Stocktwits By The Numbers – The Global Retail Revolution That Is!

Hello from Coronado where I am battling the nastiest of flu’s. I apologize for any extra typo’s ahead…

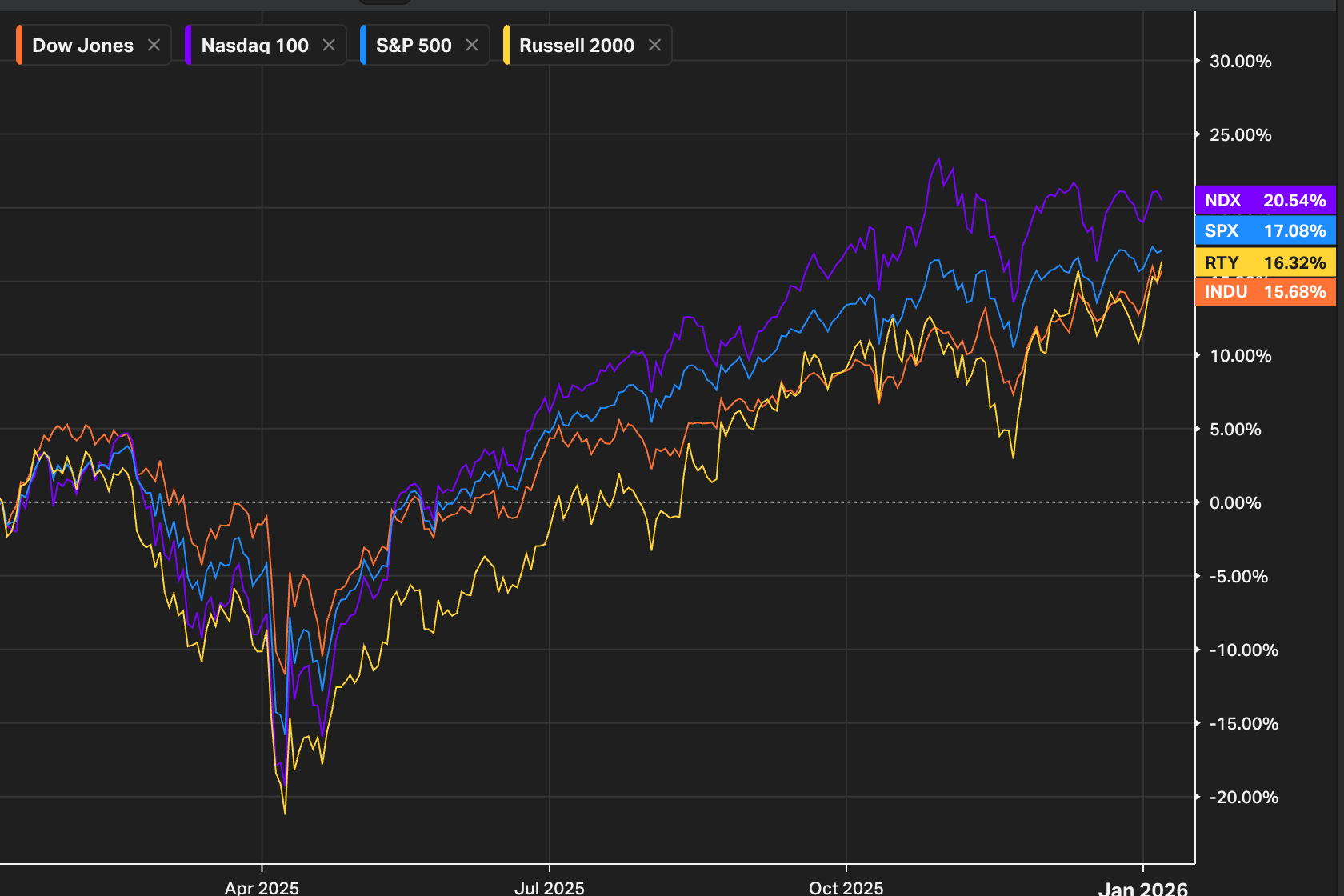

It was a fantastic year for stock market investors. The Dow, The S&P, The Nasdaq 100 and the Russell were all up double digits:

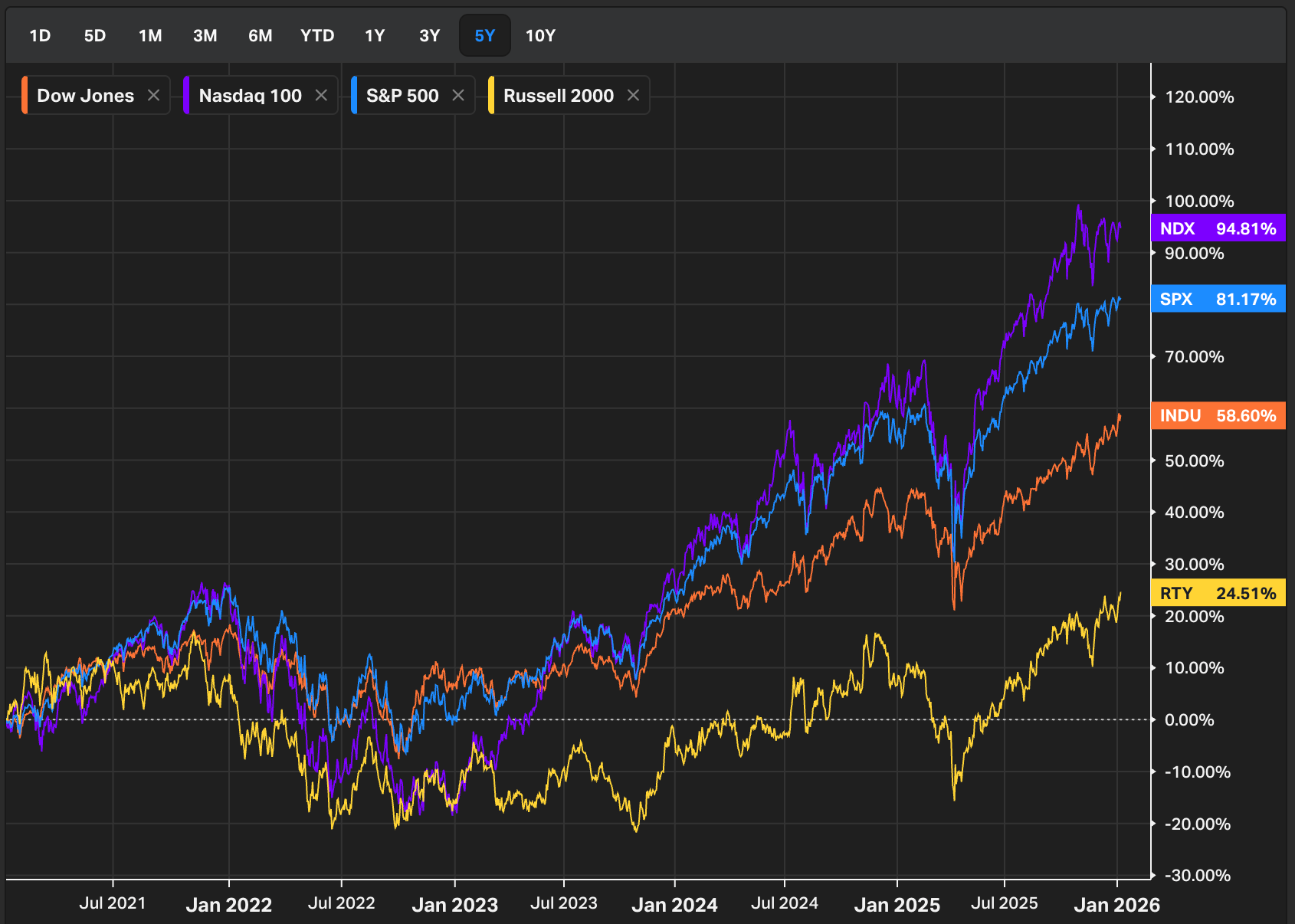

The last 5 years have also been great (not so much for for small caps) which includes the nasty post COVID bear market of 2022 and 2023.

