Asymmetric Market Update™️ #23

Crypto

Have you had enough coverage about the election yet? Yeah, me, either. It is the most important topic globally, and for good reason. The next President of the United States will shape the future of global policy and financial markets. Although most of us are exhausted from the rhetoric and gyrations in the polls, on November 5th, 2024, Americans who have not already voted will vote for the next leader of the free world…but will election night actually showcase the winner?

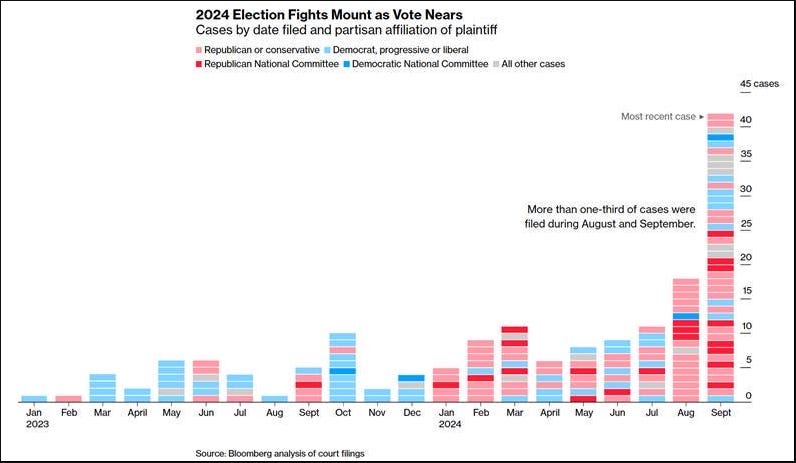

There is a non-zero chance that we won’t know who the next President will be until days, weeks, or even months after election night concludes, as the Supreme Court may be called in to determine the election results. In fact, the number of lawsuits already filed is reaching nose-bleed heights.

Nonetheless, the question remains – how does one trade the election?

As I mentioned on myriad podcasts and interviews in October (see the Team Updates below), I largely discount polls to zero and look to markets, not just prediction/betting markets but capital markets, for signals.

Polls are incredibly biased and only a fraction of the actual populace. If someone is having dinner with their family and the phone rings, they may say something quickly to get off the phone, but most importantly, a response to a question lacks skin in the game.

The highest form of signal is when someone puts their money where their mouth is.

Now, there are myriad prediction/betting markets for the Election:

-

PredictIt

-

Intrade

-

Polymarket

-

Drift Bet

-

Hedgehog

-

Kalshi

-

Betfair

-

Betonline

The list goes on.

All of these prediction markets have Trump favored as the winner.

But these betting markets are the equivalent of a binary option contract: either the event happens and you win, or it doesn’t, and you lose.

Clearly, it’s a bit tricky to hedge a binary outcome.

However, looking into other areas of the capital markets, they also suggest a Trump victory.

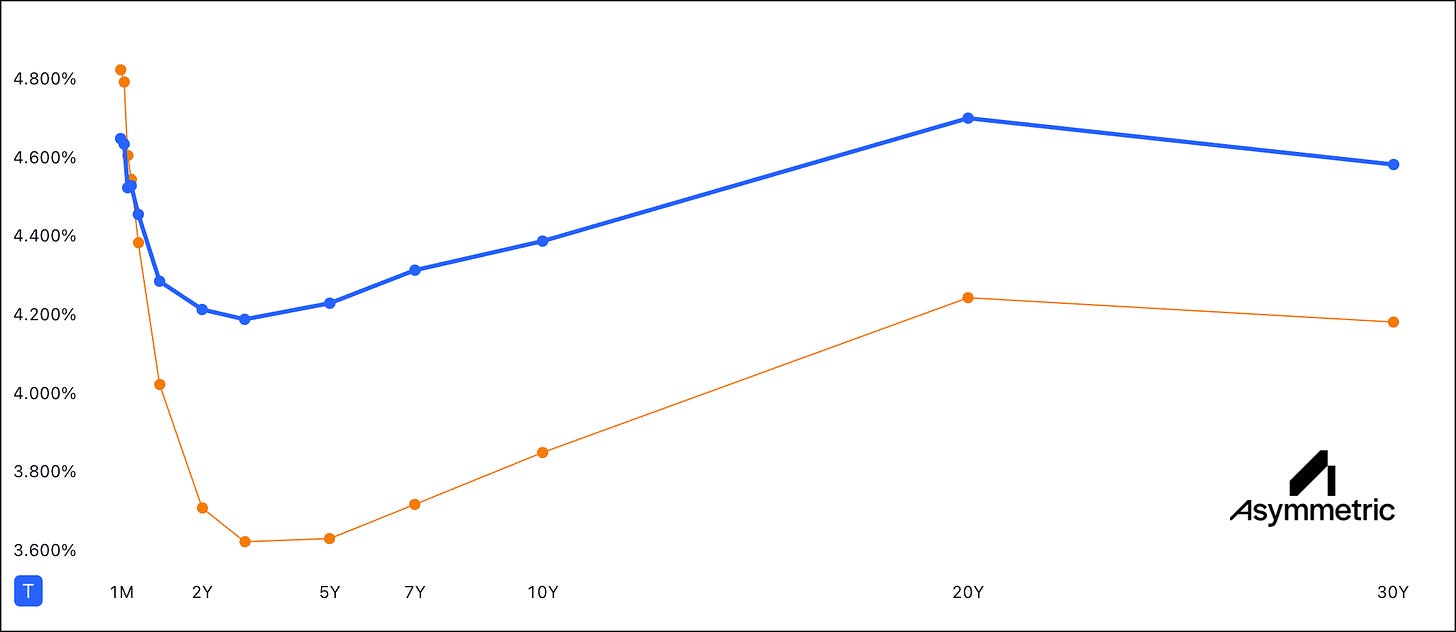

For example, let’s examine the yield curve.

The orange line represents the yield curve from a month ago, whereas the blue line represents the yield curve as of the close of the markets on November 1st, 2024.

You’ll notice a steepening of the yield curve and the precipitation of the selloff in government paper. This implies investors require a higher yield to fund the U.S. government’s deficits, and according to several analysts, a Trump administration would likely run higher deficits than a Harris administration.

Moreover, Morgan Stanley noted near the end of October, “capital markets have broadly aligned with the prediction markets. As reflected in the Republican (MSZZREP) and Democratic (MSZZDEM) baskets we track, stocks exposed to Republican win outcomes have risen.”

Can all these market participants be wrong? Of course, but probabilistically, when multiple signals point to a Trump victory, I tend to favor those with skin in the game versus those without.

If we assume a Trump victory, what does that mean for crypto? We’ve been wargaming this outcome for months at Asymmetric, and although none of this is financial advice, this is how we position ourselves.

