AI: Nvidia plans to rock GTC 2025. RTZ #662

Nvidia’s annual GTC AI Conference for 2025 kicks off this week in San Jose, CA, with the much anticipated keynote by founder CEO Jensen Huang Tuesday morning. With over 25,000 attendees, this previously humble Nvidia gathering has now taken on the moniker of ‘AI Woodstock’, given the company’s recent ascent to the top of the global stock market cap table leagues thus far in this AI Tech Wave.

The expectations are high, as the WSJ outlined in “Nvidia’s next act needs to be even bigger”:

“Nvidia’s annual GTC developers conference in San Jose, Calif., used to be a relatively modest affair, drawing about 9,000 people in its last year before the Covid outbreak. But the event now unofficially dubbed “AI Woodstock” is expected to bring more than 25,000 in-person attendees flocking to the company’s backyard this week, all lining up to hear what the AI kingmaker has up its sleeve for the months and years ahead.”

“Nvidia’s Blackwell AI chips, the main showcase of last year’s GTC conference, have only recently started shipping in high volume following delays related to the mass production of their complicated design. Blackwell is expected to be the main anchor of Nvidia’s AI business through next year. Analysts expect Nvidia Chief Executive Jensen Huang to showcase a revved-up version of that family called Blackwell Ultra at his keynote address on Tuesday.”

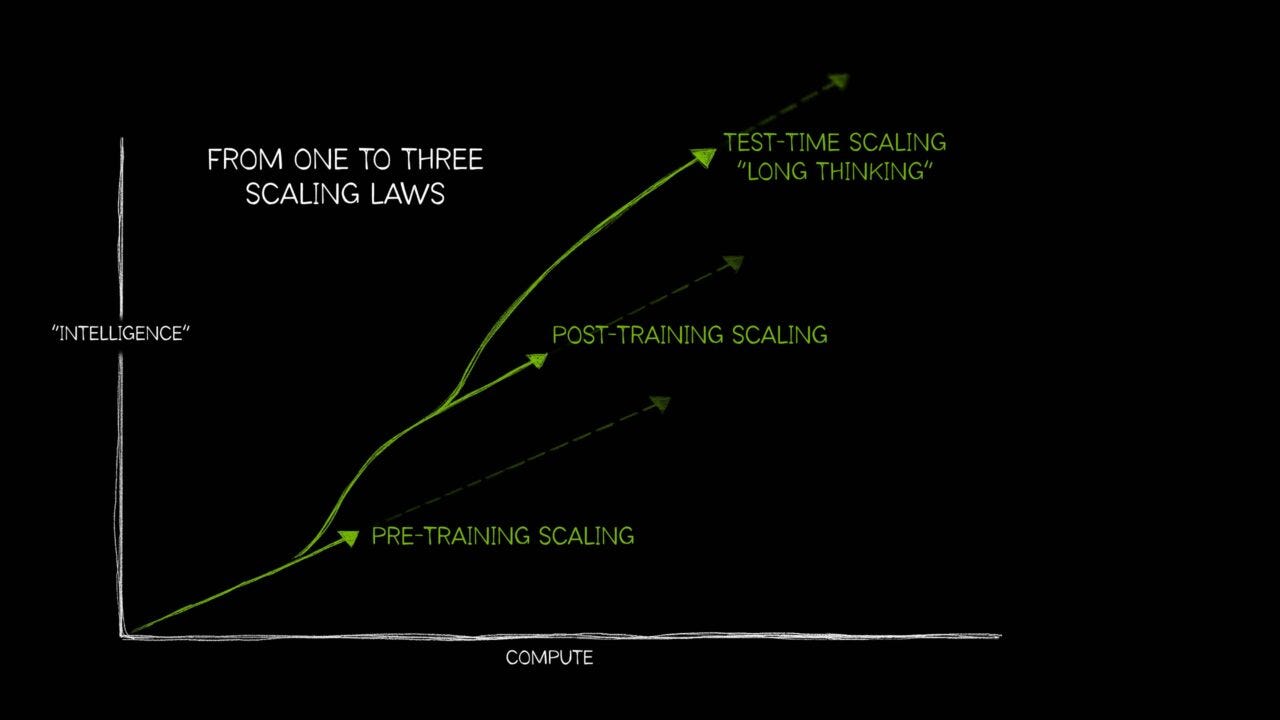

“But Nvidia watchers are especially eager to hear more about the next generation of AI chips called Rubin, which Nvidia has only teased at in prior events. Ross Seymore of Deutsche Bank expects the Rubin family to show “very impressive performance improvements” over Blackwell. Atif Malik of Citigroup notes that Blackwell provided 30 times faster performance than the company’s previous generation on AI inferencing, which is when trained AI models generate output. “We don’t rule out Rubin seeing similar improvement,” Malik wrote in a note to clients this month.”

