Stocktwits Top 25 Week 3

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

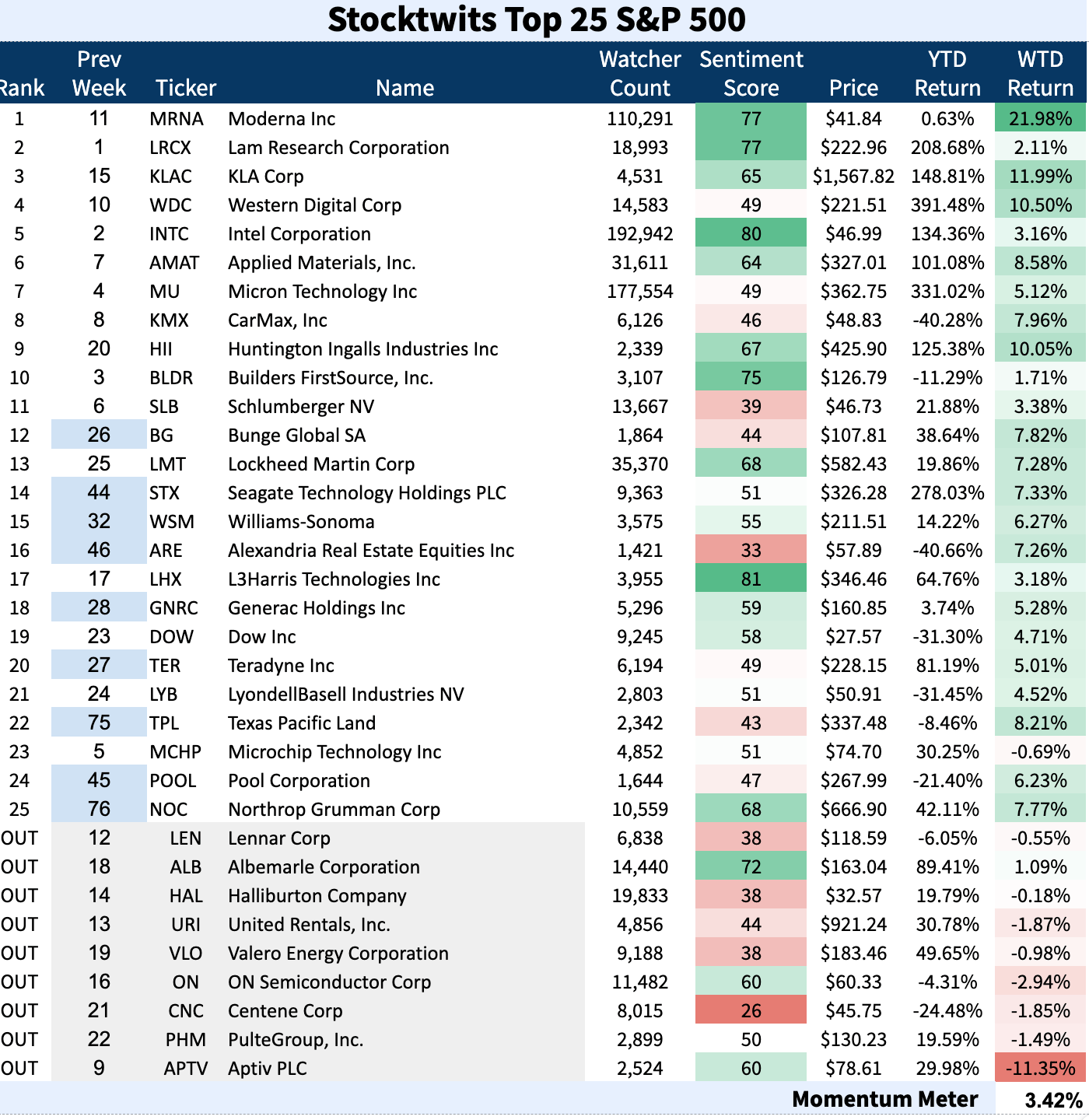

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list came up 3.42% compared to the weekly S&P 500 index -0.38%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

PRESENTED BY

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

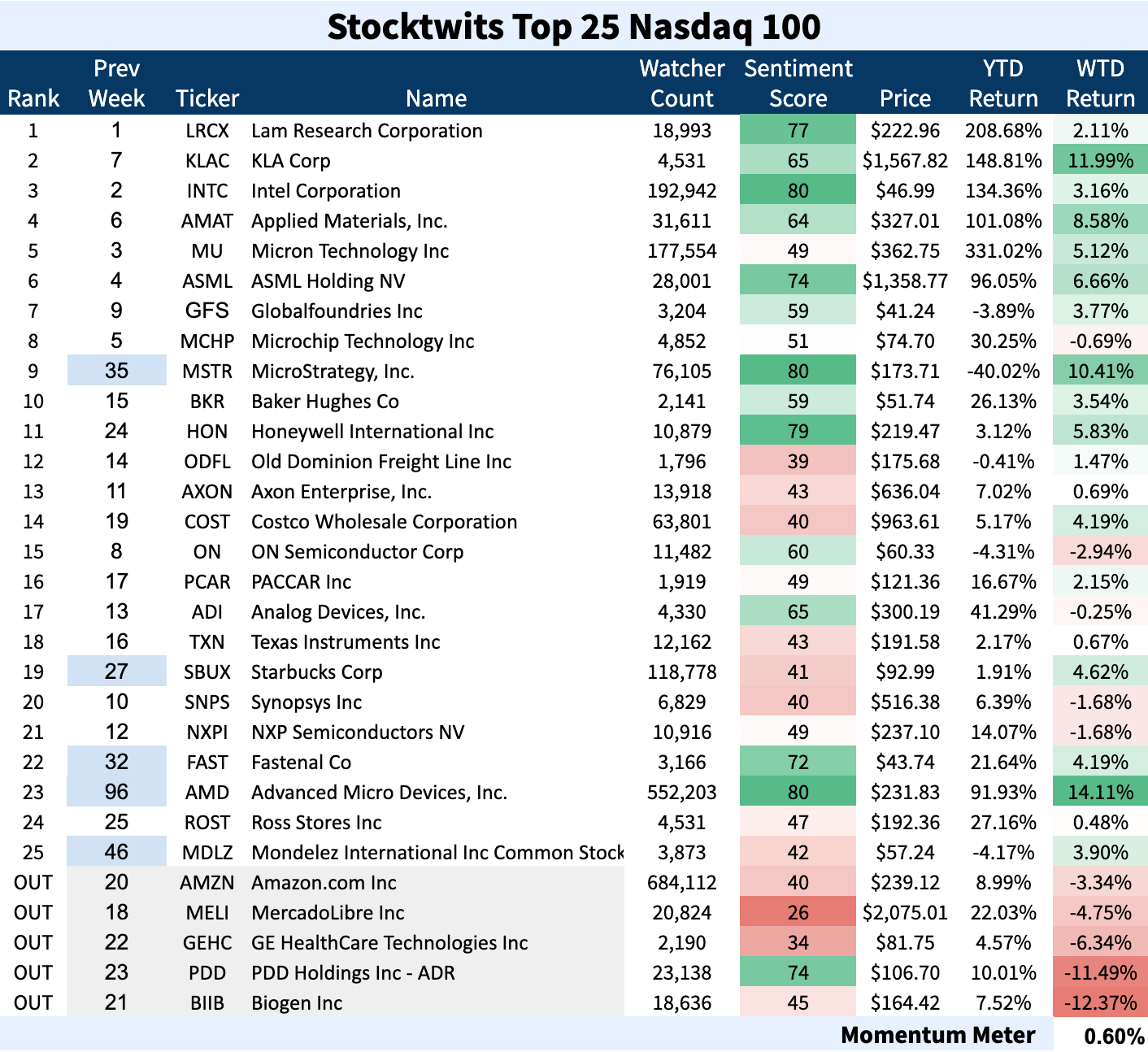

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list performed 0.60% compared to the weekly Nasdaq 100 index -0.92%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

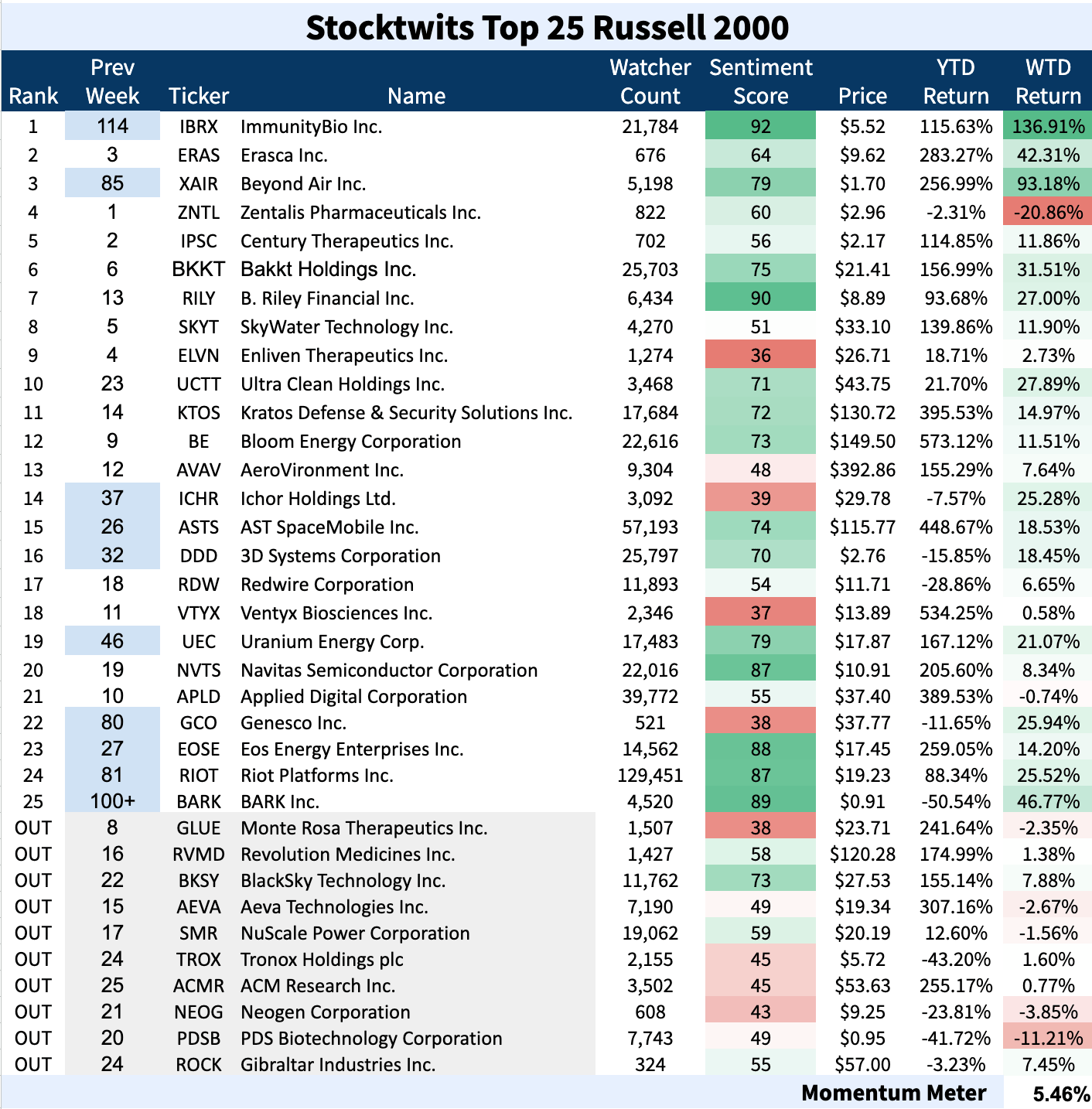

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list was 5.46% compared to the weekly Russell 2000 index 2.04%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

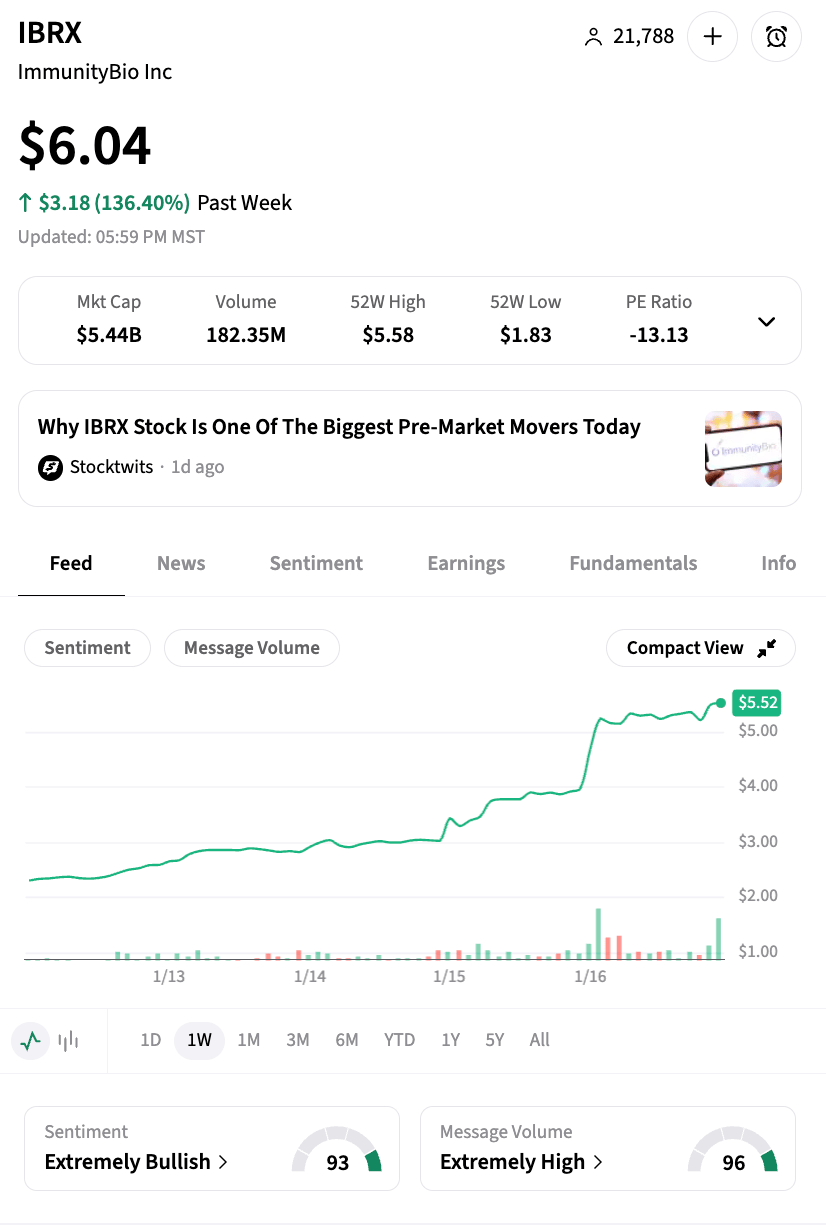

Top Dawg Of The Week 🐶

The Top 25 list’s Top Dawg was $IBRX ( ▲ 39.75% ) , climbing a whopping 136%!!

Biotech and Healthcare Breakthroughs

Shares of ImmunityBio jumped nearly 50% after the company announced that enrollment for its QUILT-2.005 bladder cancer trial surpassed internal expectations and is now 85% complete. Preliminary data shows that combining ANKTIVA with standard BCG therapy significantly extends the duration of complete response in patients, with an 85% response rate at six months compared to just 57% for the BCG-only group. The company is now on track to submit a Biologics License Application to the FDA by the end of 2026. 🧬

The news hit the wires before the market opened on Friday.

-

ImmunityBio ($IBRX): The company officially released the news at 7:00 am ET on Friday, Jan 16. The stock soared nearly 40% (briefly touching 50% in intraday trading) as investors reacted to the 85% trial enrollment and the 700% jump in Anktiva revenue.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