AI: TSMC between a 'rock and a hard place', with China. RTZ #552

Regulars here know how I’ve talked about the long-term US interest to ‘thread the needle’ with China in this AI Tech Wave. AND make sure we don’t hurt our long-term interests with the wrong actions over short-term concerns. This particularly applies to TSMC of Taiwan, which as I’ve discussed many times, is the singular semiconductor ‘Fab’ manufacturing company that makes the majority of the foundational components of global economic growth and prosperity. With Taiwan in the center of the conflict.

Nvidia and Apple inclusive in particular, for the US, depend both on TSMC and China, both between a ‘rock and a hard place’ together due to the US/China geopolitical frictions. Together, just those two companies are worth almost 25% of our almost annual $30 trillion GDP. And they’re so dependent on the US ‘threading the needle’ with China, amongst hundreds of key US companies. And not just tech companies.

And that’s BEFORE the impact of any increased tariffs by the new administration, near or far, with impact on inflation and interest rates.

I cover this context, because US government actions are now putting TSMC increasingly between a rock and a hard place that may dent us more than we expect in the longer term.

As the Information explains in “TSMC’s Push to Be Tech’s Switzerland in Doubt as U.S.-China Tensions Grow”:

“Taiwan’s chipmaking powerhouse is facing increasing U.S. pressure to cut off Chinese customers, while also walking a careful line to avoid offending Beijing.”

“If Taiwan Semiconductor Manufacturing Co. had its way, the chip manufacturing powerhouse would be a neutral party in the battle between the U.S. and China for technological supremacy—a semiconductor version of Switzerland, one TSMC executive told The Information. Unfortunately, the company may find it increasingly tough to avoid picking a side.”

“Last month, the U.S. Commerce Department launched an investigation into whether TSMC was still producing chips for Chinese tech giant Huawei Technologies in a potential violation of U.S. sanctions that have been in force since 2020, as The Information first reported.”

“As a result, TSMC in recent weeks undertook a thorough review of its Chinese customer base, combing through employee emails and chip design documents, said two people with direct knowledge of the probe. During that probe, TSMC cut off supply to multiple clients with suspicious chip orders and destroyed the wafers they ordered, said the two people.”

“The Commerce Department is exploring the possibility that Huawei bought chips from TSMC indirectly through intermediaries.”

Huawei, who continues to build its own world-class chips for its smartphones, to beat Apple and others in the US. Not to mention China’s Xiaomi doing the same building mobile chips, which will compete with US chip leader Qualcomm and others.

The US government continues to increase its efforts on ‘whack-a-mole’ China regulation:

“Earlier this month, the Commerce Department made the unusual move of ordering TSMC to halt shipments of advanced chips to Chinese clients, rather than waiting months to update formal policies to close loopholes and make other changes, according to three people with direct knowledge of the matter. (Reuters was the first to report the Commerce Department order.)”

And TSMC is trying to balance the two countries’ actions against each other:

“Meanwhile, TSMC is doing what it can to avoid getting under Beijing’s skin, especially amid constant chatter of a possible China invasion of Taiwan. China considers the self-ruled island a breakaway province, and President Xi Jinping has not ruled out the use of military force to achieve reunification, putting the island under persistent threat of a potential invasion.”

“The company operates two factories in China and produces chips for many clients from the region. Disruption in the relationship with the Chinese government could have immediate consequences for its bottom line and ripple throughout the rest of the semiconductor industry.”

The coming changes in the Executive branch will of course complicate these efforts:

“In the U.S., TSMC’s future may look complicated under the incoming Donald Trump administration. During his reelection campaign, Trump lamented that Taiwan had “stolen” the American chip industry, arguing that the U.S. was giving too much to Taiwan without getting enough back. He also suggested that the U.S. might impose high tariffs on imported chips, which could disrupt the semiconductor supply chain.”

It’s going to be tough to navigate these opposing forces:

“As far as the geopolitical pressures facing TSMC goes, the U.S. has the upper hand. Over 65% of the company’s revenue now comes from American clients, including its two biggest customers, Apple and Nvidia. That’s up from 59% in 2019.”

