Market Corrections – What I Am Doing

Happy Sunday.

I’m excited to have Max in town for a few days. We are heading up to Scottsdale National today to watch and play golf. As much as I hate golf, the game is just fantastic. The pro players today are exponentially better than just ten years ago. I could not be more bullish on the sport and game. Just this week our portfolio company Grassclippings.com (fund 4) made another huge announcement:

Gila River Resorts & Casinos has officially signed on as the Title Sponsor for the 2025 Grass Clippings Open. This partnership marks a pivotal moment in the growth of the Grass League.

@PlayAtGila has been a valued partner to numerous organizations in the community and in… x.com/i/web/status/1…

— Grass League (@GrassLeague)

7:14 PM • Mar 13, 2025

Onward…

This will be a long newsletter today because so many of my readers/friends are asking me portfolio questions as the market has corrected. I have a lot of data and charts to share below, but first things first…

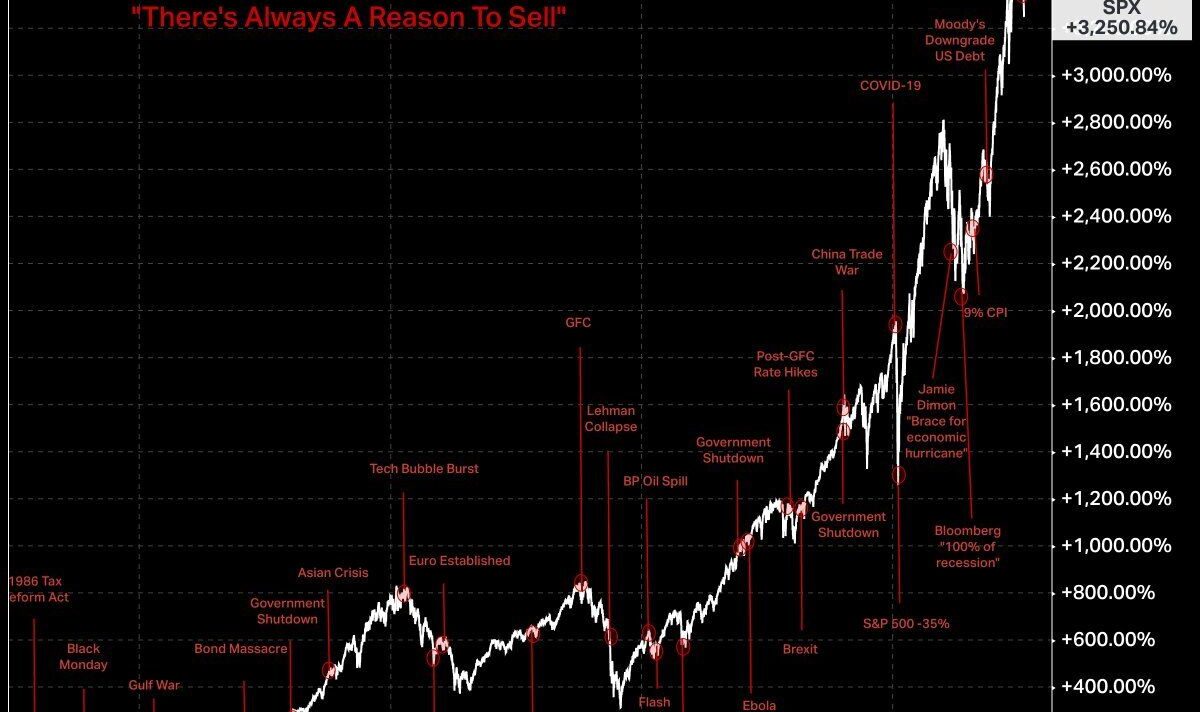

Welcome to the correction and ‘there is always a reason to sell’ (chart from Koyfin.com):

Let’s be honest…one look at this chart below and the investing world does seem to make ‘relative’ sense:

What to do?

The first thing Ellen and I are doing this week is moving cash to Robinhood. This is why…

There is no such thing as FREE money, but for us, this is pretty damn close because we can keep that money there for the two years (small print).

A second thing I have been doing is taking some individual stock losses and index losses and moving the capital to FREC.com (we are investors at Social Leverage full disclosure). FREC is the home for all our family direct indexing. Again…easy to do and as close as you get to ‘free money’.

I love that Mo (the founder) sent out this note to account owners last week to explain the opportunities and harvested gains to date:

In the app, here is what it looks like when you check an index (this on is my small semiconductor $SMH ( ▲ 3.2% ) position (adding this week) and it tracks tax losses harvested:

Now, let me dig into this ‘correction’ in the markets and stocks.

It has been a GREAT TEN years for technology and semiconductors especially (these charts are from Koyfin.com (a fund 3 portfolio company of Social Leverage):

Like all corrections, the next stop might be a bear market and from there… here we come 1929!!

I quickly discuss the semiconductor correction here:

Is the semiconductor boom over? $SMH

Listen to what @RotationReport and @howardlindzon think…

— Stocktwits (@Stocktwits)

9:44 PM • Mar 13, 2025

It is natural to worry.

My biggest worry is the ‘don’t be evil’ Google mantra that I have mostly accepted as a user is being torched. I do not trust technology companies anymore, and maybe that is the way it is supposed to be because the machines can’t be turned off.

It does ‘feel’ like technology and semiconductor stocks could easily drop 20-30 percent more. That is why I mostly direct index and root for corrections.

My more aggressive stock allocations I track here and I call my ‘degenerate economy’ index.

My ‘degenerate economy’ index is in a nasty drawdown from recent all-time highs, but still trouncing the $QQQ ( ▲ 2.42% ) and $SMH ( ▲ 3.2% ) since I started it almost two years ago…

The good news is an artist friend created a logo for the ‘degenerate economy’…

Over the last month I cut down on some $AAPL ( ▲ 1.82% ) and $GOOG ( ▲ 1.75% ) and just added $UBER ( ▲ 2.94% ) $DASH ( ▲ 2.92% ) and $RDDT ( ▲ 5.5% ) to the index. I still have a 12 percent cash position:

A couple more reads and charts before I head out…

Michael Batnick with a reminder of what I like to say here…the best time to panic is when everyone else has FOMO (fear of missing out).

Charlie has some great data on corrections in the charts below. I would only add that as degeneracy in markets explodes (parlays, 0 dated options, prediction markets) I expect faster steeper corrections that continue to happen more often that in the past.

Now go outside and have a great Sunday.