endeavors, there’s fluid sharing of resources amongst the entities:

“Prior to the acquisition, xAI and X had shared some resources, and in xAI’s early days its employees worked out of X’s San Francisco office. xAI has also leased graphic processing units, or GPUs, from X.”

Axios has an additional take on the xAI valuation and its reliance on X/Twitter for most of its traffic that is worth noting:

“xAI, on the other hand, is a growing two-year-old startup that won headlines for getting a giant new data center in Memphis, Tennessee, built fast.”

-

“The company’s AI models have become contenders in the bigger AI race, earning comparisons with better-known rivals like OpenAI and Google.”

-

“But for most of xAI’s existence the bulk of its usage has come from the X network.”

“By the numbers: Musk says xAI’s paper valuation based on its most recent private investment round is now $80 billion.”

-

“Its exact revenue is a tiny fraction of that — maybe $100 million — meaning investors are paying 800 times revenue for their shares. (The equivalent figure for Tesla right now is about eight times revenue.)”

-

“xAI’s modest revenue stream in turn comes chiefly from X itself.”

-

“For the moment, these dollars are all just circling the Musk-o-sphere in a slightly different configuration.”

“The big picture: Everyone in tech is benefiting from AI’s magic multiplication powers right now.”

Indeed.

As in most earlier tech waves, there are two distinct valuation spheres, one for established companies with growing revenues and profits, and higher, more speculative ones driven by momentum investors seeking opportunities to ride the new wave for a short, profitable time.

And it helps that the two entities share common investors that can be made happy with new stakes in a combined entity relative to their existing stakes in the current entities.

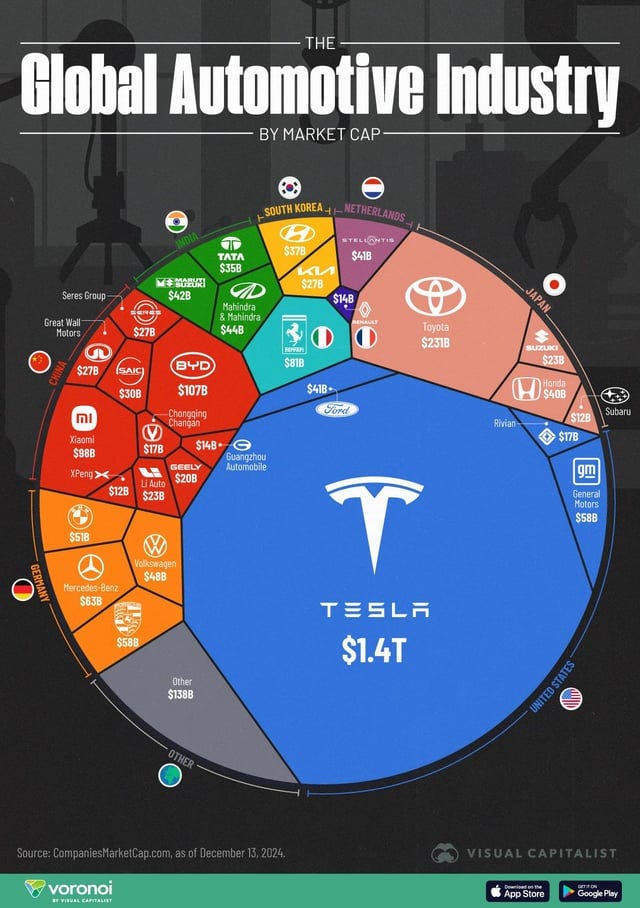

And if this new entity is indeed merged at some point with a public Tesla, both part will benefit from the dramatically higher, momentum driven valuations, relative to their individual peers. Tesla as I’ve noted before, was valued by the public markets at a market cap at multiples of the global auto industry.

And that multiple is at least two plus times the total valuation of all other auto companies IN THE WORLD, even after Tesla’s recent retracement to around $800 billion plus in market cap with the recent Musk controversies.

And the jury is out on how a Tesla brand damaged by Elon Musk’s DC DOGE reputation can be fixed.

The X/xAI deal’s professional helpers worked hard on the deals to date:

“Morgan Stanley advised on the deal, along with lawyers at Sullivan & Cromwell, according to people familiar with the matter. Morgan Stanley has close ties to Musk, having advised on his $44 billion acquisition of Twitter (now known as X) and led the financing of that deal.”

“Musk launched xAI two years ago with the goal of creating a rival to OpenAI, the nonprofit research lab behind ChatGPT. Musk co-founded OpenAI in 2015 before souring on its leadership.”

The two companies were already working together with Grok with shared resouces:

“xAI’s first product, Grok, was initially made available only via X and only with a subscription to the social media service, which provided distribution for the late entrant to the space.”