“That shift has occurred in part because the U.S. forced TSMC to stop working with some Chinese clients. Between 2019 and last year, the amount of TSMC’s revenue derived from China fell to 12% from 19%. The most notable of those former Chinese clients was Huawei, which was the company’s second-largest customer until the U.S. Commerce Department banned it from making unauthorized purchases of chips made with U.S. technologies due to national security concerns.”

There are useful charts in the piece that offer color on these exposures, and is worth reading in full.

“In recent quarters, Chinese companies contributed just over 10% of TSMC’s revenue. The share will decline further if, as is likely, the U.S. imposes more restrictions. But TSMC still doesn’t want to get on the wrong side of China because of the government’s power and the size of its markets.”

Ironically, the history of TSMC has US roots:

“Child of Globalization”

“The connections between TSMC and the U.S. run deep.”

“It was founded in 1987 by Morris Chang, a China-born, U.S.-educated engineer who previously led Texas Instruments’ chip division. In the mid-1980s, Chang, who was then in his mid-50s and had spent all of his adult life in the U.S, was invited by the Taiwanese government to boost the island’s semiconductor industry.”

“Chang moved to Taiwan and set about creating the world’s first dedicated semiconductor foundry, which would make chips for other companies so they didn’t need to build their own factories. The foundry enabled other firms to focus on chip design development without having to make the significant capital investment required for manufacturing facilities, filling a critical gap in the industry at that time.”

“In the early days, TSMC’s management and technology reflected its mix of U.S. and Taiwanese roots. Chang licensed its initial chipmaking technology, inherited from IBM, while many of TSMC’s executives—such as current chair C.C. Wei—shared his educational and work journey. They had earned their bachelor’s and master’s degrees in Taiwan, pursued their doctorates in the U.S. and gone on to work at major American tech companies.”

“TSMC rapidly scaled up its chipmaking know-how, attracting some powerful customers along the way. Apple became a hugely important one after it cut a deal with TSMC to manufacture the iPhone maker’s in-house chip designs, with the first TSMC-made Apple processor showing up in the iPhone 6 in 2014. Soon TSMC-made chips were shipping in hundreds of millions of iPhones each year.”

“The iPhone’s success—and the key role Apple’s processors played in it—prompted other companies to seek out TSMC’s services.”

“TSMC also relies on equipment from the U.S. and other Western countries. One of them is Lam Research, maker of some of the most advanced etching machines, which remove layers of material from wafers to create circuit patterns.”

Over time, TSMC became a “globalization bridge” between the US and China, which worked great while the interests of the two countries were aligned:

“At the same time, TSMC has made significant investments in China. In the early 2000s, TSMC began establishing factories in China as part of its strategy to tap into one of the world’s biggest consumer markets and expand its manufacturing capabilities. The company now has factories in two eastern cities in China, Shanghai and Nanjing, to cater to the growing demand for chips within the country.”

