AI: Nvidia's nascent 'cash flow challenges' in its 30+ year history. RTZ #957

In hindsight, Nvidia turned out to be the ultimate ‘Grand Slam’ from Denny’s. At $4.5+ trillion market cap at counting. And in many ways, its journey is just getting started.

We’ll get an update on that this week. With the Nvidia founder/CEO Jensen Huang’s upcoming keynote, at the CES 2026 trade show this week. And it’s going to be again as ambitious an outline of its roadmap as OpenAI, the other major AI company.

These two iconic bookends to the AI Tech Wave, OpenAI and Nvidia, have come a long way indeed.

All in the three years since OpenAI’s ‘ChatGPT’ moment 11/30/22. I did a three year look back on OpenAI a few weeks ago. But it’s easy to forget how far Nvidia has come in its three plus decade history at a Denny’s as well. With the ultimate hungry immigrant story.

And worth pausing a beat to do a close-up, as 2026 gets started in earnest. In particular, it’s rising ‘high-class’ problem of how to deploy accelerating flows of cash from its ‘accelerated computing’ ambitions.

The WSJ outlines how far Nvidia has come in three ‘AI years’ in “Nvidia Is Getting Creative as Options to Use Its Cash Flood Narrow”:

“Blowout AI spending fills chip maker’s coffers, but Groq deal shows that company needs to think creatively.”

“The tricky thing about being Nvidia NVDA these days is that the AI-chip giant has to find ways to spend billions of dollars while seemingly getting little to show for it.”

“It is a high-quality problem for sure. The $20 billion that Nvidia is spending on a “nonexclusive licensing agreement” with a nine-year-old AI chip startup called Groq is triple the price of the company’s largest outright acquisition to date. But much has changed since Nvidia bought Mellanox in early 2020. The company’s business has skyrocketed in that time, transforming it from a niche videogame-chip provider to the world’s most valuable enterprise.”

“Three years have passed since the launch of ChatGPT, and Nvidia still dominates the market for the chips and software needed to power the most advanced artificial intelligence models.”

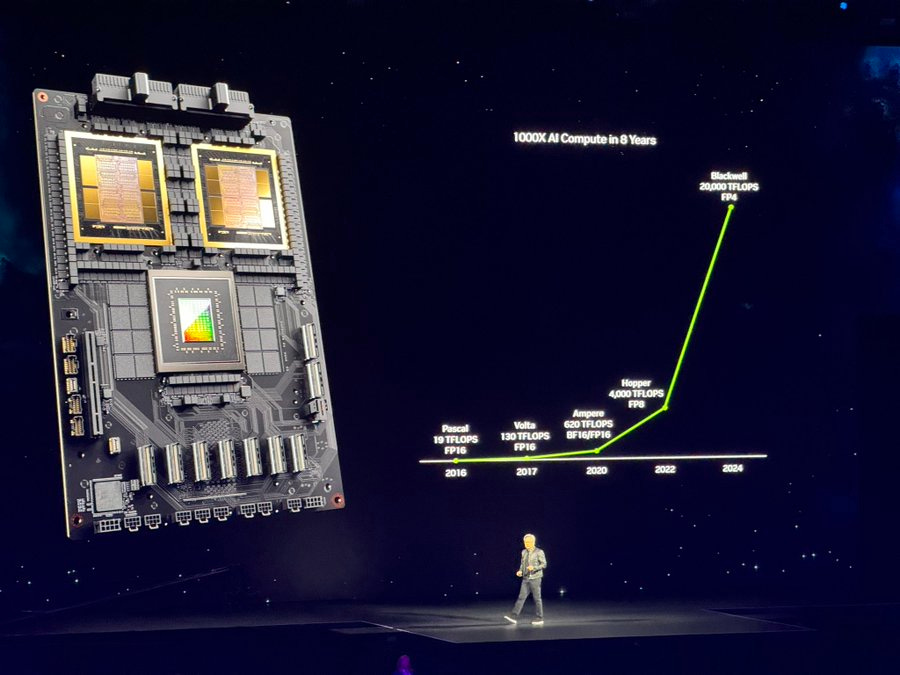

The picture below is still Nvidia’s reality for the rest of this decade at least:

And it comes with the high class problem to figure out what to do with the exploding free cash flow:

“That position has also made Nvidia the most scrutinized company on the planet. So while its financial resources have multiplied exponentially—annual free cash flow has gone from $4.2 billion in 2020 to a little more than $80 billion now—Nvidia has actually found itself with fewer options on what to do with it. Outright acquisitions have become tricky territory for big tech companies generally, and Nvidia’s commanding lead in AI ensures that any deal would be closely examined by regulators.”

“Nvidia now faces the added challenge of being a pawn in the trade war between the U.S. and China. Any sizable chip acquisition requires approvals from both countries, and China’s efforts to develop its own AI technology give the country little incentive to help an American chip maker close a major deal.”

That brings us to the Groq deal:

“In this light, a $20 billion transaction that isn’t a full acquisition makes some sense. Nvidia is getting several key Groq employees—including its founder, who was once involved in Google’s in-house chip program.”

“The company is also getting access to Groq’s technology that is designed for efficiently running “inferencing,” where trained AI models generate output.”

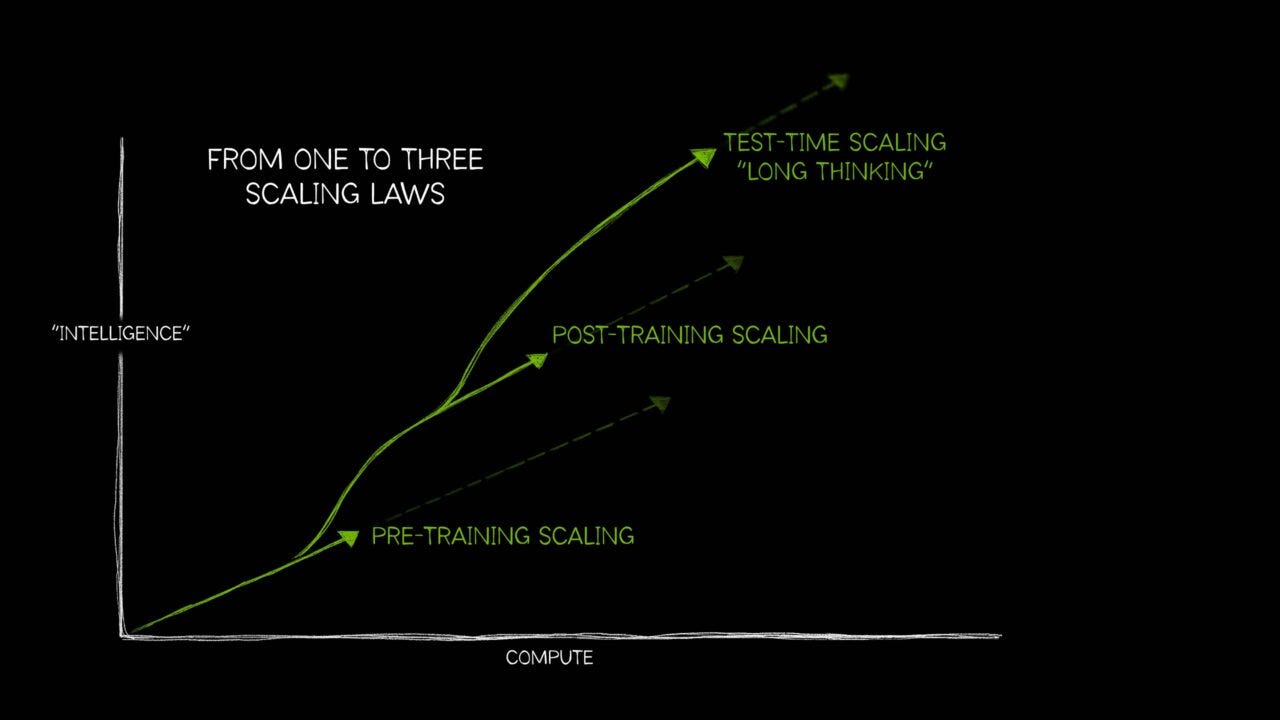

The AI Inference opportunity that Nvidia has been laser focused on for a while now. All those loops between Boxes 2 through 6 below in the AI Tech Stack:

The Groq deal allows Nvidia to take the IP there and take it to greater scale as part of Nvidia’s tech stack:

“This could help address a perceived weakness in Nvidia’s product line, which dominates in AI training. “We see this deal as a benefit to Nvidia in the long-run as it adds key [intellectual property] to its engineering team to build its inferencing capabilities,” Vijay Rakesh of Mizuho wrote in a note to clients on Tuesday.”

So it’s a useful move despite the potential hurdles:

“Still, a $20 billion acqui-hire catches the eye, especially when it seems that Nvidia won’t have exclusive access to the technology. And there is no guarantee the move will escape regulatory scrutiny, especially because other tech giants have recently been deploying the same playbook to snap up AI talent.”

“The deal to finally draw a skeptical eye could well be this one: The reported value of Nvidia’s Groq deal is 10 times what Meta Platforms is spending on a full acquisition of Manus, a startup specializing in AI agents.”

Especially given the relentless race to Scaling AI in so many directions:

“But Nvidia, which is helmed by Chief Executive Jensen Huang, has a lot to work with. The amounts of capital spending by tech giants building AI networks has essentially resulted in a huge transfer of wealth from Microsoft , Amazon, Google parent Alphabet, Meta and Oracle to their key supplier. Those five companies are on track to generate a combined free cash flow of $141 billion for calendar 2025—down 37% from the previous year, according to consensus estimates from Visible Alpha.”

The ‘Frenemies’ nature of Nvidia’s relationship with its core customers will continue to be a reality as well through the end of the decade at least.

And the big deals are part of the way forward:

“Taken alone, Nvidia’s free cash flow is projected to surge 58% to more than $96 billion for the fiscal year ending in January and surpass $162 billion next year.”

“Putting all that cash to work won’t be getting any easier. Nvidia has spent nearly $52 billion on buybacks over the past four quarters, vastly more than any other chip company and equating to 28% of the company’s revenue in that time. Other companies on the PHLX Semiconductor Index currently average about 10% of their annual revenue on buybacks, according to data from S&P Global Market Intelligence.”

Despite the ‘circular’/’boomerang’ nature of some of these epic deals, with neoclouds like CoreWeave and all:

“Writing big checks to big customers is getting problematic as well. Nvidia’s major investment deals with companies such as OpenAI, Anthropic, xAI and CoreWeave have helped feed worries about the AI market’s being propped up by circular arrangements.”

“Those worries have helped fuel a major selloff on AI names over the past couple of months. Nvidia’s share price has sunk 9% since the stock hit a record high in late October while major AI names including Microsoft, Meta, Oracle and CoreWeave have fared even worse.”

It’s all a big part of Nvidia doing what it has to do at this stage of the AI Tech Wave to expand its moat.

We may not have seen these deals before at these concurrent sizes, but we’ve certainly seen them in substance. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)