Hodlers Finally Achieve Work-Life Balance: Both Now Equally Devastating 😶

OVERVIEW

Hodlers Finally Achieve Work-Life Balance: Both Now Equally Devastating 😶

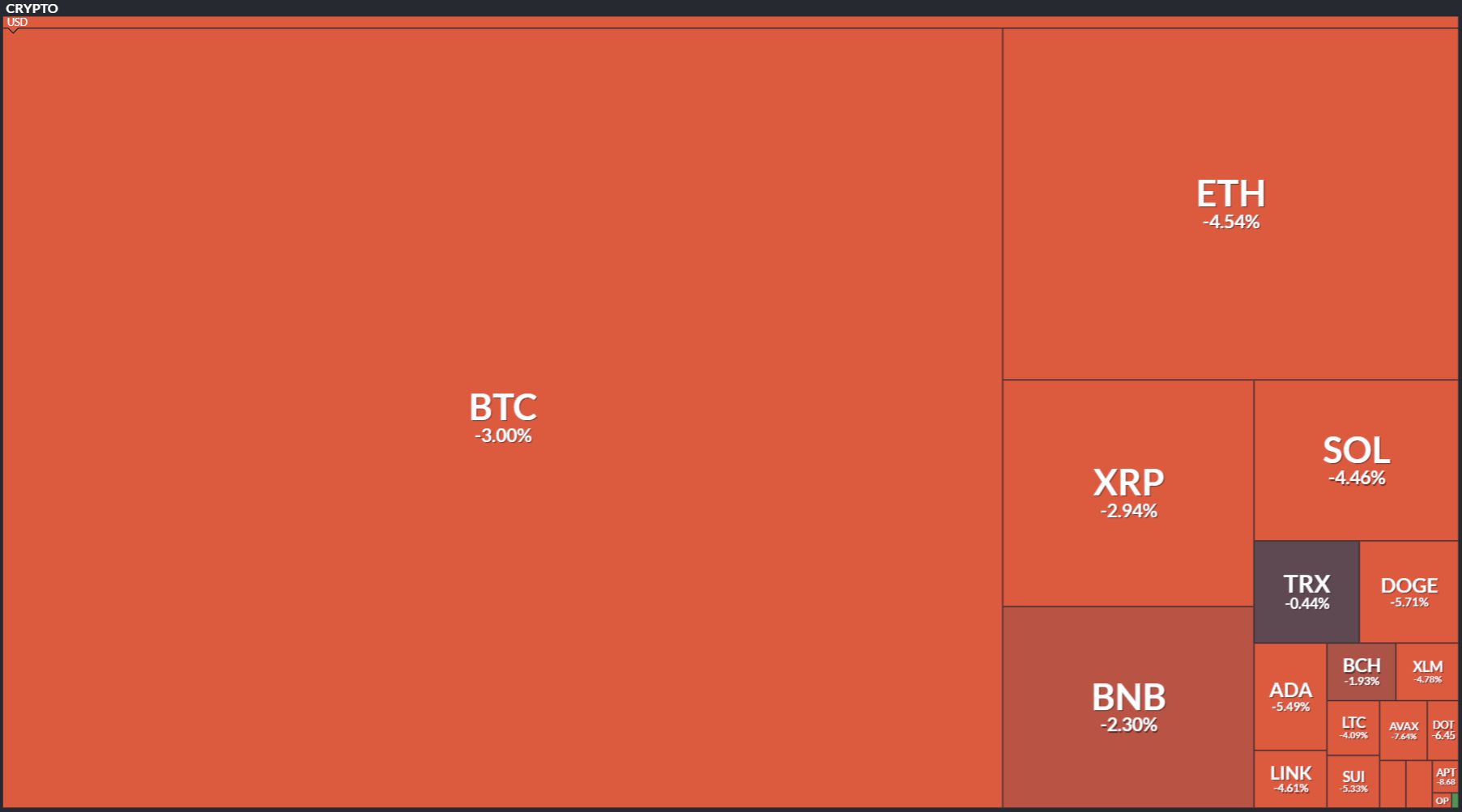

Before we dive in, here’s today’s crypto market heatmap:

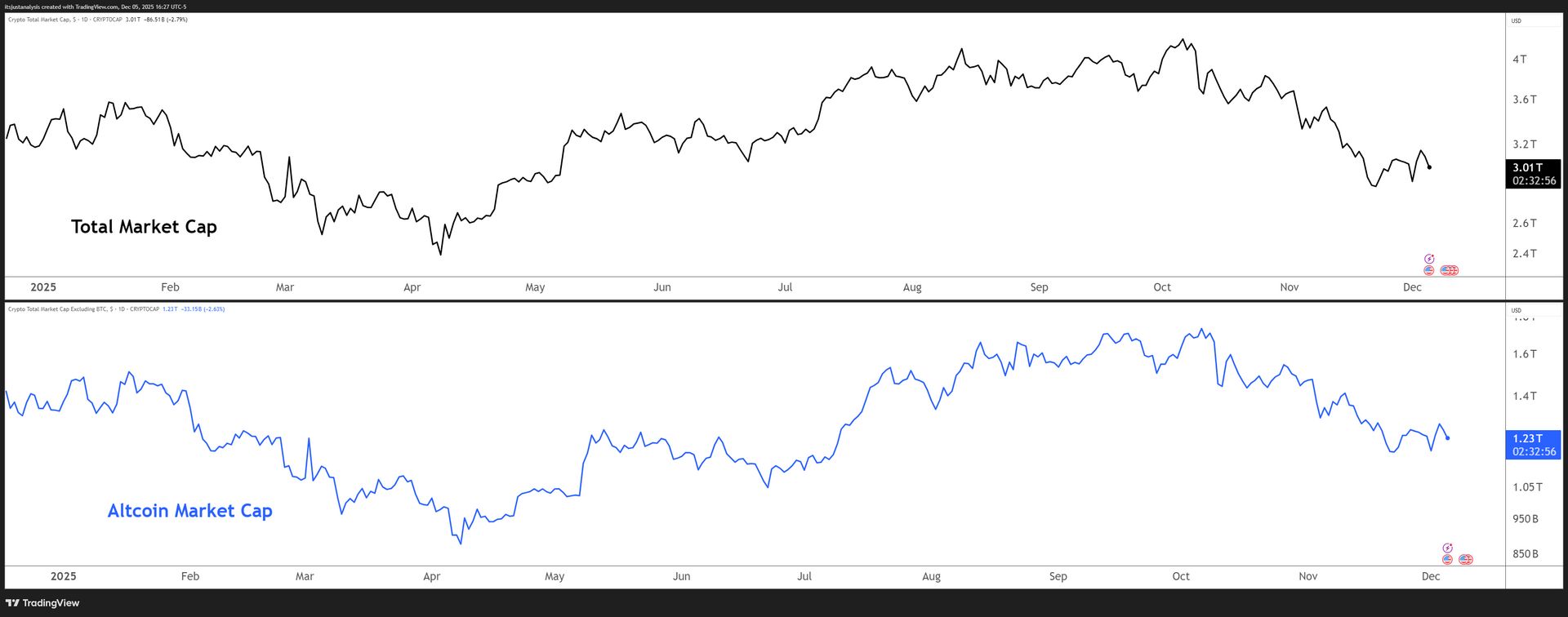

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

CZ VS Peter Schiff Fight Lasted < 1 Minute 🥊

I’ll just leave this here in case some of us haven’t seen it yet:

Twitter tweet

Pwned. 🎯

NEWS

The US DOJ Wants Do Kwon’s Head 🗣️

Plot twist: the U.S. Attorney prosecuting Do Kwon is Jay Clayton – Trump’s first-term SEC Chairman (2017-2020). Now he’s asking for twelve years for one of crypto’s biggest frauds. 😯

Clayton’s 35-page sentencing memo reminded me of just how big a piece of shite Do Kwon is.

The Numbers

-

$40+ billion in realized losses (more than SBF, Mashinsky, and Greenwood combined)

-

May 2021: UST depegged, Kwon secretly paid a trading firm to manipulate it back to $1

-

Trading firm made 90%+ of UST purchases during critical 30-minute window on May 23, 2021

-

May 2022: Final collapse – UST to pennies, LUNA from $116 to zero

The Lies

-

Claimed Terra Protocol was self-stabilizing (it wasn’t – required secret market manipulation)

-

Said the LFG (Luna Foundation Guard had independent governance (Kwon controlled everything, stole $300M after collapse)

-

Called Mirror “fully decentralized” (Terraform ran manipulation bots, faked 40% of liquidity)

-

Told investors Chai processed billions via Terra blockchain (used traditional banks, faked the data)