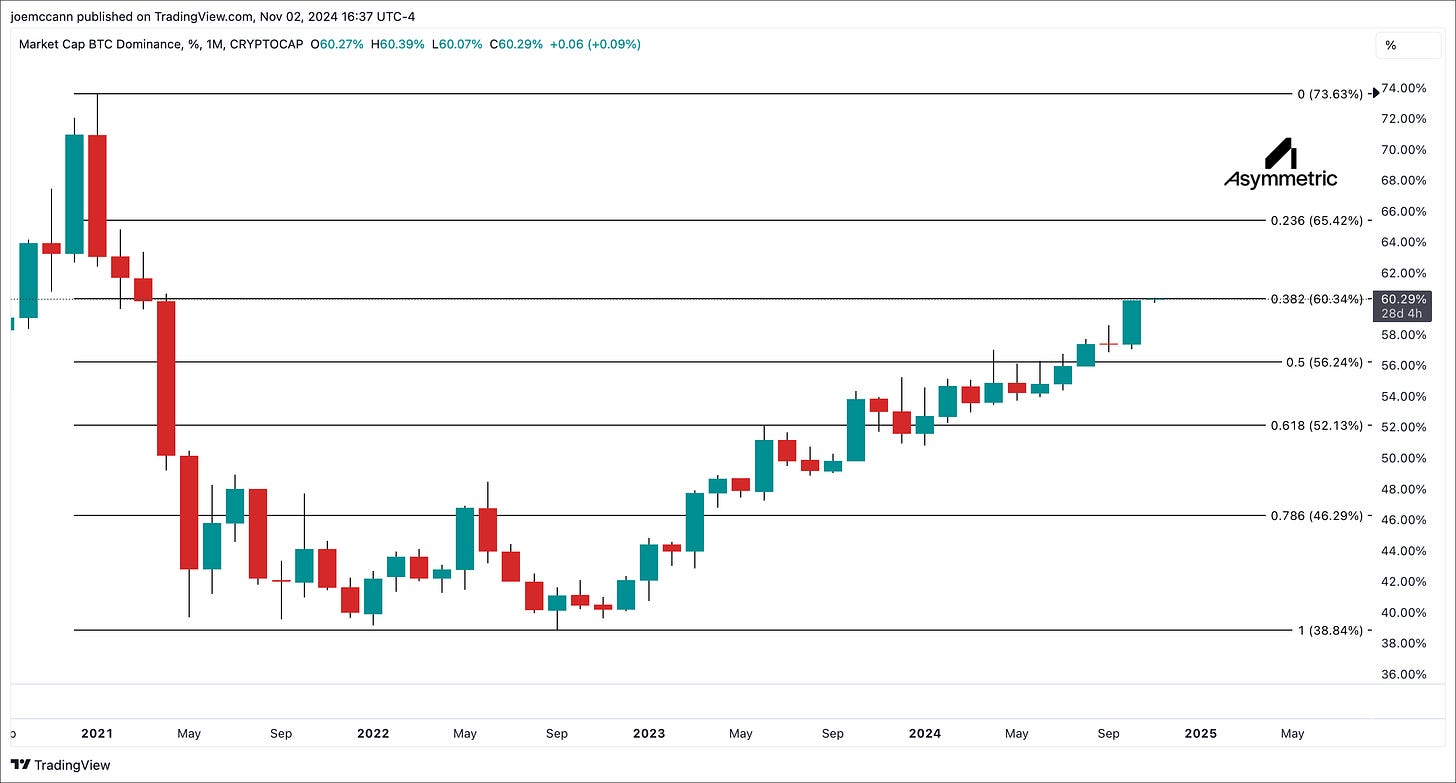

First, even though Bitcoin’s dominance (BTC.D) has been at its highest level in years, we still see it as the leader of the majors (top 20 by market capitalization). BTC.D has cleared a key technical level (the 50% Fibonacci retracement) and is now testing the 38.2% retracement level—a move through these levels increases the probability of a full retrace to ~73% dominance.

If Trump wins, Bitcoin will likely trade up to $100,000 by the end of the year for a few of reasons.

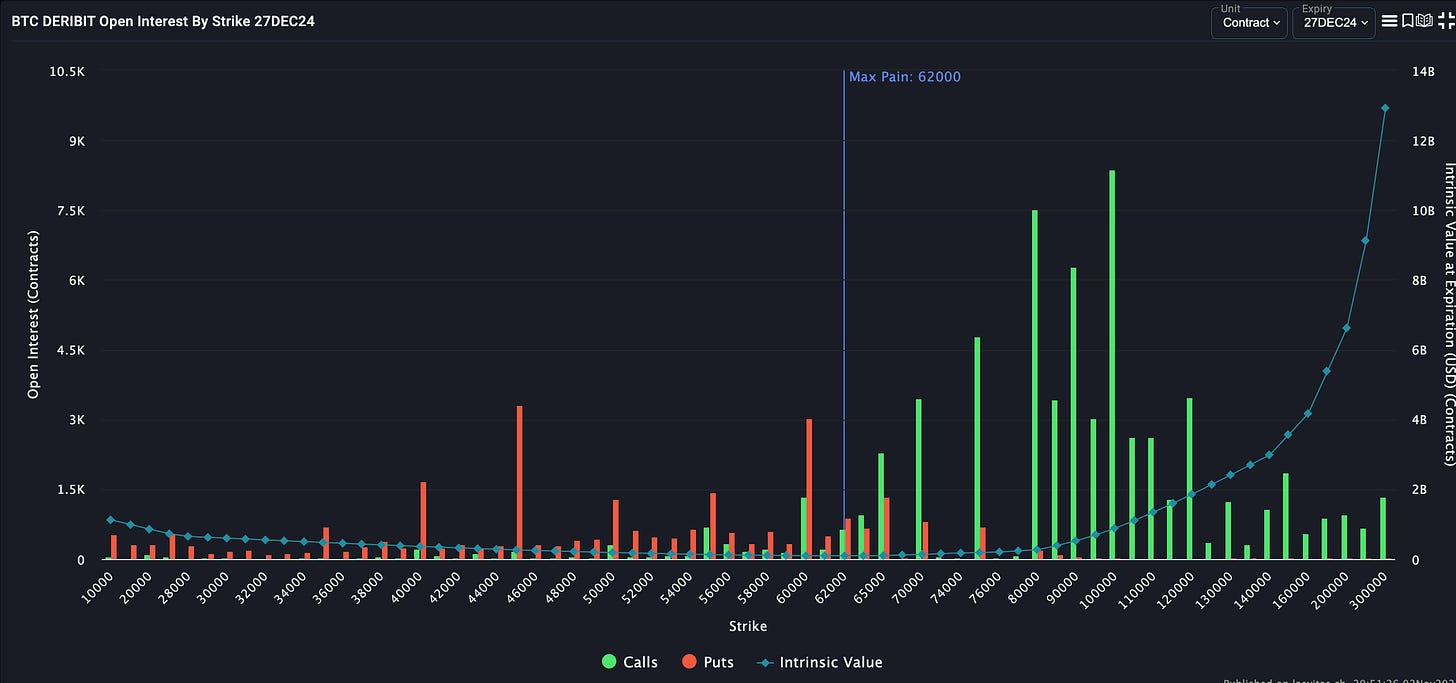

One, the largest amount of open interest in the options market has and continues to be right at the $100,000 strike for the end of the year expiration, December 27th, 2024. This has been the case for months now across all expirations until just recently; the $80,000 strike for the end of November has slightly higher open interest as traders have put on higher delta upside positions assuming…a Trump victory.

$100,000 will tend to act as a magnet as Bitcoin enters price discovery over $74,000 assuming momentum traders will “buy the breakout.”

Next, the mainstream financial media comes into play. It’s counterintuitive, but for some reason, retail loves to buy assets when they are higher than they were previously.

“If you liked it at $60,000, you’ll love it at $80,000!”

CNBC and Bloomberg will constantly cover the new all-time highs in Bitcoin, drawing even more buyers in.

Finally, the Trump election team has laid out a sufficiently detailed plan on what they would do for Bitcoin and crypto more broadly should he step back into the Oval Office, including creating a Strategic Bitcoin Reserve, which oddly enough has bipartisan support. Senator Lummis has been the architect of this bill and will certainly seek the credit for its passage. Obtaining 5% of Bitcoin’s total supply over five years is the proposed amount, which is an enormous amount of Bitcoin notionally. Even if you discount that 5% number by 50% down to 2.5% of Bitcoin’s circulating supply, that’s a truly massive number – roughly 34 billion dollars worth of Bitcoin at a price of $70,000.

Should Harris win, we suspect the market abuse algorithms will hammer Bitcoin, and a drop of 5-10% is very likely. However, in the longer term, Harris will also increase the deficit, which continues to favor Bitcoin’s price appreciation.

Where does one allocate to get some beta to a core Bitcoin position? Unsurprisingly, my answer is Solana, $SOL, and for good reason.

