Beats Are Busts

Presented by

CLOSING BELL

Beats Are Busts

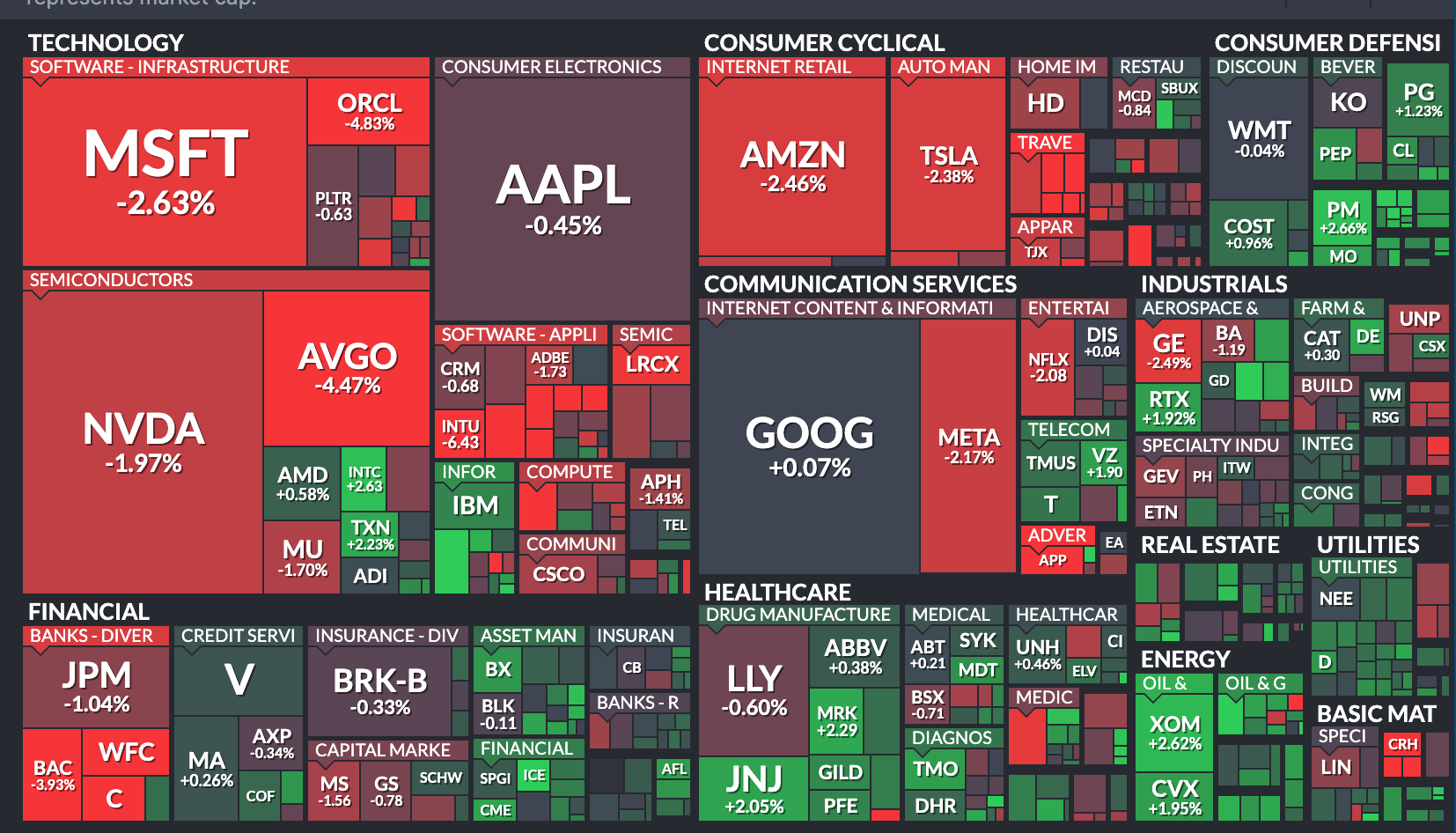

$SPY ( ▼ 0.49% ) $QQQ ( ▼ 1.07% ) $IWM ( ▲ 0.7% ) $DIA ( ▼ 0.07% )

