Jobs Look Good

Presented by

CLOSING BELL

Jobs Look Good

The market climbed again on Wednesday, after a whole new round of earnings, and ADP private jobs numbers came in healthy.

News that Michael Burry’s bets against the AI world are likely already losing bets also helped sentiment. The Supreme Court of the United States heard arguments in a case questioning the President’s legal authority to put tariffs on everything. The FAA plans to cut 10% of flights, after disagreement over cutting healthcare benefits sent us into more than 36 days of Fed shutdown. A host of opinions argued the shutdown is costing U.S. GDP anywhere form $10B-$30B per week.

Trump blamed the shutdown for affecting the economy, and in part for Democratic local political victories in NJ, Virginia, and a win for incumbent Mayo Zohran Mamdami in NYC. 👀

Today’s RIP: Hood, Duol, IONQ, report, Jobs numbers looking better, and more. 📰

9 of 11 sectors closed green, with discretionary $XLY ( ▲ 1.22% ) leading and staples $XLP ( ▼ 0.07% ) lagging.

$SPY ( ▲ 0.35% ) $QQQ ( ▲ 0.65% ) $IWM ( ▲ 1.44% ) $DIA ( ▲ 0.47% )

AFTER THE BELL

Three In The Green, One In The Red: Meet The Top Trending Reports

Tonight, chip makers were taking a seat in the second row on Wednesday behind retail favorite stocks that reported after the bell, trending the highest on Stocktwits.

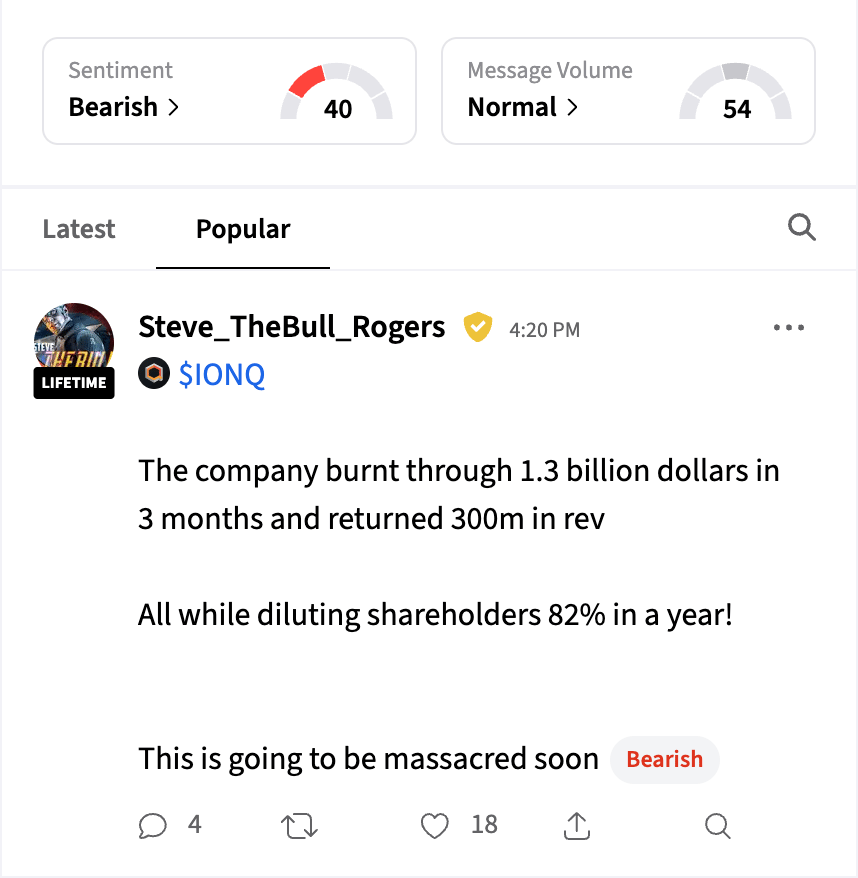

$IONQ ( ▲ 3.8% ) IONQ was climbing nearly 4-7% after the bell, reporting Q3 revenue of $39.87 million vs. $27 million estimated, a 47.65% beat. That’s a whopping 221% climb in revenue for the past quarter then a year ago, the Quantum computing startup long since becoming the apple of Stocktwits retail trading eyeballs. 👁️👄👁️

EPS came in at a loss, a net loss of $1.1B for the quarter, but a smaller loss per share than expected. –$0.24 vs. –$0.36 estimated.

“I am pleased to report that we once again beat the high end of our revenue guidance, this time by 37%. We are also raising our revenue expectations for the full year to $110 million at the high end of guidance,” said Niccolo de Masi, Chairman and CEO of IonQ.

Stocktwits retail went bearish after the news

Retail favorite brokerage shop, betting app, and cure-all Robinhood was falling slightly after its post-market report.

$HOOD ( ▲ 4.15% ) reported Q3 earnings of $0.61 per share on record $1.27 billion in revenue, beating estimates. It pulled in more than 200% of last year’s revenue in the same quarter. Crypto revenue rose over 300%, and equities revenue grew 132%. CFO Jason Warnick will step down in Q1 2026, with Shiv Verma set to take over.

$DUOL ( ▼ 0.77% ) Everyone’s favorite bird-based learning app, Duolingo, beat on revenue and EBITDA but missed user growth expectations, reporting 50.5 million daily active users vs. 51.1 million expected. The company mentioned its AI goals were ‘profitable,’ according to Chief Luis von Ahn, but the market questioned how much, as profit margins fell slightly. EPS beat, but the company recorded a tax break of like $222M in the quarter that helped alot.

Sherwood Media cited a leaked internal memo in the spring that turned investor attention onto the beef behind the shift toward AI strategy at the language learning shop: user growth was slowing, and AI would help costs.

$SNAP ( ▼ 2.28% ) Snap beat on revenue and DAUs, posting a $0.06 loss vs. $0.12 expected. Revenue hit $1.5 billion, up 10% YoY, and the company started a $500M stock buyback plan. The price climbed 22% after hours, investors most excited about an $400M AI partnership with Perplexity. Perplexity is paying Snapchat nearly half a billion for a 1 year contract to feature a conversational AI bot, like Snapchat already has. 🤖

SPONSORED

Why investors are watching this first-in-class biotech story

A little-known biotech is advancing a next-generation cell therapy for AL amyloidosis—a rare, serious disease with no FDA-approved treatments.

Recent updates report no neurotoxicity to date and an expanded U.S. clinical footprint (now 18 sites), supporting continued progress toward a potential FDA submission if data remain supportive. The program also holds RMAT and Orphan Drug designations, which may provide review efficiencies contingent on ongoing safety and efficacy.

What’s ahead? –> continued enrollment, additional readouts, and regulatory planning that could clarify timing.

If you track emerging therapies in high-need conditions, this is a developing story to follow.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MORE EARNINGS

HUGE ROUND UP: QCOM, ARM, and More

Today was yet another busy one for reporting, maybe the busiest in the entire season.

I really hope it’s the busiest in the season, because there is no other way to represent the reports after the bell than just a huge list, so:

$ARM ( ▼ 0.34% ) ARM climbed after the chip designer beat estimates with EPS of $0.39 and revenue of $1.14 billion. Q3 guidance raised to $1.18–$1.28 billion. The stock jumped 3% after hours on strong AI commentary.

$QCOM ( ▲ 3.98% ) Qualcomm beat with EPS of $3 and revenue of $11.27 billion. QCT segment brought in $9.8 billion, ahead of estimates. Stock fell 3% after disclosing a $5.7B one-time tax charge.

$APP ( ▲ 1.38% ) AppLovin beat with EPS of $2.45 and revenue of $1.40 billion. Q4 guidance raised to $1.57–$1.6 billion. Stock rose 4% despite recent SEC investigation headlines.

$FIG ( ▼ 3.93% ) Figma reported Q3 revenue of $274.17 million vs. $263.93 million estimated, a 3.88% beat. EPS came in at $0.10 vs. –$0.60 estimated, a 116.67% surprise. It was a nice sign from a company that has only publicly reported twice since gracing public markets with its presence.

