Nvidia Can Sell To China Again

CLOSING BELL

Nvidia Can Sell To China Again

The market fell while tech climbed Tuesday, after Consumer Price Index inflation data showed prices climbed about 2.7% since last year in June, a little higher than expected. It looked like the first of the long-dreaded tariff price increases, if only by a smidge.

Still, core prices climbed less than feared, and aside from inflation, tech stocks soared on Tuesday with fresh news for AI chip exports, and continued rare earth buyouts. The largest banks reported on their second quarter results, showing strong trade desk revenue and IPO activity, but cautioned about the times ahead. 👀

Today’s issue covers: Nvidia can sell H20 chips to China again, Big banks report big earnings, small caps suffer from souring sentiment, and Indonesia gets first trade deal, plus more. 📰

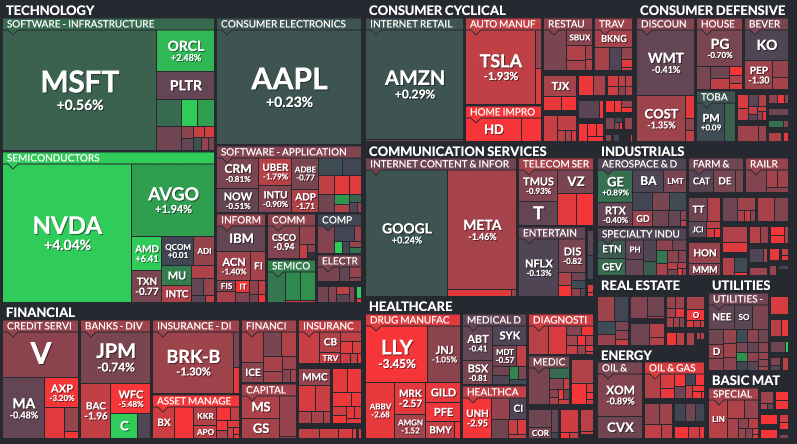

With the final numbers for indexes and the ETFs that track them, 1 of 11 sectors closed green, with tech $XLK ( ▲ 0.89% ) leading and materials $XLB ( ▼ 2.06% ) lagging.

S&P 500 $SPY ( ▼ 0.43% ) 6,243

Nasdaq 100 $QQQ ( ▲ 0.09% ) 22,884

Russell 2000 $IWM ( ▼ 1.96% ) 2,205

Dow Jones $DIA ( ▼ 1.0% ) 44,023

STOCKS

Nvidia Can Sell To China Again, Because Why Not?

In a testament to how the tables have turned, Nvidia said in a blog post Tuesday that Chief Jensen Huang is filing to sell H20 GPUs in China, after hauling sales in April.

The news sent the stock $NVDA ( ▲ 4.04% ) to a fresh all-time high of over $172/share, and ripped the Nasdaq tech stock world with it.

Back in the spring, the firm said it had to write down a $8B+ loss on the sales halt, but after meeting with President Trump in Washington last week, and heading to China for a business conference there, Huang apparently got the go-ahead he needed. He appeared on CCTV, China’s state broadcaster to announce the informal approval received from the U.S. Commerce Dept.

Speaking on Bloomberg TV, Treasury Secretary Scott Bessent said the restriction was a bargaining chip that the White House used during London trade talks with China. Nvidia has faced bans for selling high-tech chips to China since the Biden administration. Like a gas station selling aftermarket pills, Nvidia has kept changing its design formula to circumvent bans, until the most recent H20 ban. 🍁

Bloomberg Intelligence writes that the reversal could help Nvidia recover $15 billion in data center revenue that was at risk this fiscal year.

$AMD ( ▲ 6.41% ) also climbed, after it said it received clearance to resume its M1308 chip shipments to China. The firm said the White House chip halt would lead to a $800M loss. Read more 📉

SPONSORED

Amp Up Your Edge: Aggressive Daily Trading on the Hottest Names

If you’re the kind of trader who thrives on volatility, momentum, and making bold moves—this is for you. Direxion’s Single Stock Daily Leveraged ETFs give you the tools to supercharge your short-term trades in some of the market’s most-watched names. Want to double down on Nvidia or ride the Tesla wave? These ETFs offer 2X or -1X daily exposure, letting you express bullish or bearish views with precision and speed. Designed for experienced traders who live for the action. Significant risk involved.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

Welcome To Q3, Where The Market Reports Q2, And The House Always Wins 🙃

The largest financial institutions, or at least the largest investment banks, began reporting results Tuesday, kicking off a fresh earnings season, YEE HAW. Let’s piece together how they held up during the April liberation day onward. Take a wild guess, as investor excitement with volatile markets minted multiple record volume trading days?

-

JPMorgan Chase & Co. reported earnings per share of $5.24 and revenue of $45.68 billion in the second quarter, surpassing Wall Street estimates of $4.48 and $43.81 billion. The stock climbed, though the report was smaller compared to a large one-off gain in the same period last year.

-

Citi stock soared to a 17-year high after a Q2 earnings beat, fueled by strong trading revenue and a $4 billion buyback announcement. Profit climbed 25%, as market volatility sent investors to trading desks to move their assets. Markets’ revenue jumped 16% to $5.9 billion, its best performance since the second quarter of 2020.

-

Wells Fargo shares dropped after the bank’s Q2 results missed expectations, and the bank lowered net interest income guidance amid weakening consumer credit trends.

-

BlackRock Inc., the world’s largest asset manager, on Tuesday reported Q2 EPS of $12.05, beating an estimated $10.78, while its $5.42 billion revenue came in slightly lower than the expected $5.45 billion. Even with $12T in assets, the stock fell when the asset manager said they pulled in only $94M in fees, compared to estimates for $114M.

