AI: Nvidia's rocket fuel propulsion of CoreWeave. RTZ #657

It’s been a circular journey thus far in the high stakes building and powering of AI Data Centers, fueled by the ever capable AI GPUs by Nvidia. Customers need to invest billions in Nvidia AI chip hardware to make more AI in their AI data centers to sell to customers. The fueling and funding of these endeavors are stories worth telling on their own.

I’ve discussed before how Nvidia and its top customers have an ongoing balancing act in relying each other in the near-term while preparing to compete in the long term. As Microsoft, Meta, Google, Amazon and the rest of the big tech Cloud companies rely increasingly on Nvidia for its AI GPU Chip infrastructure and rising AI data center investments, all of the best companies are also planning their own chip architectures to reduce their reliance on Nvidia.

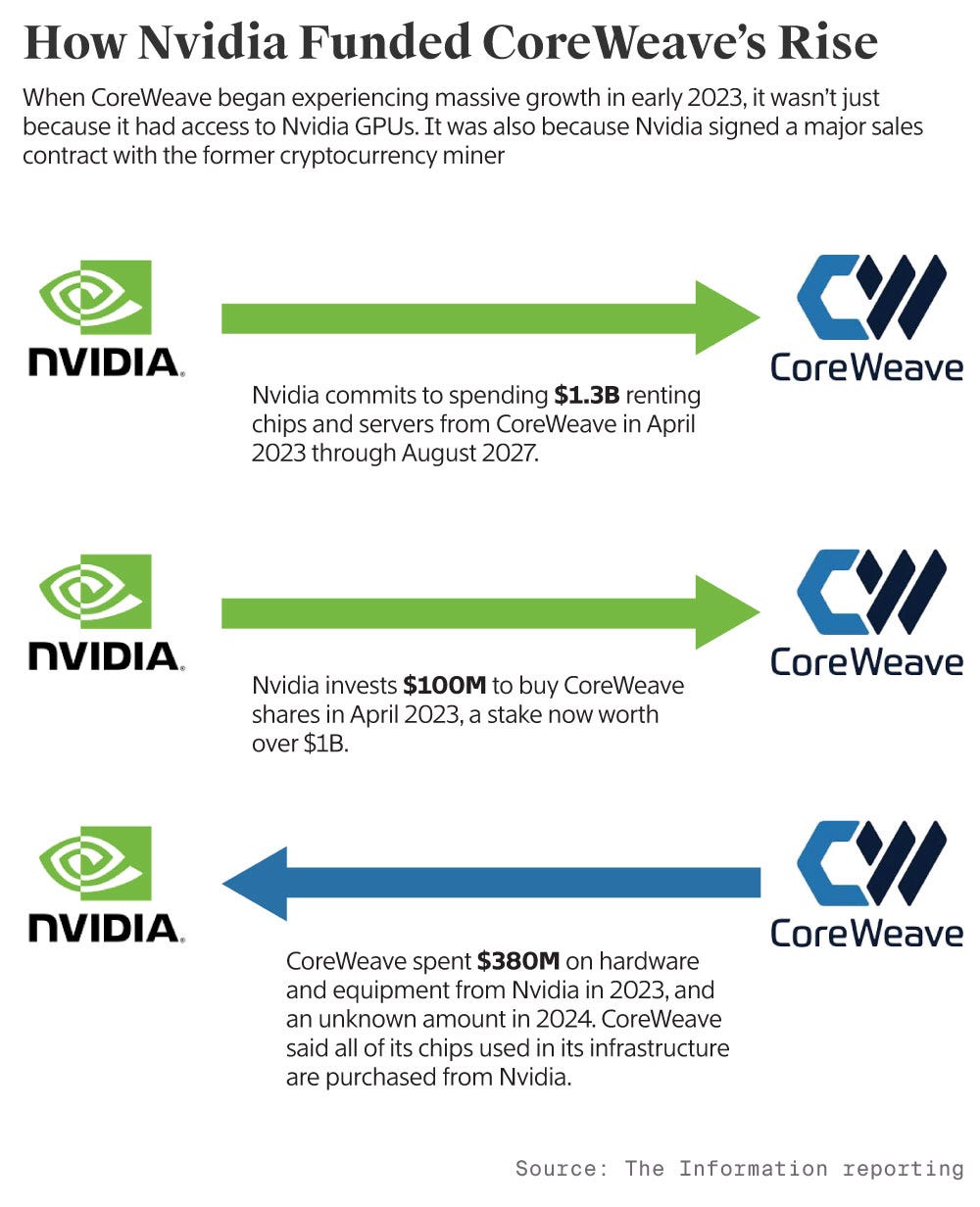

Nvidia of course has been following a similar but opposite strategy, investing and funding smaller ‘necloud’ AI cloud data center companies like CoreWeave, to provide alternative AI Cloud customers.

This reality got some additional details on the eve of a CoreWeave IPO. As the Information explains in “‘Project Osprey:’ How Nvidia Seeded CoreWeave’s Rise”:

“In early 2023, Nvidia was seeing near-endless demand for its artificial intelligence chips. Cloud computing giants such as Amazon Web Services, Microsoft Azure and Google Cloud were increasing their orders, sending Nvidia’s revenue to new heights. Developers were scrambling to access the chips, which were hard to come by.”

“Then Nvidia made a curious move: It agreed to spend $1.3 billion over four years to rent its own chips from CoreWeave, an upstart cloud computing firm trying to take on the giants. The deal, which CoreWeave dubbed “Project Osprey,” made Nvidia its second-largest customer last year after Microsoft, documents show, a detail not disclosed in CoreWeave’s filing last week for an initial public offering.”

“The deal shows how crucial Nvidia’s support has been to CoreWeave. The chip giant invested $100 million in the startup in early 2023. It funneled hundreds of thousands of high-end graphics processing units to CoreWeave. And it agreed to rent back its chips from CoreWeave through August 2027. Revenue from the deal represented 15% of CoreWeave’s sales last year.”

“CoreWeave expects to go public later this month at a valuation of more than $30 billion. If that’s the case, Nvidia’s $100 million equity investment two years ago would be worth more than $1 billion.”

These ‘Boomerang deals’ are par for the course in this AI Tech Wave:

“The circular financial arrangements are the latest example of how the money piling into AI is often coming in and out of the same places. SoftBank, in talks to become one of OpenAI’s largest benefactors, agreed to pay that company $3 billion each year to use its AI software for other startups, The Information previously reported. Microsoft has invested more than $13 billion in OpenAI, which then gives Microsoft a share of its revenue and pays the software giant billions annually for cloud services. Amazon and Google have struck similar deals with AI model company Anthropic.”

“Prospective investors have been grappling with how long they can count on CoreWeave to sustain such big customers. Contracts with Microsoft and Nvidia, which together made up more than three-quarters of the company’s sales last year, expire between 2027 and 2029.”

And these deals have indeed set CoreWeave on an explosive trajectory:

“CoreWeave, meanwhile, has fueled its expansion with $8 billion in debt and $15 billion of long-term leases for data centers and office buildings, making it essential to attract new customers to supplement its original deals. The unusual combination—a high concentration of customers, combined with significant growth and debt—has raised eyebrows among investors weighing how to value the company.”

And allowed CoreWeave to play its own starring deal with industry leader OpenAI in its $500 billion Stargate project with Softbank:

“On Monday, CoreWeave announced its own $11.9 billion, five-year deal with OpenAI under which the ChatGPT maker will buy cloud services from CoreWeave. The deal would allow CoreWeave to book about $2 billion annually in additional revenue over that period, reducing some of its dependency on Nvidia and Microsoft.”

“It’s unclear if OpenAI plans to buy cloud services from CoreWeave beyond that contract. In a press release, OpenAI said the deal would complement other cloud services it buys from Microsoft and Oracle, as well as the separate, SoftBank-backed data center project, Stargate.”

“OpenAI has told its own investors it expects Stargate to support three-quarters of the computing power it will need to run and develop its AI models by 2030, The Information previously reported.”

All this highlights the myriad cross-partnerships at scale, as the industry races to Scale AI. The Compute is a critical element of it, and that needs to grow for now as far as the eye can see in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)