'The Golden Age Of America'

NEWS

‘The Golden Age Of America’

Source: Stocktwits live stream, AP News

Liberation Day is here, and it was as eventful as we all expected. The stock market added to today’s gains when Trump began speaking, but spiraled as more details came out of his mouth. Rip-roaring IPOs Newsmax and Waton Financial Limited came back down to earth today, falling 75% and 66% after running out of the next “greater fool” to keep their upside momentum going. We’ll see how we close out the week, but for now, investors and business leaders are not feeling tariffic. 👀

P.S. Quick note from Tom Bruni. The language of my note yesterday confused some folks, so just to clarify, I will NOT be leaving Stocktwits lol. I am just handing off the newsletter writing so I can manage our team and grow our publishing offerings for you! You can always reach me anytime here. I appreciate your support! 💌

Today’s issue covers Trump’s offer of discounted tariffs, the market’s initial reaction to the macro shakeup, and other company-specific pops & drops. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with consumer discretionary (+3.79%) leading and consumer staples (-0.24%) lagging.

Source: Finviz

And here are the closing prices:

|

S&P 500 |

5,670 |

+0.67% |

|

Nasdaq |

17,601 |

+0.87% |

|

Russell 2000 |

2,045 |

+1.65% |

|

Dow Jones |

42,225 |

+0.56% |

COMPANY NEWS

Trump’s Discounted Tariff Chart Tanks Stocks 🙃

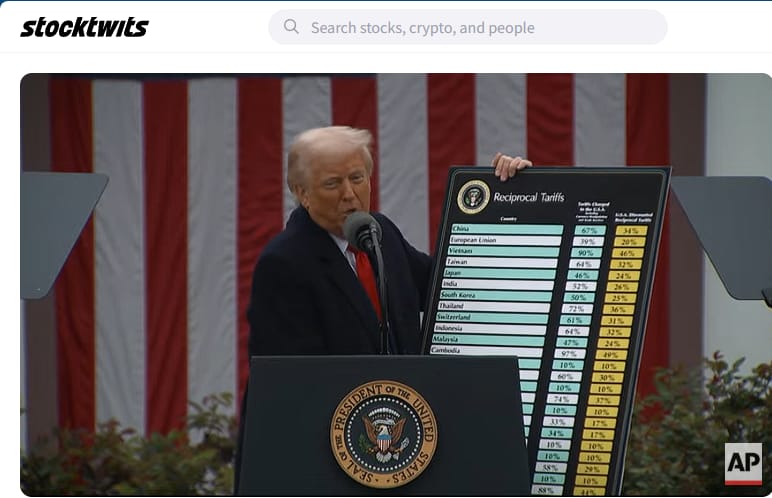

The market rose ahead of President Trump’s end-of-day announcement of 25% tariffs on all foreign-made automobiles, among other fresh reciprocal tariffs. Trump said the new levies would go into effect at midnight tonight, speaking from the Rose Garden.

“From 1789 to 1914, we were a tariff-backed nation. We were collecting so much money so fast we didn’t know what to do with it,” Trump said. Then, in 1913, “for reasons unknown,” they established the income tax. He also suggested that the Great Depression came because they moved away from the tariff system.

Since the beginning of NAFTA, Trump said the country lost 90,000 factories, 5 million manufacturing jobs, and trade deficits of $19 trillion.

If not the “Golden Age of America” that Trump said he was launching, it certainly was a golden event for quotes. Trump called the tariffs “kind” and said they were nicer than they should be.

He also pulled up a physical image that was handed to him by Secretary of Commerce Howard Lutnick. The graph showed different amounts for tariffs at a “discounted rate,” Trump said, including 46% on Vietnam and 32% on Taiwan. These are 50% discounts on what the Trump Administration says these countries charge us. He also said the ‘baseline’ tariff is 10% to help the U.S. rebuild.

