The impact of AI

Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

Subscribe to get access to these posts, and every post.

Yesterday, Text SA published its results.

But what impact does Artificial Intelligence have on their business?

Let’s summarize everything and update our investment case.

Text SA

Company Profile

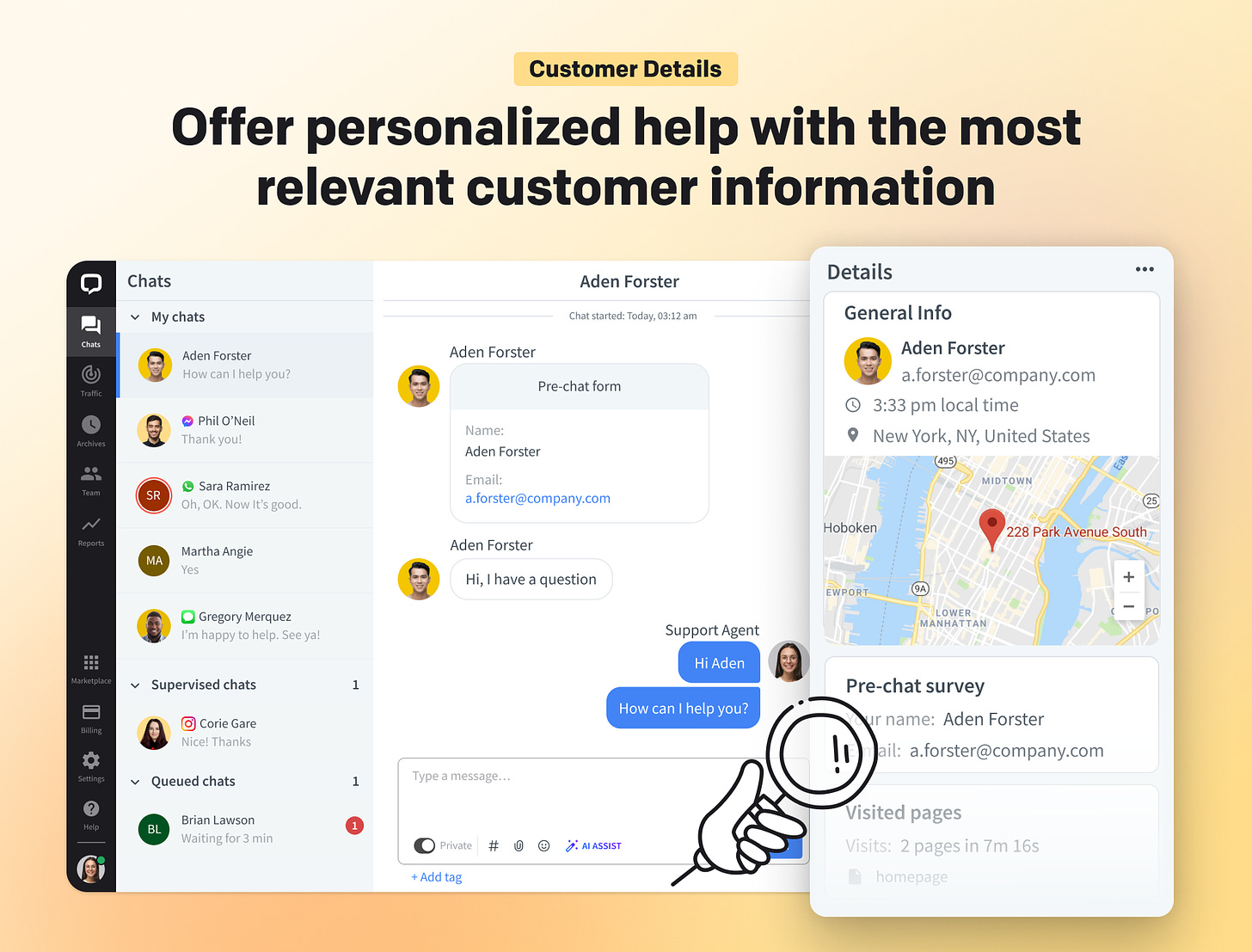

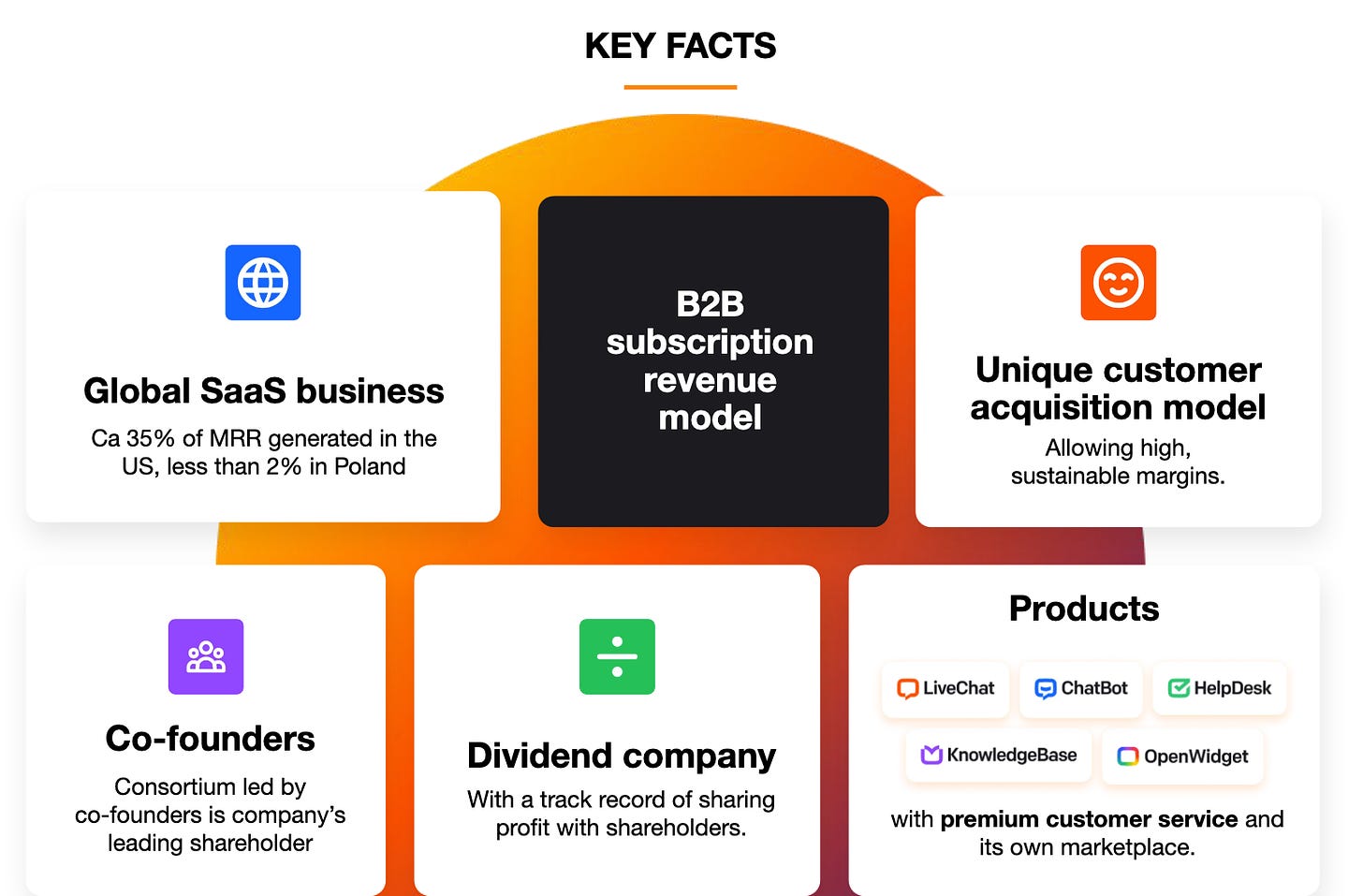

Text SA is a Software as a Service (SaaS) company. Almost all its revenue is recurring in nature.

The company manages text communication with customers in business-to-consumer (B2C) and business-to-business (B2B) sectors.