Catch Me If You Ca… You Got Me

-

Fled to Serbia, then Montenegro with fake passports

-

Arrested trying to board private jet to Dubai

-

Laundered misappropriated funds through multiple exchanges after criminal charges announced

-

Still minimizes everything in his sentencing memo

The Sentence

-

Government wants 12 years (not the max, not the 5 years Kwon wants)

-

Average for similar cases: 158 months (13 years)

-

SBF got 25 years for comparable fraud

Oh, and if you remember this line from Kwon during Terra’s collapse:

Twitter tweet

Not sure if it’s coincidence or not, but Kraken sent out this gem today:

Twitter tweet

Sentencing is next week either on Friday, or December 11 and I’m only saying one or the other because December 11 is not a Friday, it’s a Thursday, but Clayton wrote Friday, December 11, 2025 in his memo. 🤷

RWA TOKENIZATION

SMX’s Tokenized Molecular Markers Are Kind of Cool, Even If the Planet Is Already Cooked 🧑🍳

Look, we’re not saving the planet with recycled plastic. That ship sailed decades ago and is currently decomposing in the Pacific garbage patch. 🗑️

But SMX’s molecular marking technology is still legitimately cool from a “solving an actual technical problem” perspective.

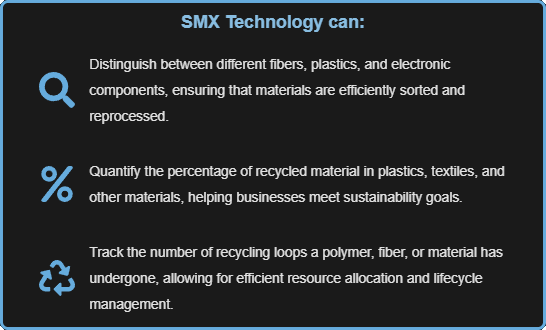

The Tech That’s Actually Interesting

SMX embeds molecular markers in materials that survive recycling, reprocessing, and transformation. You can verify whether something is virgin or recycled plastic, track how many loops it’s been through, and authenticate composition at the molecular level.

No paperwork audits. No trust-me declarations. The material carries its own proof.

Their Plastic Cycle Token tokenizes that verified data into tradeable assets. It’s like carbon credits but tied to actual measurable events instead of “we promise we planted trees somewhere.”

This Is A Thing Now

Companies are being forced to prove recycled content claims. Traditional audits are expensive theater. SMX’s markers could actually verify the numbers instead of just rubber-stamping paperwork.

Will this fix the recycling? No. Does it solve supply chain fraud and counterfeit components? Maybe. Does it create tradeable compliance infrastructure that companies will pay for? Possibly.

SMX has been applying this tech across multiple verticals – gold authenticity, recycled materials, now the Plastic Cycle Token. Whether any single application achieves commercial scale or they’re just spread too thin is the real question. 🪙

RWA TOKENIZATION

Gold Tokenization Keeps Adding Players 🥇

Gold tokenization is still a thing people are building companies around. 📣

This week brought announcements from two completely unrelated entrants: I-ON Digital ($IONI ( ▼ 4.14% )) deploying $200M in gold reserves through their U.S.-regulated platform, and Blue Gold ($BGL ( ▼ 3.55% )) closing a $15M trading facility to build a mine-to-wallet model.

Neither is competing directly with the other. They’re just both tokenizing gold in different ways, adding to a field that already includes Paxos, Tether Gold, and a dozen other platforms doing variations of the same thing.

I-ON: Infrastructure Without Distribution

I-ON’s deployed $200M in “in-situ gold reserves” (commitments for gold-in-the-ground) that they’ll tokenize through their regulated platform. Their distribution channel are supposed to turn this into tradeable products, collateral for lending, and liquidity pool assets.

They’ve got regulatory approval and auditable reserves. The question is whether institutional demand exists for their specific tokenized gold versus the dozen other gold-backed tokens already in market.

They’re planning a 2026 NASDAQ uplisting. We’ll see. 👀

Blue Gold: Full-Stack Ambition

Blue Gold’s building something different: a $15M trading facility to buy physical gold at 1-5% discounts from mines, tokenize it (earning 3% on-ramp fees), collect transaction fees (0.02% per trade), then eventually let people spend it through a fintech wallet with branded cards.