$LCID ( ▲ 5.38% ) Lucid missed on both EPS and revenue, posting a $2.65 loss on $336.6 million. Free cash flow burn rose to $955.5 million. Stock dropped 4%, Wall Street expecting more but getting cut guidance instead.

$DASH ( ▼ 0.8% ) DoorDash missed on EPS ($0.55 vs. $0.68) but beat on revenue $3.45B. Marketplace GOV and total orders exceeded expectations. Stock plunged 18% despite strong Q4 guidance and user growth.

$LYFT ( ▲ 3.4% ) Lyft reported Q3 revenue of $1.69 billion vs. $1.7 billion estimated, a slight miss of 0.83%. EPS came in at $0.11 vs. $0.08 estimated, a 37.5% beat.

Profitability exceeded expectations despite modest top-line softness.

PRESENTED BY STOCKTWITS

Job Market Is Back To Not Going Negative, For Now 🫂

ADP data shows U.S. companies added 42,000 jobs in October, a breath of fresh air for one of the only data points investors have while the government remains closed for business.

ADP is the largest private employer data collector, a huge human resources firm that collects data on 26 million employees across the U.S. The Pew Research Center found ADP data was a pretty good stand-in for BLS government data, though not perfect.

Fed’s Stephen Miran, a Trump rate cut loyalist, told Yahoo Finance it is a welcome surprise to see labor numbers recovering for now. Still, it’s time to cut rates in December, he said.

“All of that to me is an indication that rates could be a little bit lower than where they are now.”

Bloomberg reporting

IN PARTNERSHIP WITH CASHMERE

How to Invest in SpaceX, xAI & the Next Wave of Innovation

A rare opportunity for accredited investors: The Witz Ventures Multi-Asset SPV, curated by entrepreneur Austin Hankwitz and Christian Blackwell, offers access to both early-stage innovation and late-stage giants like xAI, SpaceX, and Perplexity. A portion of the SPV invests directly into The Cashmere Fund, giving participants exposure to a professionally managed portfolio of high-growth early-stage companies. The remaining allocation targets category-defining late-stage ventures shaping the AI and infrastructure boom.

The deadline to invest is Friday, November 7. Don’t miss your chance to join this limited, high-conviction venture opportunity on Republic.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Zohran Mamdani wins NYC election, raising pressure on housing stocks.

-

Hertz slides after retail-fueled Q3 surge.

-

Upstart fell 9% after missing Q3 revenue estimates.

-

Dan Ives says Wall Street is underestimating AI’s impact.

-

Rivian climbed 22% on Goldman’s long-term profit optimism.

-

Blink Charging rose 9% on strong EV demand signals.

-

Michael Burry is reportedly losing money on bearish bets.

-

McDonald’s CFO warns of tough market and cautious consumer spending.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Is @Jake__Wujastyk buying or crying this market?

Here’s what he said at Stocktoberfest…

— Stocktwits (@Stocktwits)

6:08 PM • Nov 3, 2025

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Productivity QoQ (9:30 AM), Fed Vice Chair for Supervision Barr Speaks (12:00 PM), FOMC Member Williams Speaks (12:00 PM), Atlanta Fed GDPNow (1:00 PM), Fed Waller Speaks (4:30 PM), Fed’s Balance Sheet (5:30 PM)📊

Pre-Market Earnings: Moderna ($MRNA), Novavax ($NVAX), Cronos Group ($CRON), D-Wave Quantum ($QBTS), and Under Armour ($UAA). 🛏️

After-Market Earnings: Block ($XYZ), DraftKings ($DKNG), GoPro ($GPRO), Opendoor Technologies ($OPEN), SoundHound AI ($SOUN), Peloton Interactive ($PTON), Airbnb ($ABNB), Blink Charging ($BLNK), and Trade Desk ($TTD). 🌕️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈 Want daily stock and options trade ideas for just $20 per year? You need to try MarketDiem *

🎩 FAA to cut flights by 10% at 40 major airports due to government shutdown

📜 Why Trump wants to nuke the filibuster and what it takes to make it happen

At least 12 killed by UPS plane crash in Louisville, including a child

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