OpenAI Goes Code Red

Presented by

CLOSING BELL

OpenAI Goes Code Red

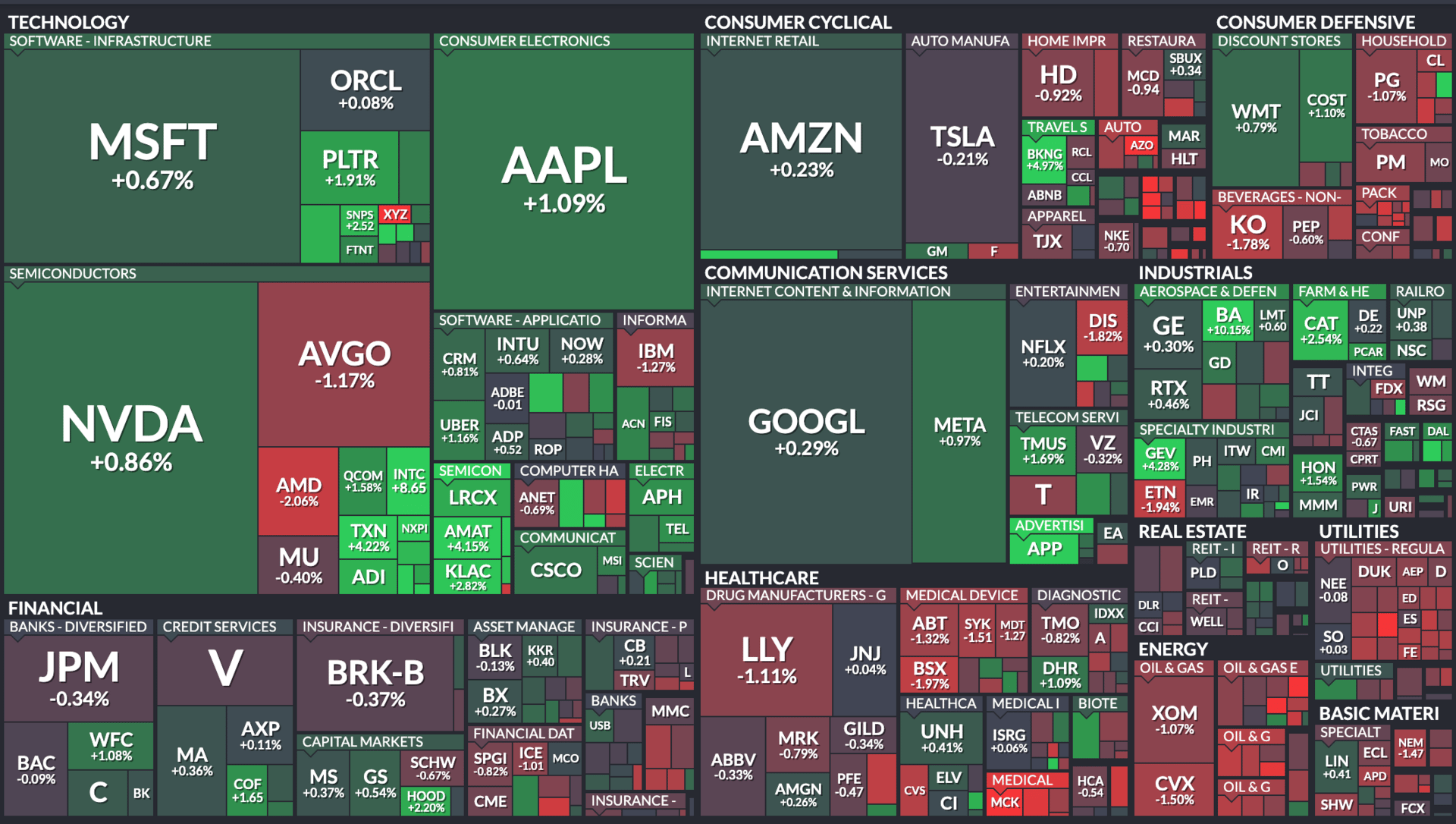

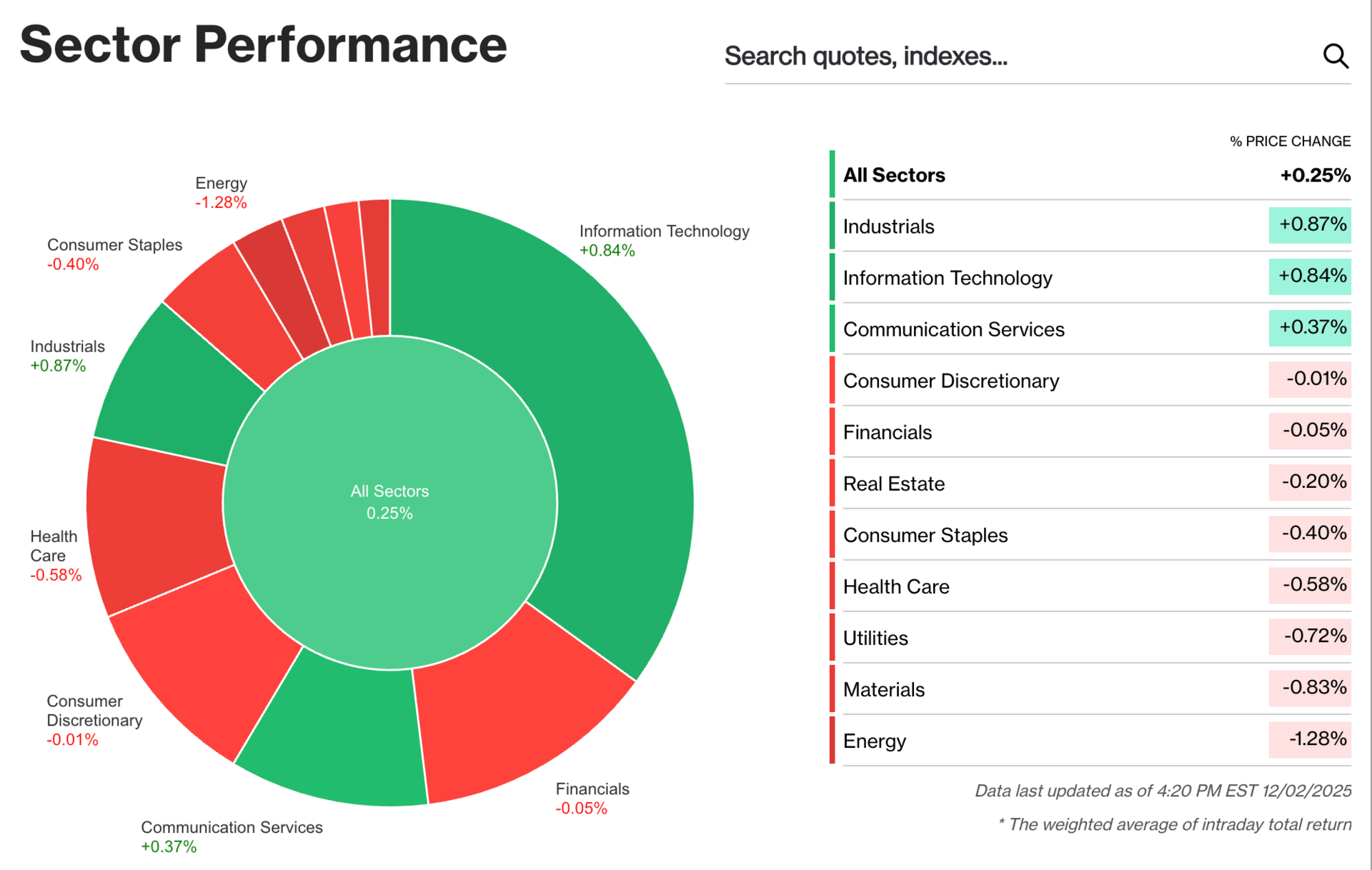

The market is green on Tuesday, after starting the week and December off in the red. November barely closed positive, the seventh month of gains slowing.

Tech climbed back, metals were minting records, Boeing jumped 8% to lead the S&P 500 higher after an optimistic 2026 sales preview, and Bitcoin was back above $90k. It was enough of a rebound for some to call the stat of the Santa Rally- the typical end-of-year push toward higher prices that makes December one of the greenest months of the year.

Uneven macro data drops and volatile price reactions to tech news could turn this December into a wild month, Omar Aguilar, CEO of Schwab Asset Management, said. Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets, told Yahoo Finance she’s not sure if there will be a Santa Rally this month.

Nothing gets a rally going like holiday shopping, and the National Retail Fed found a five-year record 202.9M consumers shopped in the past couple of days of deals. The same trade group found that retailers hired the fewest workers in nearly two decades this year to man the front lines. 🪖

Speaking of Macro, Trump hinted Hasset will be the FOMC chair, but said to wait till 2026 to find out for sure, while thanking Michael and Susan Dell for their enormous $6.25B pledge to set up $250 savings accounts for some Americans under the age of 10. 👀

AFTER THE BELL

Retail And Tech Reporting Post Market Tuesday 🛍️ 💻️

Earnings have been solid this season. 95% of companies on the S&P 500 have reported, and the index is on track to post a 13% jump in EPS, compared to weak 7% guidance before the reports started to roll in.

Crowdstrike Holdings Inc $CRWD ( ▲ 2.46% ) was falling in the post-market Tuesday. The cybersecurity giant posted a record annual recurring revenue and raised its full-year, a classic beat and raise from an AI adjacent software provider. The stock price did not react like it was a classic beat and raise, though.

ARR rose to $265 million in the quarter, up 73% year over year. It posted rev $1.23B and EPS $0.96 vs $1.21B est, $0.95 est. For the fourth quarter, CrowdStrike expects revenue of $1.29 billion to $1.30 billion, and projects adjusted net income of $282.1

$MRVL ( ▲ 1.97% ) Marvell Tech was up 11% in the post-market. It posted an EPS beat $2.20/share with revenue at $2.07B. Data center revenue rose to $1.52B. Marvell aslo said it is set to acquire Celestial AI for up to $5.5 billion.

Okta Inc $OKTA ( ▲ 1.53% ), the identity management firm, fell after hours, topping street estimates with upbeat guidance that somehow wasn’t enough. Okta said it expects up to $750M and adjusted earnings near $0.85/share in the coming quarter, above expectations.

American Eagle $AEO ( ▼ 1.98% ) was climbing post–market, it posted a raised fourth-quarter outlook and a Q3 beat as it pivoted from its Sydney Sweeney & Travis Kelce jean ad campaigns to good ole’ fashined Martha Stewart ads.

It pulled in 53C/share in Q3 and expects comparable sales growth of 8-9% during the holidays. 🎅

SPONSORED

Gain exposure to Chainlink, with GLNK.

Chainlink is a versatile blockchain network that delivers essential infrastructure for connecting on-chain and off-chain data, serving as the bridge across blockchain ecosystems. For investors looking to participate in the expanding world of digital finance, Chainlink underpins many core applications in the industry, such as tokenization. Now, investors can gain exposure to Chainlink with the newly launched Grayscale Chainlink Trust ETF (GLNK). Just search for the ticker GLNK in your brokerage account.

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink.

Please read the prospectus carefully before investing in the Fund.

Foreside Fund Services, LLC is the Marketing Agent for the Fund.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TECH NEWS

Apple ATH, OpenAI Goes ‘Code Red’ While Intel, Amazon Build Chips 🐿️

Apple hit a fresh high again Tuesday, getting closer to its 45 year IPO anniversary coming on the 12th. It scooped up a new SVP of Machine Learning and AI was coming to town, and was buoyed by the rumored news Intel was going to supply Apple chips. Analysts said Intel would start building M series chips for Apple in 2027 over the weekend.

The rumor came from a twitter post by TF International Securities Ming-Chi Kuo, cited by multiple news sources, but is unconfirmed by other primary sources yet.

Nvidia gained some ground after Amazon $AMZN ( ▲ 0.23% ) showed off a new chip called Trainium4, an in-house AI training chip, a major cost-saving alternative to expensive Nvidia chips.

Tech Crunch reported it wasn’t all bad news for $NVDA ( ▲ 0.86% ) , because the incoming Titanium4 chip, also announced at the AWS re:invent conference, will work hand in hand with Nvidia GPUs to build speed and energy efficiency, coming soon to an energy-guzzling datacenter near you (in 2027?)

OpenAI has not taken the recent Gemini 3 model launch lightly, according to Wall Street Journal. Chief Sam Altman told his company that it was taking AI competition seriously. Gemini surpassed OpenAI on ARC-AGI-2 in November, doubling performance at a tenth of the cost, Alex Conway from DataRobot explained to the Verge.

IN PARTNERSHIP WITH

7 Mistakes People Make When Choosing a Financial Advisor

Interested in finding a financial advisor? SmartAsset’s no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Comcast reportedly wants to combine NBCUniversal with Warner Bros. Discovery under a larger entity.

-

Archer Aviation stock jumped after a deal with Karem for military aircraft technology.

-

Archer Aviation stock jumped after a deal with Karem for military aircraft technology.

-

Gold, Silver, Copper all smashed records in a historic year for metals.

-

Janux Therapeutics stock fell 50% after a prostate cancer trial update prompted widespread Wall Street target cuts.

-

Boeing stock gained after its CFO projected positive free cash flow next year.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

It’s $NKE ( ▼ 0.7% ) and $AAPL ( ▲ 1.09% ) s 45-year IPO anniversary! Both went public in December 1980, and for a while, Nike did better selling shoes than Apple did selling computers, according to price action!

If you invested $2K in both at IPO, how much would you have today?

Instagram post

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: ADP Nonfarm Employment Change (8:15 AM), S&P Global Composite PMI (9:45 AM), S&P Global Services PMI (9:45 AM), ISM Non-Manufacturing PMI (10:00 AM), Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM). 📊

Pre-Market Earnings: Macy`s Inc ($M), Dollar Tree Inc ($DLTR), and Foot Locker Inc ($FL). 🛏️

After-Market Earnings: Salesforce Inc ($CRM), Snowflake Inc ($SNOW), C3.ai Inc ($AI), UiPath Inc ($PATH), and Five Below Inc ($FIVE). 🌕️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

🎩 Witkoff and Kushner meet Putin to discuss Ukraine peace plan

😨 GOP senator: Hegseth is either lying about second boat strike or incompetent

🧦 SEC is pushing back on all the 3x and 5x filings

🛍️ Holiday shopping turnout jumps to 202.9 million people during Thanksgiving weekend, NRF says

🤖 Delayed tariff impact starting to hit, could cause companies to reduce head count in 2026

👼 Michael and Susan Dell donate $6.25 billion to fund ‘Trump Accounts’ for millions of American kids

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