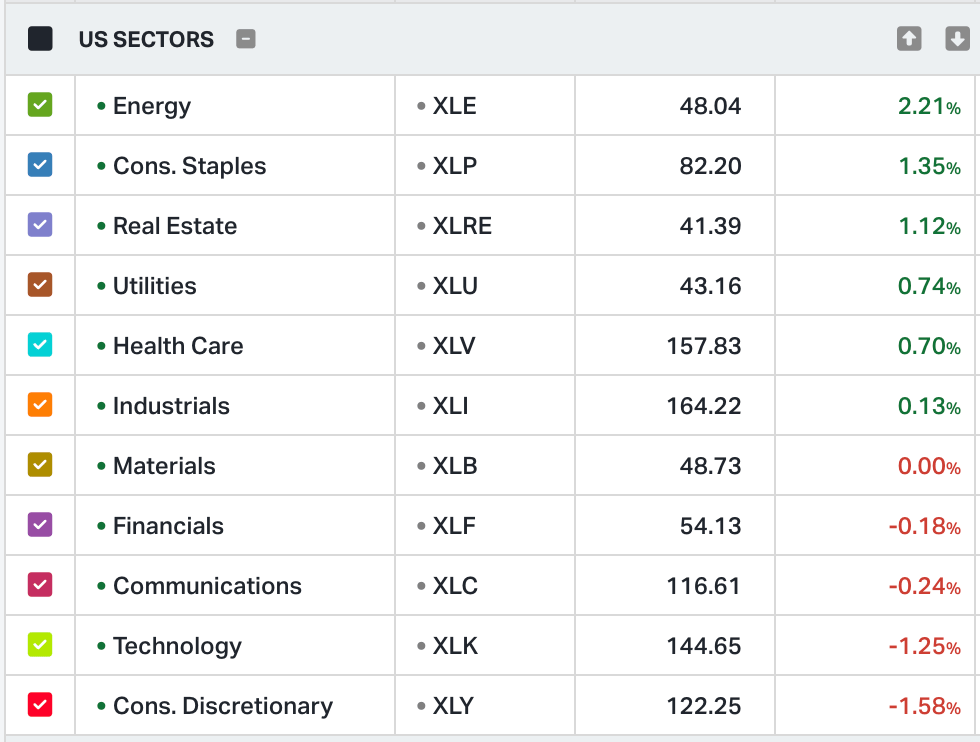

The market fell Wednesday, the official start of the earnings season rearing its ugly head over the record-setting market. Earnings have been good, but maybe not good enough to keep the good times rolling…we’ll know for sure next week when tech giants begin to report results.

Muted PPI data came out Wednesday alongside the Fed’s Beige Book, as all eyes not tearing up from record prices look for the next reason the Fed should cut rates this year. Home sales rose 5.1% in Dec. the largest increase in nearly two years, setting a four-month winning streak for the housing market. It’s all thanks to the year’s low fixed 30-year rate of 6.2%. Last year, at just over 4M sales, the United States recorded the lowest housing numbers since 1995.

Housing is one of many rhythms of the mid-term ‘affordability war drum’ beat by the White House. This week, the beat started with a tweet targeting usury, yet another evil to vanquish by the time Congress reshuffles in November. Trump called out a 10% cap for credit cards, hurting bank stocks right on their earnings week, many of the biggest names happily collecting 25% APRs with their most popular products.

Speaking of the White House, things are getting hairy in international waters. Trump met with Denmark reps over Greenland goals Wednesday, while the State Department pulled personnel from bases in Qatar over Iranian mass protests. Precious metals and crypto took center stage, as they tend to following instability. The SCOTUS did not touch tariff executive orders, yet again. Retail sales climbed.

In Iran, nearly 2,500 people have been killed in earth-shattering protests according to BBC, Iranians facing a sixth day of internet blackout as demonstrators protest the country’s terrible currency and theocratic rule.

In today’s Daily Rip, we cover the latest big bank earnings, the Trump Administration’s ongoing tussle with Greenland and EU officials, and what’s happening with Netflix, Applovin, and other trending stocks.

EARNINGS

Another Batch Of Big Bank Disappointments 😢

After JPMorgan set the tone with a positive outlook on the consumer, we got a deeper dive into investment banking as Bank of America, Wells Fargo, and Citigroup reported results. Delta’s Tuesday beat also turned red, but Wednesday’s reports were all about banking.

Net Interest Income (NII) topping expectations was the highlight of Bank of America’s results, rising 9.7% YoY to $15.92 billion alongside profits rising 12% YoY. Equities trading revenue rose 23% YoY, but, like JPMorgan, investment banking revenue was challenged, flat YoY.

CEO Brian Moynihan said, “With consumers and businesses proving resilient, as well as the regulatory environment and tax and trade policies coming into sharper focus, we expect further economic growth in the year ahead…” and “While any number of risks continue, we are bullish on the U.S. economy in 2026.”

Wells Fargo’s executive team’s outlook focused on being able to compete on a “level playing field,” referring to the Federal Reserve’s asset cap, which was lifted in June. CEO Charlie Scharf said, “We have built a strong foundation and have made great progress in improving growth and returns, though we have operated with significant constraints.”

As for overall results, the bank missed analysts’ profit estimates, as severance costs drove up expenses. More job cuts are expected this year, as the many-year trend of reducing headcount and expenses continues. Its net interest income forecast was weaker than expected, but executives focused on the resources available to focus on growth. As for its trading business, it’s more about how those services help drive financing and other services for institutional banking clients.

