How Bearish Is This?

Imagine waking up every day trying to make up reasons for why it’s bearish when the Equally-weighted S&P500 is making new all-time highs?

There are people out there who are purposely going out of their way to blatantly lie to people about how historically bearish it is when market breadth is expanding, and more and more stocks are making new highs.

It’s like a weird fetish or something. These people need help.

Here’s what they’re so angry about and why they think the market is about to fall apart:

I would understand the more cautious outlook if it was just 7 stocks going up, or if perhaps the new lows list was expanding.

But none of that is happening.

The new lows list is non-existent, regardless of whether you look at longer-term new lows or shorter-term new lows.

It’s just math – you can’t have market corrections without the prices of stocks falling. And as grown adults who passed 3rd grade math, we all have the ability to count how many stocks are falling in price.

But most adults choose not to count, in favor of arbitrary things like economic reports or corporate fundamentals.

It sounds crazy I know. But this is the nonsense going through the average investor’s mind.

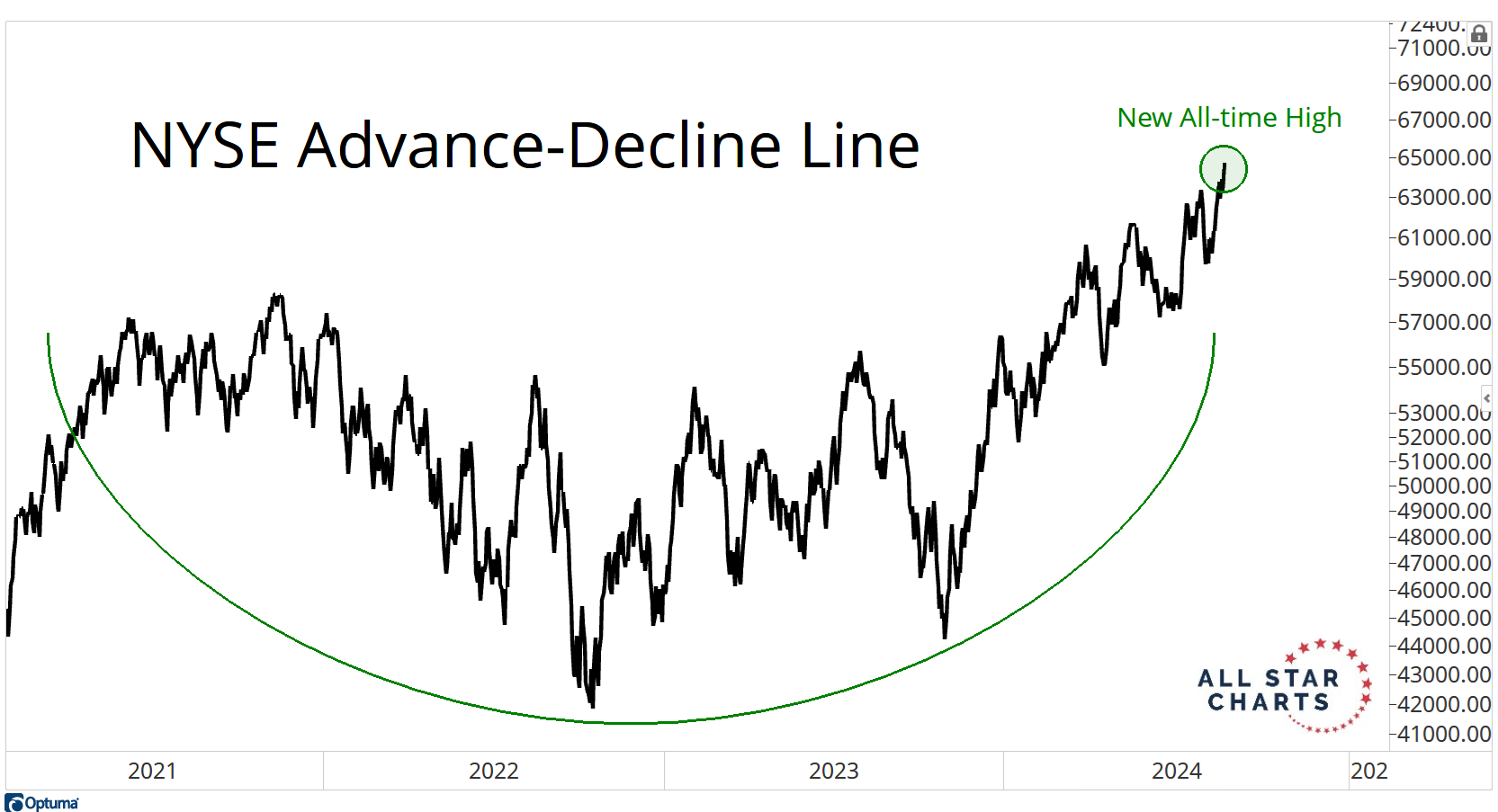

Here is the NYSE Advance-Decline Line, for example, making new all-time highs AGAIN.

This chart above is just a simple count of advancing stocks vs declining ones. More specifically, it’s the ones that trade on the world’s most important exchange.

It’s just a count.

But humans hate counting.

It’s weird.

But that’s part of the arbitrage.

If you actually take the time to count, you get a huge advantage in this game.

I would encourage you to go around the world and count how many countries are making new highs.

