AI: Weekly Summary. RTZ #871

-

OpenAI Dev Day AI OS Ambitions: OpenAI held its largest and most ambitious Dev Day this week, with over half a dozen key technical initiatives around its growing portfolio of AI Applications and strategies. This is concurrent with key AI infrastructure deals with Oracle, Nvidia, SK Hynix, Figma and others. OpenAI also continues to see continued momentum around its AI generated Sora AI content strategy, with that app leading the US App store, and continuing being invitation only. Key at Dev Day was its strategy to help App developers integrate deeply into ChatGPT. This furthers and accelerates OpenAI’s move to become the leading AI Operating System platform in this AI tech wave. More here.

-

OpenAI Chips Deals roll on with AMD: OpenAO also continued its AI Chip diversification efforts from Nvidia, with a 10% investment in rival AMD, for its latest AI Inference chips. This of course propelled a move in AMD shares, reflecting the general public market enthusiasm for ongoing AI deals by the company with public counterparts. The AMD deal is also a multi-year, multi-gigawatt AI data center deal involving eventual AI infrastructure investment in the hundreds of billions. This along with the recent Nvidia, Oracle and other deals, takes OpenAI’s AI infrastructure and power ambitions to the trillion dollar level over the next few years. More here.

-

OpenAI’s AI Device Headwinds: New reports suggest some development and AI Scaling headwinds for OpenAI’s AI device portfolio ramp up with Jony Ive’s IO Products, acquired for $6.5 billion a few months ago. This again underlines the issue of scaling hardware/software devices in the tens and hundreds of millions of units. And something we’ve seen due to different issues for Amazon’s Alexa+ and Apple’s Siri AI device initiatives. Despite these issues, OpenAI remains in pole position on AI devices over the next two to three years, vs big tech companies like Meta and others. More here.

-

AI Ramp now in GDP Numbers: Most recent economic data is now showing the recent AI Data Center and Power Infrastructure ramp in economic GDP quarterly numbers. By some measures, this category is now surpassing consumption driven GDP growth, which is a relative first in recent tech waves. This also offsets somewhat the impact from tariffs and trade issues on the broader economy. The development also of course continues to highlight the issues of concentration of the AI boom in the broader economy, both at the federal and state levels. More here.

-

Smaller ‘Small Language Models’ (SLM): New emerging innovations around Small Language Models from Samsung AI Research point to continued progress on the other end of the spectrum vs Large Language Models (LLMs) This again underlines that we have meaningful AI scaling innovations around AI Reasoning and Agentic reinforcement learning and other chain of thought related technologies. The new developments are with even tinier models in specific domains, and show promise in a variety of domain specific AI applications scaling in healthcare and other verticals in this AI Tech Wave. More local inference on hundreds and potentially thousands of open source models, could help alleviate the enormous AI Capex spending imperative across Cloud AI Data Centers and Power requirements over the rest of this decade. More here.

Other AI Readings for weekend:

-

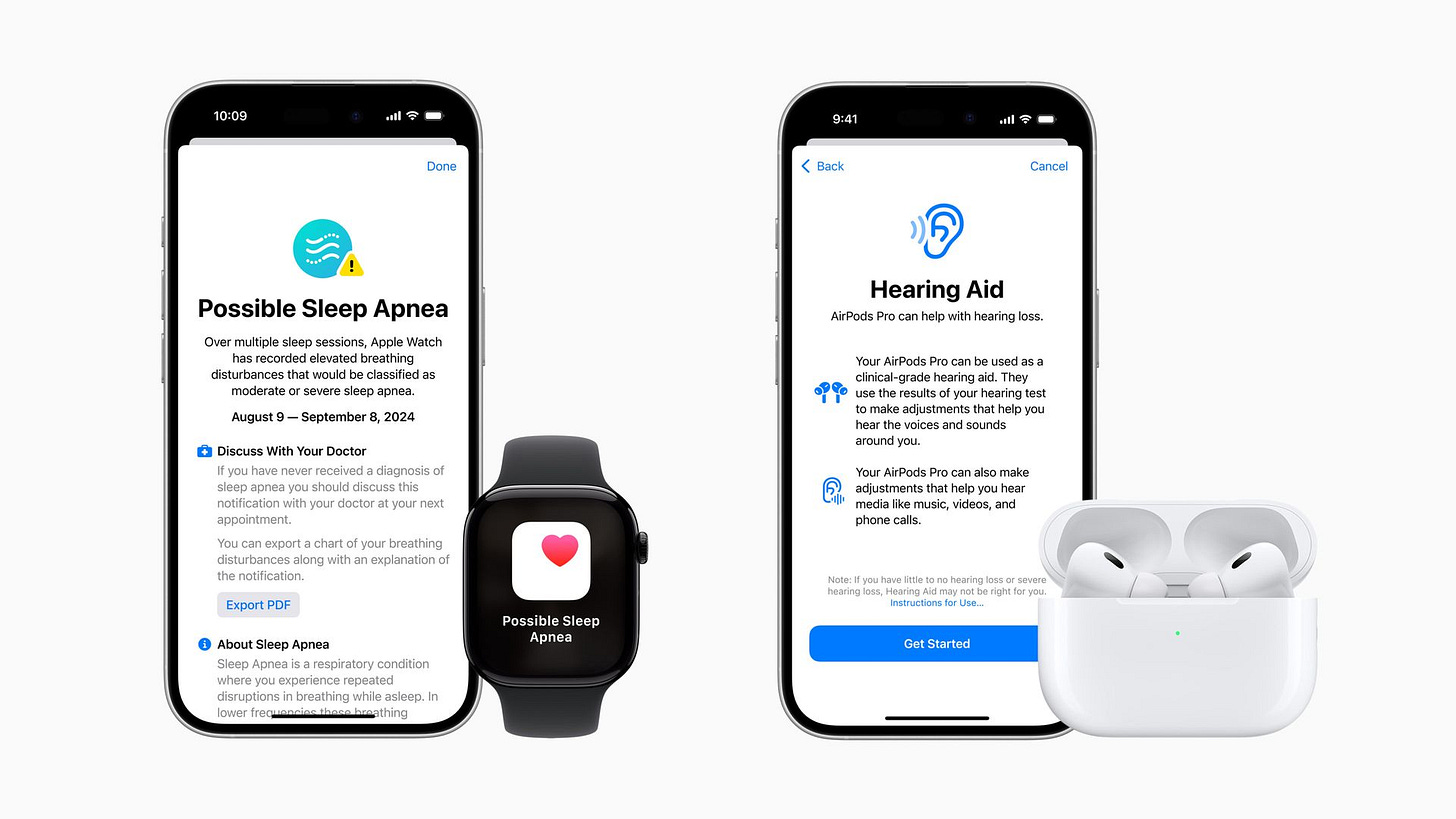

Apple Corporate Reorg around Apple Health & Fitness. More here.

-

US/China Tech/Chip/AI Trade Talks Worsen. More here.

(Additional Note: For more weekend AI listening, have a new podcast series on AI, from a Gen Z to Boomer perspective. It’s called AI Ramblings. Now 24 weekly Episodes and counting. More with the latest AI Ramblings Episode 24 here, on AI issues of the day. As well as our latest ‘Reads’ and ‘Obsessions’ of the Week. Co-hosted with my Gen Z nephew Neal Makwana):

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)