Open‐Interest Reality Check: Crypto Running Hot or Cold? 🌡️

OVERVIEW

Open‑Interest Reality Check: Crypto Running Hot or Cold? 🌡️

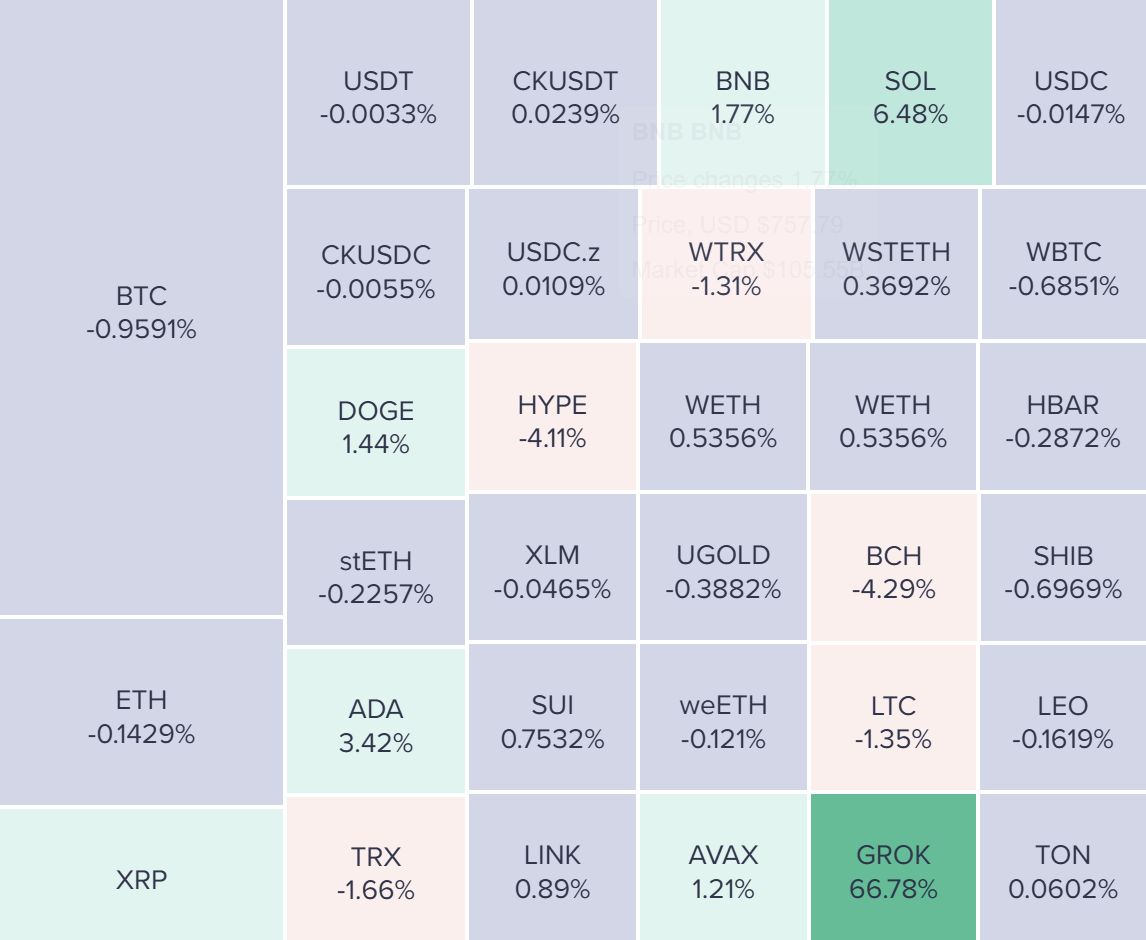

Before we dive in, here’s today’s crypto market heatmap:

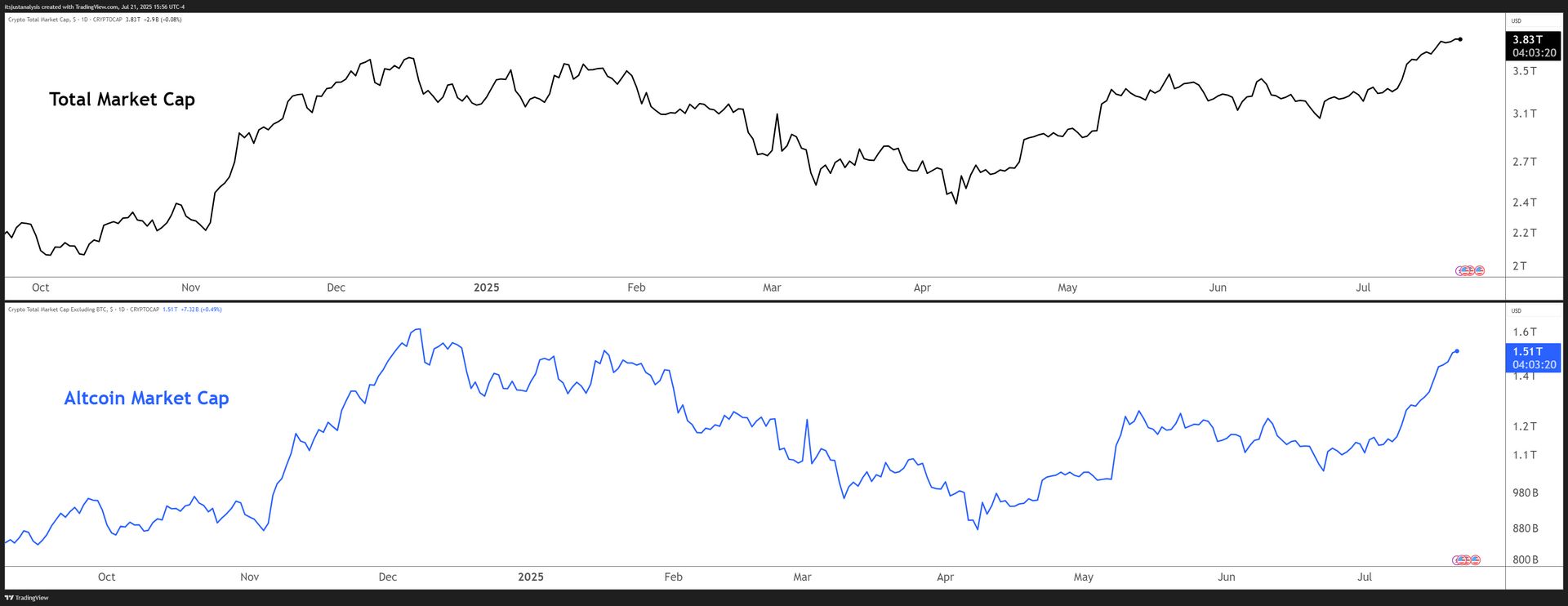

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

Open-Interest Reality Check: 30-Day Sizzle 📊

Raw open‑interest charts spit out big numbers but forget to tell you when leverage flips from “healthy curiosity” to “someone’s about to get margin‑called.” 🤔

Tired of guessing, I made something new. I fused price change, OI velocity, and real volatility into one blunt score: the Leverage Absorption Ratio (LAR).

High LAR? Buyers are soaking up leverage. Low LAR? House‑of‑cards time.

The Details 👀

-

Open interest (OI): Counts live futures contracts – a leverage gauge.

-

Data window: June 21 - July 21 2025 (30‑day view).

-

Goal: Spot who’s eating leverage gracefully and who’s about to burp firey acid reflux.

Leverage Absorption Ratio (LAR): The Cheat‑Code Metric 🧮

|

LAR Score |

Readout |

|---|---|

|

> 5 |

Smooth Sailing – leverage absorbed, price glides |

|

3 - 5 |

Check Engine – leverage warming, monitor funding |

|

< 3 |

Danger Zone – leverage stack primed to blow |

TL;DR 🎯

|

Crypto |

LAR |

Readout |

|

SOL |

5.27 |

Smooth Sailing |

|

SUI |

5.09 |

Smooth Sailing |

|

AVAX |

5.08 |

Smooth Sailing |

|

HBAR |

3.57 |

Check Engine |

|

XLM |

3.91 |

Check Engine |

|

ALGO |

4.02 |

Check Engine |

|

TRX |

4.30 |

Check Engine |

|

ADA |

2.95 |

Danger Zone |

30‑Day Look 🔥

-

SOL, SUI, AVAX: Sub‑100% leverage growth paired with solid price gains – clean, bullish.

-

XLM: Futures exploded +222%; price only doubled. That’s tinder for a squeeze.

-

ADA: Leverage ballooned but price lagged – watch your stops.

ON-CHAIN ANALYSIS

Deep Dive & Long‑Term Context 🔍

Full‑Run Numbers (Jan. 1, 2024 - Jul 21, 2025)

|

Crypto |

OI % |

Price % |

|

SOL |

+145.2 |

+28.3 |

|

SUI |

+469.7 |

+392.7 |

|

AVAX |

+13.1 |

−7.4 |

|

TRX |

+257.8 |

+146.1 |

|

ALGO |

+292.2 |

+101.4 |

|

XLM |

+869.3 |

+420.9 |

|

HBAR |

+662.4 |

+265.4 |

|

ADA |

+33.4 |

+119.0 |

Year‑Plus Reality Check 🕰️

-

XLM: OI king at +869%; price +421%. Longs loaded.

-

HBAR & SUI: Huge leverage & price climbs – real demand, not just hot money.

-

AVAX: Barely moved all year until this month’s pop – early accumulation or dead‑cat stretch.

Coin‑by‑Coin 🪙

-

ALGO: Some might say a headline is needed to justify a 149% leverage hop.

-

SUI: Leverage nearly doubled this month, 5x since ’24. Quiet coil, ready to pop.

-

HBAR: Works till sentiment flips. Mind funding.

-

TRX: Stable leverage parking lot. Meh until catalyst.

-

ADA: Short-term leverage balloon with lagging price. House‑of‑cards alert.

-

XLM: Biggest leverage inflow; volatility powder keg.

-

AVAX: Fresh leverage surge after a sleepy year. Spot confirmation needed.

-

SOL: Leverage +79% (30d), +145% (full). Best LAR in the short-term. Buyers own the dance floor.

Closing Shot 🏁

Short horizon crowns SOL, SUI, AVAX. Long horizon watches XLM, HBAR, SUI for staying power. LAR keeps you ahead of the next funding‑rate puke – let’s track it weekly so the market doesn’t teach us gravity the hard way. 😈

NEWS

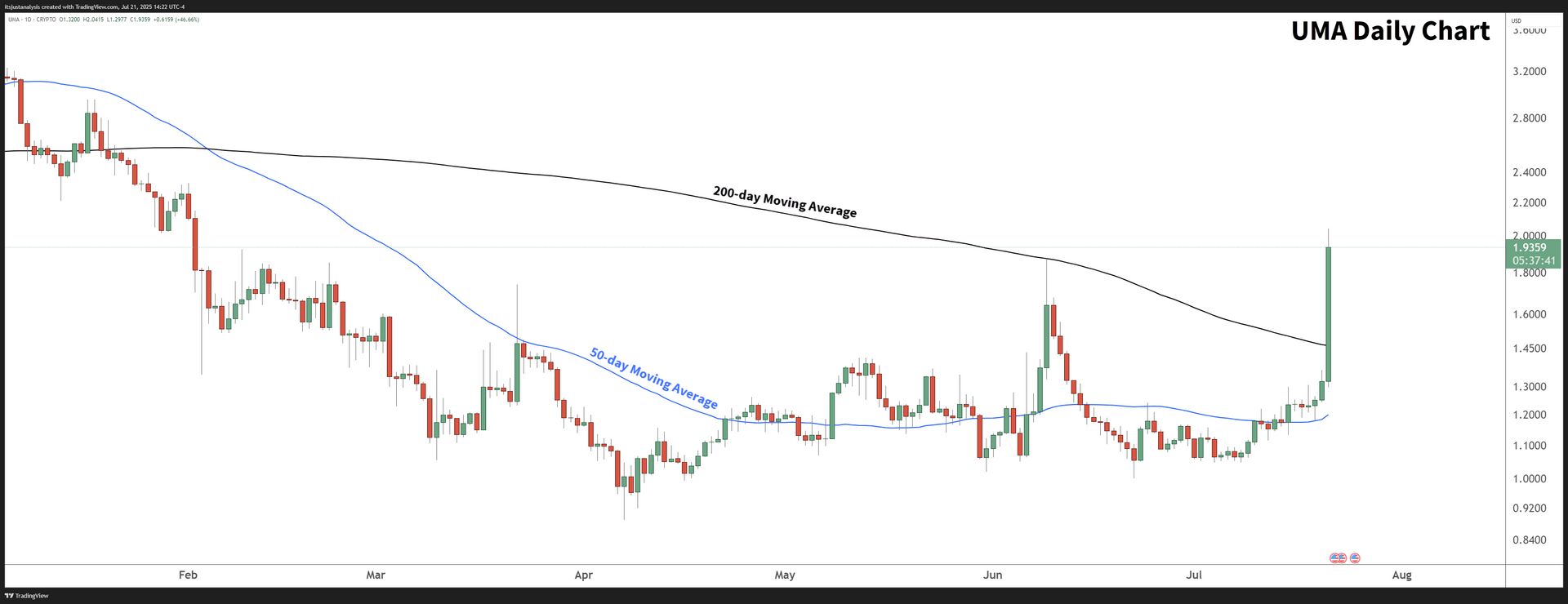

Prediction Markets Level Up: UMA Bags Gains On Polymarket Returning To USA Deal 🔼

$UMA.X ( ▲ 41.26% ) popped 50% today as Polymarket snags QCEX, and anyone who read the June 6 Litepaper shouldn’t be shocked. 🚀

-

Wut’s UMA?: UMA is the brain behind how Polymarket resolves disputed cases (examples: Zelenskyy wearing a suit or Astro vs. Dodgers).

-

Deal size: Polymarket drops $112 million on QCEX’s CFTC‑licensed exchange + clearinghouse.

-

Scale: $6 billion in wagers on Polymarket in H1 2025 alone.

-

Next up: U.S. users get a regulated prediction market instead of “use‑a‑VPN‑and‑pray.”

Polymarket’s CEO Shayne Coplan called the platform “synonymous with understanding probability.” QCEX founder Sergei Dobrovolskii basically replied, hold my license. The marriage gives Polymarket the regulatory hall pass it needed to stroll back into America.

Why does UMA care? Because its Optimistic Oracle already powers half the on‑chain prediction toys, and every time Polymarket scales, UMA scoops up more usage fees.

So What?

Prediction markets are no longer nerd side‑quests. 🙋

-

Regulatory clarity lures real liquidity.

-

UMA’s oracle fees rise with each settled bet.

-

Polygon processes the traffic, proving “Ethereum but cheaper” still sells.

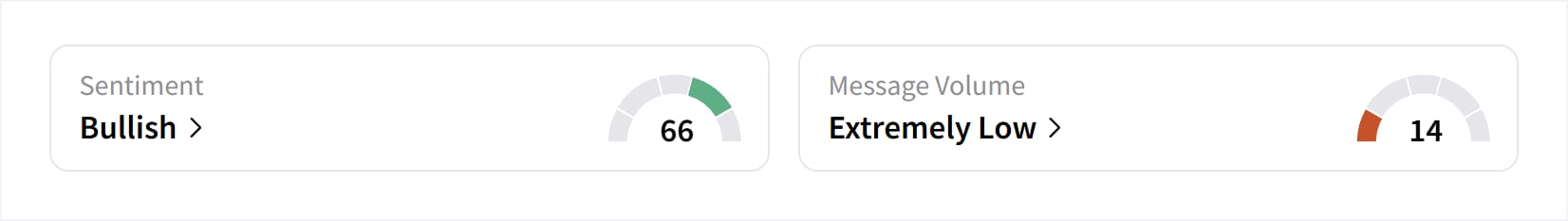

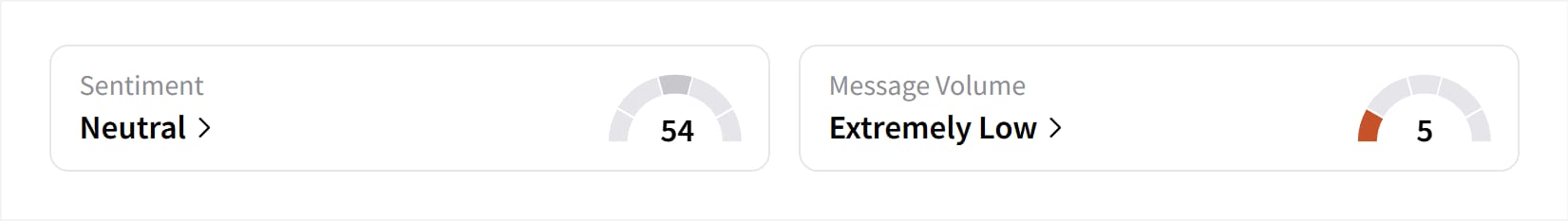

UMA spiked nearly +50% intraday (as of 1500 EST) and Stocktwits’ users are bullish.

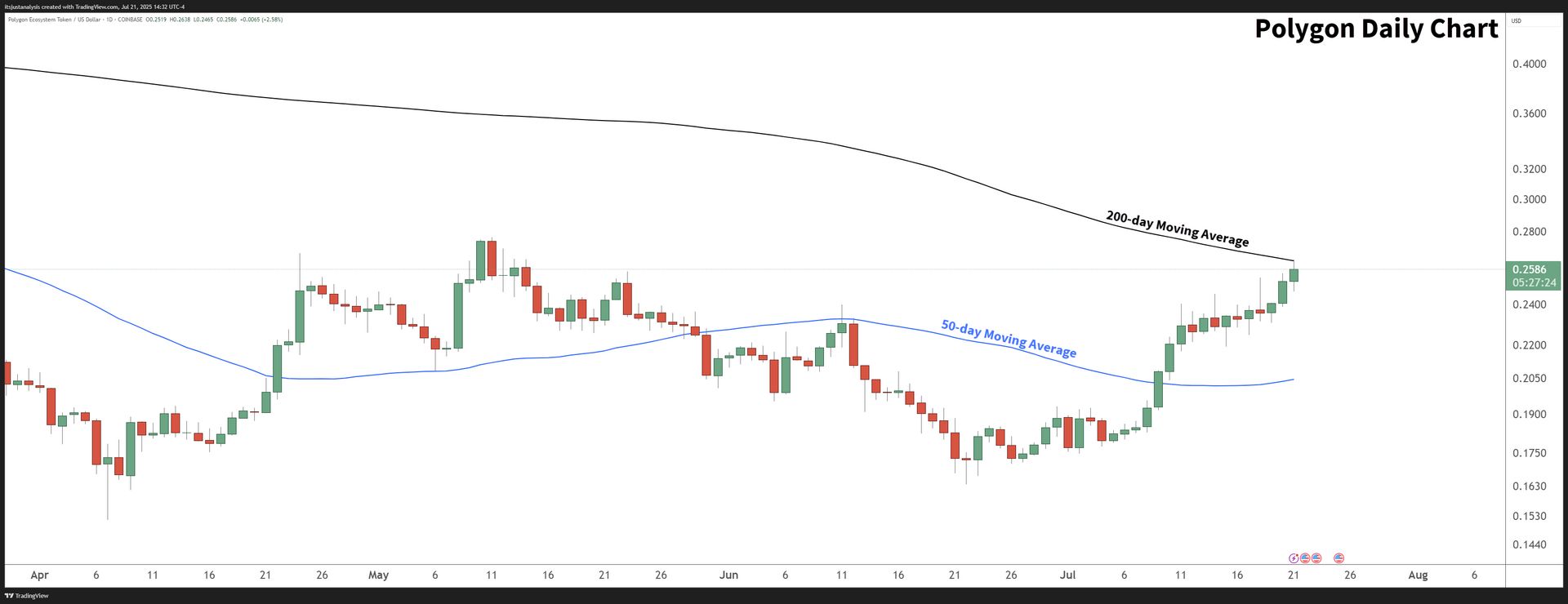

What about Polygon? $POL.X ( ▲ 0.82% ) is unloved, unknown, and nobody even wants to talk about it. 🥹