Notably, Canada and Mexico were left off the list. We can only assume they’ll have their own handmade graphs making their debut soon. In the meantime, you can check out the image directly from The White House, which has all the numbers.

Source: White House X Account

The stock market is in the toilet after hours, highlighting investor concerns (and confusion) about how these tariffs will actually be implemented and how the companies they’re investing in will navigate them. Our next story below covers all the major movers and shakers, so check that out below. 👇️

SPONSORED

This smart home company grew 200%…

No, it’s not Ring or Nest—it’s RYSE, a leader in smart shade automation, and you can invest for just $1.90 per share.

RYSE’s innovative SmartShades have already transformed how people control their window coverings, bringing automation to homes without the need for expensive replacements.

This year alone, RYSE has seen revenue grow by 200% year over year and expanded into 127 Best Buy stores, with international markets on the horizon. Plus, with partnerships with major retailers like Home Depot and Lowe’s already in the works, they’re just getting started.

Now is your chance to invest in the company disrupting home automation—before they hit their next phase of explosive growth. But don’t wait; this opportunity won’t last long.

Invest today at $1.90 per share and receive up to 25% bonus shares.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMY

Companies Must Choose: Customers Or Profits 😨

In an environment where many industries have signaled a material slowdown among low-to-middle-income consumers, today’s “Liberation Day” announcements will force CEOs to choose between maintaining prices at the cost of their profit margins and raising prices at the risk of further weakening demand. 🤹

This is a lose-lose situation for major companies that cannot quickly shift their operations to avoid or mitigate the impact of these tariffs. And the market is working to swiftly price that into shares after the bell.

From the very top, the market reacted with a knee-jerk sell-off, with all the names of the Magnificent Seven lower by 3-4%. Apple was the worst responder, down 7%. 🤖

Notably, the levies do not include certain manufacturing and tech goods like semiconductors, steel, aluminum, copper, pharmaceuticals, and lumber. Gold and energy goods are also safe on the White House list but might be subject to tariffs in the future.

Some of the hardest hit stocks that fell after hours were those that benefit from a current tariff loophole: packages shipped to the United States could go untaxed at the regular rate through a duty-free ‘de minimis.’ After Trump’s speech left investors in the dark to specifics (outside of discounts on tariffs), The White House posted a clarifying fact sheet that these loopholes would end:

Here are several of the names and industries moving the most after hours:

Companies that sell cheap goods: PDD, the owner of Temu, fell 5.7%. Dollar General fell 6%, and Dollar Tree slipped 12%. Five Below fell another 13%. 💵

Big-box retailers and wholesale clubs were also hit, though some more than others: BJ’s (-2%), Costco (-3%), Walmart, and Target (-5%). 🏬

Apparel makers and retailers with large offshore manufacturing exposure: Nike (-5%), Lululemon (-11%), Gap (-8%), Kohl’s (-4%), and more. 👟

The White House clarified that automakers and others included within the current USMCA trade deals would remain unaffected.

Even stocks that are meant to benefit from these tariffs, like U.S. auto giants Ford, GM, and Stellantis, could not hold their gains after the bell. Fears are that these actions could tip the U.S. economy into recession, which would hurt demand further in an industry already facing high vehicle and financing prices. 🚘️

Foreign automakers’ shares will likely be impacted once their home markets open for trading, as the ADRs listed on U.S. exchanges don’t see much trading volume.

Overall, investors are worried that consumer-linked stocks have no easy answer to today’s tariff announcements. Earnings will be impacted; now it’s up to management teams to communicate how they plan to navigate these uncertain waters and prepare the economy to slow even further. 🤷

STOCKTWITS CASHTAG AWARDS PRESENTED BY ETORO

Will We See You At The Cashtag Awards? 😎

The hottest night in social finance is happening live in NYC on Wednesday, April 30th, and the guest list continues to grow. Are you on it? 🤔

Join us to celebrate the biggest names in finance. Plus, network with personalities you know and love at our open-bar happy hour and cocktail reception. 🍻

Here are some of the names you may recognize: Jan van Eck (VanEck CEO), Ben Cahn & Emil DeRosa (Ben & Emil Show/The Weekend Rip), Chris Camillo (Dumb Money), Michael Batnick (Ritholtz Wealth/The Compound), Gav Blaxberg/Shay Boloor (Wolf Financial), and Jake Wujastyk (JakeWu Market Research). 👀

Plus, top Stocktwits community members like Brian Shannon (alphatrends), Gpaisa, DonCorleone77, Michael Nauss (Stats Edge Trading), and more!

If you’re in the New York area and are interested in attending, reply directly to this email with the words “I’m In.” We’ve got limited tickets available, but will do our best to hook our loyal newsletter readers up so we can see you there! 🤝

Want to guarantee you can attend? Grab your tickets now! 🎫

STOCKS

Other Noteworthy Pops & Drops 📋️

AngioDynamics, Inc. (ANGO +12%): The medical devices company reported upbeat third-quarter earnings and improved full-year guidance. It reported net sales of $72 million (+9.2% YoY) and a narrower-than-expected loss per share.

Broadcom ($AVGO +2%): The chipmaker rose after Japanese investment bank Daiwa upgraded the stock to ‘Buy’ from ‘Outperform’ and lowered its price target to $225 from $275. This still implies a 30% upside from current levels, as Daiwa sees the bank as an “AI winner.”

Tesla ($TSLA +5%): The electric vehicle maker initially fell on weaker delivery numbers but recovered on reports that CEO Elon Musk is stepping back from his role at the helm of the Department of Government Efficiency. Citing three insiders, the report said that President Trump has told his inner circle that Musk will be stepping back from his government role.

Waton Financial ($WTF -65%): The Hong Kong-based brokerage firm fell more than 60% after jumping five times in value after going public Tuesday.

Rocket Companies ($RKT +10%): The housing fintech company received multiple analyst upgrades following its $9.4 billion deal to buy loan provider Mr. Cooper.

Taiwan Semiconductor ($TSM +1%): The world’s largest contract chipmaker fell in pre-market trading after a report said the firm’s U.S. investment plan is more like “the concept of a plan.” The $100B lump sum is similar to the $40b promised in 2022 and $65b in 2024 for semi-fabrication plants in Arizona, FT said.

Rivian ($RIVN -6%): The luxury electric vehicle startup traded nearly 6% lower on Wednesday after reporting a drop in delivery numbers for the first quarter of 2025.

Circle Internet Financial, USD Coin (USDC.X): The owner of US filed for an initial public offering with the U.S. Securities and Exchange Commission, seeking a valuation between $4 billion and $5 billion.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Balance of Trade (8:30 am), Initial/Continuing Jobless Claims (8:30 am), S&P Global Composite PMI (9:45 am), ISM Services PMI (10 am), Fed Jefferson Speech (12:30 pm), Fed Cook Speech (2:30 pm). 📊

Pre-Market Earnings: Conagra ($CAG), Lamb Weston ($LW), Acuity Brands ($AYI). 🛏️

After-Hour Earnings: Exxon Mobil ($XOM), Guess ($GES), Simulations Plus ($SLP), Lifecore Biomedical ($LFCR). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🌱 Ready to grow your portfolio? Spring into action with help from IBD Digital and save $65+*

👀 Best Buy stores to open at midnight for Nintendo Switch 2 release

🤳 Amazon, AppLovin bid to buy TikTok ahead of deadline, reports say

🛒 Chinese firms place $16 billion in order for new Nvidia chips, the Information reports

📜 White House Fact Sheet: President Donald J. Trump declares national emergency to Increase our competitive Edge

🤖 Join IonQ CEO Niccolo De Masi for a Stocktwits-exclusive interview Thursday morning at 9 am ET

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