Alongside results that impressed Wall Street, JPM Chief Jamie Dimon emphasized that the economy was resilient, consumers were going to enjoy deregulation and the fresh tax breaks, but there were still risks on the horizon.

“The finalization of tax reform and potential deregulation are positive for the economic outlook; however, significant risks persist,” Dimon said, “including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits, and elevated asset prices.”

Reuters reported that JPMorgan economists estimate the most recent batch of tariffs announced this weekend would likely add 0.4 percentage point to inflation. That would mean prices climbing above 3% by 2026, complicating the case for Federal Reserve officials to consider lowering interest rates soon.

Speaking about the Fed, and Chair Jerome Powell’s job (which some have speculated Dimon might be after one day) Dimon said preserving Fed independence is “absolutely critical,” and that toying around with the Fed was not a good idea.

Dimon said that Trump has made clear he will not remove Powell. 🧓

POPS & DROPS

Top Stocktwits News Stories 🗞️

Apple is reportedly investing $500 million into a U.S.-based rare earths supplier to strengthen domestic sourcing and reduce dependence on China. Read more

Tesla lost key North American sales executive Troy Jones after 15 years with the company, compounding recent leadership exits and raising fresh concerns around Elon Musk’s management and succession planning. Read more

Elevance shares dipped after Wells Fargo cut its price target ahead of Q2 earnings, reflecting caution on growth potential and cost pressures. Read more

Albertsons beat Q2 expectations thanks to surging digital pharmacy sales, fueling bullish retail sentiment around its health-focused growth strategy. Read more

Joby Aviation stock popped as investors cheered the expansion of its Marina facility, signaling growing momentum in its electric air taxi ambitions. Read more

Broadcom unveiled its Tomahawk Ultra chip, designed to dramatically accelerate AI data flow across cloud networks with higher bandwidth and energy efficiency. Read more

Stellar is intensifying its push for decentralization by expanding validator diversity, minimizing foundation control, and investing in ecosystem tools to boost network resilience. Read more

Bitcoin dropped below $117,000 after hitting a record high past $123k, as investors locked in $3.5 billion in profits amid cooling momentum. Read more

Zeekr will go private in a $2.4 billion deal with Geely, aiming for faster innovation and operational flexibility as EV competition intensifies. Read more

CoreWeave committed $6 billion toward building next-gen AI infrastructure across the U.S., including data centers and energy assets to support rising enterprise demand. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS RETAIL RADAR

Small-Caps Succumb To Souring Sentiment ($IWM) 🛑

Last Friday, we showcased Stocktwits Sentiment and Message Volume data that suggested retail’s enthusiasm toward small-cap stocks was waning. Now that prices are starting to turn lower, let’s see how retail is positioning itself. 👇️

In mid-June, $IWM sentiment peaked and signaled a divergence after failing to reach new highs alongside prices. Last week, sentiment pushed firmly into ‘Bearish’ territory, suggesting retail expected a pullback after this record run.

With today’s move lower, sentiment touched its most bearish level since April, but message volume remains subdued. This could signal that more downside is needed to reach “peak fear” levels. 😬

When combining this with the technicals, Russell 2000 futures are pulling back from a key area of support/resistance near 2,300. The Relative Strength Index (RSI) confirmed a divergence, and today’s fall was the largest since May. 🧐

The long-term trend remains intact for investors, but retail is positioning for a ‘pause that refreshes’ after a record run. We’ve shifted from an environment where broad-based index exposure dominated to one where retail participants are becoming more selective in the stocks they’re playing. At least for the short term.

Add $IWM to your watchlist to monitor this trend reversal. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓️

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in the Russell 2000 as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

DEATH AND TAXES

Second Pause A Charm: First Deal Announced A Week After Most Recent Levies

President Trump announced a new deal with Indonesia on Tuesday, reaching 19% tariffs, which is relatively lower than the 32% rate set just last week. The agreement marks the third or so deal reached since the tariff push began nearly five months ago, though, like the Vietnam announcement a week or two ago, Indonesia has not confirmed the exact numbers yet.

The two nations trade about $38B in goods annually, according to the Commerce Department. Trump also said the nation would buy $15B in energy, $4.5B in agricultural goods, and 50 Boeing planes. CNBC reported that Indonesian airline Garuda was already in discussions to purchase 50-75 Boeing jets.

Meanwhile, in North America, Canadian Prime Minister Mark Carney said Trump’s proposed tariffs are likely “unavoidable” for Canada, a recent rise from the 25% levy on non-USMCA goods.

Speaking of USMCA, Tomato prices are projected to spike after the Trump administration reinstated a 17% duty on Mexican imports.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Core PPI (8:30 AM), PPI (8:30 AM), Crude Oil Inventories (10:30 AM), Beige Book (2:00 PM), FOMC Member Williams Speaks (4:30 PM). 📊

Pre-Market Earnings: Bank of America ($BAC), Johnson & Johnson ($JNJ), Goldman Sachs Group ($GS), ASML Holding ($ASML), Morgan Stanley ($MS), PNC Financial Services Group ($PNC), Prologis ($PLD), and Progressive ($PGR). 🛏️

After-Hour Earnings: United Airlines Holdings ($UAL), Alcoa ($AA), and Kinder Morgan ($KMI). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

⚠️ Stealth Stake Sales Helped UnitedHealth Beat Wall Street Targets

😨 It’s a huge week for crypto in D.C. But the industry may not get everything it wants

👀 Here’s the inflation breakdown for June 2025 — in one chart

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