Stocktwits Top 25 Week 5

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

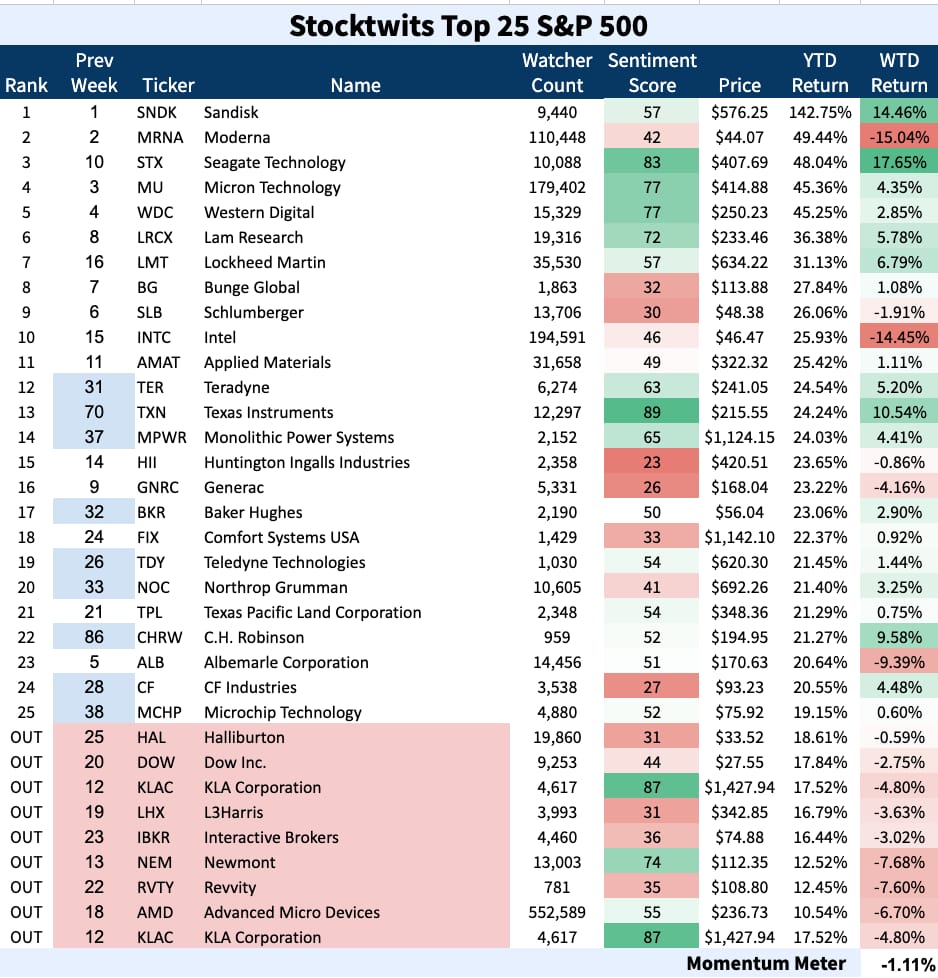

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list came up -1.11% compared to the weekly S&P 500 index 0.37%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

