AI: Now Grok, Manus et al testing AI Pricing ceilings. RTZ #676

With Elon Musk’s latest merger of X and xAI at a $113 plus billion premium valuation, the race is on figure out how it Grok LLM AI chatbot can be monetized with higher subscriptions and other revenue streams.

Grok in particular, has to project its capabilities far and wide, to compete with LLM AI leaders OpenAI, Google, Microsoft, Meta, Amazon/Anthropic and others, who have far wider and deeper distribution capabilities.

The same is going on for recent AI companies from China that have globally viral products, like DeepSeek, and Butterfly Effect’s Manus AI agents. Let me explain.

I’ve been writing regularly how the AI industry led by OpenAI, MIcrosoft, Google and others have been regularly testing higher pricing tiers for their chatbot subscriptions, and API (application programming interface) access pricing for their AI services.

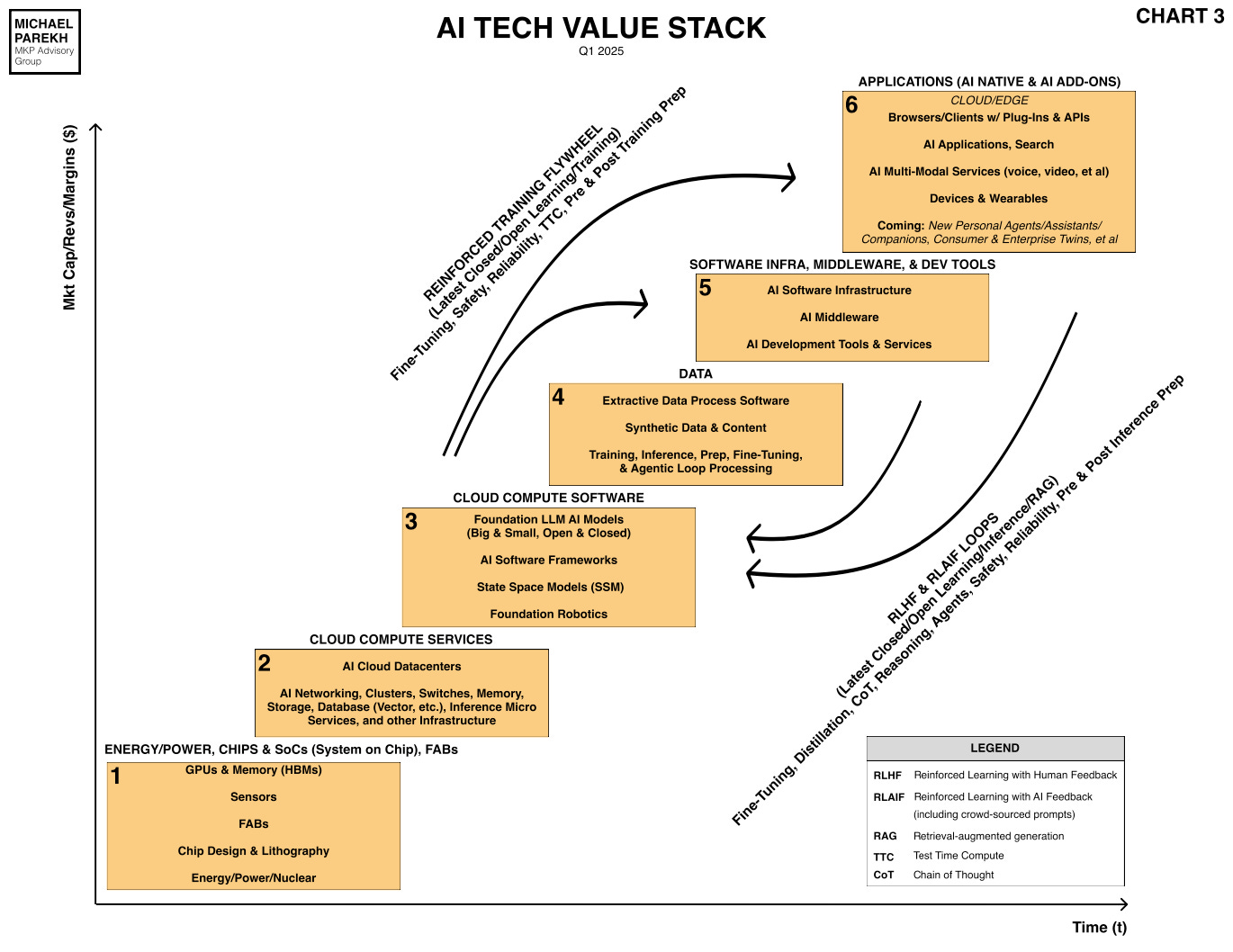

This is partly driven by the global shortage of AI GPU and infrastructure shortages, which has of coruse benefited Nvidia and other AI infrastructure providers in the lower boxes in the AI Tech Stack below.

Given the variable costs of training and inference, and new AI Reasoning and Agents driven innovations, the industry is testing different pricing tiers.

Elon Musks X/twitter, now merged into his xAI entity which houses his LLM AI Grok, is the latest to follow OpenAI and other into higher pricing tiers.

As the Information notes on Grok pricing post its high valuation X/xAI merger I discussed yesterday:

“The first is to convince millions of people on X to pay for Grok chatbot subscriptions the way they do for ChatGPT. Right now, according to Grok, there’s a $40-per-month plan for X Premium+, which includes access to the latest Grok model and voice mode, or $30 a month for SuperGrok, which includes reasoning and deep research.”

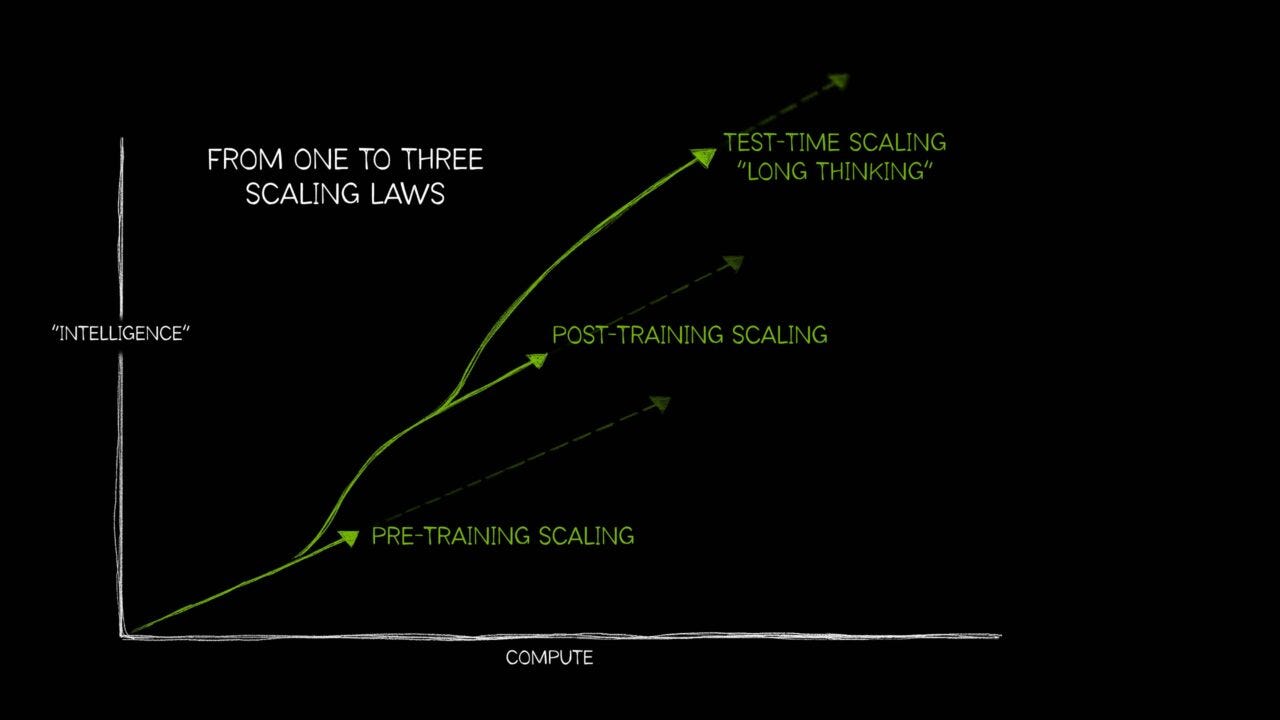

Especially given the coming ‘trifurcation’ of AI Scaling laws ahead:

OpenAI has been in the lead testing the pricing waters:

“By contrast, ChatGPT’s entry price for super users is $20 a month.”

“It’s also worth remembering why millions of software engineers and other professionals pay for ChatGPT: coding, writing and all manner of scientific, financial and health-related analyses the chatbot can do based on documents and data that customers pour into it.”

There are questions on how Elon’s X/xAI Grok follows suit here:

“Will people really use Grok the same way? This seems like a tough road for xAI to hoe, as it will need to generate the kind of word-of-mouth, organic growth ChatGPT has had in spades. But subscriptions are clearly going to be part of the answer for Grok, given the vast total addressable market for chatbots.”

Not to mention supporting Developers in an API driven enterprise model, which has not yet been X/Twitter’s forte to date.

“The second option is selling Grok as an application programming interface to developers, but that’s a cutthroat market and seems even harder than subscriptions.”

That leaves ad sales:

“The third is making money by selling ads in Grok, though ad sales is something X itself has struggled to do since Musk bought it. Grok will need a lot more scale to be attractive to advertisers. Perhaps Grok will get a boost from becoming a voice assistant for Tesla vehicles, which Musk has discussed.”

And possibly ecommerce referrals:

“OpenAI CEO Sam Altman recently sketched out a fourth path for chatbot monetization. He publicly discussed the idea of charging referral fees to merchants when ChatGPT helps people shop for goods and services.”

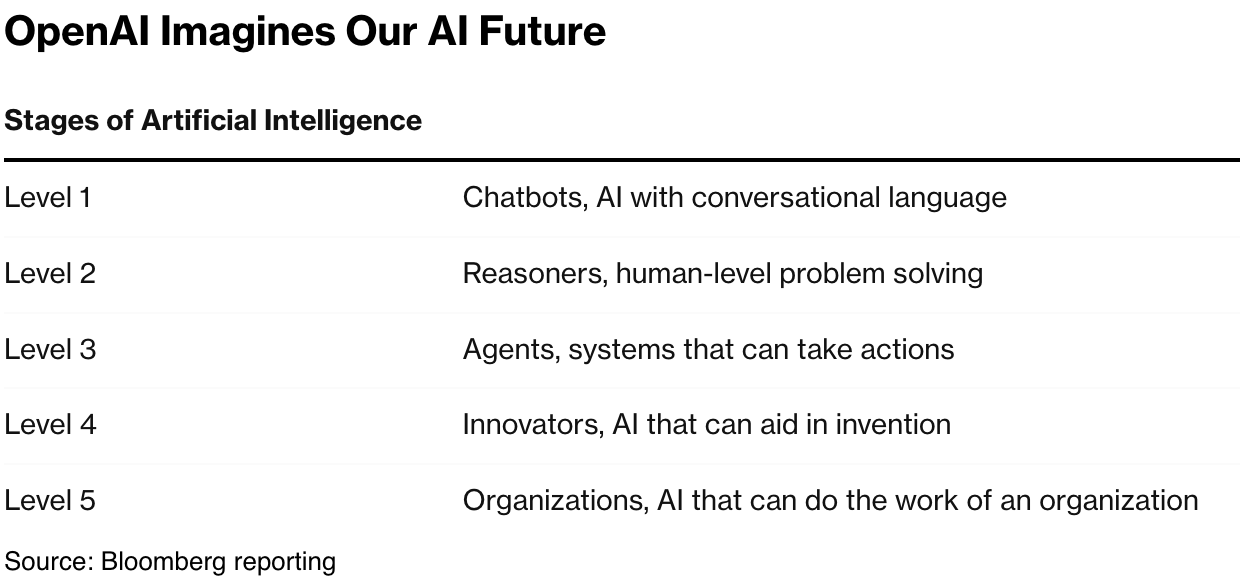

“OpenAI is also considering charging $20,000 a month for PhD-level agents someday. And Altman and Musk probably have other ideas we don’t know about yet.”

So a series of options for the new X/xAI entity with Grok AI monetization ahead:

“Investors in Musk’s companies say the xAI-X deal is a marriage of tech and distribution. At the moment, it doesn’t seem that simple.”

These these pricing questions and trials are not specific just to Elon’s Grok/XxAI. They are going global.

China’s recent AI Agent ‘phenom’ Manus, which I discussed recently, is also experimenting with higher pricing tiers, as Bloomberg explains in “China’s Manus Turns Its AI Agent Into a $39 Subscription”:

“The recently released Manus artificial intelligence agent is becoming a subscription service, marking a rapid pace to commercialization after it drew comparisons to DeepSeek.”

“The Beijing-based startup behind Manus has set up a $39-per-month tier and a $199 upgraded option, the latter in line with OpenAI’s ChatGPT Pro. That’s aggressive pricing for a membership service that is still in its beta testing stage. But the young company has drawn significant attention for its promise to have its bot perform jobs for users, acting as an agent and doing complex tasks rather than just responding to prompts.”

“The advanced subscription lets users run up to five tasks simultaneously and gives them more computation credits, according to the company’s website. Manus will still have a limited-access free version of the tool, the company said. It is built atop existing large language models, including Anthropic’s Claude family.”

“Manus released its agent this month with a slick video demonstration, eliciting reactions labeling it the next DeepSeek, a groundbreaking service and company that rattled Silicon Valley by showing performance on par with the best of OpenAI and Meta Platform Inc.’s multibillion-dollar models and systems.”

It all intensifies the competitive AI markets in China and abroad:

“The move to monetize the Manus AI agent so soon after its arrival runs counter to the all-out contest to acquire users in China. DeepSeek R1’s January debut accelerated a price war that was already underway in the country of 1.4 billion, and platform operators like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. announced a flurry of new AI offerings to keep pace. Baidu Inc. made its Ernie Bot free in February.”

“Butterfly Effect, the parent company of Manus, is in talks with prospective investors to raise funds at a valuation of at least $500 million, The Information reported last week, citing unidentified sources. Butterfly Effect’s current backers include ZhenFund and HSG, formerly known as Sequoia China.”

These developments highlights the rush to finance the AI compute for the variable costs for the next levels of AI reasoning and Agents beyond chatbots.

And to keep convincing investors both private and public that the tech innovations for infrastructure and applications can be meshed with rapidly growing financial metrix as well in this AI Tech Wave.

A tough task in a historical context. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)