As I said at the outset, it’s important that this complicated transaction is likely just the first step. Given the larger AI ambitions expressed by Elon Musk to date, Tesla is the next pit stop for this new entity.

As the WSJ outlined in a different piece last year:

“Elon Musk says Tesla will produce millions of robots and self-driving cars in the future that will propel the company’s market capitalization to stratospheric levels.”

And the question on funding all of the promises of AI, robotaxis, robots and beyond, is what this first transaction above starts to address, with Tesla being the likely next step:

“How he will fund that future is coming under sharper scrutiny. Musk is under pressure to wring better profitability from the core auto business to help pay for those moonshot bets.”

Currently there is room in the momentum-driven valuation premiums both in the private AI markets, and the public market for Tesla.

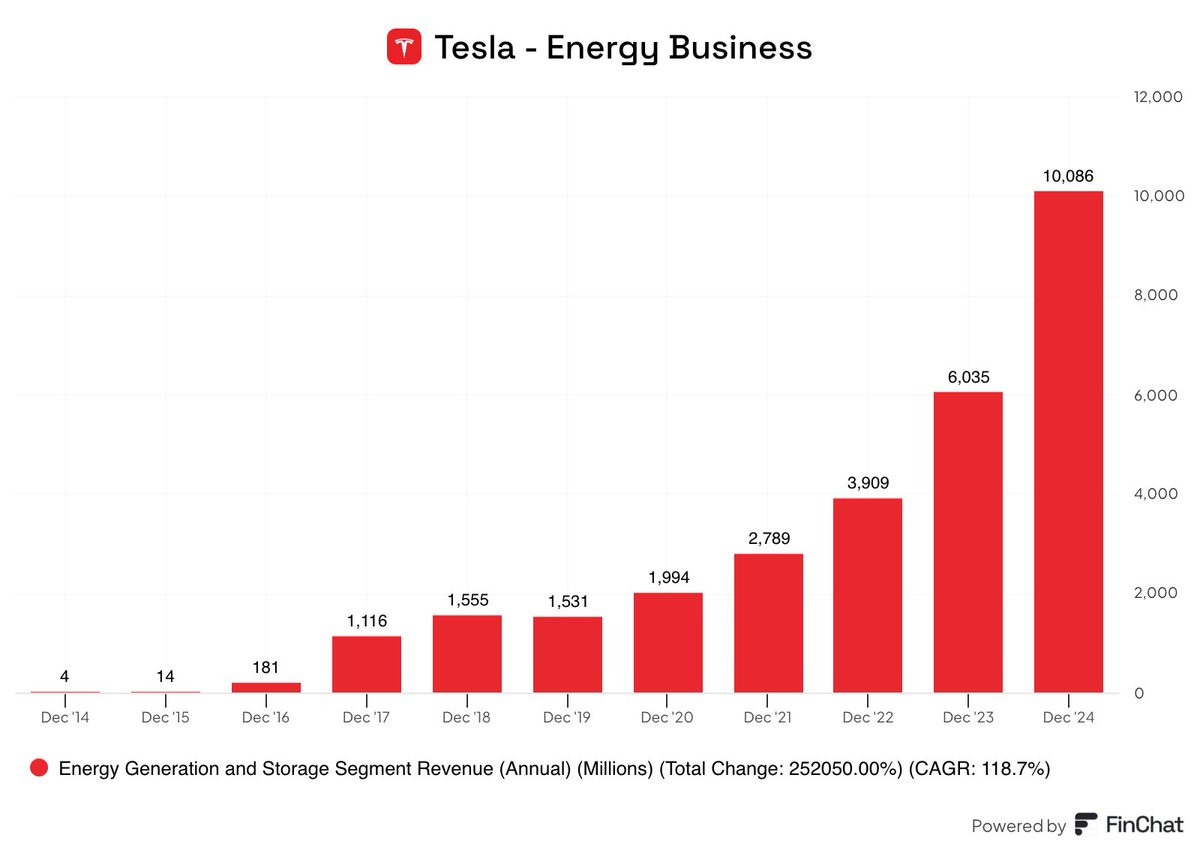

That battery & energy business today has crossed over $10 billion in revenues, or 10% of Tesla’s $97.7 billion in revenues in 2024. The unit has grown to 26% in gross margins. BYD, Tesla’s chief auto competitor in China surpassed Tesla in total revenues crossing $100 billion in revenues, and has a vertically integrated battery business as well.

The car business has growth challenges ahead:

“After years of breakneck growth, revenue from the car business has plateaued, and operating margins—while up in the third quarter—are down from a few years earlier. Now the Tesla chief executive officer says the company needs to increase spending for its next phase of growth, which includes rolling out a $30,000 self-driving Cybercab, AI-powered robots and more-affordable vehicles.”

Elon has long been redoing the Tesla narrative from an AI context:

“The billionaire has urged investors to think of Tesla as an artificial-intelligence and robotics company, rather than a typical carmaker, and has said its efforts in these areas could eventually boost the electric-car maker’s market cap to $30 trillion.”

And analysts are thus focused on the long term opportunities around robotaxis and robots:

“Wolfe Research analyst Emmanuel Rosner wrote in a note Thursday that Tesla needs to convince investors of two things: that the car business can reaccelerate, and that the company’s plans for full vehicle autonomy are on track. “Overall, they struck a very confident tone” on both points, he wrote.”

“Musk has stressed development of a robotaxi that could ferry passengers for paying rides, and aims to start selling a humanoid robot, called Optimus, in 2026.”

“Investors have largely bought into this vision, with Tesla’s $836 billion market cap more akin to Silicon Valley innovators than metal-bending manufacturers of automobiles.”

Tesla rallied to over a trillion dollar market cap post the Trump victory, and since has come down to the levels quoted above.

“Still, these endeavors are costly and come as Tesla’s profit margins are pressured by lower vehicle deliveries, an aging model lineup and the need to lean more heavily on price cuts and other promotions to keep buyers interested.”

And Tesla’s capital demands alone are accelerating going forward:

“This year alone, Tesla plans to spend about $10 billion on AI-related expenses. That figure is more than double the $4.36 billion in free cash flow Tesla generated for all of 2023.”

“In many ways, Tesla is confronting an age-old problem in the car business—one that has bedeviled automotive CEOs before.”

“Musk wants to build Tesla into a tech company with hefty investment in new ventures in part by leaning on Tesla’s automaking operations, a historically low-margin business that is highly competitive and sensitive to swings in the economy.”

“It is a tricky balancing act, made more difficult as the market’s enthusiasm for electric vehicles cools and rivals unleash new battery-powered models, aiming to dethrone Tesla as the world’s top EV seller.”

And last year was a slog:

“The first nine months of 2024 have already been a challenge for the electric-car pioneer as it cranks up spending on projects that could still be years away from generating a steady return.”

“Tesla’s operating margin was 10.8% in the third quarter, the highest level this year but still below the level of prior years before the company began cutting prices on its vehicles.”

Financial analysts are sharpening their estimates goimg forward:

“Wall Street is eager to learn how Musk plans to pay for the multibillion-dollar investments in AI research necessary to fuel Tesla’s transformation. The October unveiling of the Cybercab was met with investor disappointment, in part because Musk didn’t delve into details about the technology behind the self-driving taxi or how he plans to turn it into a viable business.

“Without much indication of progress on either technology or business models, we are back to focusing on operations and lingering concerns about governance and funding,” wrote Jefferies analyst Philippe Houchois in a note ahead of Wednesday’s report.

And the numbers get tougher going forward:

“Tesla’s AI pursuit involves multibillion-dollar investments over an uncertain timeline. The technical hurdles to putting driverless cars on public roads has challenged such deep-pocketed technology companies as Alphabet’s Waymo, which has been working on the technology since 2009.”

“Tesla is rushing to drive costs down, including with a reduction of more than 10% of its global workforce this past spring and throttling back some projects, including the Roadster sports car.”

“Musk has said the company is on track to launch a more-affordable model next year, a move that many investors view as critical to keeping Tesla competitive, especially with the rise of cheap, Chinese-made EVs.”

And China competition is revving up in AI powered self driving cars and robotics.

And the traditional car business of course traditionally has low margins:

“General Motors reported Tuesday that it had an operating margin of 7.5% in the third quarter. It is on track to report record operating profit for the full year, as a result of strong demand for gasoline vehicles.”

Tesla this year of course faces additional headwinds including the global public reaction to Musk’s political activities in DC, Europe and around the world, amplified by his X/Twitter megaphone.

Besides the dent on Tesla’s global brand is the onslaught of global EV competition from Chinese automakers led by BYD, and almost a 140 addtional EV companies there.

And that’s not including Elon Musk’s other major company SpaceX with its Starlink subsidiary, and his efforts to steer their future to Mars, with a little more work in DC via morphing NASA.

All of this means that Elon Musk has his hands full with tasks, across his fleet of companies, and out of this world objectives. And of course his ambition to lead in AI innovation and deployment in this AI Tech Wave, especially vs OpenAI.

So this X/xAI merger, is but the first step with Tesla likely the next charging station for capital and resources. And then ‘miles to go’ further thereafter like his arch-competitors. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)