AI: US Tech/AI gets some relief from China Tariffs. RTZ #688

The Bigger Picture, Sunday 4/13/25

The Bigger Picture this weekend is that Apple and Nvidia, the US’s two biggest companies, were spared the Trump Tariff ‘Hangman’s Noose’. For now. Along with a host of electronics, semiconductor and other US technology companies. They can all for now breathe a sigh of relief on the 135%+ China ‘Reciprocal Tariffs’. So even though we’ll see a ‘relief rally’ for the ‘Mag 7’ come Monday, we’re still in a challenged position for the US AI Tech Wave for this year and beyond. No $3500 iPhones…yet. Let’s unpack it all.

Bloomberg summarizes it well in “Apple, Nvidia Score Relief From US Tariffs With Exemptions”:

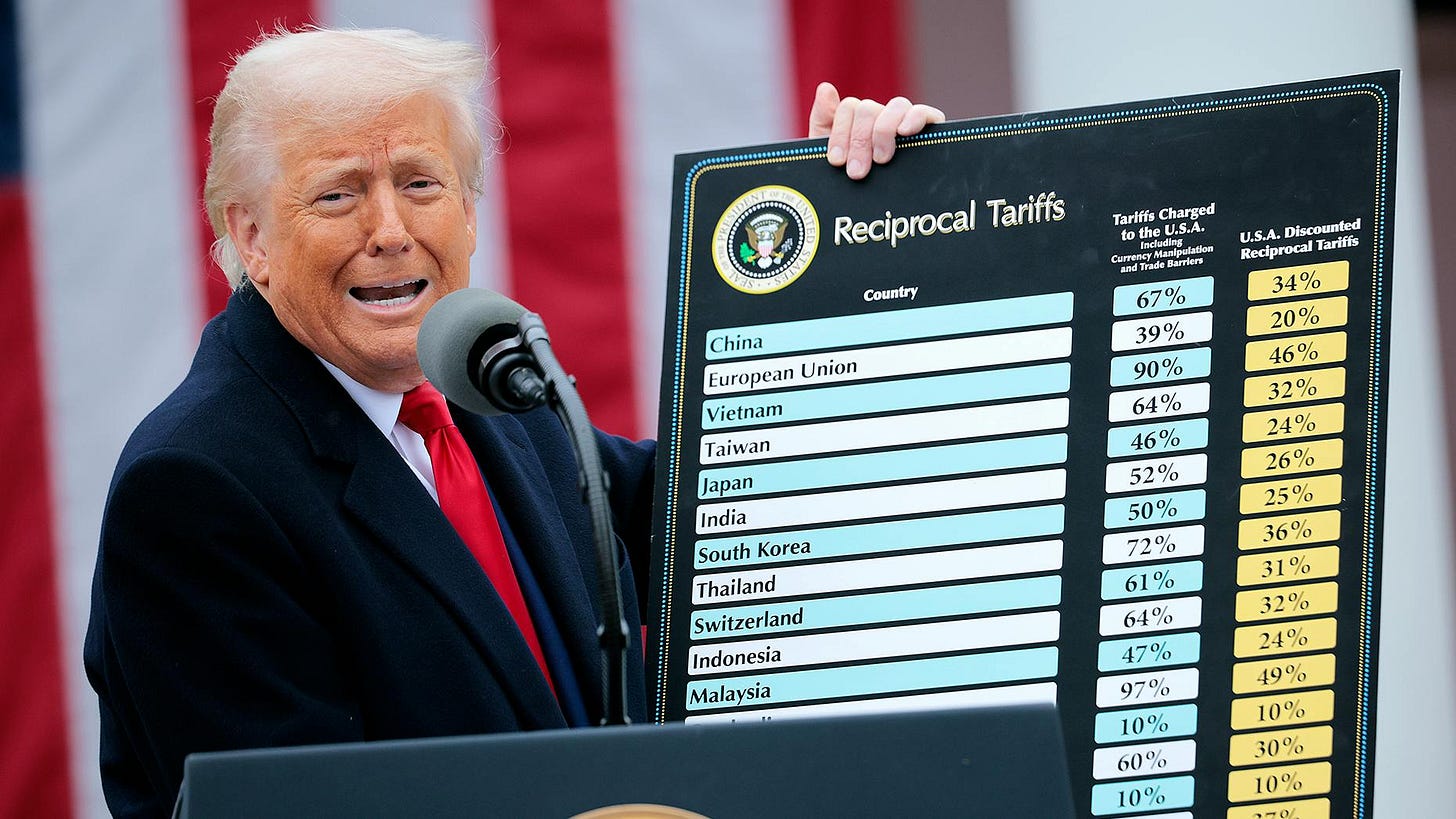

“President Donald Trump’s administration exempted smartphones, computers and other electronics from its so-called reciprocal tariffs, representing a major reprieve for global technology manufacturers including Apple Inc. and Nvidia Corp. even if it proves a temporary one.

Underline ‘TEMPORARY”…

“The exclusions, published late Friday by US Customs and Border Protection, narrow the scope of the levies by excluding the products from Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries.”

The exclusions apply to smartphones, laptop computers, hard drives and computer processors and memory chips as well as flat-screen displays. Those popular consumer electronics items generally aren’t made in the US.”

