AI: Entering 'Trough of Disillusionment' in LLM AI 'hype cycle'. RTZ #542

The Bigger Picture, November 17, 2024

November 30 this year marks the second anniversary of OpenAI’s ChatGPT moment, that got the world galvanized around the risks and opportunities of this AI Tech Wave. And while most companies and investors are leaning into the AI Scaling in data center compute and power ahead, there are ongoing AI Scaling questions and the timing of returns. All around the truly useful AI products and services to come.

A classic financial markets methodology that can be applied here is the ‘Gartner hype cycle’ framework above. It has been used for decades to measure technology waves of all types. In this AI Tech Wave we may be close the beginning of beginning of the ‘Trough of Disillusionment’ phase after the initial ‘Technology Trigger’ of ChatGPT. That is the Bigger Picture I’d like to unpack this Sunday.

As a refresher, the Gartner Hype cycle can be summarized as follows:

“Interpreting technology hype”

“When new technologies make bold promises, how do you discern the hype from what’s commercially viable? And when will such claims pay off, if at all? Gartner Hype Cycles provide a graphic representation of the maturity and adoption of technologies and applications, and how they are potentially relevant to solving real business problems and exploiting new opportunities. Gartner Hype Cycle methodology gives you a view of how a technology or application will evolve over time, providing a sound source of insight to manage its deployment within the context of your specific business goals.”

And then is marked off as five points in the curves above and below:

“How do Hype Cycles work?”

“Each Hype Cycle drills down into the five key phases of a technology’s life cycle.”

-

“Innovation Trigger: A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven.”

-

“Peak of Inflated Expectations: Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.”

-

“Trough of Disillusionment: Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.”

-

“Slope of Enlightenment: More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious.”

-

“Plateau of Productivity: Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.”

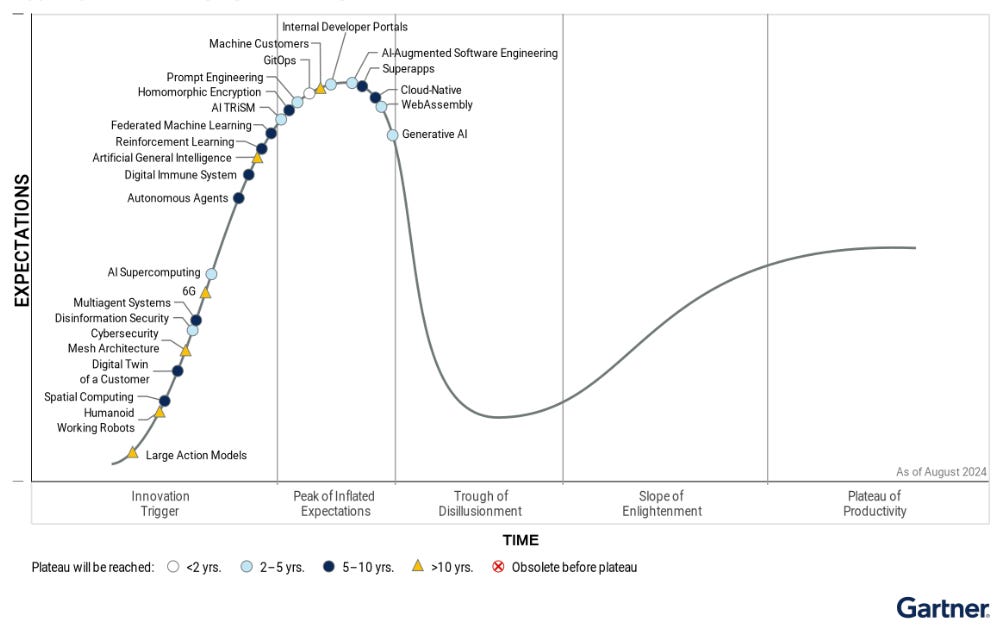

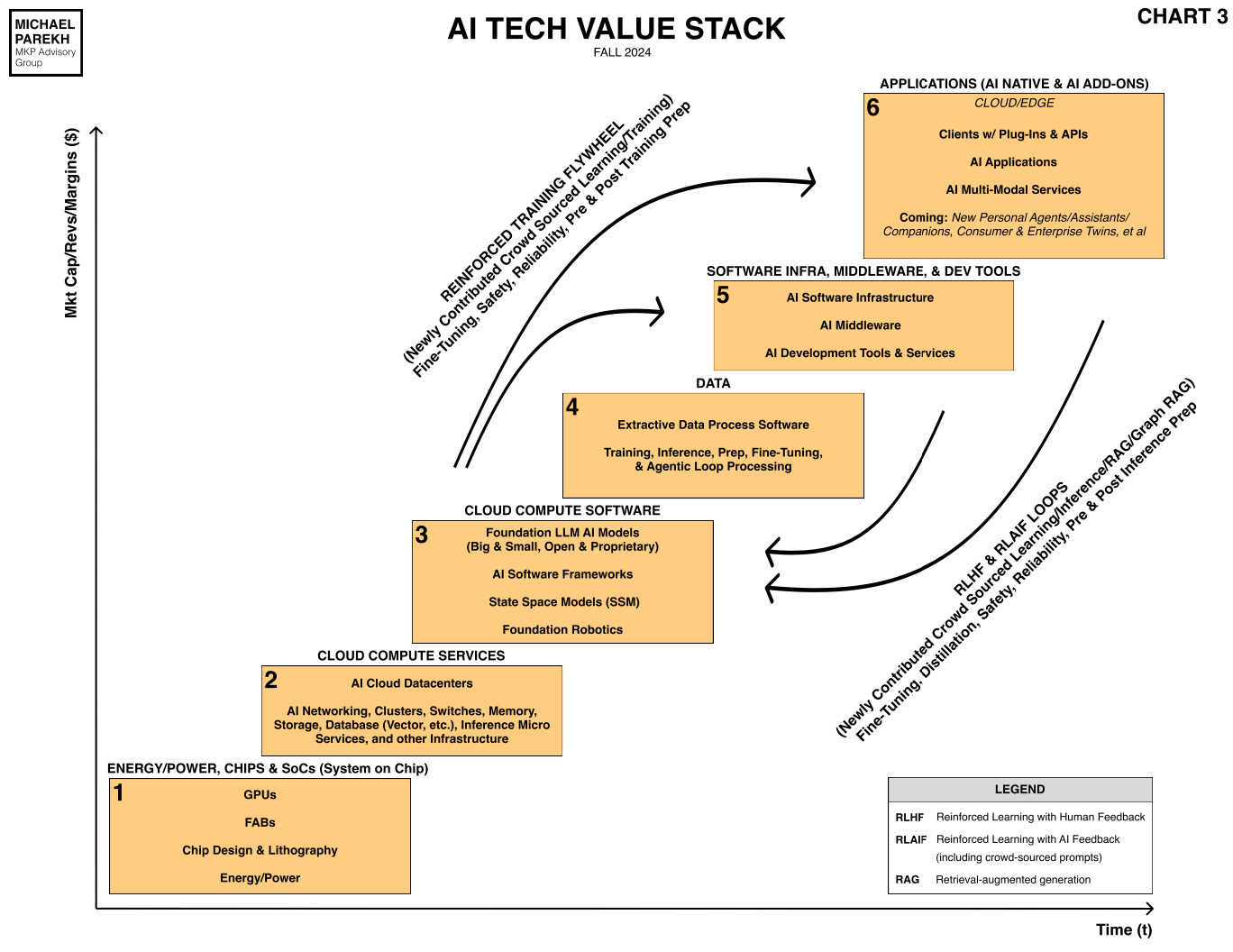

Thus far in this AI Tech Wave, we are somewhere either before, at, or just going off the first peak in the charts above. And it’s across the six boxes of the AI Tech Stack I’ve long used in these pages:

It’s an unprecedented, fervent race to Scale AI with hundreds of billions++ in AI Compute and Power. All while the debate on when the rewards may accrue to companies and investors, is increasing in pitch and volume.

Also uniquely this time, there may be multiple ‘Hype Cycles occurring beyond LLM AIs, in AI Robotics, AI self driving cars, AI Wearables, AI Voice devices, and so many others to come. And for AIs both small and large.

So unlike the PC, Internet cycles, this time there are multiple cycles to navigate, for companies, investors and users. And the companies themselves are trying to figure out how to successfully ‘Scale AI’ with Trust, in the first place, as I’ve described in these two part posts. All of this of course makes it even more difficult for investors and media to figure out the algebraic question of when to step in or out of the AI Tech Wave. It’s more of a calculus problem of several curves in immediate proximity.

The ‘trough of disillusionment’ is not just for companies and investors around AI, but users of all types, be they business or mainstream consumers. With multiple trillion dollar companies leaning into the AI race.

At this early stage of the this AI Tech Wave, I don’t expect the ‘trough of disillusionment’ to last too long. But we should be ready for some volatility on the curves above nevertheless. Tech almost always takes longer than we think to find true ‘product-market-fit’, for companies, and industries at large. That is the Bigger Picture to keep in mind in the months ahead. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)