Portfolio Update

Hi Partner 👋

What an excellent start we’ve had.

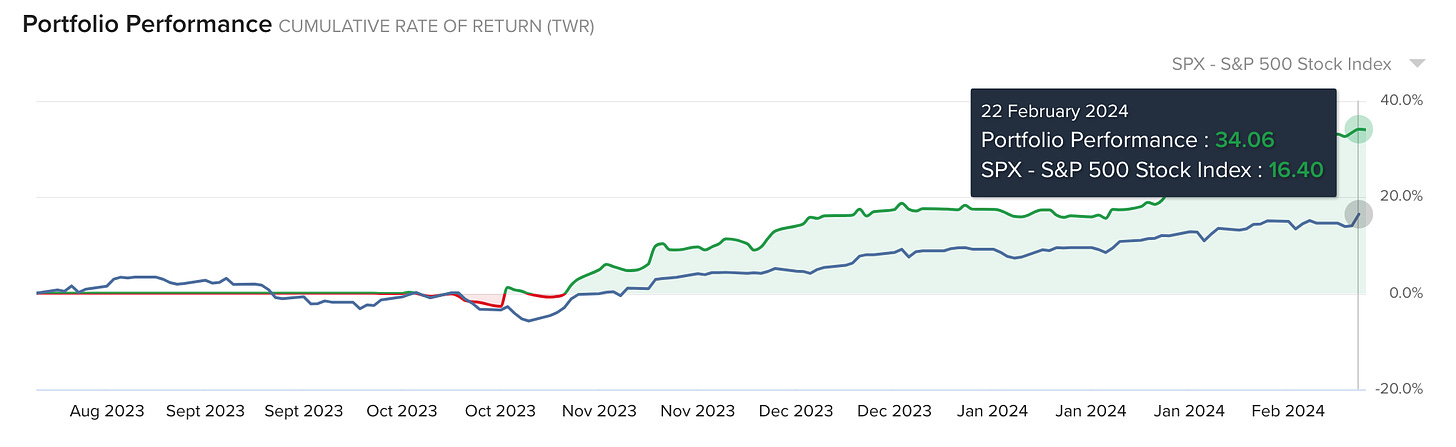

Since Compounding Quality launched on the 1st of October 2023, the Portfolio returned 34.1% versus 16.4% for the S&P 500.

This means we did 17.7% better than the S&P500 over the past 5 months.

Is this level of outperformance sustainable? Absolutely NOT.

The goal is to outperform the index by 3% in the very long term and we don’t care about short-term market fluctuations.

An overview

As a reminder, the essence of our investment philosophy looks as follows:

-

Buy wonderful companies

-

Led by outstanding managers

-

Trading at fair valuation levels

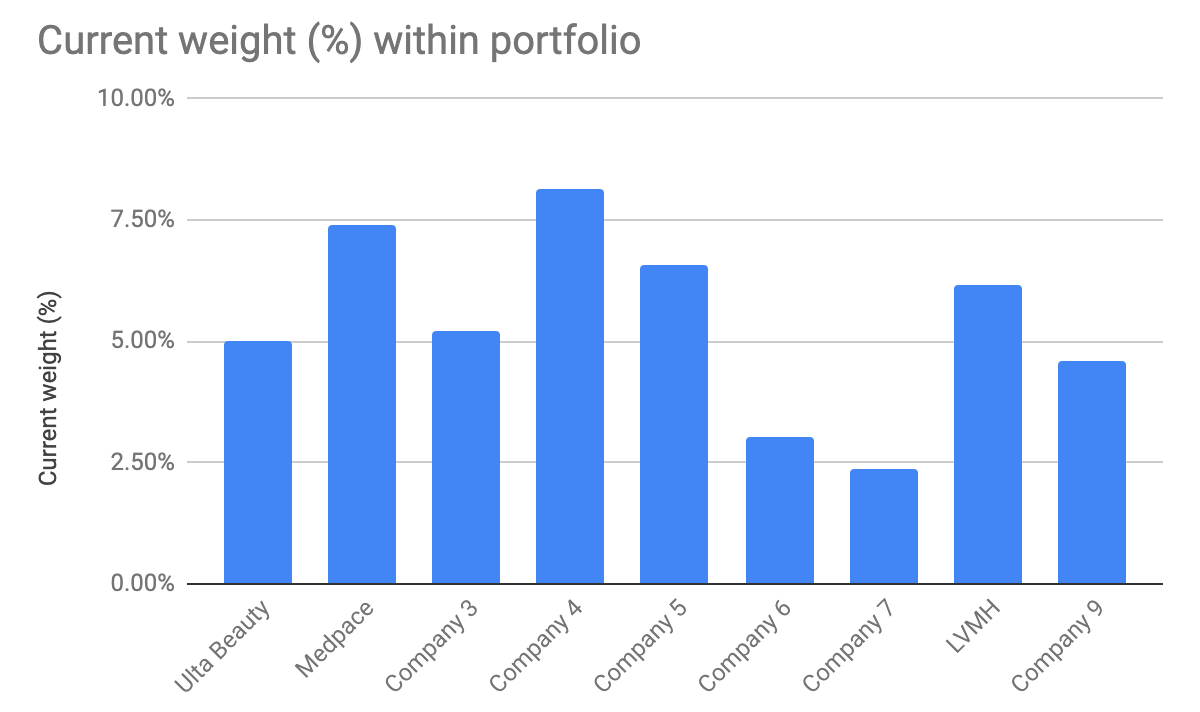

Today, we own 9 wonderful companies in which we truly believe.

Over the next few months, we will evolve to a fully invested Portfolio of 16-18 compounding machines.

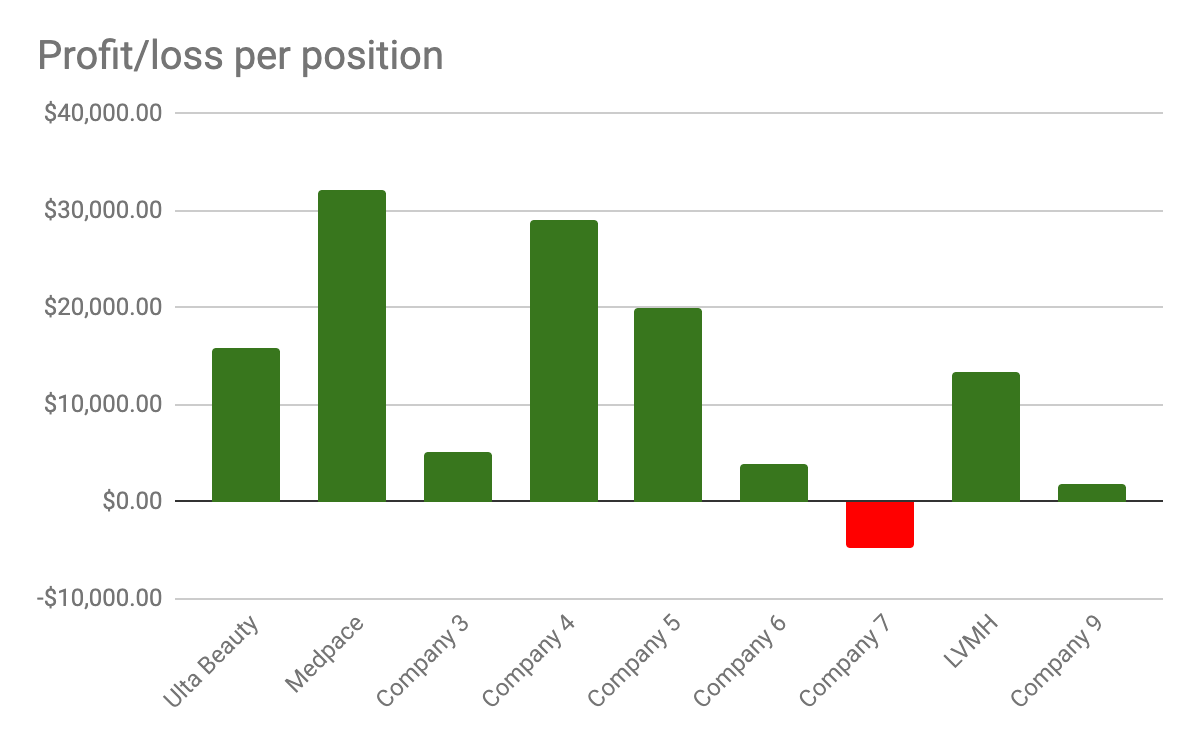

Our Portfolio looks like this:

The Portfolio performed really well since the launch. Luck played a large role in this.

“Luck played a huge role in my career. “I’m just lucky to have been in the right place at the right time.” – Warren Buffett

Three examples of companies that drove returns are Medpace, Ulta Beauty and LVMH:

-

Medpace (+60% since we bought it): Medpace published excellent results twice and the multiple increased from 26.0x to 37.2x since we first bought it.