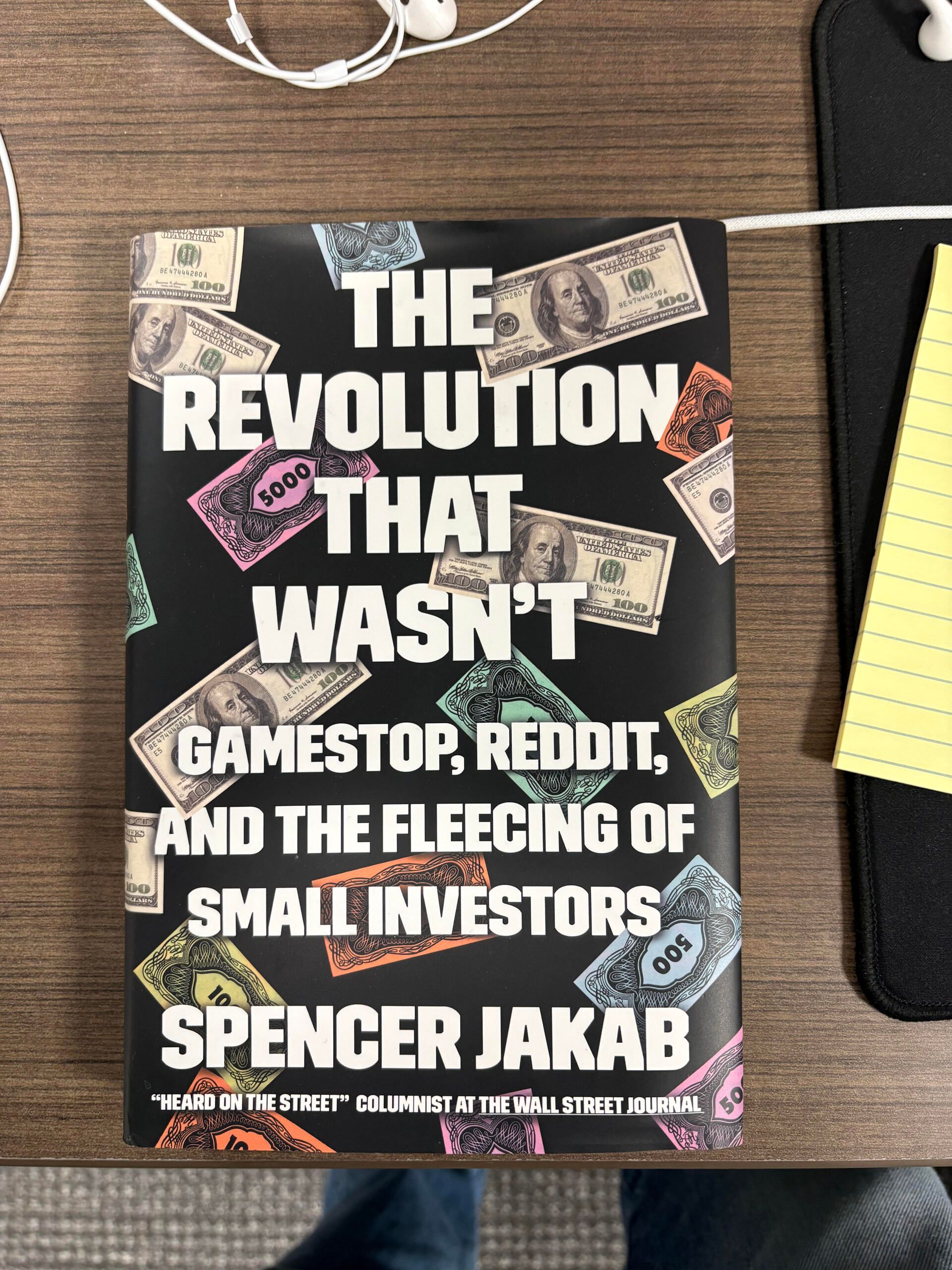

The global retail revolution and degenerate economy that is in full bloom today was not a foregone conclusion. I give you Spencer Jakab’s (Wall Street Journal) 2022 book (which I read) titled ‘The Revolution That Wasn’t’.

I have written about this here often, but in 2022 and 2023, the mob wanted blood and Robinhood founders Vlad and Baiju were the target. The Robinhood app was the cause of all the worlds problems and it was that damn ‘confetti’ that gamified trading that was to blame.

Flash forward a few years and we are betting on the capture of dictators, trading single stock futures and making sports parlay bets from tens of apps (soon hundreds), and maybe most casino like, ripping card packs on every collectible site.

Spencer got one thing right. Too many investors were and have been fleeced in the last 5 years. It has never been a better time for grifters. This would have been a better title Spencer’s book.

What most people got wrong re the ‘fleecing’, the ‘grifting’ and the 2022 bear market is investors and our leaders don’t care! Investors have brushed off the post COVID meltdown in tech stocks, the grifting in SPAC’s, the insider trading accusations aimed at Congress and The White House and the endless crypto scams.

This post and data is not going to deal with the psychology of why. As my pal and shrinkologist Phil Pearlman says with the wisdom of a PHD in behavioral psychology ..people are crazy!

A perfect storm of culture, technology (ai, algorithms, social, mobile), politics, economic, prices, money has ignited a degenerate economy as a growing global retail investor based is being onboarded via Robinhood, Coinbase, Nubank, Klarna, Affirm, Alpaca, Etoro, Binance, Polymarket, Kalshi). Fasten your seat belts.

My friend Meb Faber picked up on a riff of mine that sums it up…

Twitter tweet

So let’s get to some numbers from Stocktwits…

The Stocktwits audience grew 40 percent in 2025 which is about the same growth as 2024 when I stepped back in as CEO. As hard as our small team is working, I am happy to credit the markets here. In 2025, most of our team is now product and engineering so the pace of our product improvement and launches that will cater to a wider audience should help offest market declines.

There may just be 500 stocks in the S&P and indexing may be the right investing strategy for most investors, BUT, the Stocktwits user is curious about much more. In 2025 nearly 25,000 tickers were ‘cashtagged’. The growth in the amount of tickers people discuss/cashtag is growing very fast (crypto is helping):

10,625 symbols in 2020

18,753 symbols in 2021

21,540 symbols in 2022

19,309 symbols in 2023

19,450 symbols in 2024

24,638 symbols in 2025

If we could cashtag ($) individual bets and prediction markets (we are working on this at Stocktwits right now), imagine the amount of symbols that people would be discussing. In 2024, Americans wagered $150 billion on sports, triple the 2021 numbers. The prediction numbers are just staggering in the first full year at Robinhood alone.

We launched our first ‘prediction and betting’ podcast in December to make sure we can communicate with this younger audience as they come to parlay stocks and events in the years ahead…

Twitter tweet

Some other numbers from our community…

There are over 5,000 messages per hour on Stocktwits

Users from over 189 countries visited Stocktwits in 2025. I think just Somalia was too busy defrauding peeps in Minnesota to post on Stocktwits.

Over 1 million of our users joined an earnings call in 2025 (a new feature of Stocktwits).

Gen-z and millennials make up 68 percent of our audience so we are not your Grandpa’s CNBC.

Click volume on our very popular ‘Daily Rip’ newsletters was up 4x in 2025

While it is NOT surprising that $SPY and $TSLA and $BTC and $NVDA were our top messaged tickers, our audience can get memeeee and on the edge…

Twitter tweet

Speculation is entertainment and investing is a sport.

Don’t shoot the messenger. Learn the language!