AI: 'Experimental Recurring Revenues'. RTZ #321

I’ve been on the road attending a series of tech investor conferences and meetings in Silicon Valley and beyond. The subject most often broached with investors and entrepreneurs of course is the almost white hot AI Tech Wave, and how it compares to tech waves past. It’s a never-ending quest to try and figure out what about AI is a ‘flash in the pan’, and what’s real and investable in the long run.

The question on the minds of current investors especially be they public, private, cross-over, early stage, growth and/or late stage is ‘how real is this AI thing’?

And what are the metrics to evaluate growth of the companies large and small, incumbents and startups? Metrics both business and financial.

What’s the sustainable ‘ARR (Annual Recurring Revenues)’, and what’s the ‘Experimental Recurring Revenues (ERR)’ as customers ‘kick the AI tires’?

I spend most of my waking hours on these questions.

This topic was vividly illustrated in the Information’s “The Investors Sitting Out the Latest AI Wave—So Far”, a piece worth reading in full, to understand the spectrum of AI investors today, from enthusiastic to cautious. Specifically the piece notably quotes institutional investor Deven Parekh (no relation), on the understandably ‘cautious’ side of the spectrum:

“Deven Parekh, managing director at Insight Partners, said he finds it difficult to invest in generative AI startups right now. One reason is the tendency for some startups to use vanity metrics, or what some investors are informally dubbing “experimental recurring revenue.” The phrase—a play on the traditional enterprise software metric, annual recurring revenue—refers to sales of technology customers are only testing out rather than committing to for longer periods.”

“Parekh said companies of all kinds are testing generative AI tools to improve their software production, call centers and analysts, and that is propelling early revenues for some generative AI startups. But he doesn’t know if those customers will keep buying in the long term. “I have very strong conviction on the adoption of this technology.”

