Next Week Looks About As Safe As Bootleg Halloween Candy 🍬

OVERVIEW

Next Week Looks About As Safe As Bootleg Halloween Candy 🍬

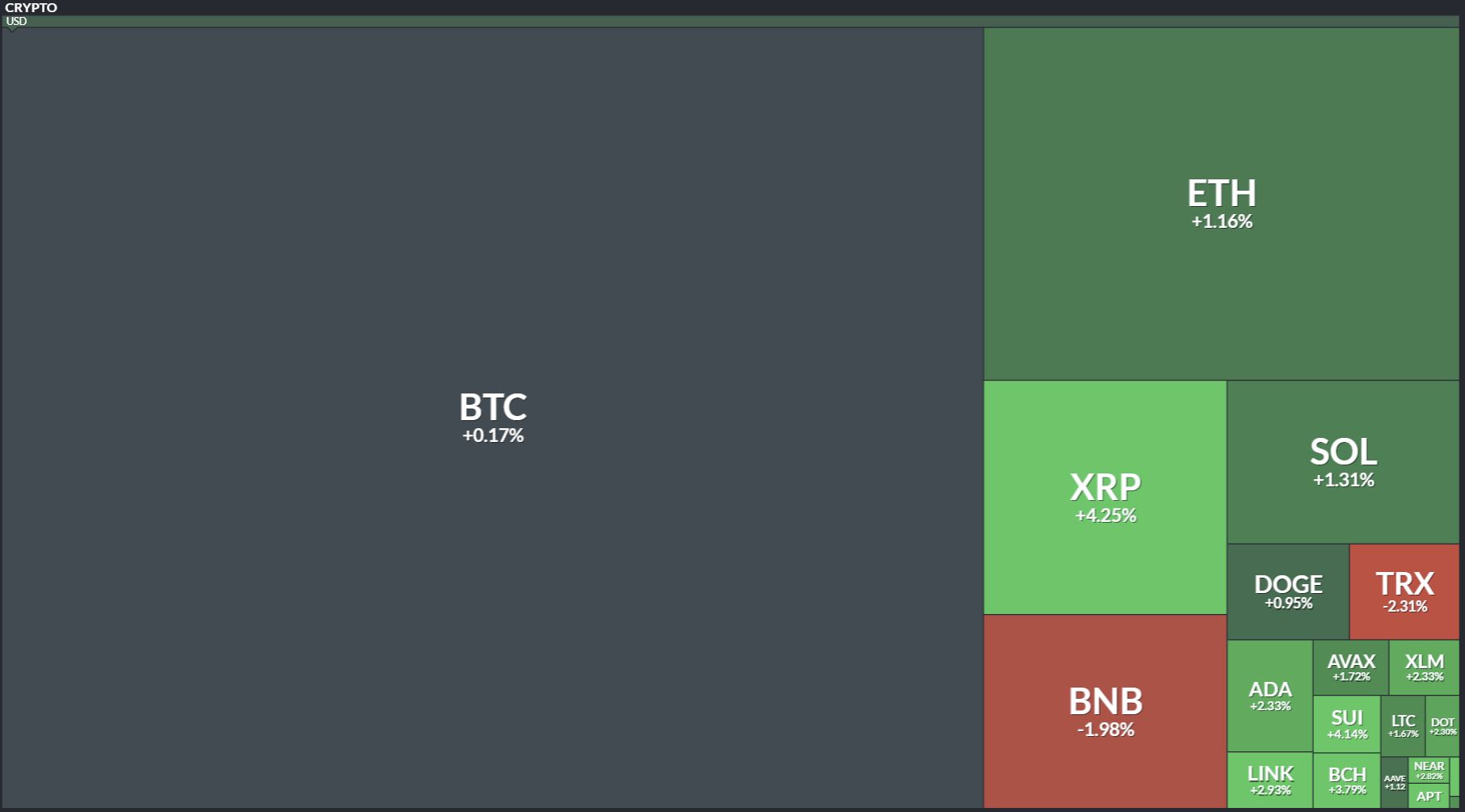

Before we dive in, here’s today’s crypto market heatmap:

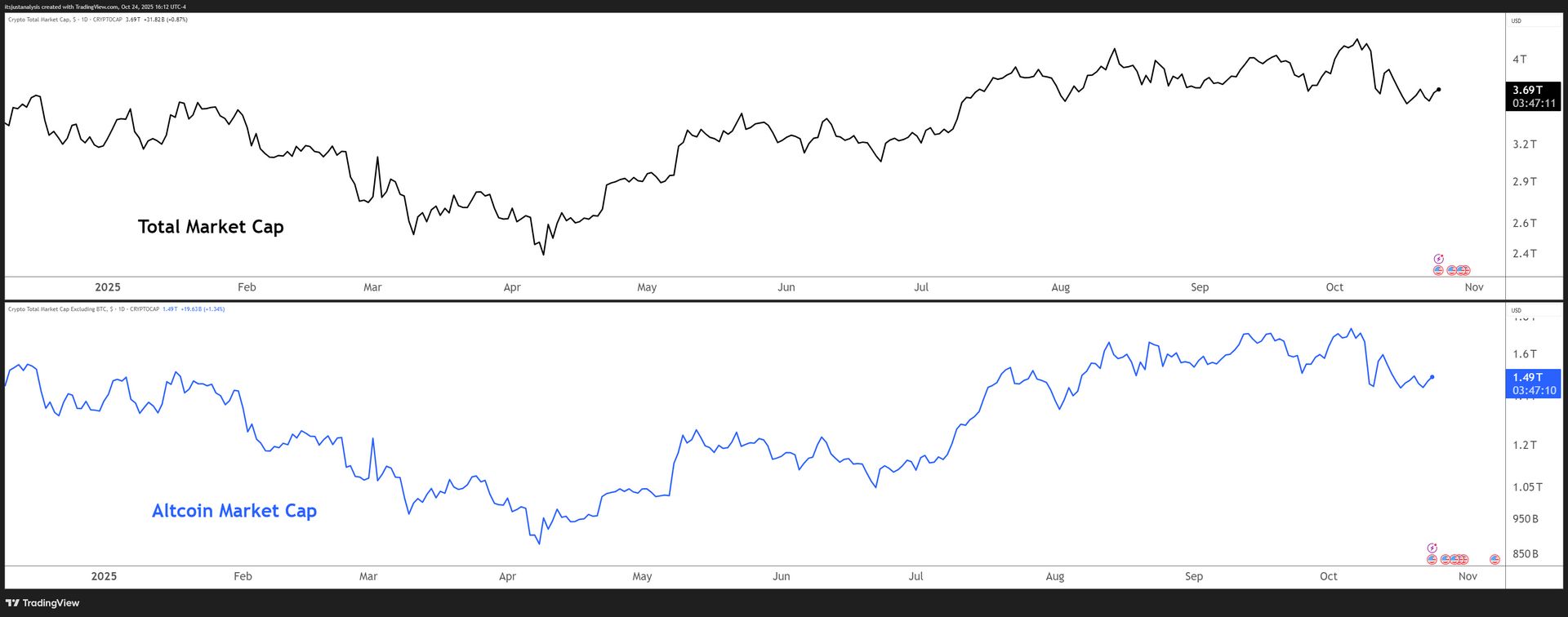

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Next Week Looks Like Gas Station Candy Risk 🤔

Usually, stuff like stonk earnings or FOMC drama doesn’t make the cut here. But next week looks about as safe as eating some bootleg Halloween candy out of a gas station bowl.

There’s a metric crap ton going on all at once – political theater, central bank suspense, and tech megacorps pretending their guidance doesn’t secretly suck. 🍬

Halloween Horror Lineup

-

Trump meets Xi, Oct 30: Supposedly a “friendship summit,” but probably more of a passive-aggressive reunion between two divorced parents arguing over the global custody of semiconductors.

