Stocktwits Top 25 Week 2

Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week! It was the first full week of the new year, so the top 25 lists are topsy-turvy. This edition, we only included new comers to the list, you won’t believe how many names changed!

Next week we will start comparing the numbers again, and see if this past week’s rapid gainers hold on to their wins this year!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list came up 3.17% compared to the weekly S&P 500 index 1.57%

Newcomers are in blue.

SPONSORED BY ZENATECH

ZenaTech Completes 20th Acquisition in Year One of Drone as a Service

ZenaTech recently announced it has completed its 20th acquisition with the addition of L.D. King, Inc., a well-established civil engineering and land surveying firm based in the Los Angeles area. The acquisition strengthens ZenaTech’s drone solutions footprint in one of the most wildfire-sensitive and disaster-prone regions in the US and marks a successful first year executing its Drone as a Service expansion strategy. Since January 2025, the company has built a US and global business network with thousands of commercial and government client relationships.

Founded in 1965, L.D. King has served Southern California for more than six decades, with a strong reputation across public works, commercial, and residential projects. Its licensed professionals provide land surveying, engineering, planning, and construction management services to public agencies and private developers.

For complete ZenaTech disclaimers and disclosures, please visit ZenaTech here.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list performed 4.03% compared to the weekly Nasdaq 100 index 2.29%

Newcomers are in blue.

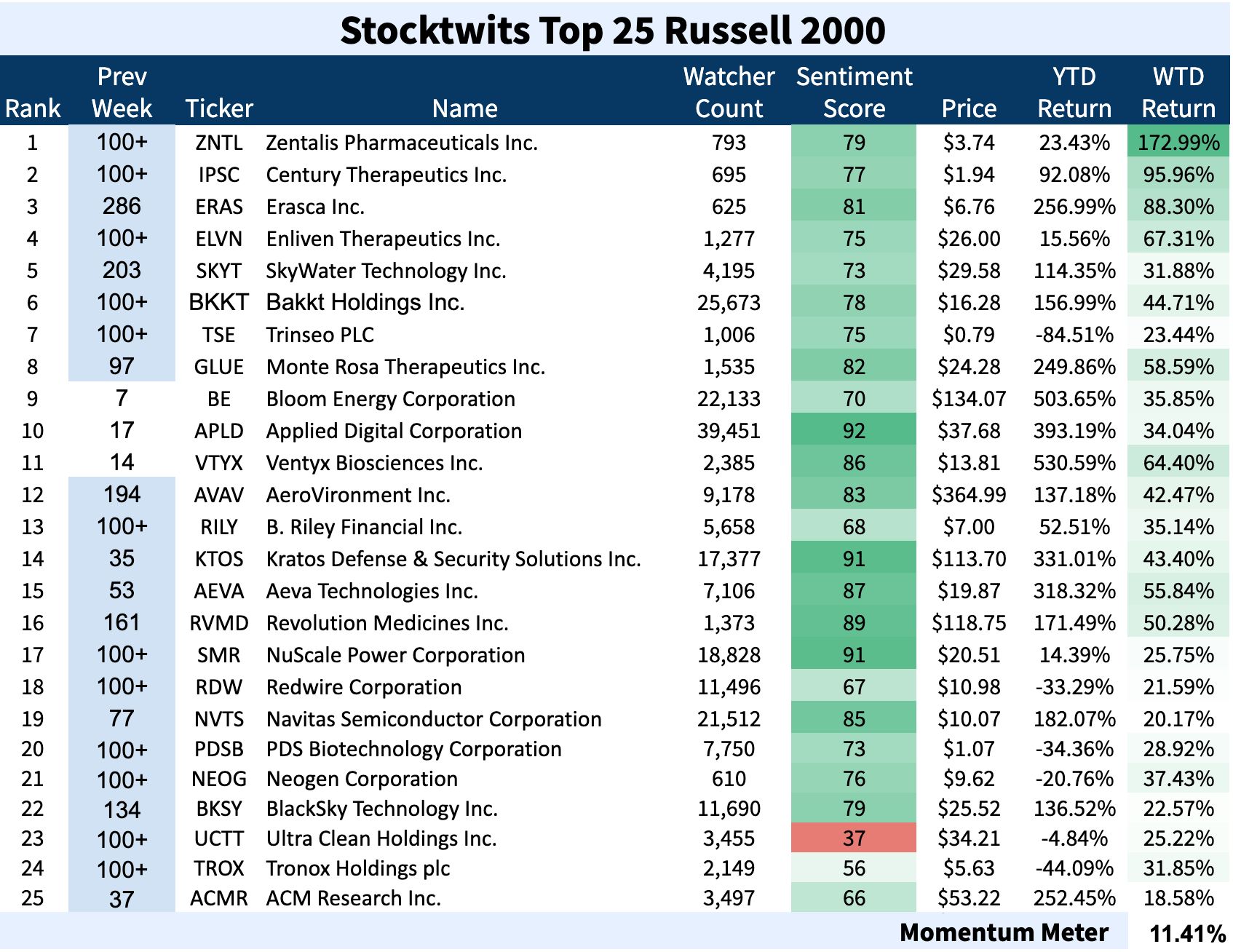

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list was 11.41% compared to the weekly Russell 2000 index 4.62%

Newcomers are in blue.

Top Dawg Of The Week 🐶

The Top 25 list’s Top Dawg was $ZNTL ( ▲ 31.69% ) , climbing a whopping 173%!

Zentalis Pharmaceuticals flew this week, a rally ignited by a “perfect storm” of a major insider purchase and a pivotal clinical roadmap for its lead cancer drug, azenosertib. 🚀

The Multi-Faceted Breakout

Massive Insider Vote of Confidence The primary fuel for the move was a Dec. 31 disclosure that major shareholder Walters Group acquired nearly 6.5 million shares at $1.20, effectively doubling its stake. This $7.75 million transaction was viewed by retail and institutional traders alike as a powerful signal that the company’s internal valuation is significantly higher than its recent multi-year lows. 💰

Then this week, on the 6th, everything changed:

-

Pivotal 2026 Clinical Roadmap: Zentalis confirmed the completion of enrollment for its Phase 2 DENALI Part 2a trial on Tuesday morning. This is the study designed to lock in the optimal dose of azenosertib, with that dose confirmation officially expected by the end of June (1H 2026).

-

Phase 3 ASPENOVA Launch: The same Tuesday update revealed that the company has already aligned with the FDA on the design of the ASPENOVA Phase 3 confirmatory trial. This trial is now scheduled to officially begin enrollment in the first half of this year.

-

Strong Financial Runway: As part of this week’s financial transparency, Zentalis reiterated its cash position of $280.7 million. While this number reflects the balance as of their last audit, the official guidance that this cash will last into late 2027 was confirmed in this Tuesday’s filing to reassure investors following their recent restructuring.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