Case Study: How Individuals Pick Stocks

When I first started investing in stocks, the hardest question was, “Where to start?” People rarely start their journey wanting to learn DCF or CAPM. More often than not, young investors have an idea of exchanging some money for more money over a period of time via the magical word market.

Some come to this idea from a movie, some from a Christmas gift of stocks, some from i-know-better, and some from “Where should I go after high school?” And because there’s an infinite amount of ways to “lose money with friends,” they are largely called “individual investors.”

We, at Roic AI, were not happy with the general definition and conducted a massive survey of our users. The aim was to develop portraits of the most common thought process for decision-making, the hardest thing to do, and how this problem has been solved up until now. Most interesting cases have been interviewed further over email or phone.

The survey was placed on the main webpage for about two weeks. We received more than 2000 results ranging from “spray and pray” to “read and think.”

Small cautionary notes should be made:

-

the style of information we provide at Roic AI is skewed toward fundamental analysis, so all trader-style answers are from technical investors who utilize the financial data and the sample size is not a representation of the whole market but our user database

-

the CAGR for each cohort was not discussed because no one wants to admit the SPY would be better

Portraits

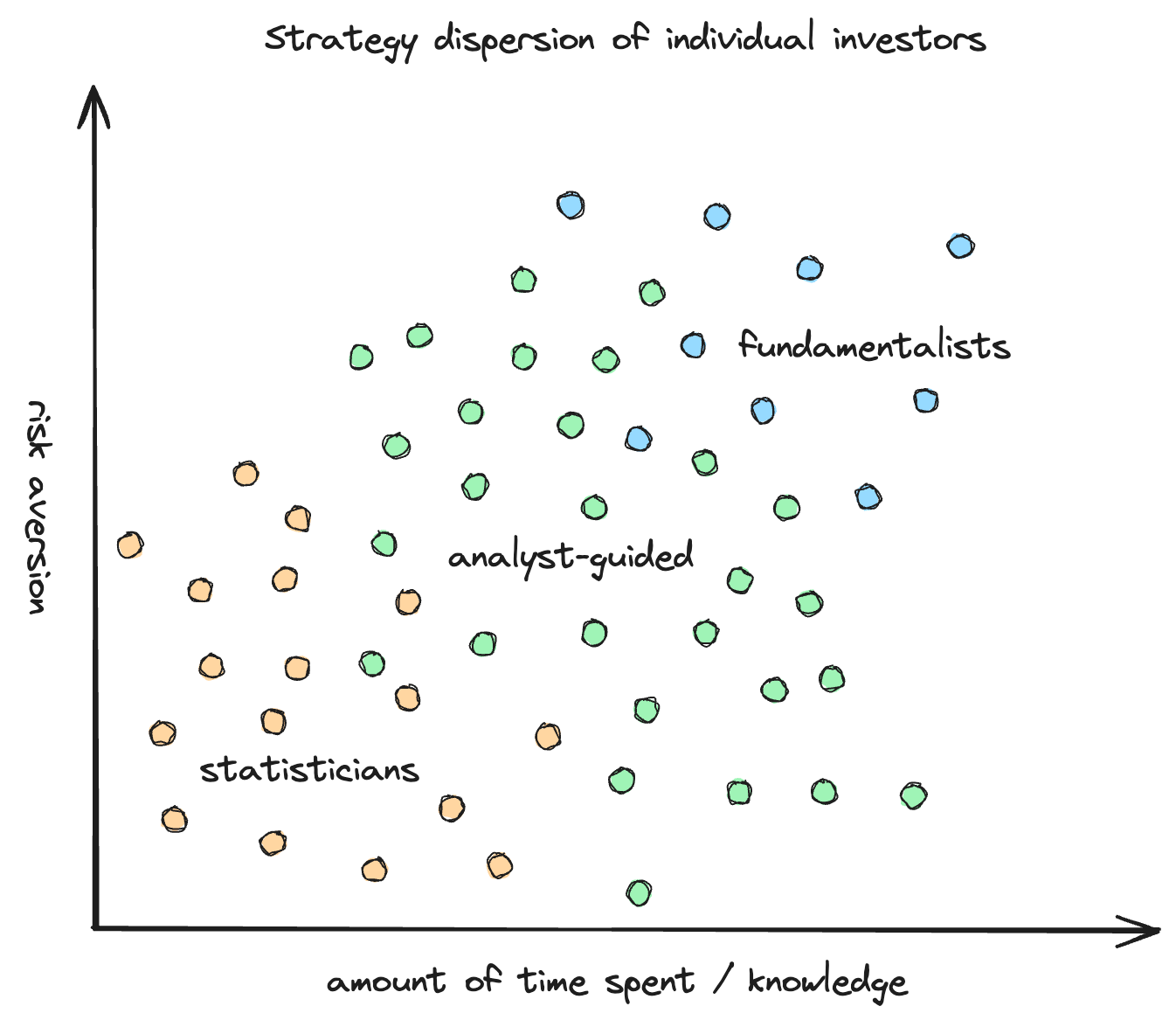

My first goal was to determine the portraits of individual investors.