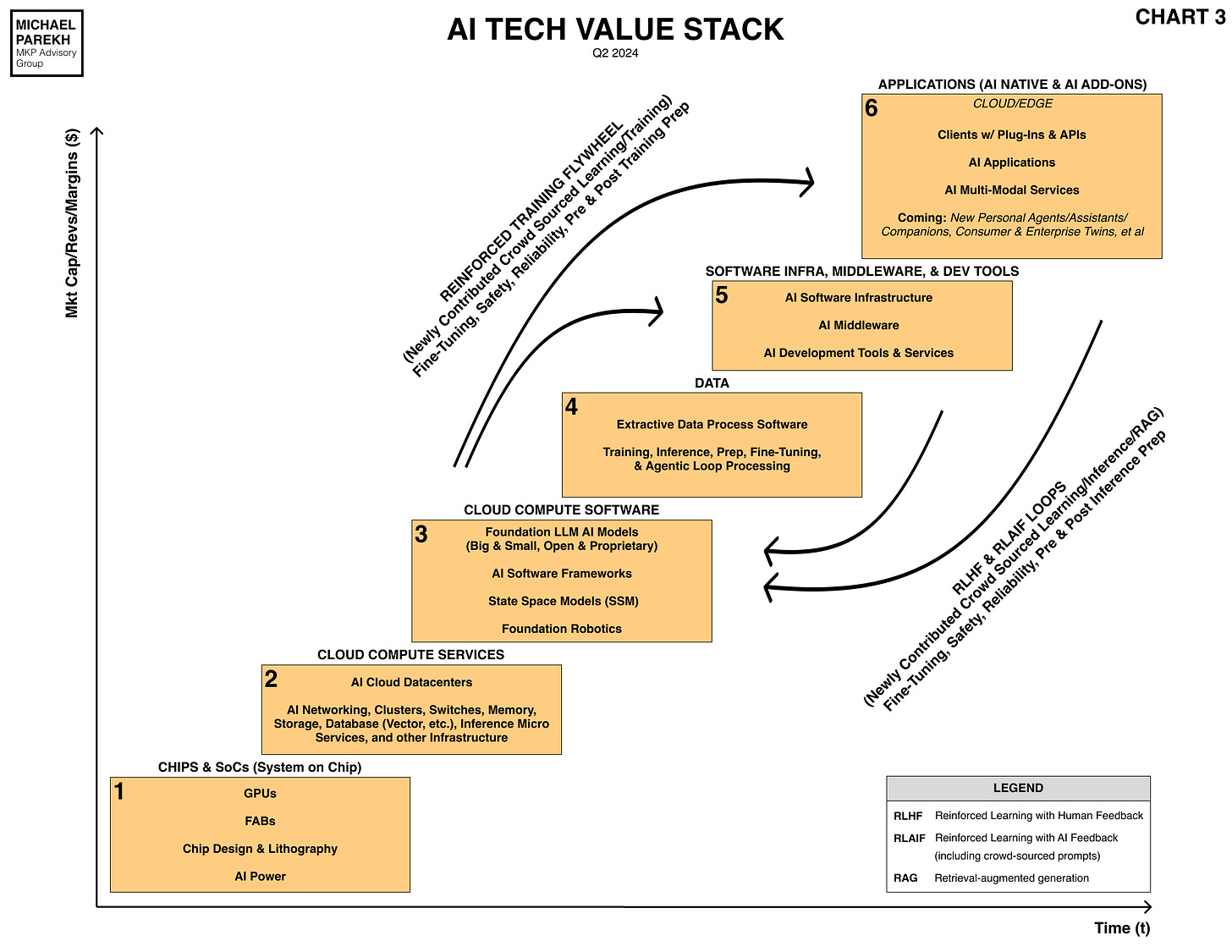

Mr. Parekh makes an important point in tech investing. Every cycle has customers of all types and sizes ‘experimenting’ with the new stuff. In every box of the Tech Stack below.

As the Information goes on to explain this in the context of other investors:

“Growth-stage firm General Atlantic, known for investments in Airbnb and ByteDance, is still waiting it out. Anton Levy, the firm’s chair of global technology, called the current wave of AI investing “the big infrastructure build-out” that would later give way to bigger opportunities to invest at the “application layer.” He said in an email that the firm saw a similar shift in the late 1990s during the rise of the internet.”

“We witnessed that the market cap of the application layer opportunity was magnitudes larger than infrastructure build-out and presented the greatest value creation opportunity for growth investors,” he wrote. “We believe the same will be true with the coming AI innovation cycle and have conviction that this technology will enable an unprecedented set of growth equity investable opportunities for the next decade.”

He’s talking about Box 6 above in the AI Tech Stack chart, the ‘holy grail’ of all tech waves from PCs to the Internet, Cloud, Mobile and many, many others.