They’ve got a 1M oz gold supply agreement giving them capacity for $4.2B in tokens at current prices. They’re targeting $30-45M in monthly trades. They want to move upstream into actual mining and downstream into consumer spending.

Right now it’s all announcements and projections. Check back in 12 months. 📆

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🌎 World ID Is Everywhere Now

Now you can prove your age or nationality without sending a scan of your ID to a stranger on the internet. World ID just expanded to a dozen countries, allowing passport holders to verify credentials. It uses zero-knowledge proofs to confirm you’re a human without sharing your personal data with a random app, which is way better. Worldcoin.

🕵️ Privacy Is Finally Cool Again

COTI is betting big that institutions finally want privacy without the sketchy regulatory heat, and they’re right. They use technology called Garbled Circuits to keep transactions confidential while still running securely on Ethereum. This makes crypto usable for big money without leaking trade secrets to the competition. COTI.

🛡️ Zashi Dumps Coinbase

Zashi wallet just kicked Coinbase to the curb because their privacy standards are no longer up to par. The new update forces Tor protection for restores, so your IP address stays hidden from prying eyes during wallet sync. It’s faster, safer, and remarkably anti-surveillance for a mobile wallet. Zcash.

🤖 Keep Your Keys Off The Cloud

Axelar released a framework called AgentFlux so AI can trade for you without stealing your private keys, which should be the standard. It runs the smart thinking part locally on your device instead of sending sensitive data to a centralized server. This lets the robots work, but ensures the wallet stays shut. Axelar.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🐸 Green Energy On The Blockchain

Bullfrog Power is tokenizing green energy certificates on Algorand because using paper trails is basically ancient history. Staples Canada is the first corporate client to use these tokens, which are verifiable on-chain records of eco-friendliness. It’s immutable proof of sustainability without the corporate paperwork headache. Algorand.

🏦 The Suits Are Apeing In

The suits are finally figuring out how to use crypto tech correctly, thanks to new investments in the Canton Network. Nasdaq and BNY just threw cash at the project to bridge the gap between global bankers and blockchain. This network connects massive financial systems with privacy controls so institutions can trade real assets on-chain. Canton.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

📉 Stop Chasing Green Candles

Most retail traders are still terrible at chasing pumps, but Carbon DeFi is finally letting you set real limit orders on-chain. They use a fancy solver system to execute your strategy automatically, so you can stop staring at charts all day. Just set your price zones, and the system will buy the dip without the emotional breakdown. Bancor.

💸 Yearn Just Got Rekt

Yearn Finance just donated nine million to a hacker because their yETH pool couldn’t handle a simple flash loan desync. Honestly, audits mean nothing if the code misses the state transitions that drain the liquidity dry in seconds. The exploit tricked the system into thinking it had more money than it actually did. Yearn Finance.

🦄 A DeFi Giant Says Regulation Is Actually Good?

1inch is arguing that clear rules are the only way DeFi goes mainstream without scaring off the normies. They want smart consumer protections baked into the code so people stop getting rugged by bad actors, which is the only way this game survives. Trust is the only currency that truly matters here. 1inch.

🐎 The Borrowing Is Now Automated

Mustang Finance integrated Summerstone to manage interest rates across all collateral types like BTC and ETH. Delegating your rate decisions to a solver is easier than staring at charts trying to optimize your loan. This is another major milestone for Liquity V2’s market-driven efficiency. Saga.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚡ Google Is Speeding Up DeFi

Using Google’s trusted hardware to bypass the 7-day wait for cross-chain transfers is the necessary compromise we didn’t know we needed. Dymension now supports TEE-backed fast withdrawals for its RollApps, achieving instant finality. This cuts fees for users and radically improves capital efficiency for market makers. Dymension.

🔥 Rizz Is The New Alpha

Injective launched a huge MultiVM campaign to celebrate over 30 projects going live on their EVM. They are tracking community members’ social media and on-chain activities using fancy metrics like “Impact Share” and “Personal Multiplier.” You know, earning five thousand INJ tokens for having good social media “rizz” is peak Web3. Injective Protocol.

LINKS

Links That Don’t Suck 🔗

😱 Gleec Buys Komodo’s Cross-Chain DeFi Stack Valued at $23.5M for Undisclosed Amount

🌍️ Revolut brings Solana payments to 65 million users globally

🇵🇱 Polish lawmakers fail to revive controversial crypto bill after presidential veto

👮 Maryland Man Sentenced for Helping North Korea Infiltrate US Tech Firms

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