-

FOMC meeting, Oct 28–29: Everyone’s watching for a tone shift. If Powell even blinks in a dovish direction, risk assets will moon. If he sniffs hawkish, the algos will liquidate joy itself.

-

Mega-cap tech earnings: Microsoft, Google, Meta midweek. Apple, Amazon after. Cloud, ads, AI, and whatever excuse they’re using this quarter for shrinking margins. This week decides whether the “AI rally” still has legs or if we’re about to see those legs snap like a stale pretzel.

-

Month-end PCE data (Oct 31): The Fed’s favorite inflation gauge drops on Halloween. Insert Trick-Or-Treat jokes about PCE making people sick or happy here.

TL;DR

Three boss fights in four days. Fed sets the oxygen level. Tech decides who gets to breathe. Trump and Xi either close in on a deal or open the hatch and vent all hope into space. Next week’s market has “high entertainment value, low survival odds” written all over it. 🎃

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

AI

Mom and Dad Finally Made Up 🫂

One of the biggest, yet lesser-known, crypto dramas is finally nearing its end. 😐️

The Artificial Superintelligence Alliance (Fetch, SingularityNET, and CUDOS) and Ocean Protocol – finally agreed to stop throwing plates at each other and call a truce. I was there for it. Literally.

Last night, I tuned into a live X Space hosted by $FET.X ( ▲ 15.12% )’s big wig, Humayun Sheikh, and the whole thing felt like a family mediation session with the kids (community) finding a resolution.

After week’s of he said/she said, the verdict came: Ocean would give back 286 million FET (worth around $120 million), and Fetch would drop all lawsuits.

Mommy and Daddy have finally, hopefully, made up. 👩⚖️

$120 Million Worth of “Let’s Just Move On”

Sheikh went full diplomatic mode on Spaces:

“The offer is simple – give my community back the tokens. I’ll drop every legal claim.”

GeoStaking, one of Fetch’s validator nodes, acted as the middle-child counselor – brokering terms between both projects. Ocean reportedly agreed to return the tokens once a formal proposal lands on paper.

Sheikh even said he’d cover the legal costs if they could just end it quickly.

After listening to the tension deflate live, which was bad ass because the decentralized part, the community, was the mender-in-chief, it was clear this was about more than FET on a balance sheet.

The community wanted closure. The developers wanted to code again. And hodlers just wanted things to back to normal. 🤷

How We Got to This Dysfunctional Family Meeting

Here’s the TL;DR for anyone who wasn’t reading Ocean Protocol co-founder Bruce Pon’s 8,841 word blog post, which, shockingly, wasn’t the biggest blog post by a protocol I read this week*.

Anyway:

-

Back in 2024, Fetch, Ocean, and SingularityNET announced the Artificial Superintelligence (ASI) Alliance. It was supposed to be a decentralized AI Voltron.

-

Ocean claimed Fetch tried to strong-arm it into surrendering its treasury and called out “massive token sell-downs” by Fetch and SingularityNET.

-

Fetch accused Ocean of converting 661 million $OCEAN tokens into 286 million $FET and then sending roughly 160 million to Binance and another 109 million to GSR Markets.

-

Ocean denied wrongdoing, saying those conversions were part of the merger terms and done through the community’s Cayman-based treasury arm, Ocean Expeditions.

-

Meanwhile, the market watched $FET bleed 93 percent in value while both sides fought over who killed it.

By October 2025, Ocean had officially left the ASI Alliance – the blockchain equivalent of moving out, changing the Netflix password, and filing a restraining order. 👮

Fast-forward to this week’s X Space, and all parties get what they wanted/need. Maybe. Probably. 93% certain.

-

Fetch gets its tokens back and avoids a messy court fight.

-

Ocean salvages its credibility without admitting fault.

-

The ASI community gets a breather from the drama.

So yeah – mom and dad had a fight. Things got loud. Furniture broke. But the kids (that’s the community) helped make it all better. Fetch gets its FET back. Ocean moves to the Caymans. Everyone promises to do better next time.

Crypto family therapy session adjourned. 🕊️

* The record and trophy for most insanely long novel-of-a-blog post goes to $EGLD.X ( ▲ 2.54% ) for this George R.R. Martin sized blog entry at 10,375 words.

NEWS

Polymarket’s Token Launch: The Smartest Bet Yet 🎰

Usually, “we’re launching a token soon” means someone’s about to dump on retail. But Polymarket isn’t playing that game. 🤯

Polymarket’s CMO, Matthew Modabber, just confirmed what everyone’s been whispering for months: yes, there’s a POLY token coming, and yes, there’ll be an airdrop. 🍿

“There will be a token, there will be an airdrop,” Modabber said, adding that they’re taking their time to make it “a token with true utility, longevity, and to be around forever.” In other words: no vapor, no rush, no rug.

Right now, the team’s main focus is the U.S. app relaunch – fully cleared to go live again after regulators benched them back in 2022. Once that’s out, the token’s next up. Speculation’s already spinning that airdrop allocations will be based on trading volume, meaning the most active users could cash in hardest.

Rumors say Polymarket’s exploring a new round that could value it at $15 billion – not bad for a platform most of TradFi still pretends doesn’t exist. The POLY token will be the bridge between that kind of capital and the community that built it. 🎟️

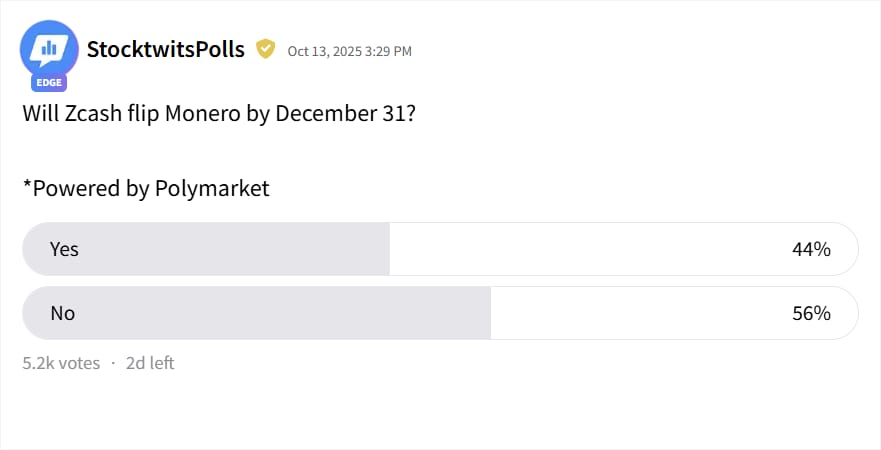

POWERED BY POLYMARKET

Speaking Of Polymarket, Here’s A Poll You Should Take 👇️

Only two days left! 😱

Honestly, I thought $ZEC.X ( ▲ 10.82% ) might pull out the win here, but the $XMR.X ( ▲ 5.21% ) believers are strong. But a lot can happen in two days. 💪

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🌎 Alchemy Pay & dLocal Bring Instant Bank Transfers to Argentina

Alchemy Pay partnered with dLocal to enable instant fiat-crypto transfers in Argentina, using local rails for real-time settlements. For users, that means buying and selling digital assets as easily as sending a bank transfer – no middlemen, no delays. Alchemy Pay.

🧩 DeXe Explores ‘Virtual Agent Economies’ for AI-Driven Governance

DeXe is building “mission economies” – controlled sandboxes where AI agents negotiate, trade, and collaborate at machine speed under human oversight. Think decentralized marketplaces for robotic fleets or AI assistants, powered by verifiable credentials and on-chain trust. It’s governance for the coming age of AI diplomacy – transparent, accountable, and programmable. DeXe.

💵 Native USDC & Cross-Chain Transfers Coming to Starknet

Circle’s native USDC and CCTP v2 are landing on Starknet, unlocking instant, regulated stablecoin transfers and smooth on/off-ramps. That means better DeFi liquidity, faster cross-chain swaps, and fewer “bridged” headaches. Goodbye, USDC.e – hello, the real deal. Circle.

⚡ Ethereal Launches USDe-Native Perps – Trade, Earn, Repeat

USDe perps are now live on Ethereal, giving traders the ability to earn yield on their entire margin balance while they trade. Built within Ethena’s fast-growing ecosystem, this move cements USDe as DeFi’s new backbone – where your trading collateral doesn’t just sit idle, it works for you. Ethena.

📡 COTI + Reverly Bring Private, Offline Crypto Messaging to the World

WhatsApp meets walkie-talkie meets Web3 – and it could keep people connected when the internet doesn’t. COTI’s privacy tech is powering Reverly, an AI-driven messaging app that works without internet – yes, really. Using Bluetooth mesh and LoRaWAN, it lets users send messages or crypto even when networks are down, all encrypted with COTI’s garbled circuits for true censorship resistance. COTI Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

💰 Nomura’s Laser Digital Fund Goes Onchain via KAIO and Sei

Here’s a textbook case of TradFi yield meeting DeFi plumbing – compliant, composable, and instant. Nomura’s Laser Digital just tokenized its Laser Carry Fund on the Sei Network using KAIO’s regulated RWA infrastructure. The fund, which captures yield through arbitrage and staking strategies, is now accessible directly onchain for institutional investors. Sei.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

💞 AI Boyfriends Go Onchain With Metis’ LazAI and Lazbubu

The $28B AI companion craze is moving to Web3. Through Metis’ LazAI and its pet project Lazbubu, users can now own AI companions – human or digital pet – as permanent onchain assets. No more losing your “AI soulmate” to a software update. Every memory, chat, and evolution belongs to you. In short: your digital partner finally can’t ghost you. Metis.

🎯 Radix Rewards Adds Quests: Earn Points Just for Holding NFTs

Radix is gamifying loyalty with Quests, a new way to earn Season Points by holding certain NFTs like RadMorphs or XRD Domains. Think of it as Pokémon meets DeFi: collect digital assets, claim weekly points, and climb the leaderboard for bigger rewards. The best part? More quests – and more eligible NFTs – are rolling out soon. Radix.

🔥 Injective Kicks Off Community BuyBack to Burn $INJ and Share Revenue

DeFi’s version of a stock buyback – except this one’s fully onchain. Injective just launched its first-ever Community BuyBack, letting anyone participate in burning $INJ while earning a slice of network revenue. Users can claim slots on the Injective Hub and directly fuel the protocol’s deflationary engine – the more burns, the fewer tokens, the higher the scarcity. Injective Protocol.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🏦 Aave Labs Acquires Stable Finance to Push Mainstream DeFi

Aave Labs just bought San Francisco’s Stable Finance to double down on consumer-grade DeFi. The move brings in Stable’s iOS savings app tech – letting users earn on stablecoins straight from their bank accounts – and its entire engineering team. Expect Aave’s next wave of products to look less like crypto wallets and more like your everyday banking app. Aave.

NEWS IN THREE SENTENCES

Protocol News 🏦

🔬 Leios Moves From Research to Engineering, Prepares for Public Testnet

Cardano’s Leios project has officially shifted from theory to build phase, now under Input Output Engineering. It’s the next major scalability upgrade, promising higher throughput and more efficient consensus via endorsement blocks and modular transaction hashing. Faster blocks, smoother performance, and fewer headaches. Cardano.

LINKS

Links That Don’t Suck 🔗

💹 Gold vs Ethereum: Which hits $5K first? Here’s what the charts say

😆 Pumpfun acquires memecoin trading terminal Padre

🙄 Former Fed chairs Bernanke and Yellen urge Supreme Court to overturn Trump’s global tariffs

🏦 Payment processor Zelle taps stablecoins for cross-border payments

🤖 I haven’t worked in industry, but I’m right about America’s robot problem

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