Momentum Monday – Will It Be Space and AI Again in 2026? Keep an Eye on Solar and China

As a reminder, MarketSurge (by Investor’s Business Daily) is a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 – save $239. That’s 80% off the most powerful stock research platform for individual investors.

Good morning…

Before I get started, Stocktwits ‘Daily Rip’ free email has a Saturday edition that tracks the top 25 momentum stocks from the major indices including their social sentiment ranks. It is my go to weekend email to stay caught up on the best performing stocks.

Ivan and I covered a lot of ground and some predictions in this weeks show.

The Venezuela news will dominate the market headlines this week as traders and investors what Trump has planned for the $18 trillion in oil. Oil is already in oversupply so if the USA mils this we will see lower prices. Here is a good quick primer on oil in Venezuela.

My long shot industry bet is Solar and China should have a good year too if the markets cooperate. Ivanhoff is sticking with AI and Space as any good trend follower would do as well.

Hope you enjoy the show. The episode breakdown is below the video. You can easily subscribe on YouTube by clicking below as well.

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

-

Intro and Overview of the Market Sentiment

-

The Continued Dominance of AI-Related Stocks

-

Analysis of the S&P 500 and Nasdaq Momentum

-

Deep Dive: Nvidia ($NVDA ( ▲ 1.26% ) ) and the “Magnificent 7”

-

Secondary AI Plays: Super Micro ($SMCI ( ▲ 2.88% ) ) and Others

-

Breadth vs. Concentration in Tech

-

Discussion on Interest Rates and Macro Headwinds

-

Potential Risks: Is the AI Trade Getting Overcrowded?

-

Stocks to Watch for the Upcoming Week

-

Final Thoughts and Closing Remarks

In This Episode, We Cover:

-

Intro and Overview of the Market Sentiment (0:00)

-

The Continued Dominance of AI-Related Stocks (1:15)

-

Analysis of the S&P 500 and Nasdaq Momentum (3:42)

-

Deep Dive: Nvidia ($NVDA ( ▲ 1.26% ) ) and the “Magnificent 7” (6:20)

-

Secondary AI Plays: Super Micro ($SMCI ( ▲ 2.88% ) ) and Others (9:15)

-

Breadth vs. Concentration in Tech (12:40)

-

Discussion on Interest Rates and Macro Headwinds (15:55)

-

Potential Risks: Is the AI Trade Getting Overcrowded? (18:30)

-

Stocks to Watch for the Upcoming Week (21:10)

-

Final Thoughts and Closing Remarks (24:45)

Here are Ivanhoff’s thoughts:

The first trading day of 2026 offered a wide variety of action. Big tech stocks gapped up and then sold off, while the small-cap index Russell 2k (IWM) found support near its 50-day moving average and finished strong. This could be the foundation of the January effect, which benefits small caps.