-

Ulta Beauty (+36%): the market recognized that share buybacks would create a lot of shareholder value at the cheap valuation level the company traded at.

-

LVMH (+25%): We bought LVMH just before they published their full-year results of 2023. The stock increased by 12% that day.

The million-dollar-question obviously is whether these companies are still attractive today.

Let’s update our Models, Quality Scores, and Buy Below levels.

Earnings Growth Model

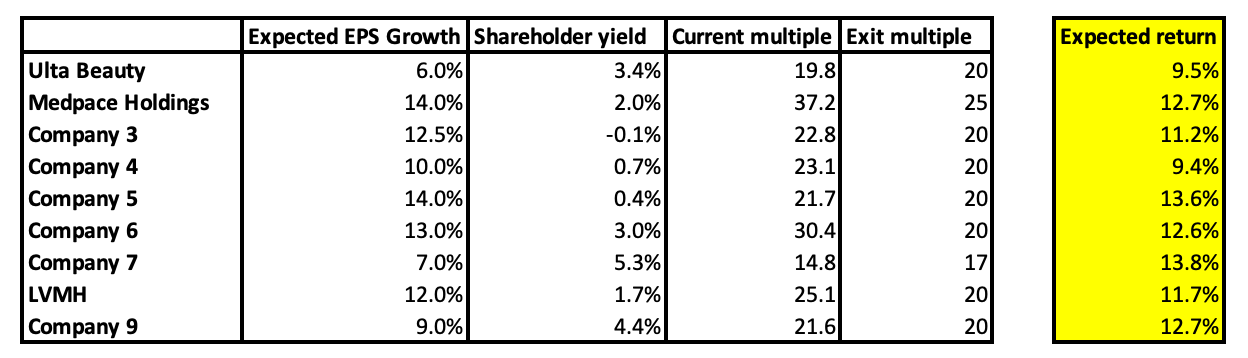

We always use an Earnings Growth Model to estimate our expected yearly return.

Expected Yearly Return = EPS Growth + Shareholder Yield +/- Multiple Expansion (Multiple Contraction)

Here’s what things look like for all our positions:

When you take the average of these expected returns, you get an expected yearly return of 11.9% per year.

I would sign for a yearly return of 11.9% in the future for sure.

Would you too?

Reverse DCF

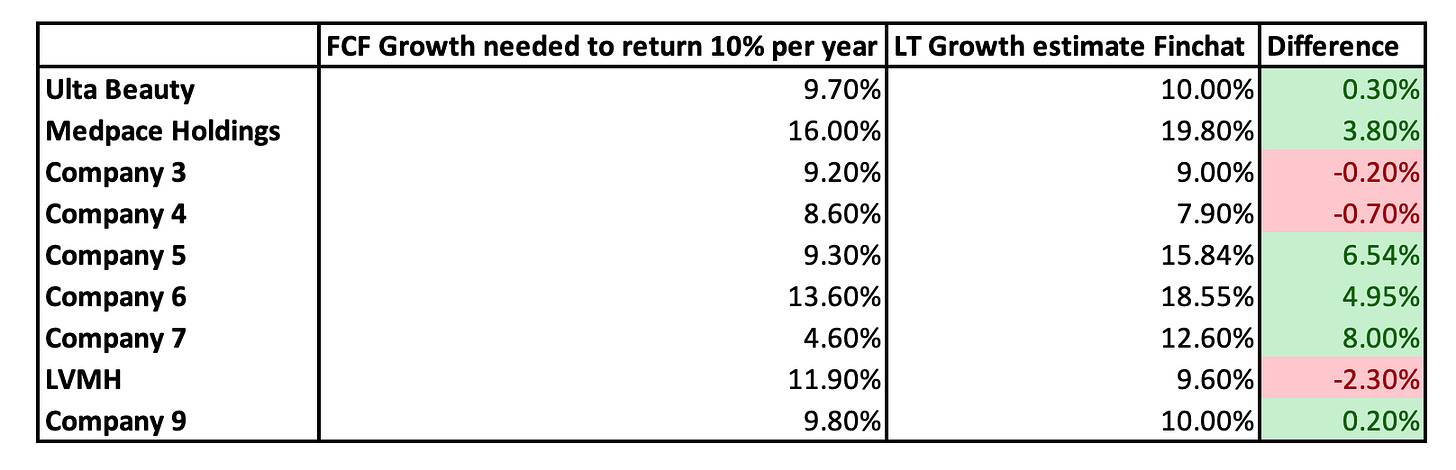

I updated the reverse DCF for all companies within the Portfolio:

But how to look at the table above?

-

Required FCF Growth to return 10% per year: This column shows you at which rate the company should grow its Free Cash Flow to return 10% per year to shareholders

-

Expected LT Growth: This is the expected long-term growth rate of the company based on Finchat data

-

Difference: The difference between the expected long-term growth rate and the required FCF growth to return 10% per year. If the number is marked in green, the expected growth is higher than the required growth rate

As you can see, the expected growth of most companies is higher than the required growth rate to return 10% per year to shareholders.

However, this isn’t true for companies like LVMH.

Does this mean we should consider selling LVMH?

Absolutely not.

The Long-Term Growth Estimates of Finchat are too pessimistic for these 3 companies in my opinion.

I think LVMH will continue to perform well in the years to come.

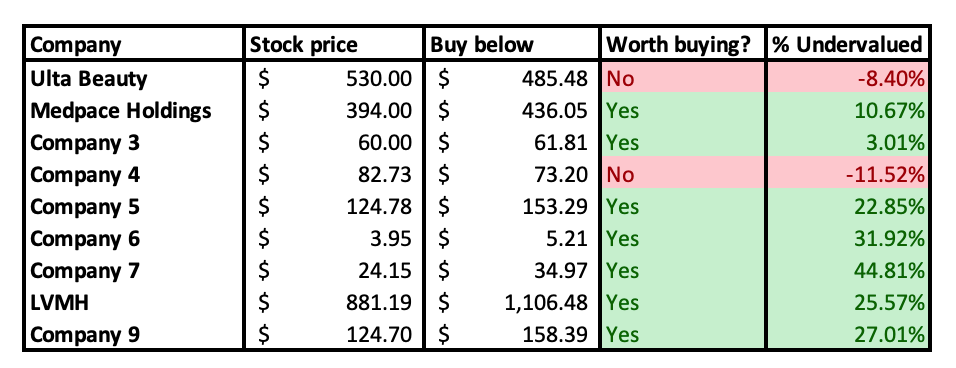

Update Buy-Below Prices

For every company, there is a ‘buy-below’ price.

The buy-below price shows at which price I think it’s interesting to buy these companies.

Recently, a lot of Partners asked questions about it. On which criteria is the buy-below price based?!

The answer? A combination of doing your homework, the current valuation level and gut feeling.

Some Partners asked to quantify the buy-below price a bit more.

And as we are all equals in this (you are just as important for Compounding Quality as I am), let’s address this request.

From now on, the buy-below price will represent the stock price at which your expected annual return is equal to 10% in our Earnings Growth Model.

In other words, when you can buy a company for this price or lower, you can expect a yearly return of 10% when the assumptions we made are correct.

Here’s what things look like for our Portfolio:

Hopefully, this table can help you to make better investment decisions.

Update Quality Scores

Since every company was bought for the first time, we haven’t updated the Quality Scores yet.

Let’s do it right now:

As you can see, most Quality Scores remained the same and some decreased slightly.

The single reason for every decline in the Quality Score?

Valuation. We are long-term investors and we like to buy stocks at cheap prices.

The more our stocks increase, the less we like it as the expected return will go down.

The market is currently in ‘Greed’ mode. We prefer to buy stocks when the market is in ‘(Extreme) Fear’.

Conclusion

Here’s what you need to remember from today’s article:

-

The Portfolio has performed exceptionally well since the start. Our return is equal to 34.1% over the past 5 months (outperformance versus S&P 500: +17.7%

-

Is this level of outperformance sustainable? Absolutely NOT.

-

Today, we own 9 wonderful companies in which we truly believe. Over the next few months, we will evolve to a fully invested Portfolio of 16-18 stocks.

-

Earnings Growth Model: The expected yearly return for our Portfolio is equal to 11.9%

-

Reverse DCF: Most companies in our Portfolio look undervalued today

-

Update Buy Below prices: We update the buy below prices to the prices at which your expected yearly return would be equal to 10%

-

Update Quality Scores: The Quality Scores of the companies we own still look very good. Some scores declined slightly due to higher valuation levels

If you liked this and want to get an insight in my entire Portfolio, consider becoming a Premium Subscriber of Compounding Quality:

Happy Compounding!

Pieter (Compounding Quality)

Whenever you’re ready

That’s it for today.

Whenever you’re ready, here’s how I can help you: