Bad Day? Probably Not Minus $164,000,000 Bad. 😱

OVERVIEW

Bad Day? Probably Not Minus $164,000,000 Bad. 😱

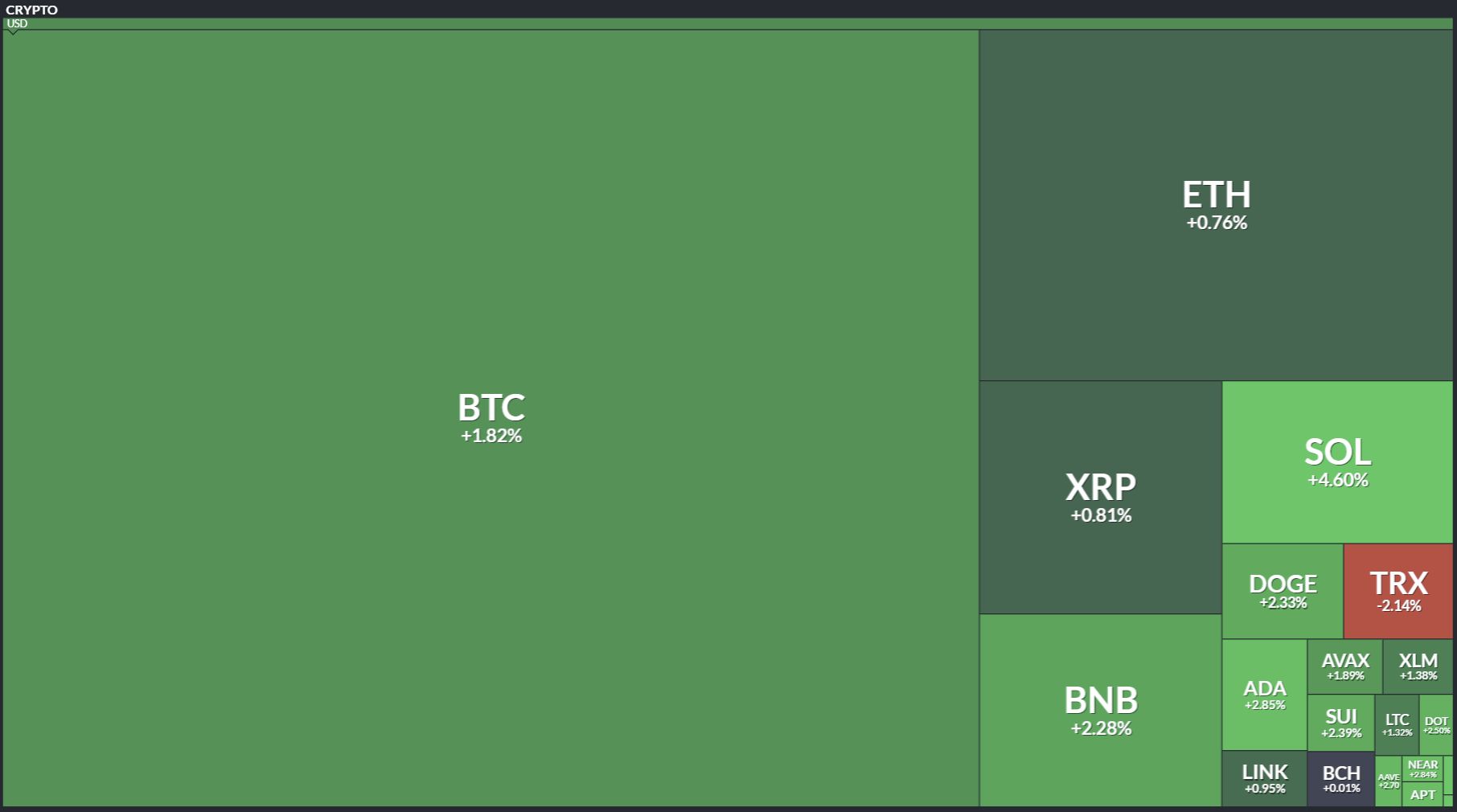

Before we dive in, here’s today’s crypto market heatmap:

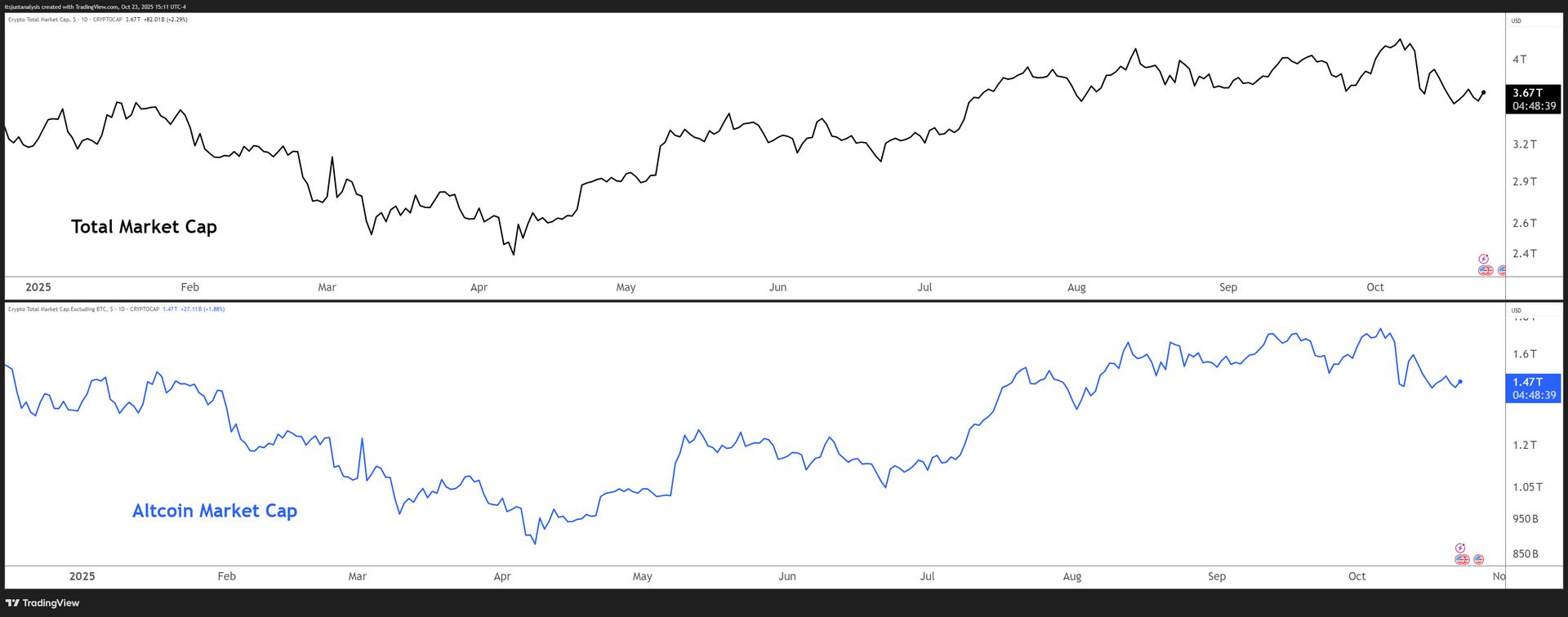

And here’s a look at crypto’s total market and altcoin market cap charts:

COULD BE WORSE

Bad Day? Probably Not -$164,000,000 Bad. 😱

Que up Daniel Powter’s 2005 hit Bad Day. 🎵

James Wynn went short when he should have went long.

I’ve just been liquidated for $100,000,000.

I got fucked. I was a bear. And then green hourly candles got me.

Please show some love and respect I’ve lost everything.

– Wynn

— James Wynn (@JamesWynnReal)

1:38 PM • Oct 23, 2025

No matter how bad of a day, week, or month it’s been, it’s probably not millions in losses bad.

And if your losses to exceed Wynns, well, I have no words. 📖

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

TECHNICAL ANALYSIS

One Week Left, Who’s Winning And Who’s Bleeding? 🤔

One week left until Sucktober ends (okay, one week and a day), so what tickers are looking good and which one’s are looking like Apollo Creed after Ivan Drago got a hold of him? 🥊

Winners

There are not a lot of winners. Filtering for market caps of at least $500M, there are only two that have +100% or more gains: $DASH.X ( ▼ 0.25% ) and $ZEC.X ( ▲ 1.23% ) over the past 30-days.

Zcash is up +390% so far and DASH +100%. From there, the performance drops to the next best performing, $TAO.X ( ▲ 0.48% ), which is up +22%. After that? Single digits, that’s it.

