AI: Weekly Summary. RTZ #680

-

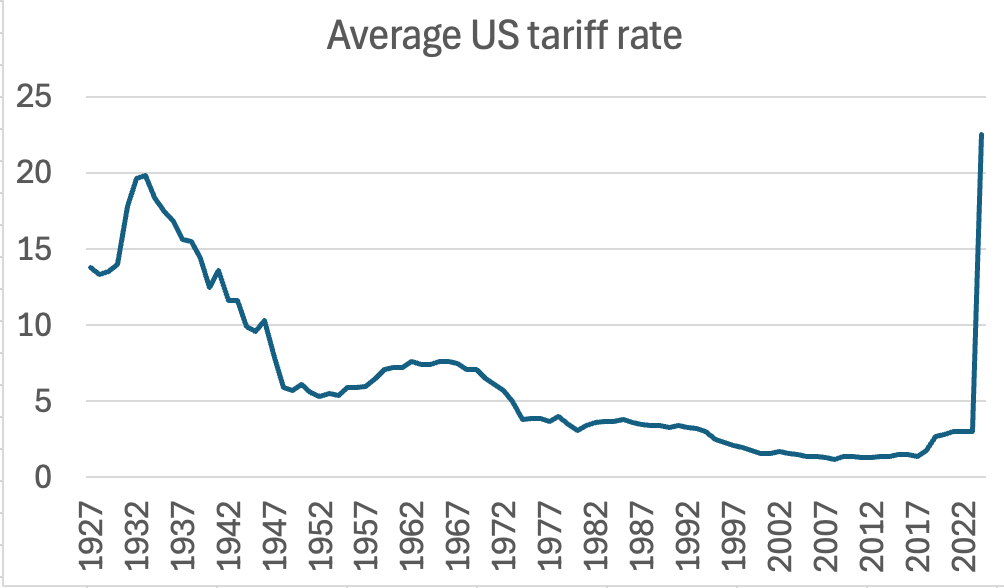

Tariff impact on US AI Tech: The long awaited Trump tariffs are here, and the global market reactions have been volatile. The tariffs are higher and deeper than expected. And rolled out in haste with an expectation of negotiating the final ‘reciprocal’ tariffs with individual countries, regions and even companies. An exercise of thousands of ongoing negotiations, with uncertainties for businesses likely extended for months if not years. The levels of the tariffs rival the Smoot Hawley Republican tariffs of 1930, at a time when global trade is three times larger in 2025. Despite exemptions of semiconductors for now, the implications are relatively dire for US tech across the board, with Nvidia and Apple in the cross-hairs on China. China is responding in kind. This will likely be the overarching issue for AI in particular for this year. More here.

-

OpenAI goes partial ‘open weights’: OpenAI founder/CEO Sam Altman announced new ‘open weight’ LLM AI models to come from the company. This addresses a long time question if OpenAI will have open source AI offerings along with its traditional and fast growing array of AI chatbots, reasoning and agent technologies. The moves are a timely response to open source LLM AI initiatives by Meta with Llama in the US, and DeepSeek and others in China. The moves are concurrent with an acceleration in OpenAI’s AI businesses, and a closing of its $40 billion round with Softbank. Sam Altman also hinted at an AI hardware device down the road. OpenAI remains on an accelerated path going into the second quarter. More here.

-

AI Startup ‘ARR’ ramps: There’s a growing crop of tech startups seeing accelerating ARR (annual revenue run rate) ramps, especially around AI technologies. It’s a trend exemplified by companies like AI coding company Cursor, which crossed a $100 million ARR threshold faster than previous norms. AI technologies are allowing companies to do more with less, even at a time when the technologies have bugs to be worked out. In particular, companies across industries are experimenting wider and deeper with AI technologies, and with larger budgets than in previous waves. The DeepSeek open source innovations have been a catalyst, and we are likely at an early stage for now. More here.

-

AI pricing tests at Grok & Manus: xAI’s Grok is seeing new pricing tests, with additional tiers being tried at varios capabilities. This is consistent with the industry trying to test upper pricing ceilings, with OpenAI’s recent pricing experiments a case in point. Given the variable costs of AI a differentiating factor vs prior tech waves, it’s important to find what customers will bear. Especially given the unprecedented costs of AI Compute. The trend also applies to China, where AI Agent startup Manus is also testing various pricing tiers. It’s a crucial step to address ongoing investor concerns around AI capex. More here.

-

Elon Musk merges X and xAI: Musk combines xAI with Twitter/X in a $113 billion of two private companies, following an old playbook. The next step would be merging the XxAI entity with public Tesla, both with optimism driven private and public valuations. The moves would make the current sharing of financial and people resources among the entities easier, given the larger, longer term goals towards AI Robotaxis and Robots. These moves to scale up the group’s AI efforts against competitors in the US and China. AI robots in particular are ramping from a more nascent stage than self-driving cars. More here.

Other AI Readings for weekend:

-

Amazon tests AI ‘Buy for Me’ agent buttons. More on agentic incentive alignments here.

-

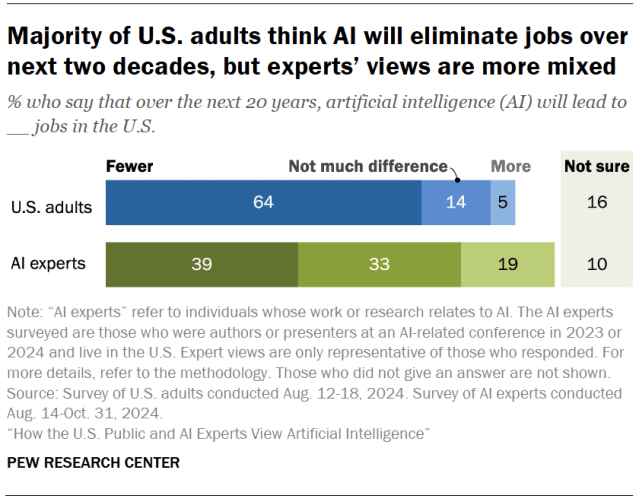

New Pew research on AI sentiments. Prior reports here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)