AI: Oracle gains half an OpenAI as their 'backhoe' contractor. RTZ #842

Backhoes and AI Data Center Construction is all the rage this Fall. And all so early in this AI Tech Wave.

Oracle, highlighted here last month for its AI momentum, is a key contractor for OpenAI in its $500 billion+, multi-year ‘Stargate’ AI Infrastructure global project with Softbank. All augmented with a just announced $300 billion+ new OpenAI data center deal.

And ORCL saw its market cap rise in just one day by $244 billion after announcing its quarterly results along with a gargantuan revenue backlog from OpenAI and other LLM AI clients. Its market cap is now nudging a trillion dollars for the first time for the half century old tech company.

That’s about half of OpenAI’s recently announced latest valuation of $500 billion. Which of course makes OpenAI the largest amongst private US companies.

A decade old tech company whose AI innovations have led the field of LLM/Generative AI for over a thousand days now since it’s ‘ChatGPT Moment’ in November 2022. Revamping its non-profit to profit status, and modifying its partnership with Microsoft along the way to a milestone down the road of an IPO.

AI Cloud and ‘neocloud’ companies like Oracle, CoreWeave, Crusoe and others have certainly excited the imagination and enthusiasm of public and private investors worldwide.

All as contractors in the global multi-trillion dollar rush to build AI Data Centers with multi-gigawatts of Power to make them run. And for now, they’re capturing the value of those contracts in unprecedented spurts of investor enthusiasm for AI Infrastructure. They may also be capturing the IP and ‘learning on our dime’, as OpenAI CEO Sarah Friar recently observed.

The Mag 7s like Microsoft, Meta, Google, Tesla/xAI and others are leaning into their commitment to build these data centers, and investors have given them flashing green lights to keep going. Perhaps faster.

I suggested investors might positively receive an opportunity to invest in an Amazon AWS type opportunity directly a few months ago in the context of Meta employing a similar strategy as it ramped up its multi-gigawatt data centers in tents no less.

For now the value of these investments are being captured by the AI Infrastructure Contractors in Box 2 of my AI Tech Stack below. And relatively less to the higher margin LLM AI companies in boxes 3 through 6. This is a trend I’ve discussed in detail in recent posts.

The LLM AI companies, and the companies that will build the applications and services upstream to Box 6 have yet to see the kind of gains seen by the 48 year old Oracle this week. Making its 81 year founder Larry Ellison the current ‘world’s richest’ vs Elon Musk.

As the WSJ summarizes it in “Oracle Stock Finishes 36% Higher in Historic Rally”:

“Shares jumped by as much as 43% and closed at a record $328.33, up 36% on the day.”

“It was the software giant’s largest one-day gain since December 1992.”

“Oracle’s rally was the first time a U.S. company with a market cap of $500 billion or more gained more than 25% in a single trading day. On the day, the company added an estimated $244 billion in market value, the seventh largest one-day bump on record, according to Dow Jones Market Data.”

“Oracle’s market cap is now $922 billion, surpassing JPMorgan Chase and Walmart and putting it in the top 10 of U.S. companies for the first time since 2011.”

“The runup offers a big boost to the wealth of Chairman Larry Ellison, already ranked the world’s second-richest person by Forbes.”

“The surge in Oracle shares sparked a broad rally in AI-related stocks, including Broadcom, TSMC, Nvidia, AMD and Palantir.”

“Oracle’s bookings, or total remaining performance obligations, swelled to $455 billion at the end of August, from $138 billion three months before.”

Most of the backlog is of course from OpenAI, which is not officially in the ‘Mag 7’.

Yet.

As the WSJ notes separately in “Oracle, OpenAI Sign $300 Billion Cloud Deal”

“The majority of new revenue revealed by Oracle will come from OpenAI deal, sources say”

“OpenAI signed a contract with Oracle ORCL 35.95%increase; green up pointing triangle to purchase $300 billion in computing power over roughly five years, people familiar with the matter said, a massive commitment that far outstrips the startup’s current revenue.”

“The deal is one of the largest cloud contracts ever signed, reflecting how spending on AI data centers is hitting new highs despite mounting concerns over a potential bubble.”

“The Oracle contract will require 4.5 gigawatts of power capacity, roughly comparable to the electricity produced by more than two Hoover Dams or the amount consumed by about four million homes.”

“Oracle shares surged by as much as 43% on Wednesday after the cloud company revealed it added $317 billion in future contract revenue during its latest quarter that ended in Aug. 31. Chief Executive Safra Catz told analysts that it had signed contracts with three different customers during the quarter.”

Oracle is already being put in the same rarefied air as Nvidia, a bit prematurely in my view.

Again the WSJ in “Oracle Is the New Nvidia, for Better or Worse”:

“Software giant expected to double revenue in three years, but its future now fully hinges on the AI splurge.”

I’d already highlighted Oracle as a key beneficiary of this AI Tech Wave just last month.

The markets both public and private are now officially in the ‘boom’ phase of this AI Tech Wave, far beyond its recent doubts.

Of course not all AI and market observers share the AI ‘baclhoes’ driven enthusiasm for Oracle, as can be noted here and here.

The Economist asks the next inevitable question in “What if the AI stockmarket blows up?”:

“We find that the potential cost has risen alarmingly high”.

“Since the release of ChatGPT in 2022, the value of America’s stockmarket has risen by $21 trillion. Just ten firms—including Amazon, Broadcom and Nvidia—account for 55% of the rise. All are riding high on enthusiasm for artificial intelligence, and they are not the only ones. Larry Ellison briefly became the world’s richest man, after AI enthusiasm prompted the share price of Oracle, his firm, to leap. In the first half of the year an IT investment boom accounted for all America’s GDP growth; in the year to date a third of the West’s venture-capital dollars have gone to AI firms.”

It’s a well researched, detailed piece worth reading in full.

And not only because they quote yours truly on why sometimes market fundamentals can both lag and lead technical fundamentals:

“This may seem like a striking admission, but Mr Sam Altman and his ilk also argue that bubbles are normal when new technologies emerge.”

“Tech enthusiasm always runs ahead of tech realities,” according to Michael Parekh, a former analyst at Goldman Sachs, yet another bank.”

An observation fueled by over three decades of professional tech market analysis and pattern recognition.

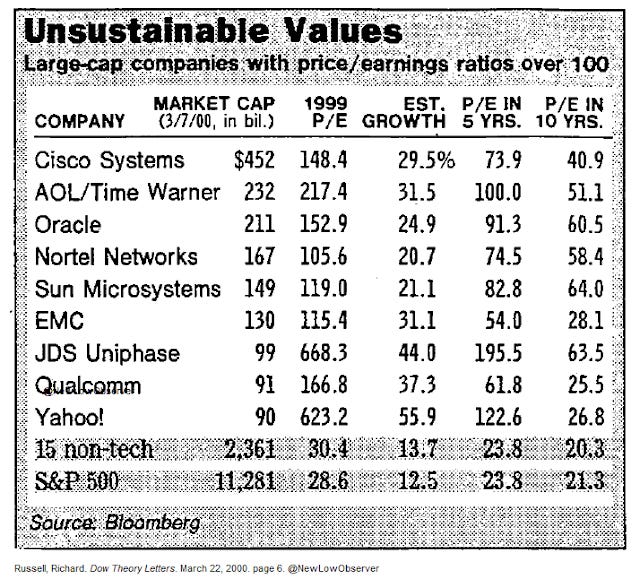

As I say at this point in the video above, in the internet boom, as the head of Goldman Sachs’ global internet research group, there was a very noticeable switch in 1998-1999.

That’s when every company wanted to be known as an ‘Internet’ company. And not just tech companies.

It was the toughest time in my two decades at Goldman Sachs. Even after being honored as a Partner at the Firm.

History is rhyming again with AI.

Every company in almost every industry, wants to show investors their connection to AI today, and most investors are receptive to hearing their pitch.

Oracle, an almost 50 year old enterprise software company is being heralded as one of the most interesting AI Infrastructure companies in the world. Kind of like Cisco and others in the Internet boom.

It’s always important to reflect on the relationship between secular technology and financial market fundamentals at various points in every tech cycle. We may be close to that point now.

Bill Gurley, the now iconic tech/VC investor, who was also a PC/Tech analyst in the nineties, had a pithy piece back then. Reminding us that ‘Backhoes Don’t Obey Moore’s Law: a story of Convergence”. Worth a read again.

The Oracle episode this week again echoes the market infatuation with backhoes.

Exuberance, Irrational and otherwise can continue unabated until the music pauses or stops. But it’s important to keep track of the emotions relative to the fundamentals.

We may be closer to one of those moments for the AI Tech Wave as well. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)