Citigroup’s net income fell 13% YoY, even as it collected more interest income and had smaller-than-expected loan loss provisions. That’s primarily due to a $1.1 billion after-tax loss tied to the planned divestment of its Russian operations. CEO Jane Fraser has led the company through a significant restructuring, saying, “We enter 2026 with visible momentum across the firm.”

Overall, on the consumer side, smaller loan loss provisions suggest that loan quality and the overall health of consumers remain intact. For these three bank stocks (and U.S. economy) that are levered to the consumer, that’s music to investors’ ears. Unfortunately, it just seems that prices and expectations have gotten a little high, and some of the excess steam is coming out. Retail investors see longer-term conditions as favorable for financial stocks and are likely looking to buy the dip

SPONSORED BY THE MOTLEY FOOL

5 Stocks We Think Will Explode in 2026

“If you could only recommend 5 stocks for 2026… what would they be?” That’s the question we asked our analysts recently. Because right now, the S&P is sitting at all-time highs.

UBS says it could hit 7,500 by the end of 2026. Meanwhile, Bill Gates is sounding the alarm, warning that many investments could be “dead ends.” This is exactly the kind of market where Stock Advisor proves its worth. When the noise is loud. The risks are real. And the decisions actually matter.

We’ve helped investors navigate crashes, bubbles, and chaos for over 20 years, averaging +974%* per recommendation. And now, after weeks of debate, poring over earnings and digging deep into the data…

Our analysts have identified their five highest-conviction stocks for 2026 and beyond. We’re giving it away to new members at no cost, along with a special discount.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Trump Raises Stakes In Greenland Negotiations 😬

Trump turned up the heat ahead of his administration’s meetings with Greenland and Denmark officials, saying that the U.S. needs Greenland for national security and that “anything less than U.S. control is unacceptable.”

‘Unacceptable’ is also a word Danish Foreign Minister Lars Rasmussen used talking to reporters about the fundamental disagreements that remained after his Washington visit Wednesday. Any proposal to take over Greenland without respect to Denmrks teritorial contol, or Greenland’s right to self-determination is a non-starter, he said.

Danish media is taking the meeting and U.S. plans for what at this point looks like colonization seriously in their reporting as the most decisive moment in politics since WWII.

VP Vance and Secretary of State Marco Rubio led the meeting, representing the Trump Cabinet’s aims to take over northern NATO defense against Russia, while also nabbing the critical metal reserves of the thinly populated country.

“For us, ideas that would not respect the territorial integrity of the kingdom of Denmark and the right of self-determination of the Greenland people are of course totally unacceptable and we therefore still have a fundamental disagreement,” Rasmussen said. “We will, however, continue to talk.”

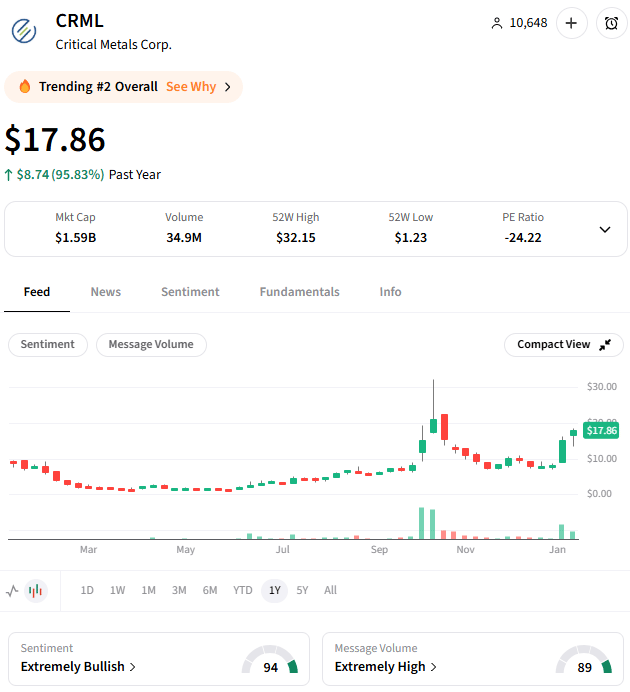

Speaking or rare earths, Critical Metals Corp. surged following its 2025 drilling program results, reporting additional high-grade rare earth results across its Tanbreez asset (located in Greenland). ⚒️

The company stated that the drilling results confirm consistent rare earth grades and highlight the presence of strategic metals. This includes gallium, hafnium, cerium, and yttrium, adding that this reinforces Tanbreez’s position as a significant peralkaline-hosted rare earth system.

Although it’s been a volatile year for the shares, Stocktwits sentiment remains in “extremely bullish” territory, with this latest news strengthening conviction in this name as a major player in the “critical” (no pun intended) rare earths space.