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

💵 USDY Treasuries Catch a Bullet Train to Sei

Say hello to Wall Street speed with DeFi composability. Ondo’s tokenized T-bill vault, second-biggest on chain, is landing on Sei’s sub-second rails as productive collateral. Sei blew past 821 percent TVL growth to $670 million, so plugging in 32 percent of the treasury-token market should crank the yield machine. Ondo Finance.

🌞 Stellar Declares “Stable Summer” and Shows Real-World Receipts

At ETHCC Cannes, SDF flaunted MoneyGram cash-outs, stablecoin payrolls, and Franklin Templeton tokens riding XLM rails. Panels ditched maxi bickering and drooled over on-ramps, compliance, and quiet infrastructure that actually moves money. Turns out “boring” is sexy when nurses get paid on time. Stellar.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏀 Pistons Rewards Turns Gas Receipts Into Free Jerseys

Uptop ports its Cavs loyalty engine to Detroit with AI receipt scans, live prediction bets, and Avalanche settlement humming under the hood. Fans rack points on groceries, gas, and guessing the over-under, then swap them for merch or lower-bowl seats. Blockchain stays invisible – the tech finally learned to… rebound (dad pun 100% intended). Avalanche.

💻 CUDOS Logs 2.5 Million GPU Hours and Lands on Jensen’s Slides

Permissionless servers printing cash – cloud incumbents might want a towel. June’s report brags $2.2 million revenue, two-minute Nexus node templates, and a cameo in NVIDIA’s keynote. Wallet-only, no-KYC compute keeps powering ASI while obliterating every 2024 metric. CUDOS.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

📊 Chaos Labs Says Aave Survives a 30 Percent ETH Crash Without Flinching

Their 40-page risk paper models $2.5 billion in USDe loops and Pendle PTs, concluding bad-debt odds sit under 0.1 percent even if a CEX implodes. Oracle floors, eMode caps, and Monte Carlo hedges keep contagion caged. Translation: find something else to FUD. Chaos Labs.

🔄 NEAR Intents Warps 80 Assets Into Sui in One Click

So much for cross-chain being hard – the usual excuses just vanished. Sui’s DeFi already flexes $1.7 billion TVL and now slurps tokens from 20 chains without bridge headaches. Swapping BTC, DOGE, or granny’s XRP happens in seconds while a solver hides the gas-juggling mess. Sui.

🗳️ Starknet Waves 5 Million STRK at Validators Who Show Up

The Foundation will match stake 1:1, cap at 5 million STRK, and slash nobody’s uptime excuses on the march to proof-of-stake. Stake matching, residual pools, and sub-10 percent commissions aim to spread power before whales get comfy. Validators wanted – bring hardware, keep 99 percent uptime, skip the drama. Starknet.

🚚 LTO Abandons Its L1, Hops to Base, and Sets a Two-Month Token Swap Clock

Maintaining a solo chain proved pricey, so LTO will burn the boats, issue an ERC-20, and hand governance to a community DAO. Miss the short swap window and your old tokens age like unrefrigerated milk. Tough love, but excess baggage slows the trek. LTO Network.

LINKS

Links That Don’t Suck 🔗

🤦 UK Chancellor Mulls Selling $7.2B Bitcoin Stash to Plug Gap in National Finances

👍️ Aave proposal to launch centralized lending on Kraken’s Ink moves to next phase

🦺 Crypto custodian BitGo joins Grayscale in confidentially filing IPO documents with SEC

🤮 ‘Sick to my stomach’: Why Dave Portnoy fumbled his XRP bag before the boom

🙄 Expert sets timeline when quantum computers will ‘rip Bitcoin to shreds’

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