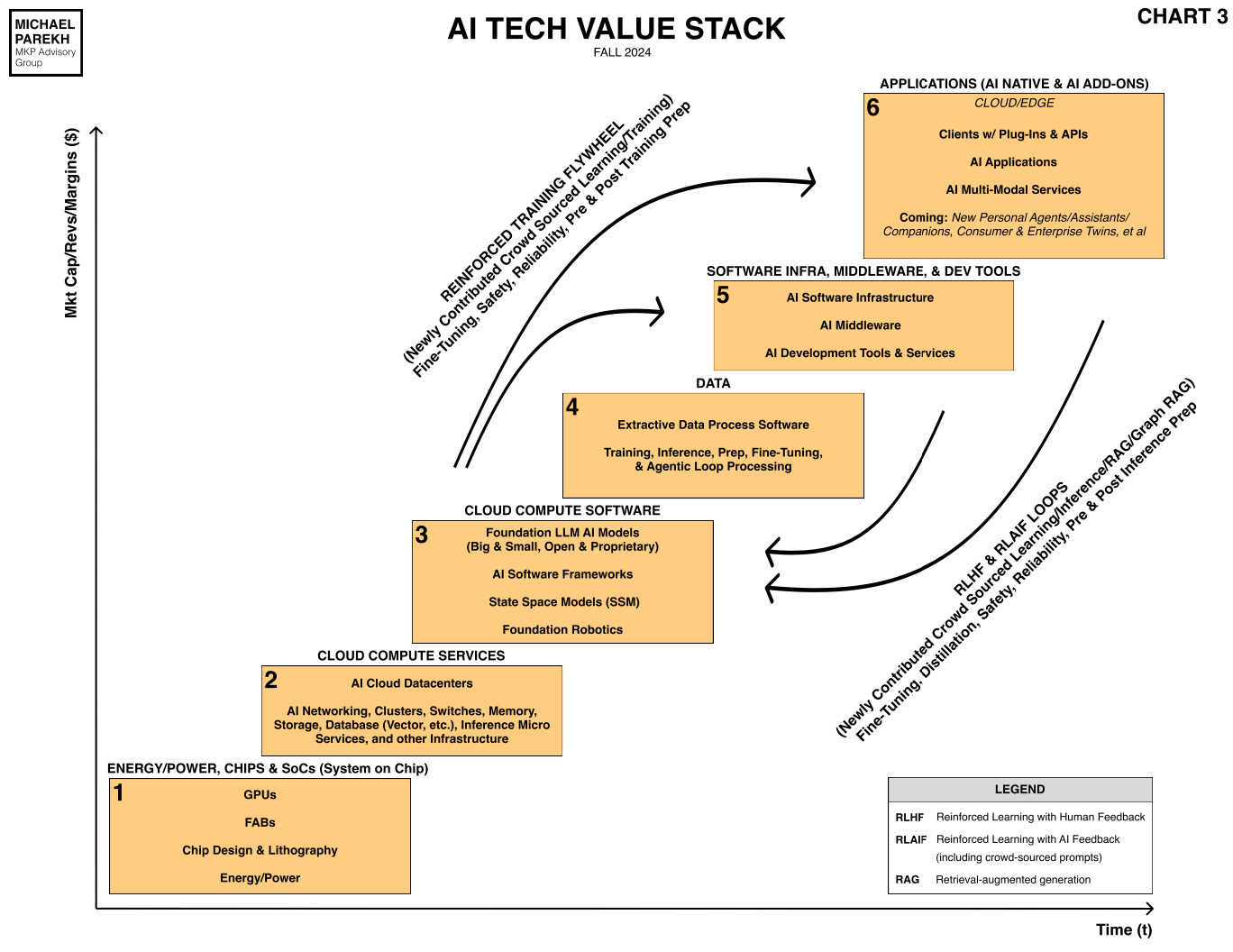

But now, in this AI Tech Wave in particular, the winds have turned, in almost every box in the tech stack below:

‘Globalization Is Almost Dead’

“While TSMC prospered through the growth of free global trade, it has had to adjust to a new reality in the U.S. in recent years.”

“In 2020, TSMC announced it would build factories in Arizona with financial support from the U.S. government. The three factories—one of which is finished while the other two are still in the planning phase—are critical parts of the U.S. government’s strategy to bring chip manufacturing back home and reduce its reliance on Taiwan, based on the risk of a potential Chinese invasion.”

But it’s been easier than done, and more expensive in the near-term:

“But many critics viewed the $40 billion chip projects in the U.S. as unwise. Among them was Chang, TSMC’s 93-year-old founder, who is now retired.”

“Speaking on a Brookings Institution podcast in 2022, he described the U.S. push for increased chip manufacturing as a “wasteful, expensive exercise,” and said manufacturing costs were about 50% higher in the U.S. than in Taiwan. And at an event to celebrate the initial installation of equipment in TSMC’s first Arizona factory in 2022, Chang bemoaned how dramatically geopolitics had reshaped trade over the past couple of decades.”

“Globalization is almost dead and free trade is almost dead,” he said. “A lot of people still wish they would come back, but I don’t think they will be back.”