Really, anything involved with the privacy side of crypto has done well this month. But that’s about it. 🧠

Losers

Sucktobers losers are truly in the horrible wipeout zone. $MYX.X ( ▼ 2.23% ) is down -82%, $IP.X ( ▼ 4.36% ) -62%, and $FET.X ( ▲ 4.31% ) -58%.

One that sticks out to as a huge surprise to me is how badly $AVAX.X ( ▼ 1.72% ) got hit this month: down -42%. It was trading at $36 on September 25th and is now at $19. Ouch.

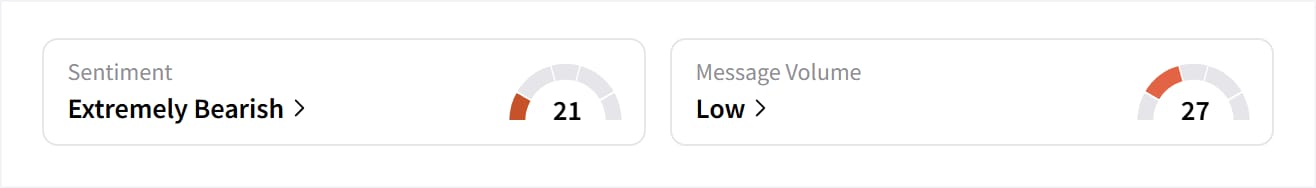

If you really want to get an idea of how people are feeling about Avalanche, Stocktwits’ Social and Message Volume scores really sum it up.

Click to enlarge.

People are so convinced that this thing is trash they don’t even want to talk about it anymore. 😥

NEWS

Trump Pardon’s CZ 🧑⚖️

President Donald Trump granted a pardon to Changpeng “CZ” Zhao. According to the White House, the pardon was framed as a corrective action to what the statement described as the Biden-administration’s “war on cryptocurrency”. 👍️

A Walk Down Memory Lane

In November 2023, CZ pleaded guilty to violating the Bank Secrecy Act by failing to implement an effective anti-money-laundering (AML) program at Binance). That little oversight let the platform process transactions tied to ransomware gangs, darknet markets, and sanctioned entities like Iran.

The Department of Justice never accused CZ of laundering money himself – just of letting it happen, knowingly. Think of it as “willful negligence” on steroids.

-

Binance’s fine: $4.3 billion — one of the biggest in U.S. history.

-

$3.4 billion to FinCEN.

-

$968 million to OFAC.

-

-

CZ’s personal fine: $50 million.

-

Restitution: None, since no victims were directly defrauded.

-

Charge: Failure to maintain an AML program under the Bank Secrecy Act.

-

No charges of direct money laundering or terrorism financing.

So basically, he didn’t rob the bank. He just forgot to lock the vault.

People are wondering if SBF will get some treatment in the form of a pardon or commutation of his sentence. But that might be a tougher sell because while SBF played hard to get and still maintains his innocence, CZ willingly came to the US, stuck around, plead guilty and served his time. ⏲️

MEMECOINS

Melania, Memecoins, and a Federal Courtroom Walk-In 🪙

This is another walk down memory lane, from the very beginning of the year in to be specific. From the DailyBeast: Melania Trump just got pulled into a crypto lawsuit, but not as a suspect.

The first lady’s name ended up front and center in what plaintiffs call a multi-million-dollar memecoin scam that rode her brand, fooled her followers, and allegedly made insiders rich.

What Happened

-

The Coin: $MELANIA.X ( ▲ 7.29% ) launched right before Donald Trump’s second inauguration. Melania posted “The Official Melania Meme is live! You can buy $MELANIA now.”

-

The Pump: Within hours, it hit $13.73 per coin. Retail piled in, memes flew, and liquidity poured in.

-

The Dump: Price cratered to under $0.10.

The Alleged Masterminds

-

Benjamin Chow – cofounder of crypto exchange Meteora, accused of running at least 15 “pump and dump” plays using influencer tie-ins.

-

Hayden Davis – cofounder of Kelsier Labs, allegedly helped coordinate the token launches and offload profits through insider wallets.

Melania’s Role (or Lack of One)

-

She’s not named as a defendant.

-

The filing says her team “granted permission without knowledge of the fraud, insider rigging, or deceptive mechanics.”

