Software Seriously Red

CLOSING BELL

Software Seriously Red

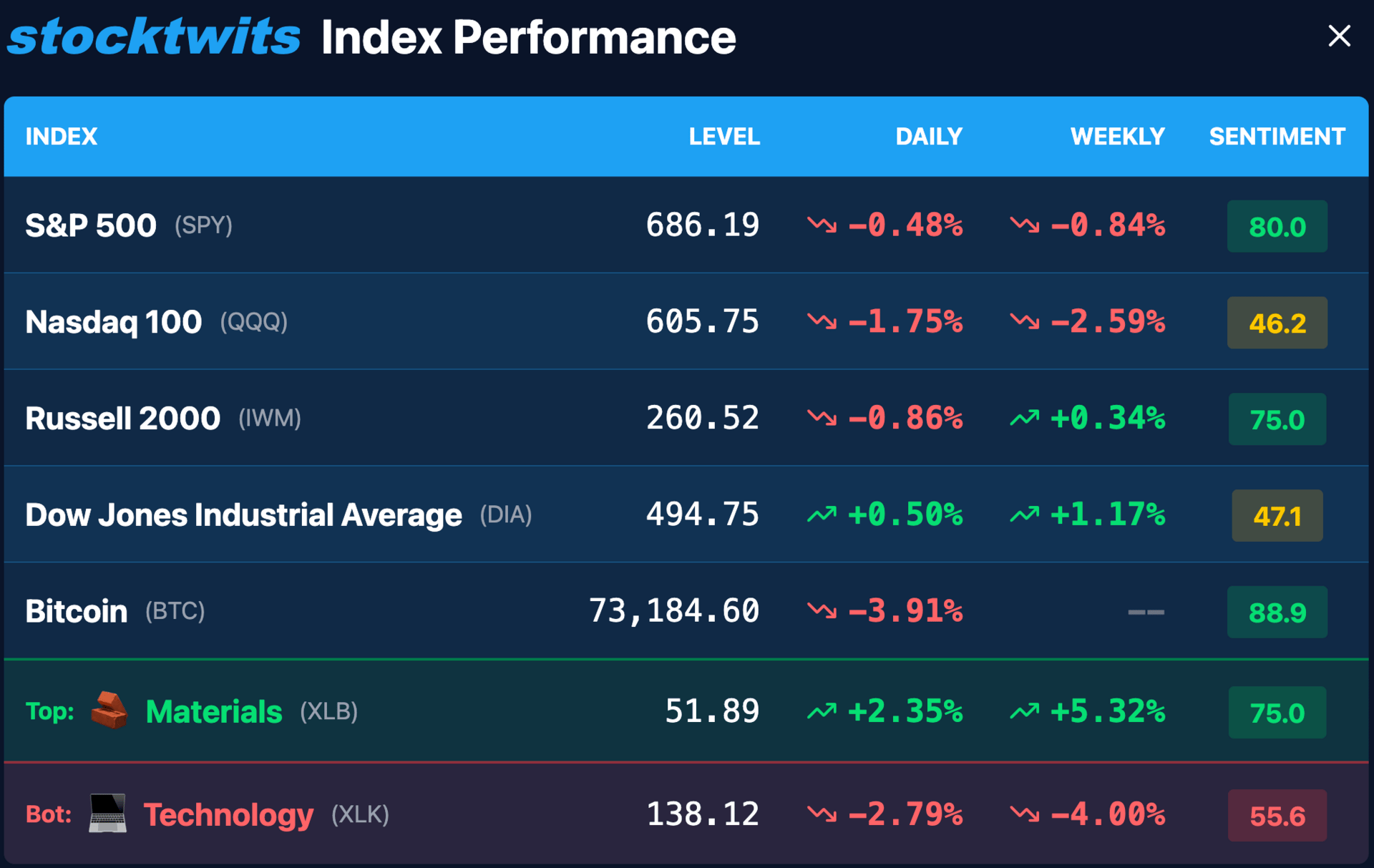

Happy Wednesday, software bloodbath day. The market opened greenish but by the afternoon, even the bang up resaults form Palantir’s last quarter were not enough to keep it from tanking into the red.