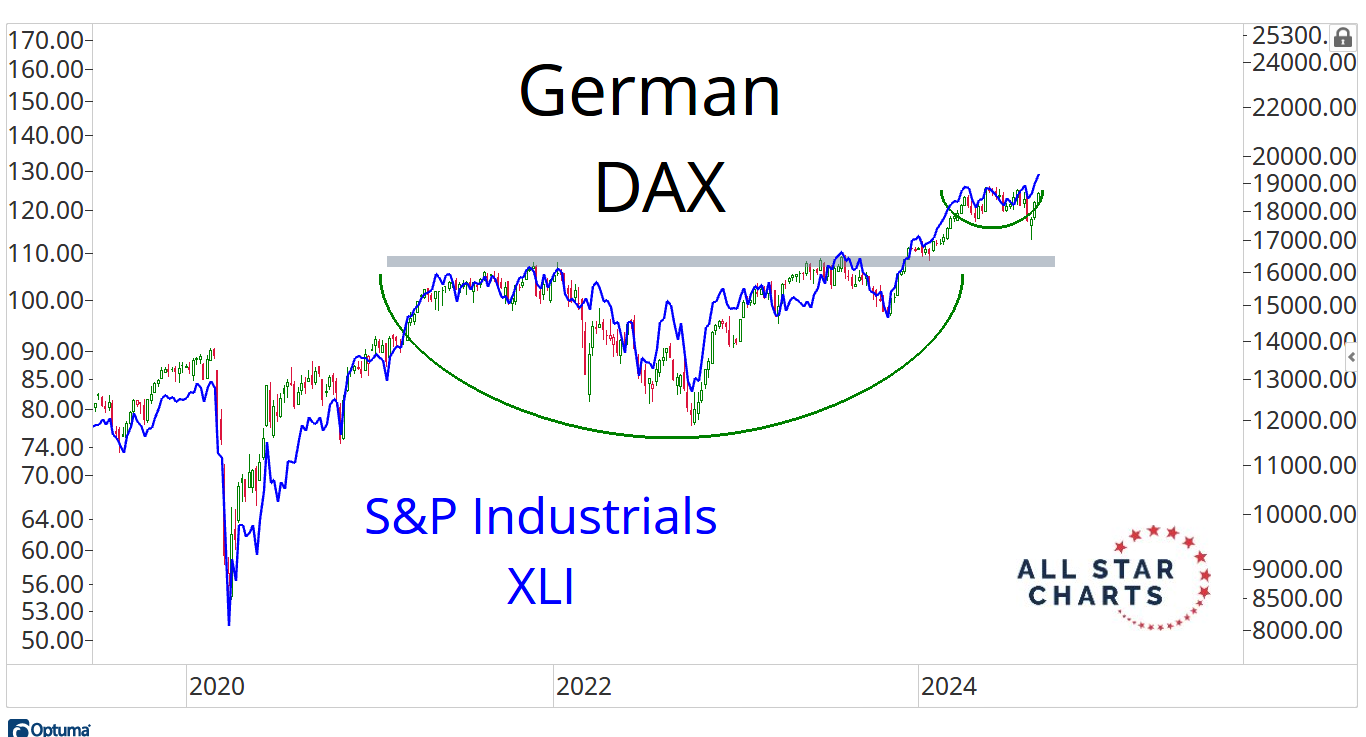

One can argue that the German DAX is the next most important stock market index outside the U.S. markets.

And the DAX is right up against new all-time highs, Again.

But look at this chart below. I overlaid the U.S. Industrials Index fund, just to show what a large driver the Industrial stocks are to Germany.

Industrials represent almost 25% of the entire German DAX Index.

And U.S. Industrials, meanwhile, just closed at yet another New All-time High yesterday:

I’m being told this market is going parabolic and that this is all unsustainable. But in a lot of cases, we’re seeing stocks just breaking out for the first time.

In the case of the small-caps indexes, they haven’t even broken out yet.

Look at this massive multi-year base in the Small-cap 600 Index:

It hasn’t even gotten going yet.

This is barely even the beginning.

We’re not seeing any evidence at all the we’re near the final stages of a bull market.

In fact, we’re seeing more and more evidence coming in that this could just be getting started.

Besides, have you seen how quickly people forget about Semiconductors?

The group just had a well-deserved correction after literally tripling in 2 years. Yes that’s right, the Semiconductors Index already tripled in price during the current bull market.

One small, well-deserved, digestion of gains and everyone just forgets about them.

But not us.

This is a group of stocks that continues to show explosive growth. Just 5 years ago Semi’s only had 3 companies worth more than $100 billion in market cap—Broadcom, Texas Instruments, and Taiwan Semiconductor.

Today there are 13 semis over that threshold, including the grandaddy of them all, Nvidia.

The growth here is so staggering, so unlike anything we have ever seen from one industry group, that we had to put together a FREE special report about it.

We looked at Nvidia, the semiconductor complex more broadly, and what we think of the group going forward.

Click here to get it sent to your inbox.

And while you’re at it, tune in on Wednesday Aug 28th @ 3:45 pm ET for a special show we’re doing to discuss this report, as well as Nvidia’s Q2 earnings. We’ll be live here.

I’ll see you there. Enjoy your weekend.

JC

The post How Bearish Is This? appeared first on All Star Charts.