Part of the issue has been that the US doesn’t have the broader tech ecosystem to support the pure manufacturing chip fabs within its shores:

“There have also been issues with the construction of the Arizona factories, including equipment delivery delays and labor issues. The lack of a chip and electronics manufacturing base in Phoenix, Ariz., has posed staffing hurdles.”

“A shortage of experienced workers in the U.S. prompted TSMC to bring in staff from Taiwan, the two people said. But the increasing number of Taiwanese workers also brought cultural conflicts.”

“A talent acquisition executive at TSMC, Deborah Howington, sued the company in federal court in Northern California last August, alleging that TSMC discriminated against people “who are not Asian and not Taiwanese citizens.” Twelve former employees have joined the lawsuit as plaintiffs.”

And these efforts face new headwinds with the changing of administrations to come:

“The new Trump administration adds further uncertainty to the company’s future as a manufacturer in the U.S. During his campaign, Trump criticized the program, known as the CHIPS and Science Act, under which TSMC is set to receive $6.6 billion in grants and $5 billion in loans. This month, House Speaker Mike Johnson hinted at a possible repeal of the law, though he later retracted that statement.”

And the impact will be felt wider than just TSMC:

“Avoiding Fines”

“TSMC isn’t the only company receiving notifications from the Commerce Department about export restrictions.”

“In 2022, the Commerce Department sent letters to Nvidia and AMD, limiting their ability to export advanced AI chips to China. These rules later became part of the official export regulations, and the department applied them to other companies as well.”

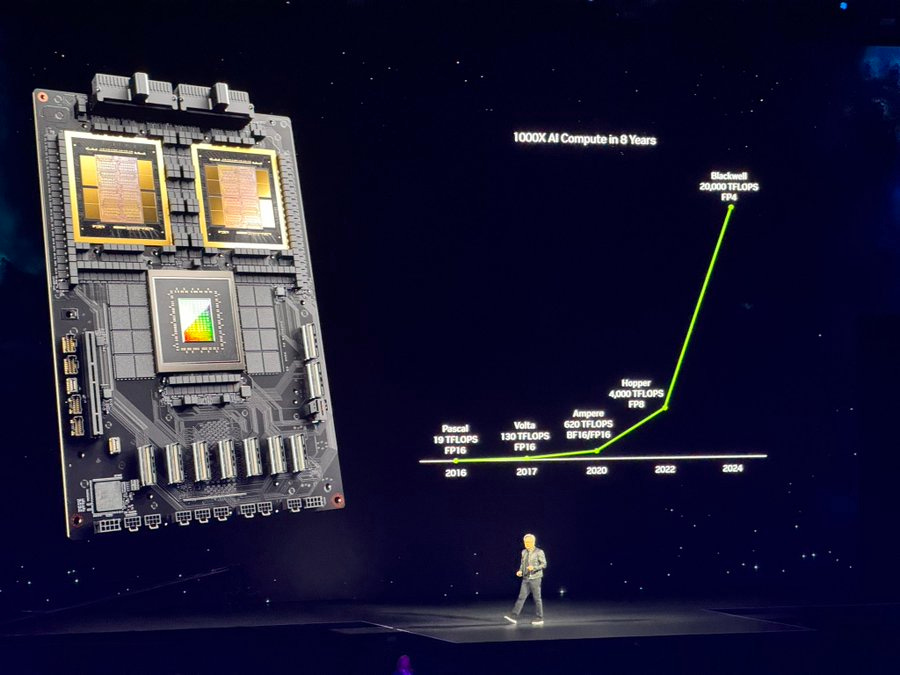

All of this is to highlight one of the fundamental differences in this AI Tech Wave vs other tech waves like the PC, Internet, Mobile et al over the last few decades. For the first time, the US and China are on opposite sides, and the gulf is getting wider. That is something that can ‘unscale’ the best of AI Scaling, be it with LLM AIs, robotics, EVs, and any other types of AI powered tech to come.

These are new, negative inputs in investor spreadsheets, be they private or public, equity or debt.

They’re likely to slow down markets and attendant growth on all sides. In a way that the current tech ecosystem, and the global economy, has not experienced in generations. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)