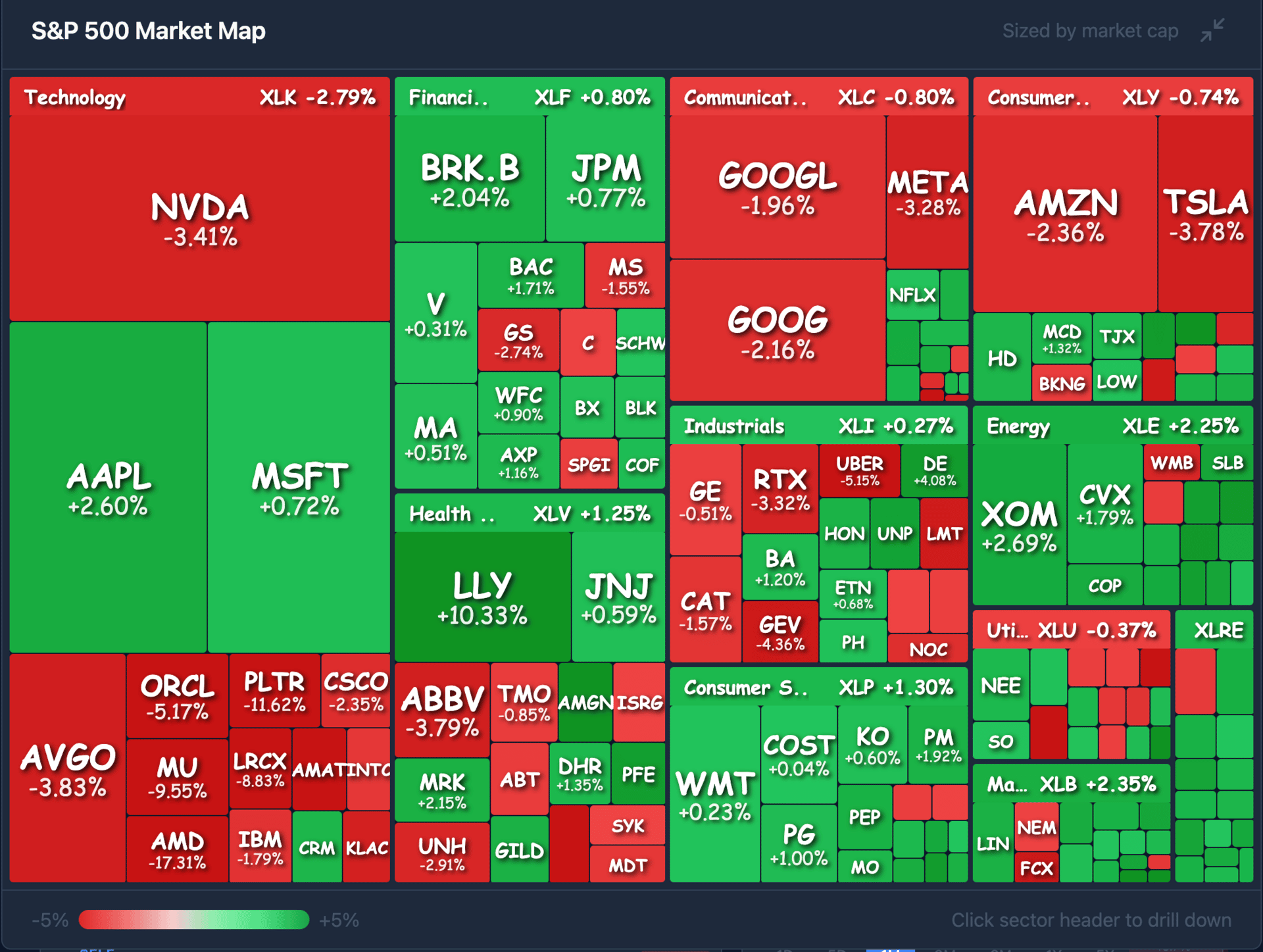

It was a case of AI agents freaking out the tech market, as nerds continued to flock online and post their projects using Anthropoi’s Cowork, OpenAI’s Codex, and yes OpenClaw bots. The narrative ‘who needs special, expensive software as a service when you can just ask a clanker to do it?’ sent tech into a tailspin, overshadowing earnings.

It was the worst two-day slide for tech since April, as software kings AppLovin, Palantir dropped 11%, and even solid memory providers like Sandisk fell 15%.

Bitcoin and crypto were falling, selling off after a massive run, dangerously close to a ‘death spiral,’ according to big shorter Michael Burry. Things got rowdy after a testy Treasury hearing in the Senate, where Scott Bessent said he had no authority to buy Bitcoin or cryptos, saying basically there would be no bail out.

Presdient Trump talked to President Xi Jinping of China to talk Taiwan and geopolitics, and it went well, especially for soybean farmers now promised ‘25M tons of sales for the next season.’ 🫘

Private payroll numbers from ADP showed just 22,000 new jobs in Jan, less than December, and half the hopeful forecast. Last February, employers hired 186,000.

In earnings, beats turned to misses as the market took a pause from rewarding massive tech numbers while the current AI software sell off plays out. After all, big tech is spending $500B+ on AI this year. 👀

AFTER THE BELL

Google is Spending HOW MUCH on AI? 💀

Alphabet Inc. Gemini 3 Launch Powers Revenue Acceleration 📈

Alphabet smashed top-line estimates as the Gemini 3 rollout fueled a massive surge in enterprise AI adoption. The company reported a 17% jump in search revenue and a staggering 48% increase in cloud sales, marking its first year exceeding $400 billion in total revenue. If only that could have helped its stock price, as the stock jumped and then retreated as investors priced in the search giant’s expensive AI plans.

Management signaled aggressive infrastructure expansion, projecting 2026 capital expenditures between $175 billion and $185 billion. This nearly doubles the 2025 spend, highlighting a massive commitment to securing dominance in the generative AI era.

Google is going to spend nearly $500M on AI every single day this year.

Sure, $GOOG ( ▼ 2.16% ) delivered $2.82 EPS on $113.8 billion in revenue, comfortably outperforming the $2.64 and $111.4 billion anticipated by the Street. Google Cloud was the standout performer, generating $17.7 billion against the $16.29 billion consensus. But is the cost worth it?

SPONSORED

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Anthropic Tech, OpenAI Launch Triggers Global Software Rout 📉

A violent sell-off erased over $300 billion in market value from software and data providers this week as Anthropic’s new “Claude Cowork” plugins sparked existential fears for traditional SaaS. The rout expanded Wednesday beyond niche providers to hit industry titans, dragging the S&P Software & Services index down 26% from its October peak. It wasn’t just Anthropic: OpenAI launched ‘Codex’ an app for building agents, and even open-source projects like OpenClaw freaked out traditional tech providers.

Anthropic’s AI legal tools forced many to ask how quickly the technology might advance. “It spooked the broader tech sector,” Tom Bruni, head of market and retail investor insights at Stocktwits told WSJ. “The impact could be a lot more widespread than initially thought.

The software sector is being “sentenced before trial” as major players like $CRM, $ADBE, and $INTU shed between 2% and 6.6% in a single session. The pain extended to private credit and lending, with software company loans dropping to 91.27 cents on the dollar as the volume of distressed software debt doubled to $25 billion in just one month.

Analysts warn of continued volatility as the market shifts from a “growth at any cost” AI narrative to questioning the long-term viability of non-AI-native firms. While some strategists suggest the sell-off is overwrought, the rapid rotation into cyclical sectors like energy and materials suggests a structural de-risking of software portfolios is underway heading into late 2026. 😟

MORE AFTER BELL NEWS

Because It Would Not Fit Above The Fold 📰

Qualcomm Memory Shortage Dents Outlook Amid AI Pivot 📱

$QCOM ( ▲ 1.16% ) issued cautious forward guidance as a global memory shortage, fueled by AI data center demand, constrains the smartphone market despite a record-breaking holiday quarter. Management warned that RAM manufacturers shifted to building for data centers, not mobile devices, and they had to scale back growth plans. They can’t keep up.

The Beat Miss: Qualcomm reported fiscal Q1 revenue of $12.25 billion and adjusted EPS of $3.50, which beat estimates, but the stock fell in extended trading. QCOM expects revenue between $10.2 billion and $11 billion this quarter, well below the $11.11 billion Wall Street expected.

Arm Holdings Record Royalties Overshadowed by Licensing Miss 🤖

Arm Holdings reported record quarterly revenue and royalty growth, yet the stock slipped 6% after-hours as investors fixated on a rare miss in its licensing segment. Despite the dip, the firm’s shift toward high-value v9 architecture continues to expand its margin profile across data centers and mobile.

$ARM ( ▲ 0.34% ) The chip designer posted an adjusted $0.43 EPS, significantly ahead of the $0.32 forecast, with total revenue of $1.24 billion edging past the $1.22 billion target. Royalty revenue hit a record $737 million, up 27% year-over-year.

Licensing revenue came in at $505 million, falling short of the $520 million estimate due to the timing of major contract sign-offs. Arm’s management remains bullish on the “AI at the edge” narrative, expecting increased compute requirements to drive sustainable royalty tailwinds.

MACRO NEWS

Department of Homeland Security Standoff Sees Two-Week Deadline 🏛️

Congress narrowly averted a full government shutdown by passing a short-term extension for the Department of Homeland Security on Tuesday, but remains deadlocked over the agency’s future. The move provides a 10-day window to resolve fierce disputes over ICE accountability and CBP enforcement tactics following recent high-profile incidents in Minneapolis.

The House voted 217–214 to fund most federal agencies through September 2026, while limiting DHS funding to a stopgap through February 13. The deal requires negotiators to bridge a massive gap between the $3.8 billion ICE detention budget sought by Republicans and the strict reform mandates demanded by Democrats.

The standoff was triggered by the recent deaths of Renee Good and Alex Pretti during enforcement operations, sparking a “backlash against ICE” and demands for body-worn cameras and unmasking requirements.

The Outlook: With the February 14 shutdown deadline looming, the House Freedom Caucus is demanding a seat at the table to protect conservative priorities, including funding for 22,000 Border Patrol agents and 50,000 detention beds. Unless a compromise is reached on warrant codification or oversight, the department faces a total funding lapse at the end of next week. The shut down will delay macro labor data that was set for Friday. 🎱

TRENDING STOCKS

Winners and Losers

-

$SMCI ( ▲ 13.79% ) : Rallied on booming demand for AI server infrastructure and a massive boost to full-year sales forecasts.

-

$LLY ( ▲ 10.33% ) : Gained as weight-loss drug demand continues to scale, with 2026 EPS guidance of $33.50 – $35.00 exceeding expectations.

-

$ODFL ( ▲ 9.89% ) : Rose amid positive momentum in the transport and logistics sector.

-

$CDW ( ▲ 9.45% ) : Increased as IT solutions spending remains resilient among enterprise customers.

-

$AMGN ( ▲ 8.15% ) : Climbed following its inclusion in the day’s pharmaceutical rally led by sector-wide earnings beats.

-

$AMD ( ▼ 17.31% ) : Dropped despite beating Q4 estimates, as a “soft” Q1 revenue guide of $9.8 billion failed to satisfy elevated investor expectations for AI growth.

-

$APP ( ▼ 16.12% ) : Fell as the high-flying software sector faced a sharp valuation correction and profit-taking.

-

$SNDK ( ▼ 15.95% ) : Declined following weakness in the broader semiconductor and memory storage markets.

-

$PLTR ( ▼ 11.62% ) : Slumped as the market reassessed stratospheric valuations for AI-linked software companies.

-

$MU ( ▼ 9.55% ) : Lost sympathizing with the broader chip sell-off triggered by soft guidance from industry peers.

ST MEDIA

Top Stocktwits Stories 🗞️

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Macro: Initial Jobless Claims, Productivity. 📊

Pre-Market Earnings: $B, $BMY, $COP, $SHEL, $EL, $XPO, $CI, $HSY, $TPR, $KKR, $CMI, $CARR, $CAH, $RL, $ICE, $ROK, $HII, $LIN. ☀️

After-Market Earnings: $AMZN, $MSTR, $RBLX, $AFRM, $IREN, $RDDT, $ARM, $BE, $TEAM, $ILMN, $FTNT, $MCHP, $GEN, $DLR, $VTR, $MPWR. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈 Want to learn proven strategies for picking top stocks? Join IBD’s free online workshop on 2/7*

🤑 ‘It’s an absolute bloodbath’: Washington Post lays off hundreds of workers

😨 ICE attorney to judge: ‘This job sucks’

💰️ US software stocks hit by Anthropic wake-up call on AI disruption

📺️ Private payroll growth in January misses expectations as market awaits official jobs data

👀 The AI-Only Social Network Isn’t Plotting Against Us

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋

1