The company’s come far in performance and expectations, with a formidable moat in AI hardware and software:

“Rubin products aren’t expected to start shipping until next year. But much is already expected of the lineup; analysts forecast Nvidia’s data-center business will hit about $237 billion in revenue for the fiscal year ending in January of 2027, more than double its current size. The same segment is expected to eclipse $300 billion in annual revenue two years later, according to consensus estimates from Visible Alpha. That would imply an average annual growth rate of 30% over the next four years, for a business that has already exploded more than sevenfold over the last two.”

“High marks, to be sure. And doable—if the world’s largest tech giants keep dumping significant amounts of capital investments on AI infrastructure. But by that point, such spending will only be justified if there is substantial demand from consumers and businesses for generative AI services, and a willingness to pay a premium for them.”

Of course the market has concerns going forward, given the ‘high marks’ to date, including competition with AI chips by their top customers, and implications of China’s DeepSeek on AI Chip and data center demand:

“Such an outcome is still a bit iffy, especially with the potential for the global economy to slip into a recession sparked by tariffs, geopolitical instability and inflation. Nvidia has also been haunted by worries about competition with in-house chips designed by its biggest customers like Amazon and Google. Another concern has been the efficiency breakthroughs claimed by Chinese AI startup DeepSeek, which would seemingly lessen the need for the types of AI chip clusters that Nvidia sells for top dollar. Nvidia’s stock has actually picked up some gains against the market’s turbulence in recent days, but the shares are still down more than 9% so far this year, more than double the S&P 500’s decline.”

I’ve discussed how DeepSeek means more demand for Nvidia AI chips and infrastructure, not less. And the company has thus far managed to ‘grow into’ its valuation:

“That at least sets a more reasonable stage for this year’s GTC. Nvidia’s stock is now trading for less than 27 times this year’s projected earnings, which is a 23% discount to the multiple it was commanding at last year’s conference and cheaper than the stocks of most other megacap tech companies that aren’t growing nearly as fast. The tech world still expects a lot of Nvidia and its latest chips. But at least the market is no longer pricing in guaranteed blockbusters.”

I’ve written about Rubin earlier, and this year’s GTC will provide updates here and elsewhere in Nvidia’s product lineup. Especially given the core underlying innovations of AI GPU chips beyond training and inference that I’ve discussed at length.

Techcrunch offers glimpses on what to expect in “Nvidia GTC 2025: What to expect from this year’s show”:

“CEO Jensen Huang will give a keynote address at the SAP Center on Tuesday at 10 a.m. PT, focusing on — what else? — AI and accelerating computing technologies, according to Nvidia. The company is also teasing reveals related to robotics, sovereign AI, AI agents, and automotive — plus 1,000 sessions with 2,000 speakers and close to 400 exhibitors.”

“Here’s how to watch the Nvidia GTC 2025 keynote online, along with many other sessions, talks, and panels.”

“So what do we expect to see at GTC? Well, Nvidia typically reserves a big chunk of the conference for GPU-related debuts. A new, upgraded iteration of the company’s Blackwell chip lineup seems likely.”

First up, updates on the company’s critical Blackwell AI GPUs, the next Generationn Rubin line, and all their ‘tick-tock’ upgrades over the coming years:

“During Nvidia’s most recent earnings call, Huang confirmed that the upcoming Blackwell B300 series, codenamed Blackwell Ultra, is slated for release in the second half of this year. In addition to higher computing performance, Blackwell Ultra cards pack more memory (288GB), an attractive feature for customers looking to run and train memory-hungry AI models.”

“Rubin, Nvidia’s next-gen GPU series, is almost certain to get a mention at GTC alongside Blackwell Ultra. Due out in 2026, Rubin promises to deliver what Huang has described as a “big, big, huge step up” in computing power.”

“Huang said during the aforementioned Nvidia earnings call that he’d talk about post-Rubin products at GTC, as well. That could be Rubin Ultra GPUs, or perhaps the GPU architecture that’ll come after the Rubin family. (The chips are named after Vera Rubin, the astronomer who discovered dark matter.)”

Also expected is Jensen talking about Nvidia’s role in quantum computing, after saying earlier that quantum computing at commercial scale may take a while. Something I agree on, despite recent progress by Microsoft and others in the very nascent field:

“Beyond GPUs, Nvidia may illuminate its approach to recent quantum computing advancements. The company has scheduled a “quantum day” for GTC, during which it’ll host execs from prominent companies in the space to “[map] the path toward useful quantum applications.””

I’m also looking forward to what Jensen has to say about Nvidia’s focus on ‘Small AI’ computing platforms, another key area of investment for the company.

So overall, a lot to expect from Nvidia’s GTC this year.

The momentum continues for the company at this infrastructure ramp stage in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)