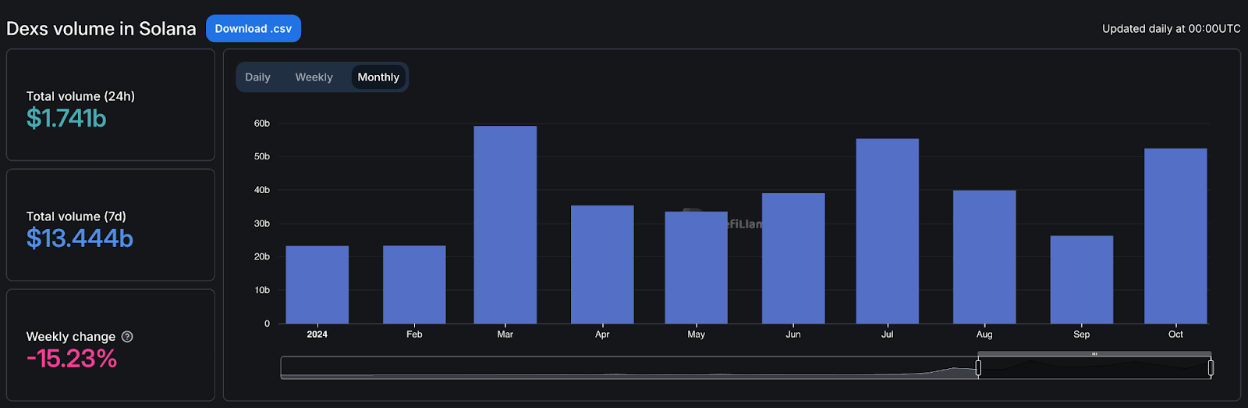

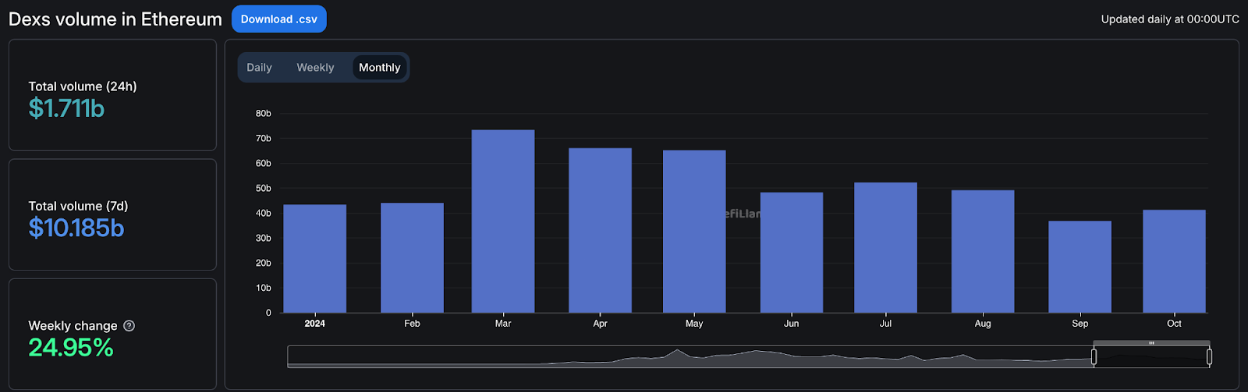

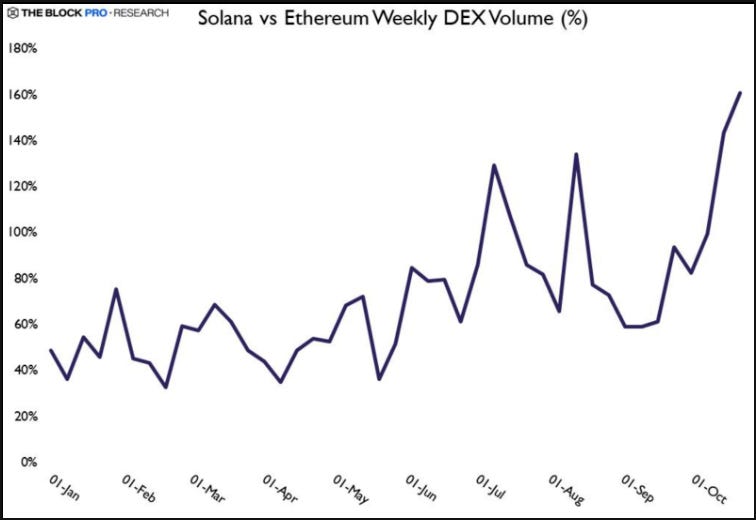

October was a historic month for Solana, consistently flipping not only Ethereum but other protocols as well.

Solana’s DEX volume reached $52.157B in October, surpassing Ethereum’s $41.499B.

Unique users in Solana traded $4.12 billion worth of tokens on DEXes, three times higher than Ethereum’s $1.48 billion.

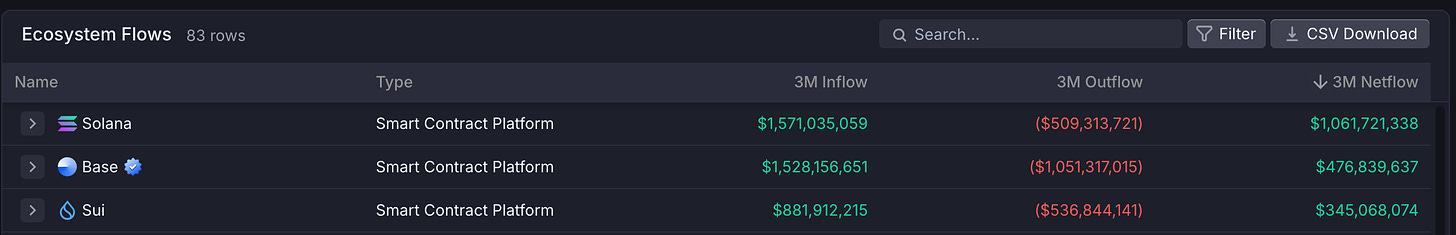

This trend is further reinforced by industry-wide net flows. According to Artemis data, Solana has led all blockchains in net inflows over the past three months, attracting over $1B USD of funds from alternative chains. Comparatively, Ethereum is the third-worst-performing chain, suffering over $228M in net flows during the same time frame.

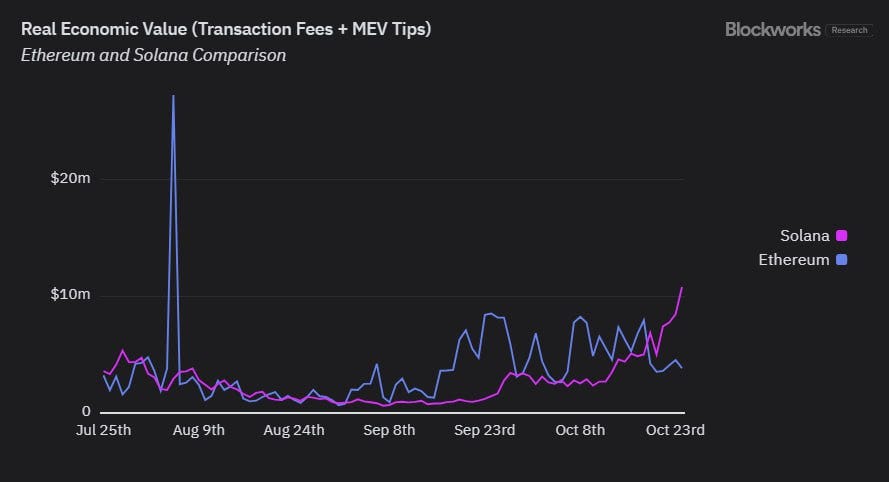

Real economic value (Transaction Fees + MEV tips) is exploding thanks to Asymmetric portfolio company Jito.