-

Translation: she and her staff were likely used as “window dressing” to make the token look legitimate.

-

Her lawyers say if they’d known what was happening, “they would have rescinded consent immediately.”

Melania’s the face, not the villain. But her image was the marketing asset that made the grift believable. Also: the filings against Benjamin Chow and Hayden Davis are civil class-action lawsuits, not criminal indictments.

We’ll keep you updated as this story develops. 🧠

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🦆 DUSK Lands on Binance US, Americans Finally Invited to the Privacy Party

Turns out “compliance-friendly privacy” is exactly what happens when you build a blockchain that Wall Street doesn’t immediately want to kill. DUSK just became the first token to hit Binance US. And the timing couldn’t be sweeter: DuskEVM is launching soon, plus a dApp for tokenizing €300M in real securities via NPEX. DUSK Network.

🤖 ChainGPT and Secret Network Offer $70K to Build Private, AI-Powered dApps

If you’re building privacy-first dApps and want funding plus ecosystem clout, this is basically a two-for-one coupon with a grant stapled to it. ChainGPT Pad and Secret Network are throwing up to $70K per project at builders who launch via ChainGPT Buzz and use Secret’s TEE-based privacy tech or SecretAI. The deal includes co-marketing, access to ChainGPT’s open-source Solidity LLM, and eventually AgenticOS for building autonomous Web3 agents. Secret Network.

NEWS IN THREE SENTENCES

Metaverse, Web3, & Gaming News 🕹️

🏬 SKALE Wants to Open a Store in Every Blockchain Mall

SKALE’s master plan: stop begging users to visit their superstore and instead deploy SKALE Manager smart contracts on every L2 and L1, turning competitors into partners by offering gas-free transactions and instant finality wherever liquidity already lives. First test case is Base, where dApps can tap SKALE’s speed and privacy while swimming in Coinbase’s liquidity pool. SKALE Network.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🎢 YieldBasis Solves Impermanent Loss, Curve DAO Cashes Checks

YieldBasis launched on Curve with a 2x compounding leverage trick that without getting rekt by impermanent loss – and every time pool caps increased (1M to 10M to 100M), users filled them in literal minutes. Curve’s getting 75M $YB tokens over time, plus YieldBasis has already generated $188ishK in fees across pools and PegKeepers, with TVL spiking from 6M to 300M in three jumps. Curve Finance.

🐻 Berachain Approves iBGT and stBGT Vaults, Plus USDe Gets HONEY Minting Rights

Smilee Finance just got two new Kodiak reward vaults approved on Berachain connecting Infrared, BakerDAO, and Smilee in exotic staking derivative combos that sound like a DeFi smoothie (or word salad). Also, Ethena’s USDe became the fourth stablecoin approved as collateral for minting HONEY, Berachain’s native stablecoin. Berachain.

💰 Spark Savings V2: One Rate to Rule Them All (It’s Boring on Purpose)

Spark launched Savings V2 with a Universal Savings Rate (SUSR) for USDC, USDT, and ETH, anchored at 4.75% and deliberately light on risky perp collateral after the October ADL disaster reminded everyone why conservative beats clever. ETH Savings starts at 1.35% APY (plus 50k Spark Points per ETH), and while that’s not sexy, it’s also not going to blow up your account when the market sneezes. Maybe. Spark Network.

NEWS IN THREE SENTENCES

Protocol News 🏦

🌉 LayerZero Plugs Sui Into the Omnichain Economy, Non-EVM Finally Joins the Party

Probably a big deal for those who get all this mumbo jumbo, but LayerZero just went live on Sui. Sui builders can now pull liquidity from Ethereum, and EVM devs can tap Sui’s object-centric model, zkLogin, and Walrus without learning Move from scratch. Cetus gets deeper stablecoin pools, Scallop gets cross-chain BTC collateral, and users finally stop caring which chain their money lives on because LayerZero makes it all feel like one giant, fluid network. LayerZero.

LINKS

Links That Don’t Suck 🔗

🐋 Ethereum whale scoops up $32M in ETH as Bitcoin, Solana shales cash out

🐶 Crypto exchange KuCoin launches mining pool for Dogecoin, Litecoin and soon Bitcoin

🛹 Skateboarding pig earns Guinness World Record

🤖 Elon Musk said Tesla’s robot will be ‘incredible surgeon,’ left Wall Street with no guidance on EVs

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