Investment rationale

-

Overlooked Compounding Machine

-

Net profit margin of over 50% (!)

-

Trading at very cheap valuation levels (PE: 12.2x)

For those interested, you can read the full investment case here:

Results

-

Financials third quarter 2023/2024

-

Revenue increased by +3.9% (+17.8% in USD) and net profit decreased by 7.1% due to unfavorable exchange rate changes

-

Net cash from operating activities amounted to PLN 134.7 million

-

Text SA generates virtually all of its revenues in dollars, and the weakening of the USD hurt the dynamics of results

-

We don’t try to predict FX movements

-

A time will come when the USD/PLN evolves in our favor

-

-

-

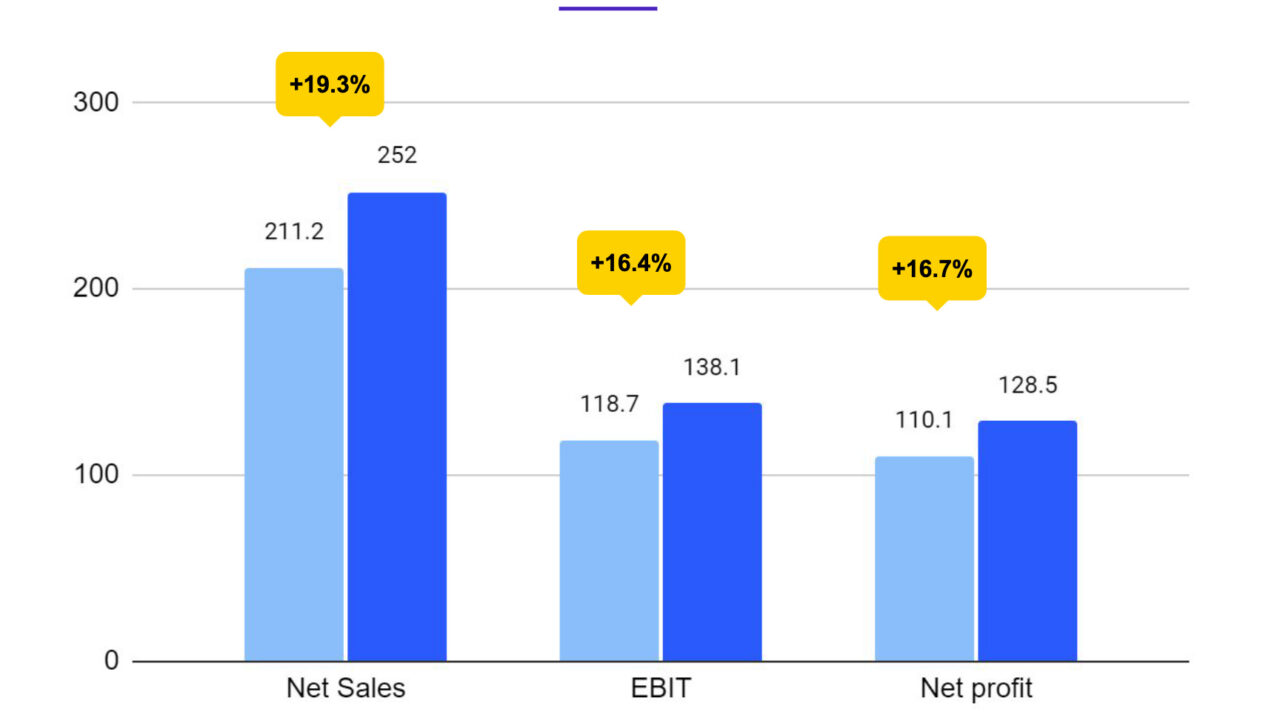

Financials first 9 months 2023/2024

-

Revenue grew by +19.3% and net profit grew by +16.7%

-

-

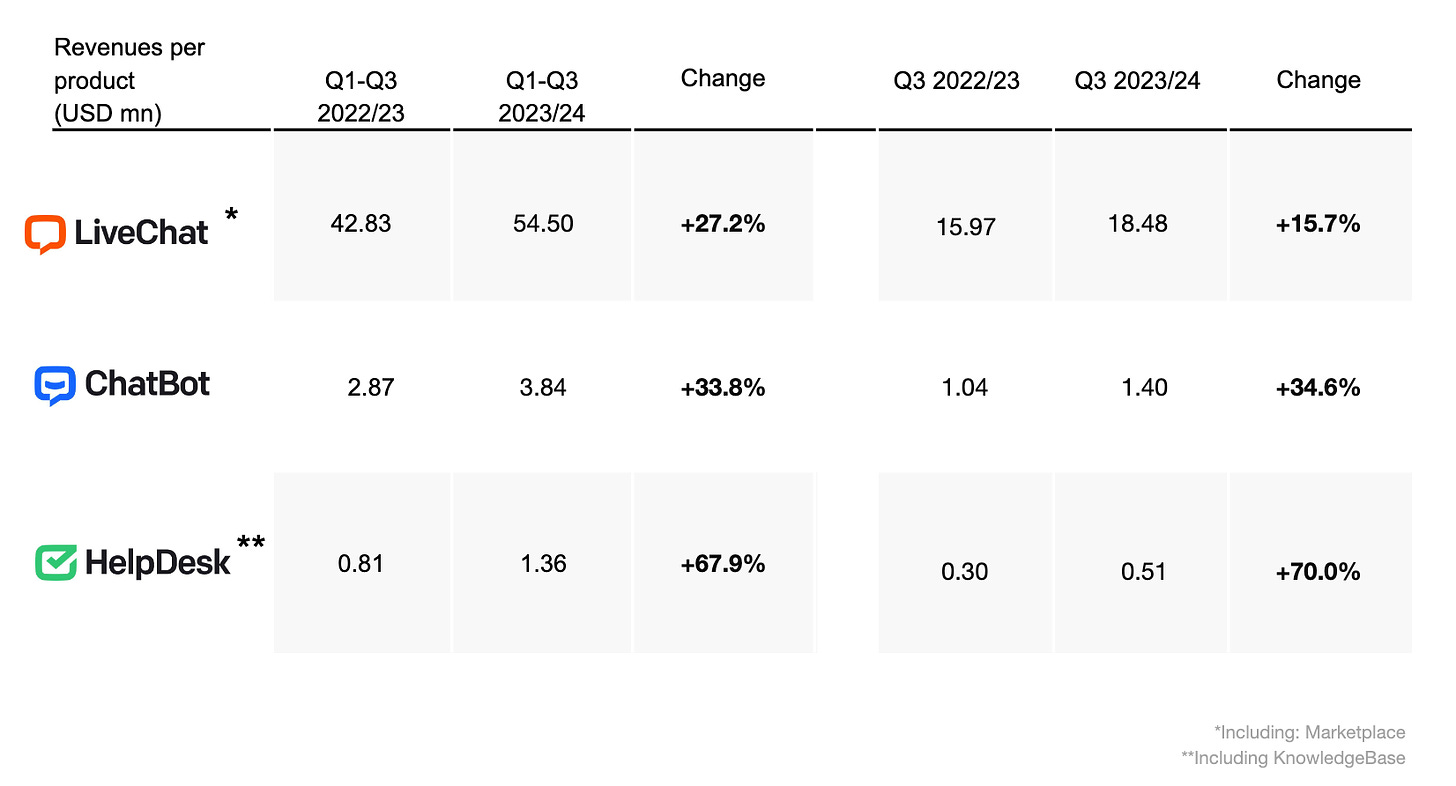

Revenue per product

-

ChatBot is becoming more important (this segment benefits from AI)