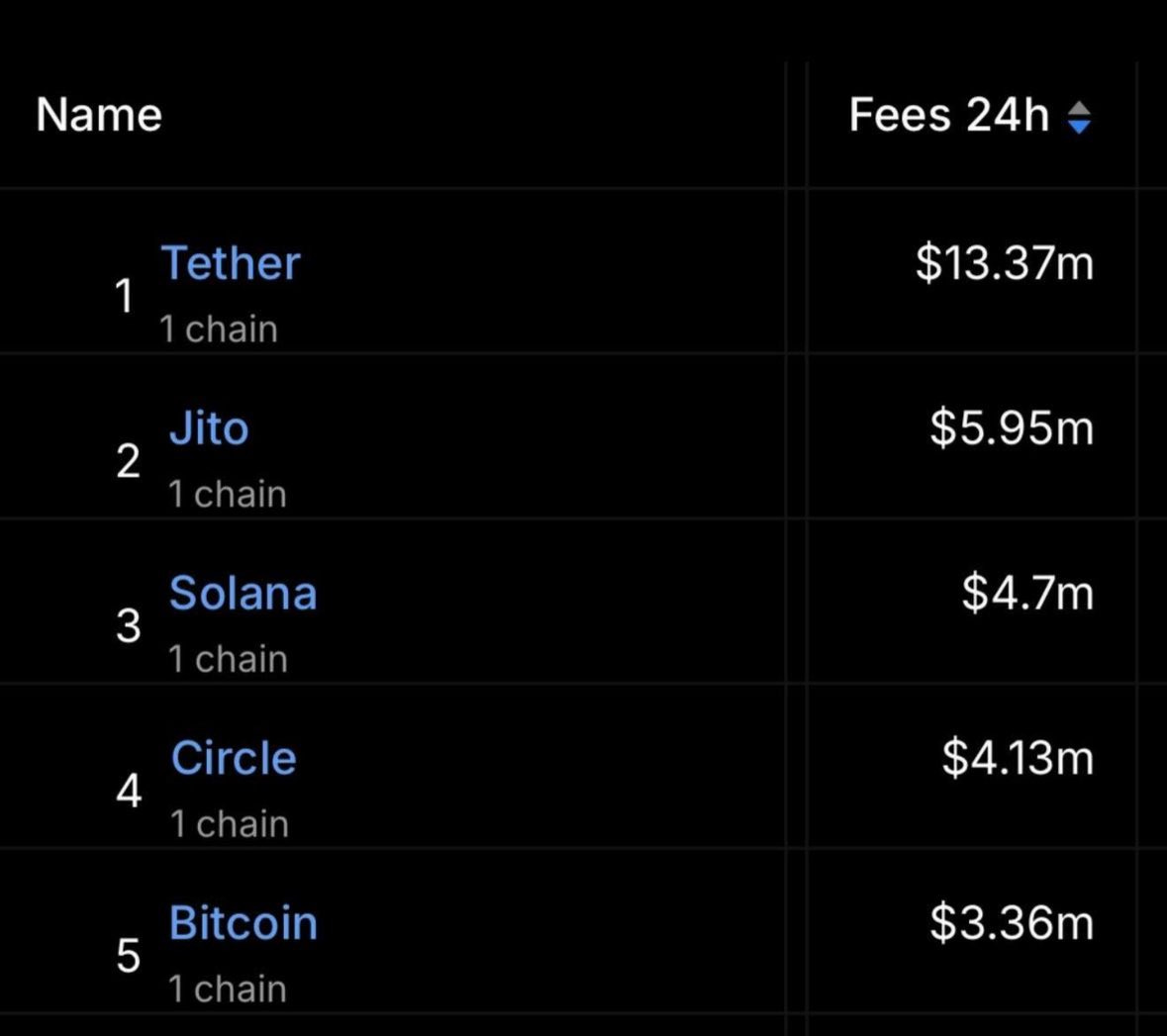

In fact, on October 26th, 2024, Jito was the second highest revenue-generating on-chain service behind the stablecoin leader Tether.

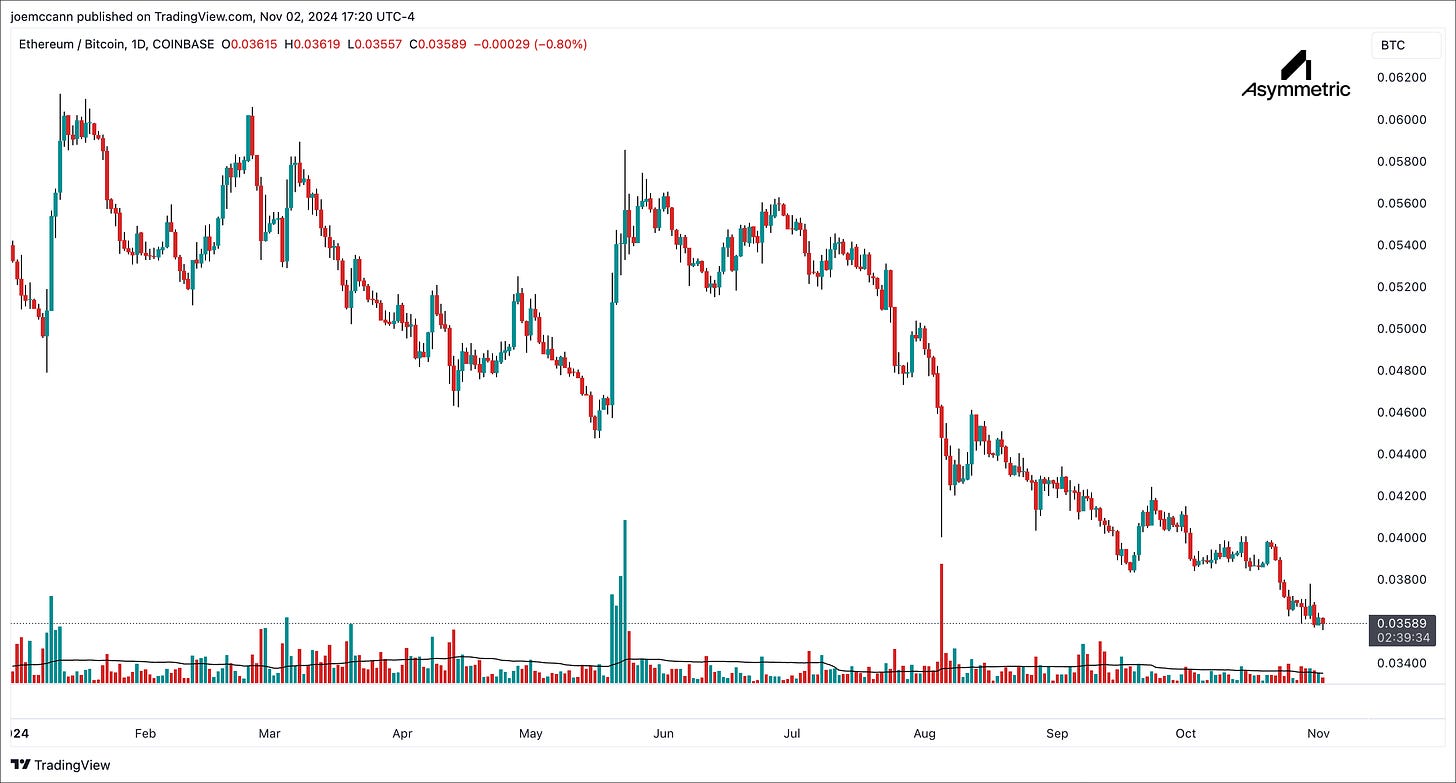

$SOLETH also just traded to a new all-time high in October and looks poised to break out even further while $ETHBTC continues to make new year-to-date lows.

If you’ve been following us at Asymmetric, it should be no surprise that we will still favor $BTC and $SOL as the perfect barbell approach heading into the election, again assuming a Trump victory.

Like any good trader, we always reserve the right to change our views based on new data, which will be available on election night, November 5th, 2024.

Macro

Certain historical events have deemed “macro” analysis locally important: wars, natural disasters, elections, etc. Luckily, we have (or have recently had) all of the above. That said, the predominant driver of the next phase of markets will be the US Election. The predominant traditional macro data that will drive Fed policy for the next two (at least) FOMC meetings will be US Employment. We will focus on those two things.

The US Election

The US Election is a game of perception and fear. The perceptions involve the following:

Kamala Wins

-

Fiscally irresponsible – yields go higher further out the curve (growth positive on the margin).

-

Continues current path with high regulation (not growth positive on the margin).

-

Increases taxation on individuals and corporations (growth and asset price negative on the margin).

-

Continues the policy of contained chaos in the Middle East (the oil price will be higher on the margin).

Trump Wins

-

Fiscally irresponsible, even more so than Kamala – yields go higher further out the curve (growth positive on the margin).

-

Reduces regulation across industries (increases growth and corporate profitability on the margin).

-

Decreases taxation on individuals and corporations (increases growth and corporate profitability on the margin).

-

Peace in the Middle East and the aforementioned deregulation of the energy industry (oil price higher on the margin).

-

Tariffs on China and others who choose to move away from setting trade in USD (inflationary on the margin) – USD higher.

-

Mass deportation – the market seems to ignore this impact (it is negative growth and negative inflation). One could split hairs on whether this creates wage pressure, etc. One cannot split hairs that fewer people = less consumption = less growth. We saw the impact of mass immigration, so we need not speculate. If A = B, then -A = -B.

We do not believe all those market perceptions/initial moves will hold over time. That said, how we think it ends has nothing to do with the market’s first reaction before it means it reaches sensibility and linkage to the actual outcome.

There are three possible outcomes, in our view:

-

Kamala Wins – Split Congress

-

Trump Wins – Split Congress

-

Trump Wins – Red Sweep of Congress

Given these, let’s discuss the first moves of the market. Again, the devil will be in the details, but these are the moves we envisage:

Kamala Wins – Split Congress

-

More Fed cuts are put back into the front end, and longer-end yields also go lower.

-

USD goes lower.

-

Stocks go lower.

-

Oil goes higher.

-

Bitcoin goes lower.

Trump Wins – Split Congress

-

The market tries to price one or two more 25bps cuts, and that is it. Longer-dated interest rates go higher.

-

USD goes higher.

-

Stocks go higher (led by the Russell).

-

Oil goes lower.

-

Bitcoin goes higher.

Trump Wins – Red Sweep of Congress

-

Bitcoin going much, much higher is the most obvious trade for this. Not only will we have a full set of crypto-friendly regulations within 90 days of Trump taking office, but the strategic BTC reserve at the US Treasury seems like a high-probability event.

-

Interest rates will gap up a lot higher. 30y to 5%? 5.50%?

-

Stocks initially go much higher. People will get nervous that higher rates will adversely impact stocks. You can’t have it both ways. If stocks are up because of true growth and earning potential (e.g., real rates stay similar as nominal rates go higher), then this is not bad for stocks at all.

-

Oil lower.

We do not believe that all of these market movements hold over time. In particular, we think the USD will fade/reverse after the initial spike in interest rates (the timing is unclear and is also level-dependent). So, there will be the initial trades for the election outcome. Then, there will be the mean reversion of the emotional trading once reality sets in.

US Employment – When the Macro Becomes the Micro

The FOMC has been very clear that real rates are restrictive. They have repeated that they have begun normalizing real rates and will continue to do so. They have also stated that they could accelerate this process should they see weakness in the labor market. Though the labor market is in good shape, broadly speaking, it is certainly decelerating at best. Pundits calling for the FOMC to pause rate cuts (ceterus paribus with the election) are completely missing the point. The fed will (and should) continue normalizing rates to be less restrictive. The labor data indicates this is the correct path for the FOMC.

We have pointed out the non-linearity of the job market historically many times. Everything is OK; then it isn’t fine at all. The FOMC is aware of this. This is where sensible risk management calls for a continuation of rate cuts to remove restrictions as the job market performance is past its peak.

Unemployment rate

The unemployment rate (UR) was flat on a rounded basis, but it rose by a tenth on an unrounded basis, from 4.05% to 4.14%. The Sahm Rule was triggered, then un-triggered, and now the UR has ticked back up again. We are at the convexity point for unemployment, where the FOMC needs to be on high alert not to create an employment issue with unnecessarily restrictive rates.

NFP

The U.S. economy added 12,000 jobs in October, and payrolls were revised lower by 112,000 in August and September. This is clear moderation, especially when taken with material downward revisions to previous NFPs.

The private sector reported a net loss of 28,000 jobs in October, bringing the 3-month average down to 67,000 and the 6-month average to just under 101,000 jobs per month. We have spoken about the importance of the government’s profligate spending. It becomes a real problem when the private sector is being crushed by restrictive interest rates, but that is being masked by government spending and hiring. Not to be a doom and gloom, but the evidence is mounting that we are approaching a situation in line with this explanation.

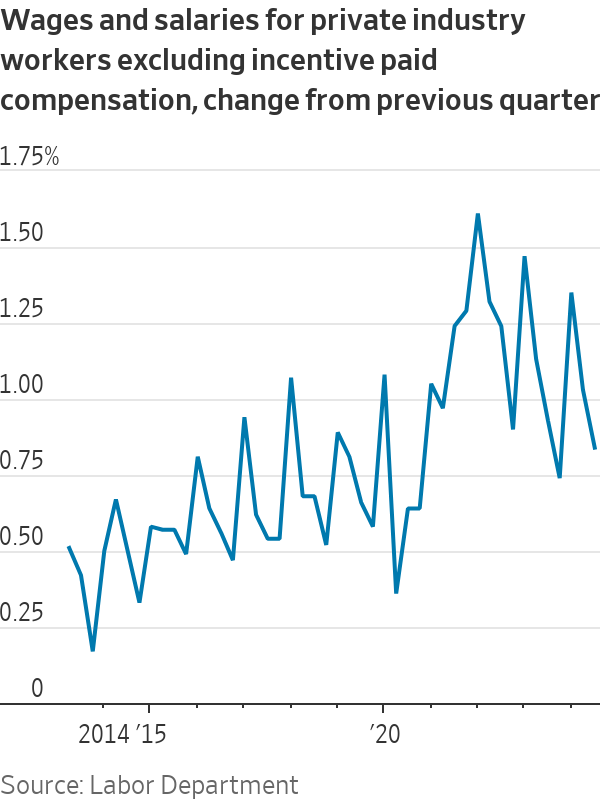

Per Nick Timiraos of the WSJ: “The employment cost index is seen inside the Fed as the highest-quality measure of compensation growth. Wages + salaries for private-sector workers ex-incentive paid occupations was +0.8% in Q3.”

This is just more evidence that the economy is nowhere near overheating. It continues to mean revert (albeit slightly choppy) to long-run averages. The implication is that nominal (and real) rates will continue declining. This is supportive of fixed income and risk assets in a macro sense. Squaring the circle of this plus our discussion of the US election, we believe Q1 2025 is setting up to be a constructive period for asset prices.

VC

Stripe Acquires Bridge Network

Stripe recently announced its acquisition of Bridge, a stablecoin payments platform, in a landmark $1.1 billion deal. This acquisition, Stripe’s largest to date, positions the fintech giant to expand its services into crypto, offering businesses streamlined access to stablecoin infrastructure for global transactions. By integrating Bridge’s banking connectivity, Stripe aims to simplify cash flow, compliance, and treasury functions within a unified platform, enhancing its appeal to both traditional enterprises and crypto-native projects. The acquisition holds particular value for VC-backed crypto companies, which can leverage Stripe’s enhanced capabilities for smoother fiat-crypto integrations and improved financial operations.

Stripe + Bridge: A Strategic Step Forward for VC-backed Crypto Projects

Stripe’s acquisition of Bridge is more than a tactical expansion into financial integrations. It has specific implications for the crypto ecosystem, particularly for venture-backed projects navigating between fiat and digital assets. By folding Bridge’s bank connectivity tech into its platform, Stripe moves closer to a full-stack solution that could offer VC-backed crypto companies the support they need to scale effectively.

Fiat-to-Crypto Flow Simplification

Crypto projects live and die by their ability to manage fiat-crypto flows securely and in compliance with global regulations. Stripe’s enhanced access to banking infrastructure via Bridge could potentially facilitate seamless on- and off-ramps for VC-backed projects. Reliable fiat-to-crypto flow is an operational necessity, especially for onboarding users and moving funds—an area many early-stage crypto startups struggle to manage independently.

Optimizing Cash Flow and Treasury Management

Real-time visibility into cash flow is often elusive for crypto projects, which depend on fragmented banking solutions. By leveraging Bridge’s robust bank connections, Stripe could simplify cash flow management for these projects, enabling them to consolidate financial operations and reduce operational friction. For startups, particularly those in Web3, this could translate to greater agility in a high-volatility environment.

Compliance Gains for Regulated Markets

Compliance remains one of the most significant operational burdens for crypto businesses, especially those looking to scale across multiple jurisdictions. Bridge’s banking infrastructure could enable Stripe to develop more robust KYC and AML solutions tailored for crypto. For VC-backed projects working to expand globally, Stripe’s infrastructure upgrade could streamline compliance and lessen the need for piecemeal solutions, cutting costs and risk.

Embedded Finance Meets Web3

Bridge’s acquisition sets Stripe up to offer deeper embedded finance solutions, which are strategically aligned with crypto’s push into decentralized finance (DeFi) and Web3 applications. VC-backed projects could harness these tools to embed traditional financial services—such as savings accounts, lending, and payments—directly into crypto-native products, helping to boost user retention and expand the Web3 ecosystem.

Expanding Global Reach

Stripe’s global footprint, now strengthened by Bridge, could help crypto companies looking to operate across borders manage international transactions more efficiently. For crypto companies with users in multiple regions, the ability to settle funds cross-border seamlessly will be essential as regulatory requirements vary significantly by region.

Scalable Financial Infrastructure

For crypto companies backed by venture capital, Stripe’s newly enhanced infrastructure could serve as a bridge (pun intended) to secure, compliant, and scalable operations without excessive spending on custom solutions. By addressing key operational challenges—fiat access, compliance, and treasury management—Stripe + Bridge has the potential to play a meaningful role in sustaining crypto innovation.

Conclusion

In short, Stripe’s acquisition of Bridge isn’t just about banking integrations. It’s a move that positions Stripe as a comprehensive partner for the next generation of crypto companies, offering solutions that tackle the unique challenges of scaling in a regulated, rapidly evolving space. This is a meaningful shift for VC-backed projects looking for sustainable growth avenues in crypto.

Optimism is growing, and we’re watching closely.

Bitcoin DeFi

Venture Funding

Bitcoin-focused funding has re-accelerated after September slowdown. With a primary focus on categories such as stablecoins (Hermetica, Yala and Ducat; $11M), LSTs (Lombard, Solv Protocol and SatLayer; $50M), and L2s (BitLayer, Hemi, Zulu, Bool Network, Uniquid Layer; $45M).

Bitcoin Restaking Becomes a Billion-Dollar DeFi Category: Expanding Bitcoin’s Utility

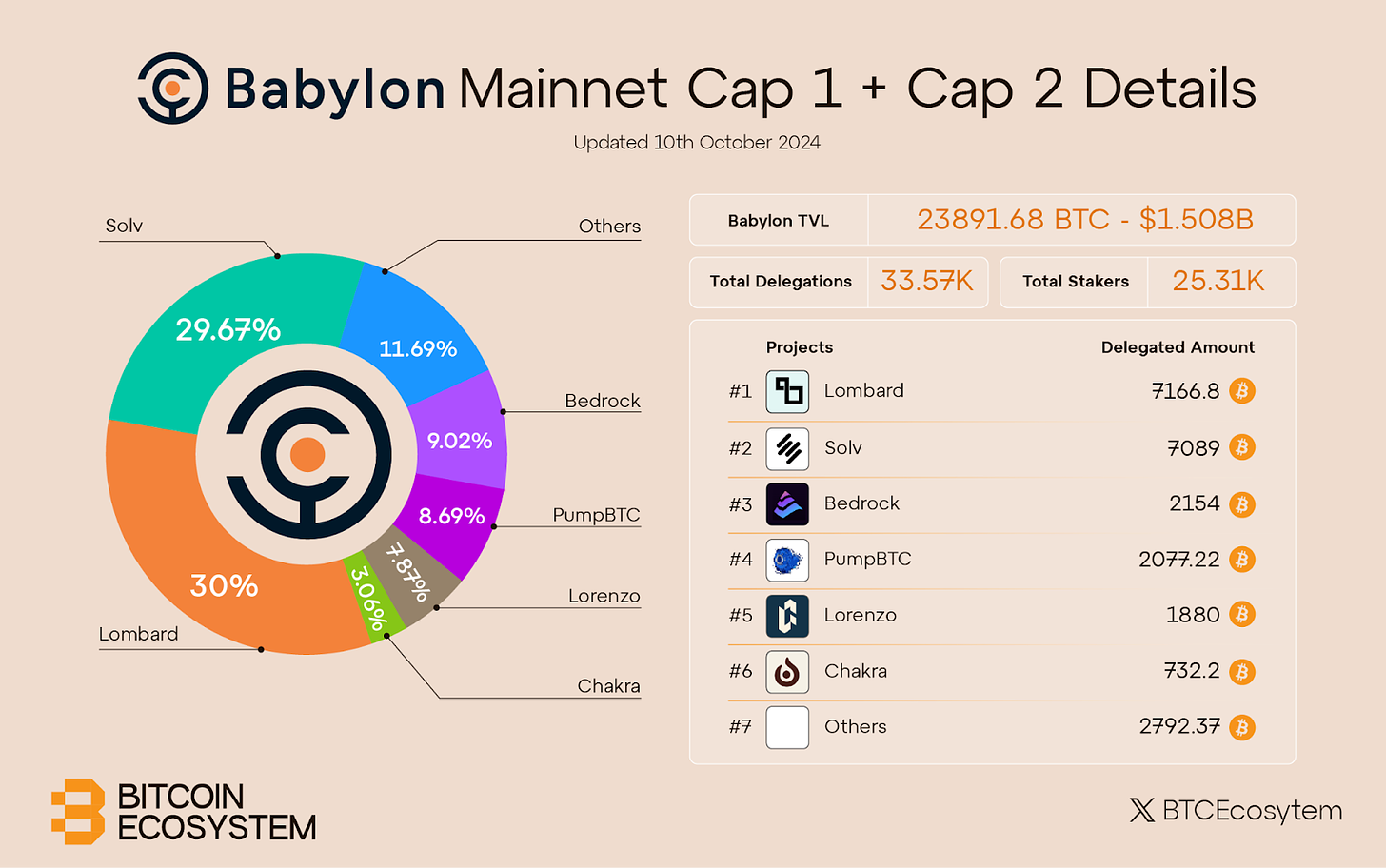

We are particularly excited about the success of Babylon Mainnet’s Cap-2, with 22,891 BTC staked and a total value locked (TVL) of $1.7 billion, marks an important step in Bitcoin’s evolving role in decentralized finance (DeFi). Through Babylon’s Anchored Verification System (AVS), Bitcoin can now help secure the Cosmos ecosystem, with potential expansion to other chains in the future.

While BTC itself remains on the Bitcoin blockchain and cannot directly move to other chains, AVS allows Bitcoin holders to stake their BTC and support Cosmos-based networks. This introduces a way for Bitcoin to indirectly contribute to the security and stability of decentralized applications (dApps) within Cosmos, even though users must still rely on other assets for interaction with those dApps.

Babylon’s AVS expands Bitcoin’s utility, allowing it to be an integral part of securing non-Bitcoin DeFi ecosystems. This demonstrates Bitcoin’s growing influence as a productive asset that, while traditionally viewed as a store of value, can now indirectly support broader decentralized financial infrastructure, with future potential to secure additional chains beyond Cosmos.

Source: CoinWire

TVL on Bitcoin L2s Continues to Accelerate

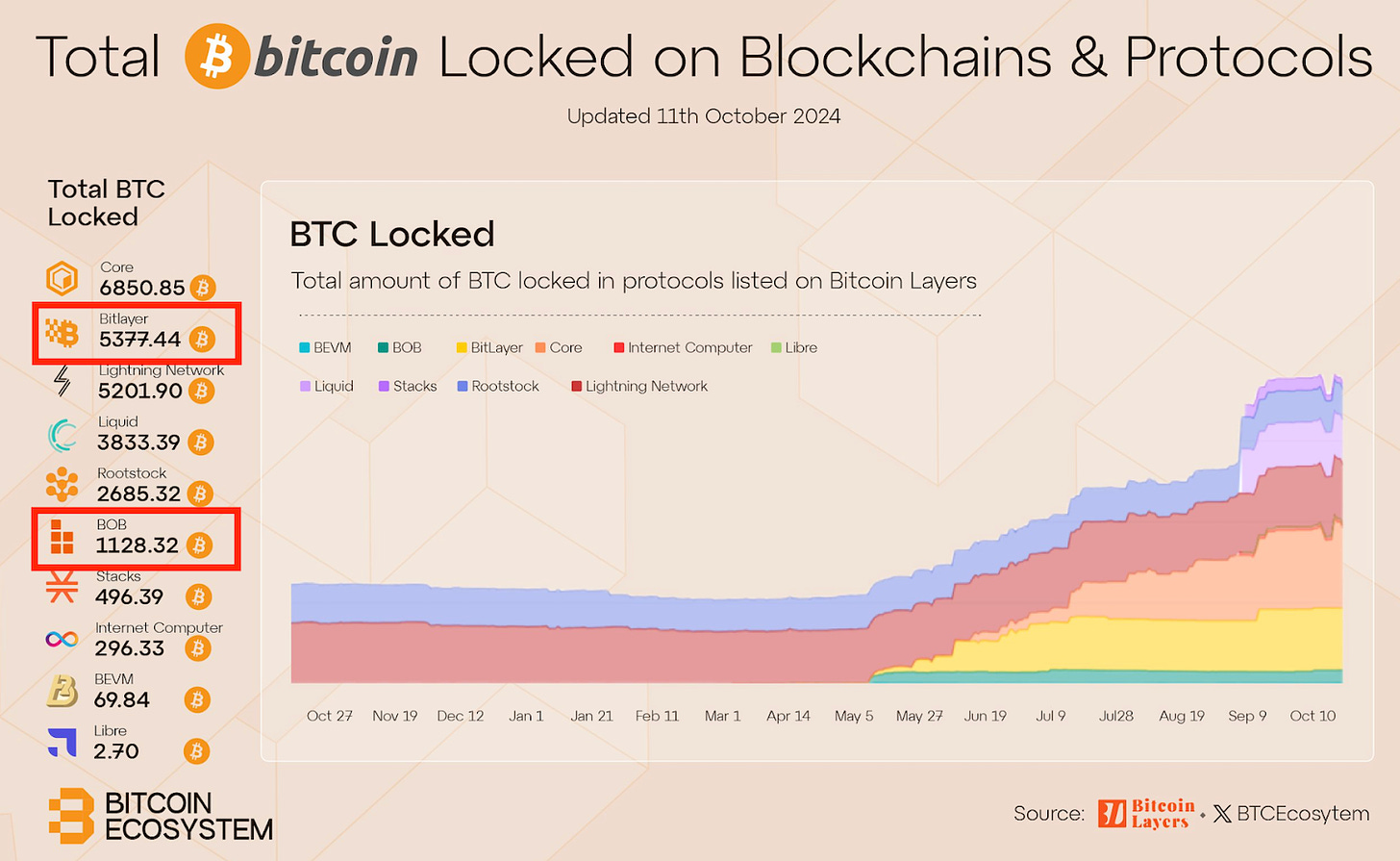

The rise in Bitcoin’s total value locked (TVL) across Layer 2 (L2) solutions showcases the expanding utility and adoption of Bitcoin within the broader decentralized finance (DeFi) landscape. According to data from Bitcoin Layers, several L2 platforms are demonstrating impressive growth:

Source: CoinWire

As these L2s grow, Bitcoin’s role in decentralized applications and scaling solutions expands, pushing its use cases further into DeFi, payments, and smart contract functionality. Each of these platforms highlights the increasing demand for Bitcoin’s integration into the broader ecosystem while maintaining the security and decentralization that define the Bitcoin network.

We continue to be optimistic in teams such as BitLayer, BOB, and Mezo (Asymmetric PortCos) and their involvement to bring trust-minimized Bitcoin to their respective L2s.

Portfolio Spotlight: Satflow Emerges as a Bitcoin L1 Asset Marketplace

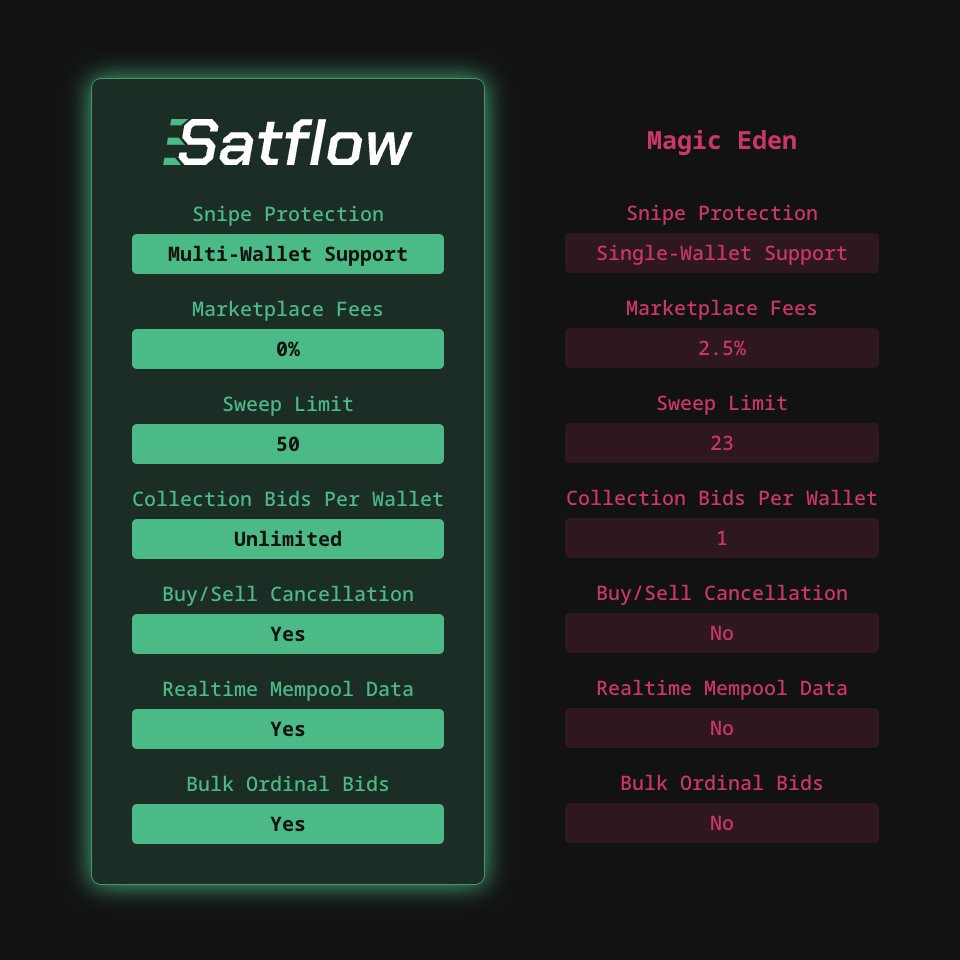

We are excited to announce that Satflow, a portfolio company, has officially come out of stealth and is now competing against established players like Magic Eden in the rapidly growing marketplace for Bitcoin Layer 1 assets, including Ordinals and Runes.

Satflow was born out of a need for a faster, more efficient trading platform, particularly in response to challenges such as mempool sniping. The company has developed a unique, real-time marketplace and Bitcoin mempool aggregator that allows users to place multiple collection bids, counter-snipe legacy trades, and manage transactions with unprecedented speed.

As part of its launch, Satflow is offering zero transaction fees, a strategic move designed to attract users and drive adoption. This fee-free structure includes secure purchases with non-snipable listings, the ability to conduct sweeps, bulk ordinal bidding, and advanced counter-snipe tooling. To further incentivize adoption, Satflow is introducing FLUX rewards, similar to points farming on other chains.

Satflow’s innovative approach positions it well in the market, making it an exciting player to watch as it aims to reshape the landscape for trading Bitcoin L1 assets. As investors, we are optimistic about Satflow’s potential to capture market share in this burgeoning sector.

A comparison against Magic Eden can be found below:

Source: Satflow

Law & Regulations

How Morrison v. National Australia Bank and Williams v. Binance Shape Crypto Regulation Today

The U.S. court system is now wrestling with how to regulate crypto transactions that happen across borders, often in places without fixed physical locations. Recently, the Crypto Council for Innovation (CCI) filed an amicus brief, asking the Supreme Court to review a Second Circuit ruling in Binance v. Anderson that involved determining U.S. jurisdiction based on the location of internet servers. This case follows a trend sparked by the 2010 Morrison v. National Australia Bank decision, which set limits on when U.S. securities laws apply, stating they only cover transactions that happen within the U.S. But with digital transactions, the location question becomes complicated, especially for decentralized platforms like Binance.

Morrison v. National Australia Bank: The Foundation of U.S. Transactional Law

Morrison introduced what’s known as the “transactional test,” limiting U.S. securities laws to transactions in the United States. This test has been relatively straightforward for traditional assets, where trades happen on a physical exchange. However, applying this test to a decentralized crypto exchange like Binance—an entity that claims no physical headquarters—brings up new challenges in defining “location.”

Williams v. Binance: When Location is Nowhere and Everywhere

In Williams v. Binance, the Second Circuit court held Binance to U.S. securities laws despite its decentralized structure. Binance argued that it operates without a physical location, making it challenging to apply jurisdictional tests. However, the court focused on the location of Binance’s servers in the U.S. and the fact that U.S.-based users placed trades on the platform. Judge Alison Nathan noted that “the answer to where [trade matching] occurs cannot be ‘nowhere.’” This ruling implies that, for legal purposes, the servers’ U.S. location creates enough of a link to bring Binance under U.S. jurisdiction.

Yet, many in the crypto industry, including the CCI, view this interpretation as potentially dangerous. If the location of internet servers becomes a standard for jurisdiction, U.S. regulatory reach could expand to any platform that happens to use a server located in the U.S.—a precedent that could have significant implications for the internet economy and beyond.

Why the Server Location Debate Matters for Crypto and Beyond

Servers are a critical part of internet infrastructure, but they aren’t necessarily “locations” in the traditional sense. As Ji Kim from CCI highlights, the internet is designed to operate invisibly, with data passing through global networks and servers in milliseconds. If a U.S. court can base jurisdiction on server location, it might mean that any business using U.S. infrastructure could be subject to U.S. law, regardless of where the business is headquartered. This could have the unintended effect of stifling innovation, as crypto and tech companies may try to avoid U.S. servers or infrastructure altogether to dodge legal risks.

For crypto, where transactions occur on a distributed blockchain rather than a central server, the server-location argument seems especially misplaced. As Kim notes, blockchain is like a global computer run by nodes, which are scattered worldwide. Defining “location” for blockchain is tricky because transactions are validated by a global network of nodes, making it nearly impossible to pinpoint a single spot where a transaction happens.

Risks of Expanding U.S. Jurisdiction and the Path Forward

The potential expansion of U.S. jurisdiction could have a chilling effect on American businesses, as foreign companies might avoid U.S. tech infrastructure to prevent being brought under American law. This decision could also backfire, as other countries might take a similar approach, potentially exposing U.S. citizens to lawsuits in foreign courts simply because data happens to travel through servers abroad.

The CCI argues that the Supreme Court should step in to prevent further harm by clarifying the limits of U.S. securities law in cases involving decentralized platforms and international internet infrastructure. They stress that regulatory overreach could damage U.S. competitiveness in the global tech and financial markets and limit the growth of the crypto industry.

Looking Ahead: Toward a Fair Approach to Crypto Regulation

The evolving landscape of crypto regulation is likely to bring further tests to the Morrison precedent, particularly as courts grapple with whether digital platforms like Binance fit within traditional legal frameworks. For the crypto industry and the internet economy at large, the outcomes of cases like Williams v. Binance and Binance v. Anderson could set critical precedents, influencing where and how companies choose to operate globally.

Ultimately, this debate underscores the need for a regulatory approach that understands the decentralized nature of crypto. By focusing on the true essence of blockchain as a globally distributed technology rather than the incidental location of its infrastructure, U.S. regulators and courts can strike a balance between safeguarding investors and fostering innovation. As the Supreme Court considers whether to review the Second Circuit’s decision, the crypto industry and legal community alike watch closely, recognizing the impact such decisions will have on the future of digital finance and cross-border regulation.

Team Updates

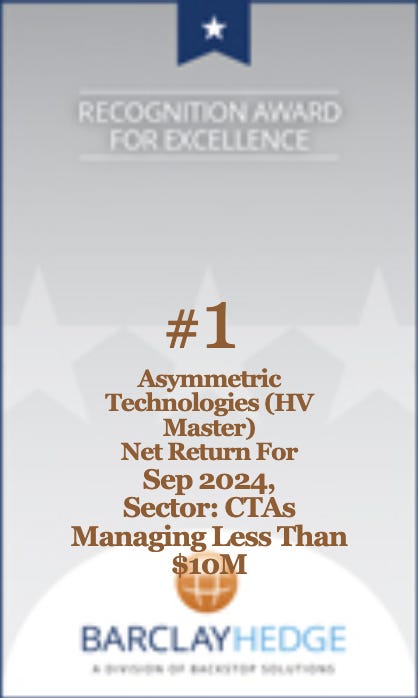

BarclayHedge notified us that our newest hedge fund product, which we launched in August 2024, was #1 across two categories for September.

-

Joe co-hosted a couple more Bits and Bips podcast episodes.

-

Joe was featured twice on the Milk Road Show: “Why the Next 6 Months Could Be the Best Crypto Has Ever Seen?” and “How Joe McCann Became The Top-Performing Crypto Fund Manager”.

-

Tanaya Macheel with CNBC interviewed Joe for their Crypto World segment.

-

Joe spoke twice while at Permissionless in Salt Lake City, Utah: “Seeking Alpha in Liquid Markets” and “Why Institutions Should Care About Memes”.

-

Check out Joe on an episode of Galaxy Brains with Alex Thorn.

-

Listen to the Scenius Studios 50th Episode where Joe was featured alongside Pranav Kanade and David Kalk.

-

Watch Joe talk about “The Bull Case For Solana” on Lightspeed.

-

U.S. News & World Report highlighted Joe in their article “How to Buy Solana Meme Coins”.

-

Listen to our GP Dan Held on the BOB Twitter space last week where he and Alexei (co-founder) dive into how BOB works.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric