AI: The true costs of 'an Economy for Sale'. RTZ #691

Big tech companies in the US and abroad are doing what they must do to navigate the new global Trump Tariff world. Something I’ve discussed in multiple parts, as a trend in this AI Tech Wave.

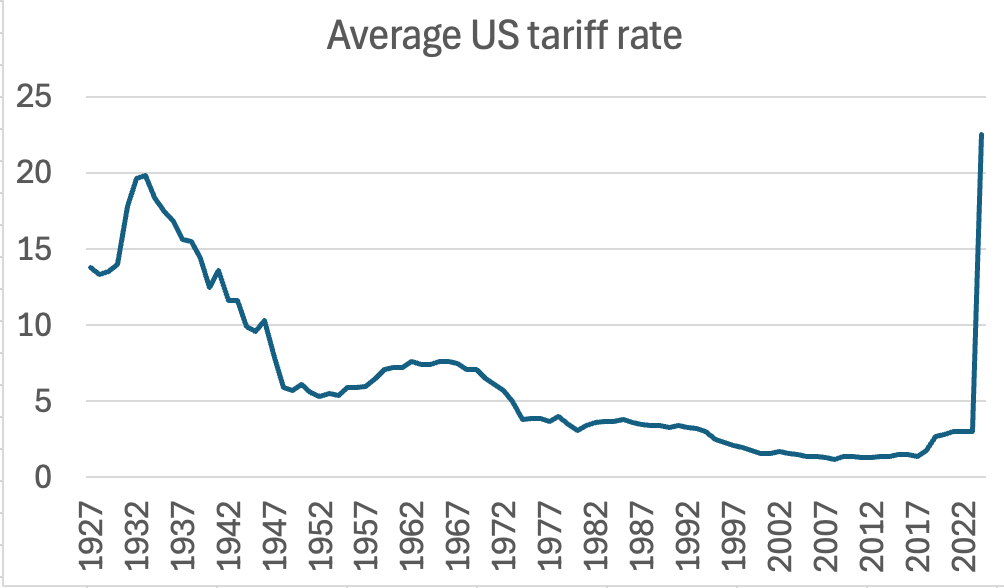

Where companies from Apple to Nvidia to to OpenAI/Softbank to TSMC and others embraced the new “$100 billion+ US Investment” ‘pledge’ as the new ‘Table Stakes’ with the administration. That is now rapidly shifting to higher gears as the global trade negotiations lurch forward with ‘on again, off again’ tariff rates and regimes. And still at historical rates over century long timespans.

Axios summarizes it all in “Tech’s two roads through Trump’s tariffs”:

“U.S. tech giants are awkwardly navigating two paths through the minefield of President Trump’s global trade war.”

“The big picture: Companies like Apple and Nvidia are altering their short-term supply chains and diversifying their product sourcing to minimize the cost of Trump’s tariffs.”

-

“At the same time, they’re doing everything they can to get on Trump’s good side, hoping it will pay off in carve-outs or other favors.”

This cozying up capitalism is reminiscent of countries like India over the past few decades, as Geopolitics maven Fareed Zakaria reminds us pithily. As he reminds us in this must-read “The U.S. economy is for sale”:

“These tariff negotiations will inevitably result in a cascade of corruption. The American economy is being transformed from the leading free market in the world to the leading example of crony capitalism.”

“A market economy functions best when there are limited constraints placed on it, but especially when those constraints are clear, fair and applicable to all. The more complicated the taxes, rules and regulations, the greater the inefficiency — as studies show in country after country, from India to Nigeria to Morocco. But more significant, the greater the complexity, the greater the corruption. With tariffs come tariff waivers, often granted by the hundreds to specific industries, companies, even products.”

Let us count the ways this ‘waiver and exemption’ chasing is accelerating in the US, with our tech companies, as Axios continues to highlight:

“Driving the news: Nvidia said yesterday it has begun making some of its AI chips at TSMC’s Arizona plant and will also start making “AI supercomputers” in Texas.”

-

“Nvidia also said it will aim, along with its partners, to spend $500 billion on domestic U.S. AI infrastructure.”

-

“Meanwhile, CEO Jensen Huang reportedly attended a $1 million-per-person dinner at Mar-a-Lago last week — and shortly after, per NPR, the White House shelved planned new restrictions on Nvidia’s chip exports to China.”

“Apple has also been seeking to dodge the tariffs’ blows.”

-

“The company has reportedly flown planeloads of iPhones to the U.S. in hopes of beating tariffs, delaying potential price increases or profit hits.”

-

“Apple is also reportedly encouraging all its non-Chinese manufacturing operations to make as many devices as possible.”

“At the same time, CEO Tim Cook’s efforts to placate Trump seemed to bear some fruit when the White House announced Friday the new tariffs would not apply to smartphones and electronics.”

-

“That felt like a repeat from Trump’s first term, when Cook won a tariff exemption for the iPhone.”

-

“But by Sunday, Apple’s reprieve looked like it could be short-lived, with Trump warning that “NOBODY is getting off the hook.”

And of course our best tech companies have been doing their best to diversify their supply chains out of China to India and elsewhere, Apple as a prime exhibit.

“Catch up quick: Tech companies began efforts to diversify their production beyond China during the first Trump administration, and those efforts expanded after the pandemic.”

-

“Much of that production moved to countries like Vietnam and India that are also targets of Trump’s now-paused reciprocal tariffs.”

Like any game with stakes, this one has clear rules that are emerging:

“State of play: For tech’s biggest firms, the game of Trump management involves rituals of appeasement in the form of public announcements of extravagant — and ostensibly new — investments. The game has four rules.”

-

“Pick a crazy high investment number in the hundreds of billions of dollars, then hedge it by using terms like “up to” and “planned.”

-

“Roll together projects that were already in the pipeline with new spending plans to boost the final tally.”

-

“Be sure to credit Trump by name, or otherwise signal he made the deals possible, or just don’t contradict him when he takes credit.”

-

I”n a few months or years, feel free to change course or back out as needed.”

And it’s a game plays wide and deep amongst our best tech companies:

“Microsoft and OpenAI have also played this game since Trump returned to office, announcing splashy investments of their own.”

And it has a lot of unforeseen unintended consequences short and longer term:

“Between the lines: Tariffs hit some tech giants much harder than others.”

-

“Tariffs affect physical goods shipped by boat or plane. So companies like Apple and Nvidia that deal in hardware have a lot more at stake than software-and-services companies like Microsoft, Google and Meta.”

-

“But if tariffs bring on an economic slowdown or recession, every firm would feel the pain.”

“What’s next: Industry watchers will keep a close eye on what companies actually spend on the ground over time.”

All this is important to keep in mind, especially through the short-term ‘relief rallies’ in the stock market. Those up days merely mask the price that the US, it’s economy, it’s tech companies large and small, and most importantly, the mainstream consumers in the US and abroad will pay.

Not just in terms of the first order effects of near-term higher prices like $2500+ iPhones, but second and third order effects like the postponement of AI benefits for years.

And the shrunken down market opportunities in this AI Tech Wave, earlier than they need to be.

In my view, the US Tech/AI Industry, currently leading the world, is the ‘canary in the coal-mine’ in terms of the broader implications for the whole US Economy, of course largest in the world at $29+ trillion dollars. Both the small manufacturing part (less than 10% of US GDP), and the larger services part (over 70% of US GDP).

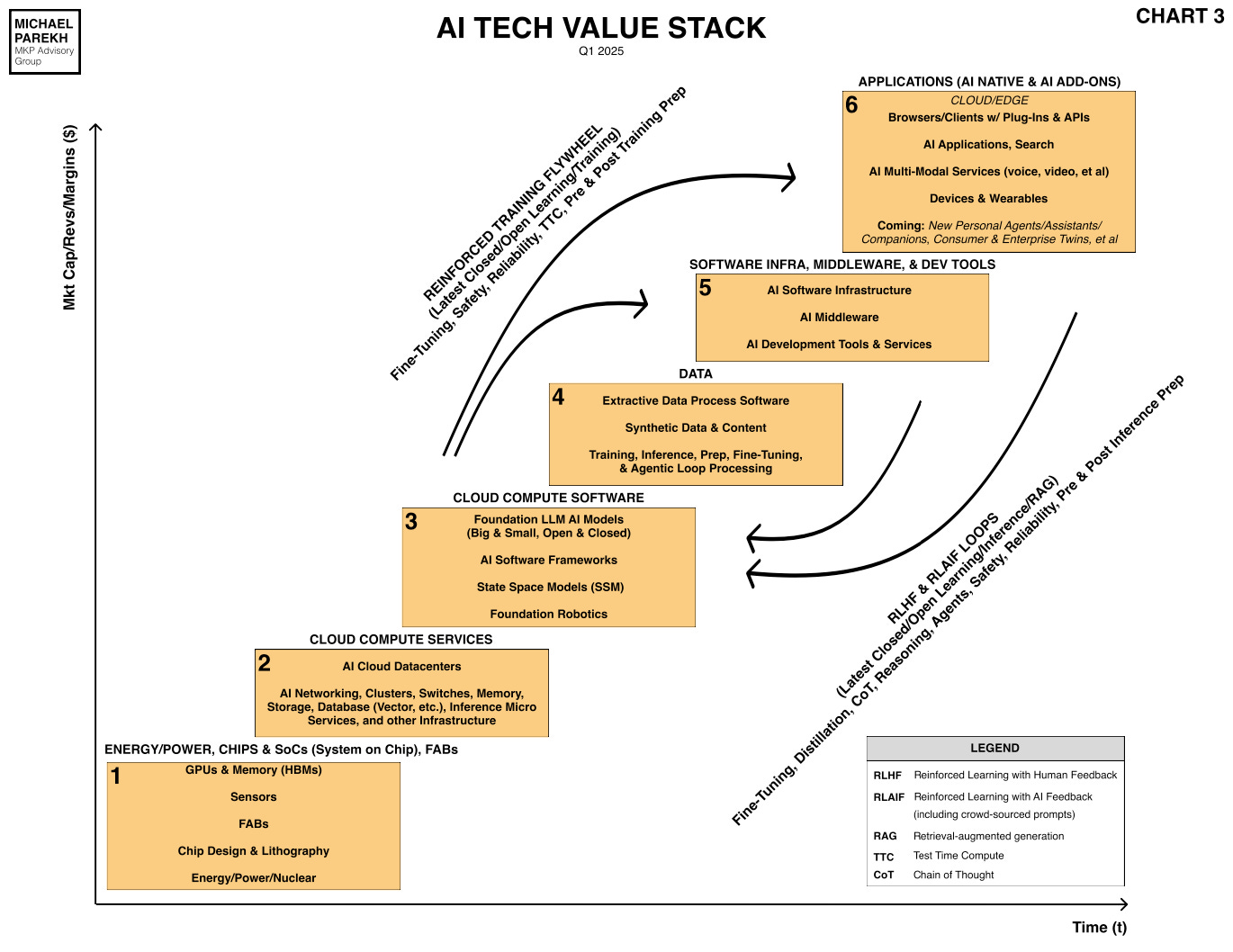

Ironically, most of the Trump Tariff self-chosen fight is ostensibly about helping that far smaller manufacturing piece. Rather than growing the larger, and higher margin services pieces (Boxes 3-6 above).

And the US Tech companies create the biggest opportunities in both buckets globally, as evidenced by the multiple trillion dollar companies thus far.

All slowed and shrunken down by our current era of ‘tariff economics’. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)