TRENDING STOCKS

Retail Favorites Back In The Headlines 📰

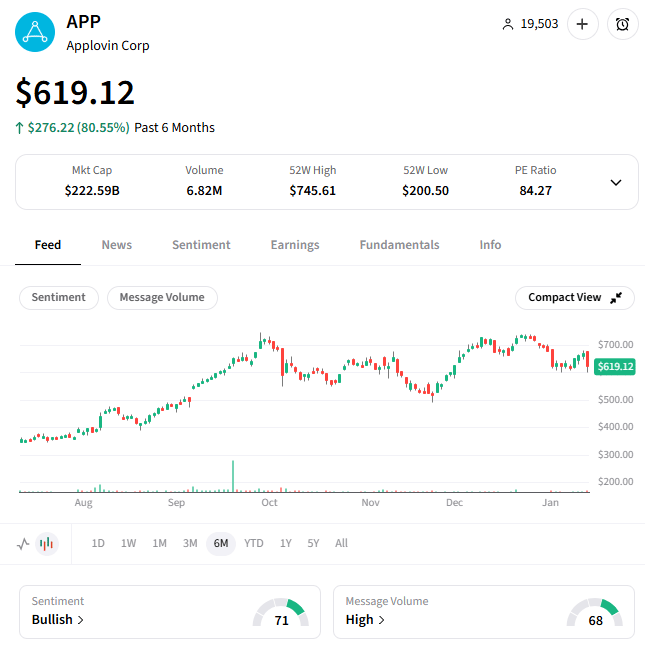

The slamming of software stocks continued today, with AppLovin $APP ( ▼ 7.61% ) shares down despite a new “Outperform” rating from Evercore ISI. The firm set a bullish $835 price target based on the company’s high-growth e-commerce and mobile gaming potential. The stock was dragged down by a broader technology sector sell-off, overshadowing analysts’ projections of 30% annual revenue growth through 2028. Investors remain focused on an ongoing SEC investigation into data-collection practices, though analysts believe AppLovin’s AI-driven platform is well-positioned to gain market share even under stricter regulatory enforcement.

Warner Bros’ bidders keep raising the bar. Netflix $NFLX ( ▼ 1.96% ) fell on news it is likely to amend its proposed acquisition of Warner Bros. Discovery’s $WBD ( ▼ 0.8% ) studio and streaming assets to an all-cash structure, moving away from the original cash-and-stock mix valued at $27.75 per share.

The shift is designed to neutralize the impact of Netflix’s recent stock price decline and accelerate the shareholder approval process, potentially moving the vote up to late February. This strategic pivot comes as Paramount Skydance $PSKY ( ▼ 0.49% ) intensifies its hostile takeover attempt, using a $30 per share all-cash offer and a fresh lawsuit to challenge the $WBD board’s preference for the Netflix deal.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

China’s Trip.com fell sharply after regulators launched a formal antitrust investigation.

-

High Roller Technologies signed a binding letter of intent with a Crypto.com entity to explore an exclusive collaboration in the U.S. market.

-

TG Therapeutics’ retail investor chatter surged following a strong 2026 outlook.

-

Rivian dove 10% after UBS downgraded it from ‘Neutral’ to ‘Sell,’ citing “elevated expectations.”

-

Baidu considers primary Hong Kong listing as U.S.-China tensions heat up.

-

Goldman flags sales upside ahead for Walmart as its AI push begins to pay off.

-

Privacy coins like Monero, Dash, and ZCash continue to outperform in the latest crypto rally.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

“True Odds” Hosts Boast 5-0 Weekend, See Their Latest Picks 👀

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nov Import/Export Prices (8:30 am ET), Jan Empire State Manufacturing Index (8:30 am ET), Philadelphia Fed Manufacturing Index (8:30 am ET), Fed Bostic Speech (8:35 am ET), Fed Bar Speech (9:15 am ET), Fed Barkin Speech (12:40 pm ET). 📊

Pre-Market Earnings: Goldman Sachs ($GS), Morgan Stanley ($MS), BlackRock ($BLK).🛏️

After-Market Earnings: JB Hunt Transportation ($JBHT), WaFd Inc. ($WAFD). 🌕️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

🆘 Want daily trade ideas for just $20/year? IBD’s MarketDiem newsletter has got you covered*

🪙 Binance co-founder CZ says Bitcoin at $200,000 is only ‘a matter of time’

🏬 Cash-strapped luxury retailer Saks Global files for bankruptcy protection

💳️ Sen. Warren says Trump called her to work on credit card interest rate caps

🪧 Digital rights group target Apple and Google for removal of Grok, X from app stores

🌎️ Trump says anything less than U.S. control of Greenland is ‘unacceptable’ ahead of crunch talks

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