Shareholder letter Warren Buffett

Hi Partner 👋

Welcome to this week’s 📈 free edition 📈 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

If you’re not a subscriber, here’s what you missed this month:

Subscribe to get access to these posts, and every post.

Last weekend, Warren Buffett published his 47th (!) annual letter.

Since The Oracle of Omaha took over Berkshire Hathaway in 1965, the stock increased 44,000x.

This means an investment of $10,000 turned into $440 million!

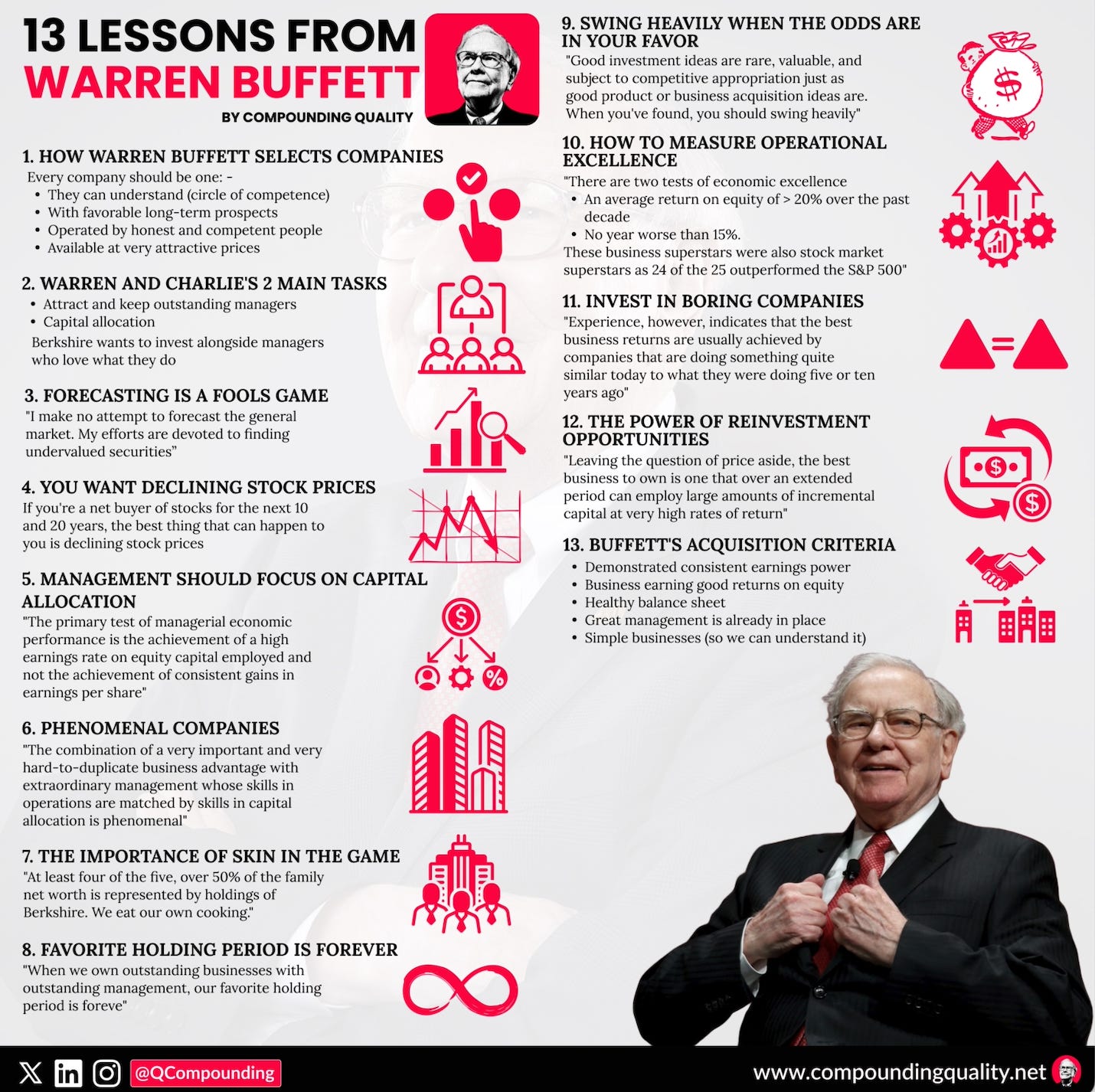

I read the letter and summarized it in 14 key learnings for you.

Key takeaways

1. Tribute to Charlie Munger

-

“Charlie was the “architect” of the present Berkshire, and I acted as the “general contractor” to carry out the day-by-day construction of his vision.”

-

“Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.”

2. The power of incentives

-

“Bertie understands the power – for good or bad – of incentives, the weaknesses of humans, the “tells” that can be recognized when observing human behavior. She knows who is “selling” and who can be trusted. In short, she is nobody’s fool.”

-

“I think I’ve been in the top 5 percent of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it.”

3. Time in the market beats timing the market

-

“I can’t remember a period since March 11, 1942 – the date of my first stock purchase – that I have not had a majority of my net worth in equities, U.S.-based equities. And so far, so good.”

4. Buy good companies

-

“We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring. Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. “

5. Focus on companies with plenty of reinvestment opportunities

-

“At Berkshire, we favor the rare enterprise that can deploy additional capital at high returns in the future. Owning only one of these companies can deliver wealth almost beyond measure.”

6. Buy companies run by great managers

-

“We also hope these favored businesses are run by able and trustworthy managers, though that is a more difficult judgment to make, however, and Berkshire has had its share of disappointments.”

7. Let your winners run

-

“By both luck and pluck, a few huge winners have emerged from a great many dozens of decisions. And we now have a small cadre of long-time managers who never muse about going elsewhere and who regard 65 as just another birthday.”

8. Try to be a bit above average for long periods of time

-

“Berkshire should do a bit better than the average American corporation and, more importantly, should also operate with materially less risk of permanent loss of capital.”

9. Buy when there’s blood running through the streets

-

“Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity.”

10. Rule Number 1: Never lose money

-

“One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital.”

11. Share repurchases only make sense when the company is undervalued

-

“All stock repurchases should be price-dependent. What is sensible at a discount to business value becomes stupid if done at a premium.”

12. Never sell wonderful companies

-

“The lesson from Coke and AMEX? When you find a truly wonderful business, stick with it. Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable.”

13. Don’t try to make market forecasts

-

“We don’t believe we can forecast market prices of major currencies. We also don’t believe we can hire anyone with this ability.”

14. The magic of compounding

-

“We have been in the business for 57 years and despite our nearly 5,000-fold increase in volume – from $17 million to $83 billion – we have much room to grow.”

Free E-book

Last year, I read everything Warren Buffett ever said and wrote.

It’s a 5,000-page document.

The good news? I summarized everything for you in a 60-page e-book.

You can grab it for free here:

Whenever you’re ready

That’s it for today.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

-

📈 Access to my Portfolio with 100% transparancy

-

📚 Access to my ETF Portfolio

-

🔎 Full investment cases about interesting companies

-

📊 Access to the Community

-

✍️ And much more!

Happy Compounding!

Pieter (Compounding Quality)

Used sources

-

Interactive Brokers: Portfolio data and executing all transactions

-

Finchat: Financial data