Here’s the result:

-

traders

-

index-buyers

-

ETF-buyers

-

statisticians

-

analyst-guided

-

fundamentalists

For the sake of shortness, we’ll drop the discussion about the first three groups because their decision-making process is irrelevant to our product or too short to be of value.

Statisticians (20% of the sample)

It was an absolute surprise to discover this type of distinct behavioral pattern. Statisticians are people who buy and sell stocks based purely on ratios without reading financials. Usually, this was the type of yesterday’s traders who dropped down too far, but the dopamine habit is too strong to forgo.

The most popular ratios are P/E, P/S, debt-to-equity ratio, ROE, ROIC, and ROA.

This type of investing can be best described as “Magic Formula Investing.” This is an investment strategy outlined by Joel Greenblatt in his book “The Little Book That Beats the Market.” The gist is that you select stocks based on two criteria: earnings yield and return on capital. Rank them using these financial metrics. Hold for a year. Rinse and repeat.

Statisticians just choose different ratios and periods, trying to beat the market.

The average time to make a decision (open a position): 1 week

The main problems are:

-

insufficient data on different ratios

-

accuracy of data

Ways of solving:

-

gathering ratios from different resources

-

manual check

Interesting findings: this cohort didn’t express the need for a proper backtesting tool, nor did it want automated tools for portfolio allocation.

Analyst-guided (40% of the sample)

These investors make decisions by reading SeekingAlpha articles, MorningStar reports, or various paid substacks.

I see this as the most widespread share of investors who want to put a hand in the game. This is also the most targeted group by businesses. The reason is a mental fallacy in our brains. People don’t like taking responsibility.

Because in the case of a mistake, there won’t be anyone to blame except for themselves. But for a mere $40 a month, someone can be exempt from all the pain of selecting stocks. Particularly buying a target to blame, even reading “not financial advice” under every article.

I don’t say people who follow the analysts are making bad decisions. I’m just warning them that there are way more analysts than good analysts. Pick your favorite one carefully.

A group of analysts in the company are in no way better than individuals. We’ve seen many, many, many examples of poor market prediction.

The average time to make a decision (open a position): 1 month

The main problems are:

-

hard to follow analysts fast (opening and closing a position)

-

expensive subscriptions

Ways of solving:

-

none

-

splitting the price by several people

Interesting findings: investors have 2–3 active paid subscriptions with a ~25% churn rate. They cancel the subscription and reactivate it a month later, paying once every two months.

Fundamentalists (10% of the sample)

Fundamentalists (we call them this way for shortness) are usually those who have the knowledge of reading financials and have a deep understanding of finance but have decided not to proceed with a financial career. They use our service as an intermediary point.

First, these investors find a company through screening, reading, or scuttlebutting. Then they use Roic AI as a one-pager for a glance and dive into financials.

Damodaran, Meldrum, CFA, terminal value, IRR, and CAGR are well-known words for them. They rarely read analyst reports about a company under consideration because they know about the confirmation bias.

They don’t even use financial data providers for their Excel models because the best and most accurate numbers are always in the statement footnotes. So they carefully insert them one by one.

After the valuation is done, they put the company on a watchlist and just wait for a good price to come, updating models with fresh data along the way.

The most popular portraits of this style are, of course, those of Warren Buffett and Charlie Munger.

The average time to make a decision (open a position): 2 months

The main problems are:

-

to much time spent on reading financials

-

good companies are expensive

-

manual data entry is tedious

Ways of solving:

-

none

-

none

-

using tools to facilitate the process

Interesting findings: these investors are the least targeted by businesses. The average time to make a decision is way shorter than we anticipated.

This issue is free of ads. If you’d like to showcase your product here, please contact me at vnotes@substack.com

Blend it

All this segregation is done for a pure research process. In reality, clear portraits are very rare. Some fundamental investors read analyst reports. Some traders read statements. Everyone tries to change the established strategy a bit.

In my opinion, this comes from a natural tendency to be a contrarian, but not so contrarian as to look foolish. This is why there are so many investment strategies, and there’s a general term for “individual investor.”

Which strategy to choose

We didn’t talk about returns from these investment types because there are styles and there are numbers. 9 out of 10 times, investors can’t beat a market. But that one time is so tantalizing.

Choosing an investment style should rely solely on three factors. The time you can spend looking for promising stocks. The financial knowledge you’re willing to acquire. And the amount of stress you’re able to bear.

By the end of the day, will still be available. But it’s not something people talk about at parties, right?

If you’re finding this newsletter valuable, feel free to share it with someone who might also find it beneficial.

Also, if you have feedback to share, whether public or private, feel free to leave a comment or write to me directly at vnotes@substack.com

Take care of yourself and your someone,

Vlad.