Consider them selective rewards for some big commitments by the major tech companies from Apple to Nvidia to TSMC and others to invest in the US going forward:

“The pause will be welcome news to consumers, some of whom rushed to buy new iPhones and other devices amid fears that the tariffs would send prices soaring. It’s also a big win for major technology companies that have presented massive US spending pledges for Trump in recent months. Trump’s tariffs upended global markets, triggered a selloff in stocks and ignited a rapidly escalating trade war with China.”

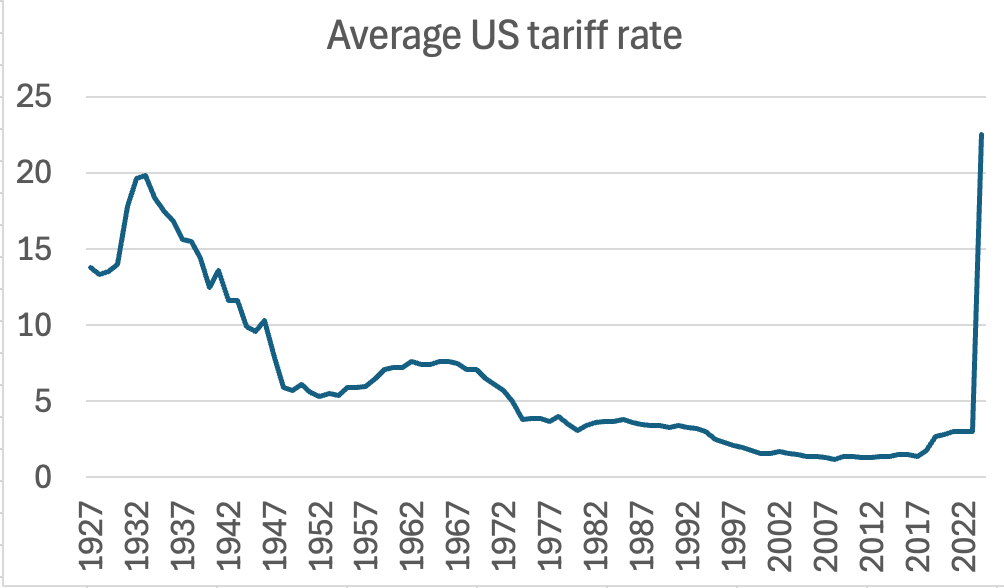

We’re still at overall tariff rates that rival the 1930 Smoot Hawley tariffs that accelerated the Great Depression. Especially when one looks beyond US Tech.

And this one is noteworthy because it lifts some of the pressure off the China focused tariffs:

“The move is the first significant softening of any kind in Trump’s conflict with China. It was backdated to April 5.”

“The exemptions cover almost $390 billion in US imports based on official US 2024 trade statistics, including more than $101 billion from China, according to data compiled by Gerard DiPippo, associate director of the Rand China Research Center.”

“The biggest category related to China is smartphones. The US imported smartphones valued at more than $41 billion from China in 2024, or about 9% of total imports from China. Also covered are computers and similar devices, of which the US imported more than $36 billion in 2024.”

“Altogether the exemptions cover consumer electronics and semiconductors that accounted for about 22% of US imports from China in 2024, DiPippo said.”

““This is a large hole in the US tariff wall that will spare key firms like Apple and consumers of laptops and phones from sticker shock,” he said. “But many other consumer, intermediate, and capital goods from China still face prohibitively high US tariffs. This exemption only covers one segment of the US economy.”

“The White House also released a corresponding memo indicating that the exemptions also extend to changes in small-parcel shipping duties. Trump had moved to end the so-called “de minimis” exemption, beginning with China, that generally means parcels worth $800 or below don’t face duties.”

But it’s all not rosy news…longer term uncertainties still pervades the air. Unforced errors indeed:

“The tariff reprieve may prove fleeting. The exclusions stem from the initial order, which prevented extra tariffs on certain sectors from stacking cumulatively on top of the country-wide rates. The exclusion is a sign that the products may soon be subject to a different tariff, albeit almost surely a lower one for China.”

Asian companies outside China also got some relief:

“The products that won’t be subject to Trump’s new tariffs include machines used to make semiconductors. That would be important for Taiwan Semiconductor Manufacturing Co., which has announced a major new investment in the US, as well as other chipmakers.”

“The move appeared to exclude the products from the 10% global baseline tariff on other countries, including Samsung Electronics Co.’s home of South Korea.”

And additional nuance:

“The tariff reprieve does not extend to a separate Trump levy on China — a 20% duty applied to pressure Beijing to crack down on fentanyl, including the shipment of precursor materials. Other previously existing levies, including those that predate Trump’s current term, also appear unaffected.”

And it’s bumpy times still ahead:

“The US tech industry has a loud voice and despite initial strong pushback against exemptions within the White House the reality of the situation was finally recognized in the Beltway,” Wedbush Securities analyst Daniel Ives said in a research note on Saturday. “There is still clear uncertainty and volatility ahead with these China negotiations.”

But some additional details are noteworthy:

“The original list of tariff exemptions included some semiconductor products — including central processing units konwn as CPUs. But those measures did not carve out tech products crucial to AI development including graphics processing units, or GPUs, and the servers that they power. Servers powered by AI chips from companies such as Nvidia and their critical components are primarily manufactured and assembled in Taiwan and Mexico.”

“Friday’s announcement would cover both Taiwanese and Mexican production, in a significant reprieve for companies seeking to build AI infrastructure in the US.”

“Semiconductor Equipment Exemptions”

“Also crucial are new exemptions on semiconductor manufacturing equipment, made by companies such as ASML Holding NV in the Netherlands and Tokyo Electron Ltd. in Japan. Those tools are essential for building chip factories, and comprise the lion’s share of the multi-billion dollar price tag for such plants. Companies including TSMC, Samsung, and Intel Corp. are building new US facilities with support from the 2022 Chips and Science Act.”

Trump’s initial “reciprocal” tariff announcement included exemptions for semiconductors and other sectors, to which Trump has regularly pledged to apply a specific tariff. He hasn’t yet done so but the latest exclusions are related to that exemption.”

And the BIG ONE, iPhones by Apple:

“The move excludes most of Apple’s core products from the escalating tariffs on China, including iPhones, iPads and Apple watches. Apple shares have slid since Trump announced the tariffs.”

“Discussions gained additional urgency in recent days after Trump increased the tariffs on China, putting companies like Apple in a more difficult position than competitors like Samsung, who are less reliant on China. Companies and tech industry lobbyists have also argued that reshoring the final assembly of smartphones and other products is impossible, one person familiar with the discussions said.”

So for now, it’s some relief.

It may not last long. Already, Commerce Secretary Howard Lutnick is saying products given reprieve may be subject to separate tariff duties for semiconductors “in a month or two”.

What a “way to run a railroad!”

Regardless, as I’ve discussed in several pieces in recent days, the US AI Tech industry is going to be secularly dented for the foreseeable future. ‘On again, Off again’ tariffs are no way to run the leading economic power in the world. It all continues to cede long term advantage the second leading economic power in the long run.

And that is the real Bigger Picture to keep in mind in this AI Tech Wave, as the markets enjoy a brief ‘relief rally’ early this week. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)