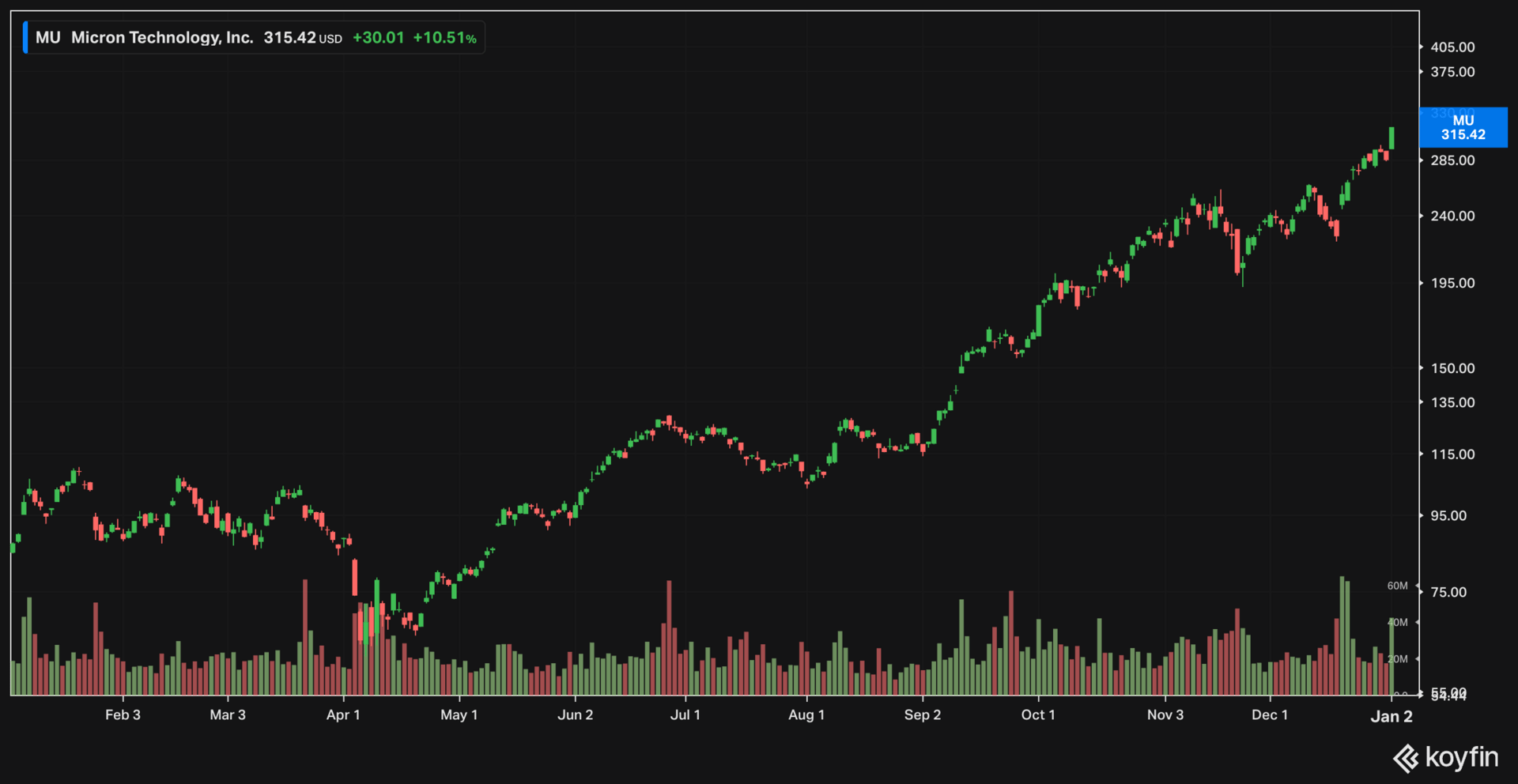

Unlike the rest of tech, semiconductors, which are the backbone of the AI revolution, had a strong start to the new year. SMH gained 4% to finish near its all-time highs. Memory stocks like Micron (MU) and Sandisk (SNDK) gained more than 10%. BIDU is not known as a semiconductor stock, but it actually owns Kunlunxin, which is a leading TPU chip manufacturer in China, and it is expected to go public in 2026. BIDU gained 14% on Friday, and it is currently the strongest Chinese stock.

The real bottleneck in AI is not processing power but electric power. The start of the new year saw strength in a large array of energy stocks. CEG, which is a top natural gas and nuclear play, gained 4%. GEV, which provides grid solutions and power-generation systems, bounced near its 20-day simple moving average and gained 3%. Bloom Energy (BE) designs and manufactures “energy servers” that use an electrochemical process to convert fuels—such as natural gas, biogas, or hydrogen—into electricity without combustion. Their systems provide a “plug-and-play” solution that allows businesses, particularly AI data centers, to bypass traditional grid interconnection delays. BE bounced near its 20-week moving average and gained 13% on January 2nd. Other energy plays like TLN, NRG, and BWXT also had hefty gains.

Solar also had a strong start to the year. The solar ETF, TAN, gained 5% in one day, boosted by strong performance in FSLR, CSIQ, ENPH, SEDG, JKS, SHLS, etc. I’ve said it here before – at 5 cents per kWh, solar is by far the cheapest source of electricity. China knows that and installed 300 GW in 2025. The US is expected to install 300GW of solar in the next five years.

In other words, AI remains the top market theme at the start of 2026. The difference this year is that the wave is not lifting all boats – some are sinking, some are treading water, but select few in the semiconductors and energy space are pushing higher.