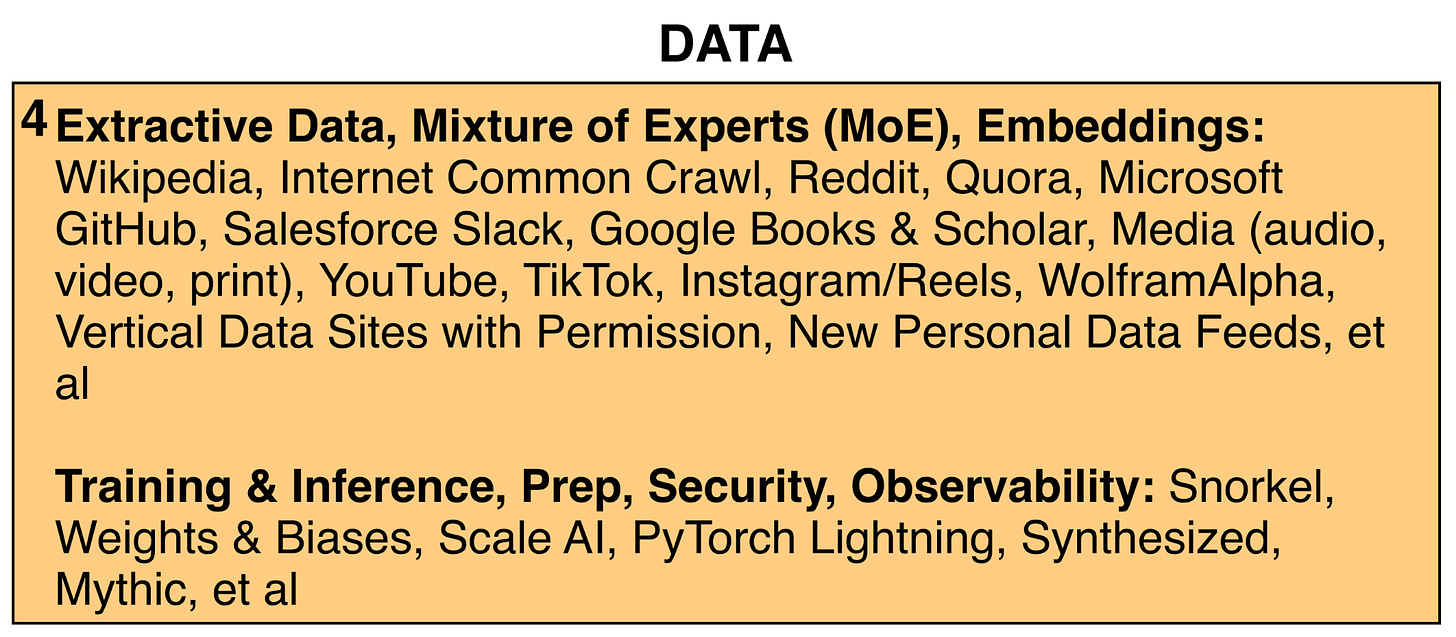

But this time there may be additional ‘Application’ level sustainable opportunities further down the tech stack. Especially in Boxes 2 through 5, which have traditionally been viewed and should be viewed as ‘Infrastructure’. The reason is Box 4, ‘Data’, that I’ve discussed in depth here.

This is a new Box not present in prior tech waves. It’s a never-ending input, along with AI Talent, AI data centers, GPUs and power, to make AI do its AI thing via ‘Reinforcement Learning’ Inference and Training Loops’ illustrated above. It’s dynamic, and likely transformative in the context of AI inference and training that is barely becoming clear.

As customers of all types customize their own data into their own clusters and swarms of ‘smart agents’ to automate tasks of all type, this activity alone is likely one of the biggest new ‘Applications’ of this wave.

Not dissimilar to how Advertisers became a permanent customer class of the middle ‘infrastructure’ tech stack in the Social Media and Mobile stages of the Internet Tech wave. And made Google one of the most extraordinary businesses in the history of technology companies. For companies like Meta and Google, they are the more important sustainable ‘customer’ than billions of their end users.

The users are of course in many ways the product. The AI Tech Wave could see something similar emerge. It’s why Meta’s Mark Zuckerberg and others are earnestly tasking their best AI engineering resources to Advertisers as much as their end users.

The point I’m making here is that this wave has characteristics and inputs that can define new layers of sustainable ‘application’ products and services not seen before. And it’s tough to judge what’s ‘experimental’, transient, and eventually sustainable in every tech wave. It’s why ‘Native AI’ companies like Scale AI in the ‘Data’ Box 4 above are intriguing. Either just a ‘lightning flash’ or ‘lightning in a bottle’.

Investors of all stripes, early or late stage, need to study the deep secular technology drivers in this tech wave more than any other. The depth of the technologies, and their early nature, means that we’re far from figuring out what’s here to stay.

The underlying technology layers are fluid and exponential in dimensions I’ve not seen before in previous waves. And some unexpected elements in the boxes above are likely to translate into sustainable ‘annual recurring revenues’, not just ‘experimental’.

What’s the ‘lightning in a bottle’, and what’s lightning that startles and dissipates as suddenly as it comes. Will have a lot more to say about all this in future posts. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)