-

-

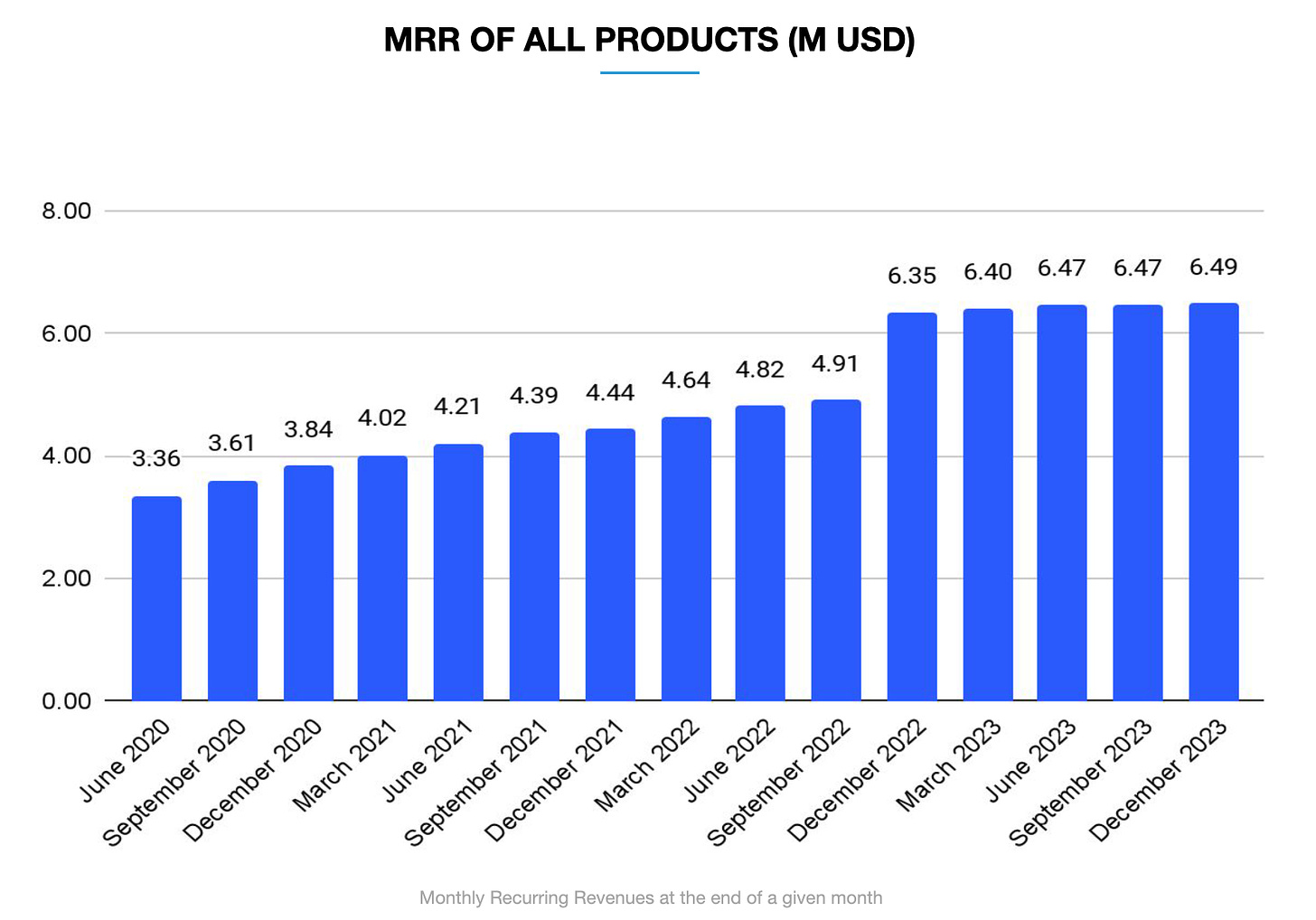

Monthly Recurring Revenue (MRR)

-

MRR is by far the most important metric for Text SA

-

MRR remained stable since Text SA increased its prices by roughly 25%

-

Text SA should grow its MRR again to do well as an investment

-

Due to the cheap valuation level of Text SA (see later), I think Text SA’s stock price can spike when they report MRR growth again

-

-

Monthly Recurring Revenue (MRR) is a measure of predictable total revenue generated from all active and paying subscriptions in a particular month. It includes all recurring charges but excludes one-time fees.

Text SA’s Moat

Recently, I talked with Shreekkanth Viswanathan, founder of SVN Capital, about Text SA’s moat.

Is the moat of Text SA as wide as we initially thought?