PRESENTED BY

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

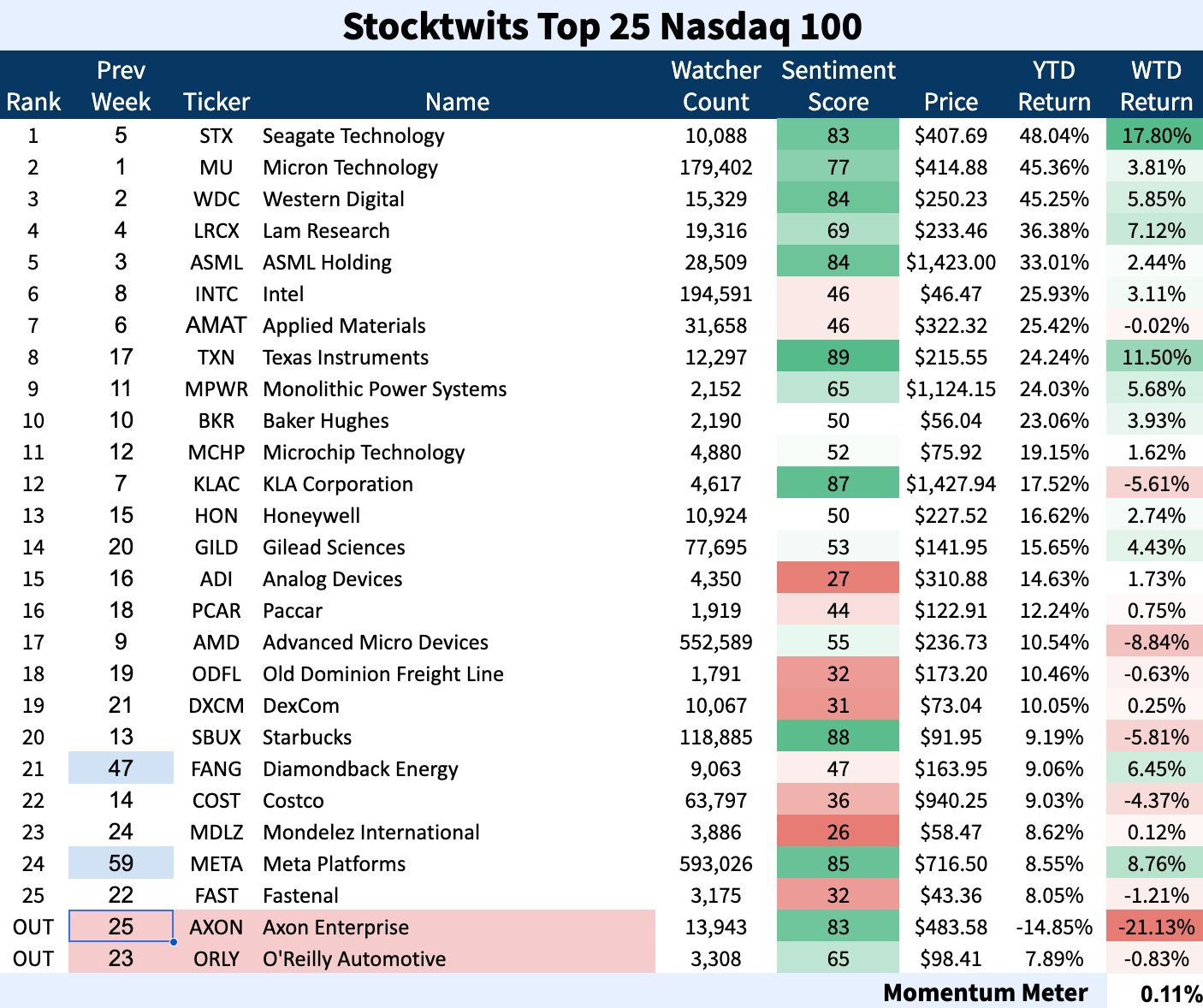

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list performed +0.11% compared to the weekly Nasdaq 100 index -0.21%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

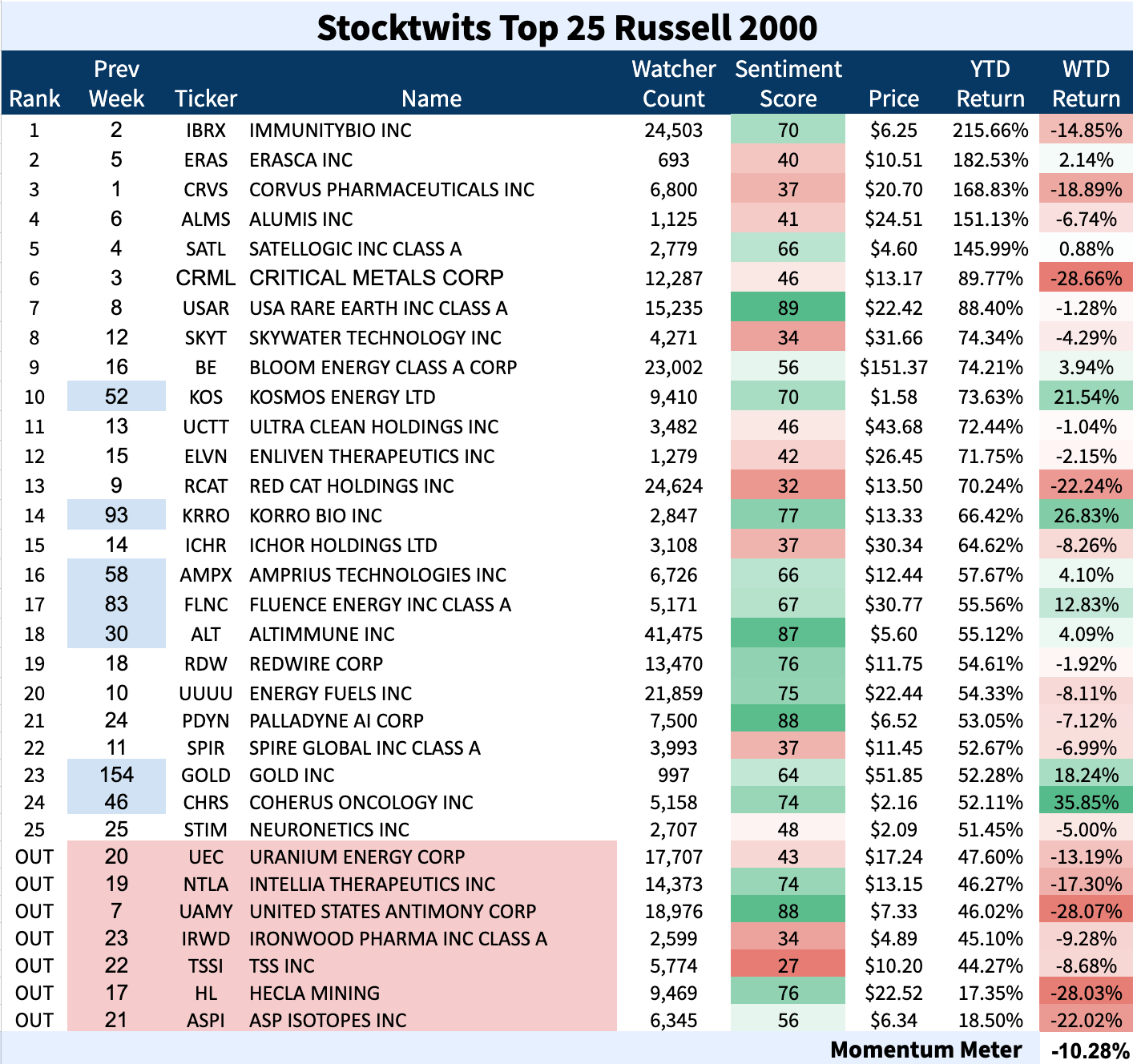

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list was -10.28% compared to the weekly Russell 2000 index -2.08%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

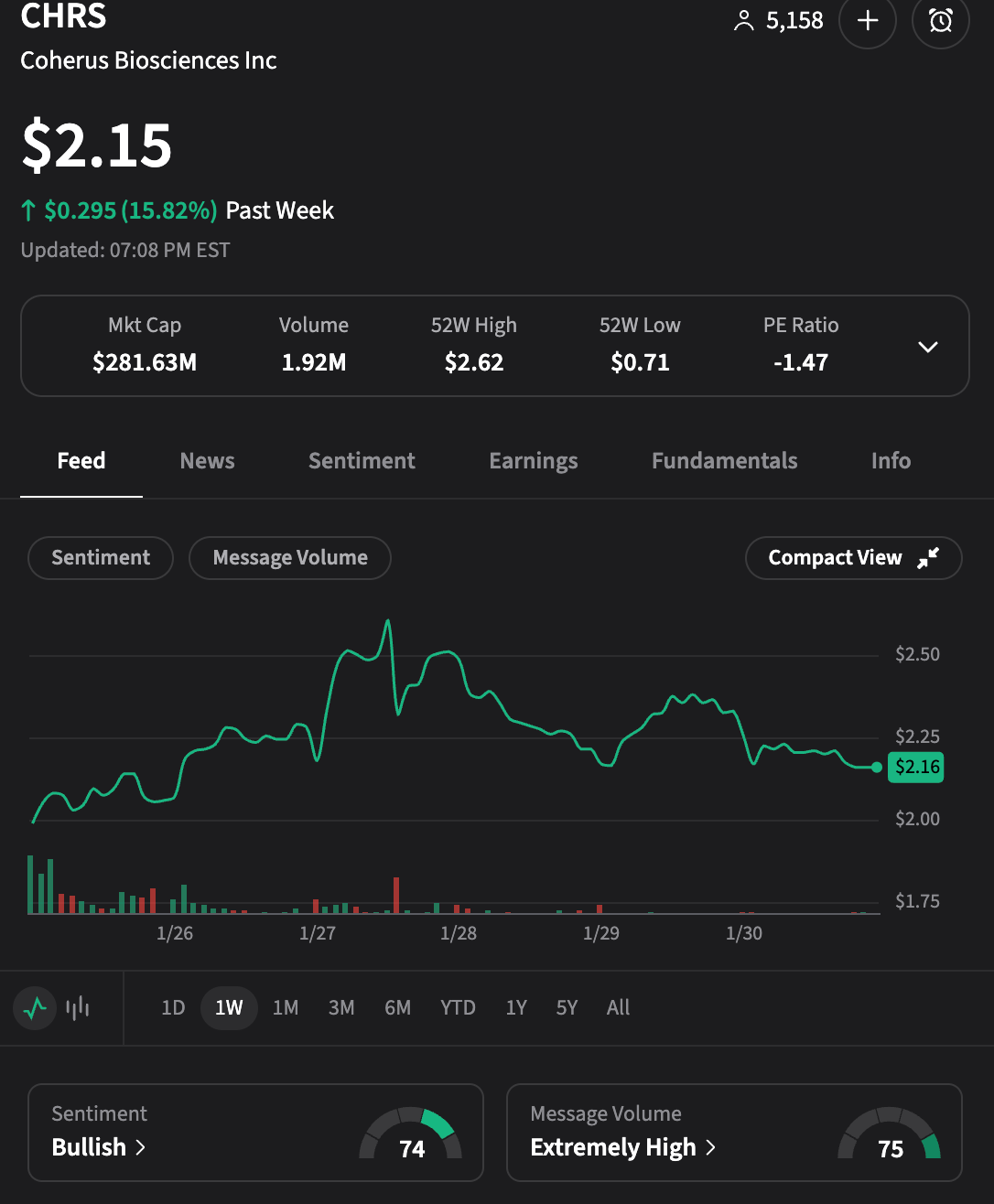

Top Dawg Of The Week 🐶

The Top 25 list’s Top Dawg was $CHRS ( ▼ 7.3% ) Coherus Biosciences Inc climbing 35%!

Coherus Biosciences saw a massive weekly surge as the market repositioned around its transition into a pure-play oncology leader and new institutional backing. The stock rallied to a $2.51 high as investors looked past historical dilution toward a high-margin immunotherapy pipeline.

-

The Numbers: $CHRS shares jumped over 10% in a single session on January 26 after Oppenheimer initiated coverage with an Outperform rating and a $10 price target—representing over 300% upside from the weekly open.

-

The Catalyst: Momentum was fueled by a fresh $64.88 million at-the-market equity offering to accelerate the LOQTORZI commercial ramp and a Schedule 13G/A filing showing Vanguard increased its stake to 8.29% of the company.

-

The Outlook: Management is pivoting toward “high-signal” registration pathways with pivotal data readouts for 2026, aiming to capture a larger share of the immuno-oncology market.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