Trade of the Day

Happy Monday everyone.

Today’s post is a bit different.

I’m highlighting the best risk/reward setup I see right now.

Every now and then, a trade stands out. Let’s call it an A++.

These don’t show up often — but when they do, you’ll get the facts.

Let’s talk Tesla.

Autonomous Mobility + Relative Strength

Tesla is scaling its robotaxi service as autonomous driving spreads across Austin.

Unlike Waymo, Tesla isn’t using lidar. It’s relying on sensors and billions of driving hours to train its system.

Love him or hate him — it’s a creative approach by Elon and co.

But here’s what makes the trade interesting:

Despite the nonstop negativity around Musk, the stock shows strength.

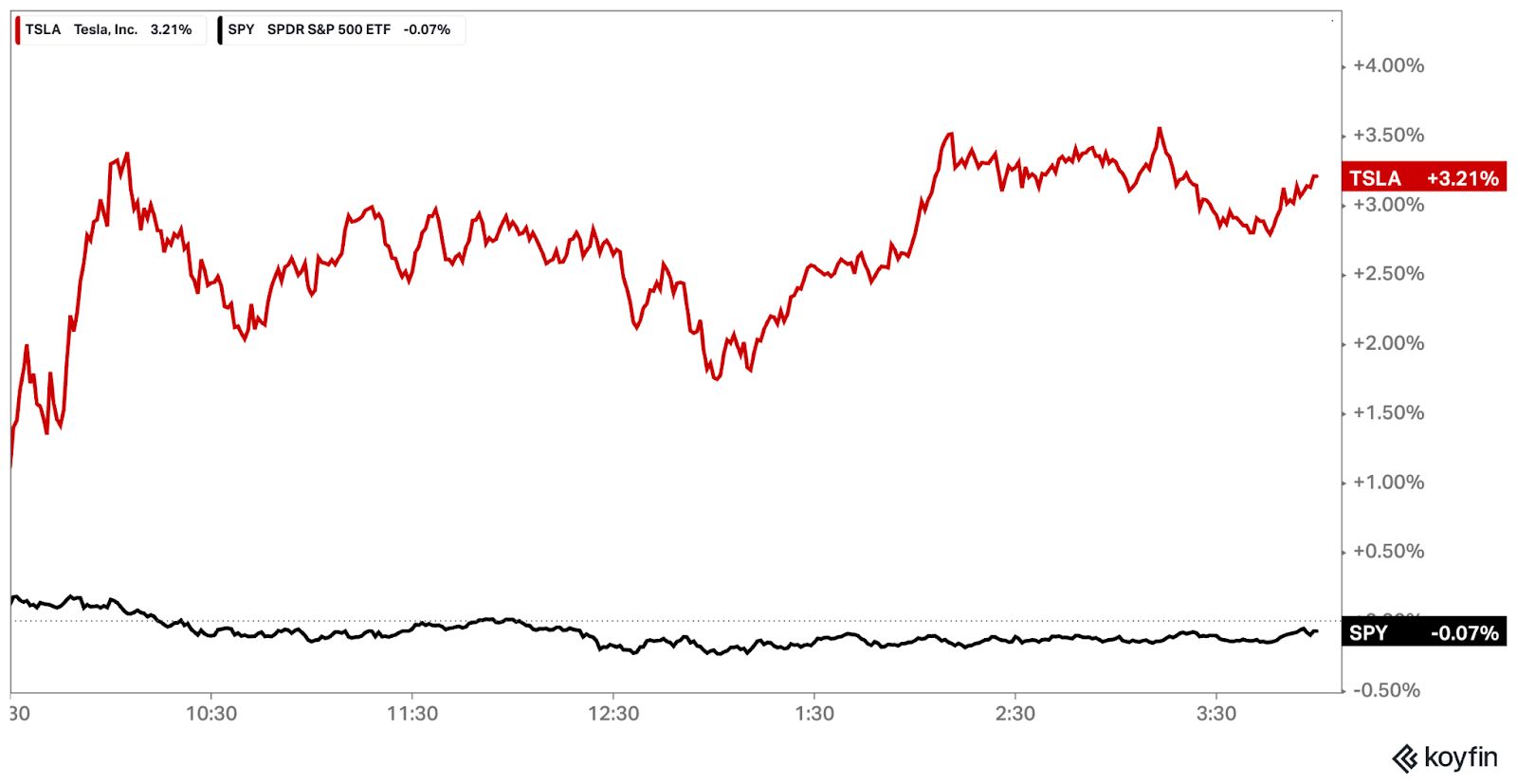

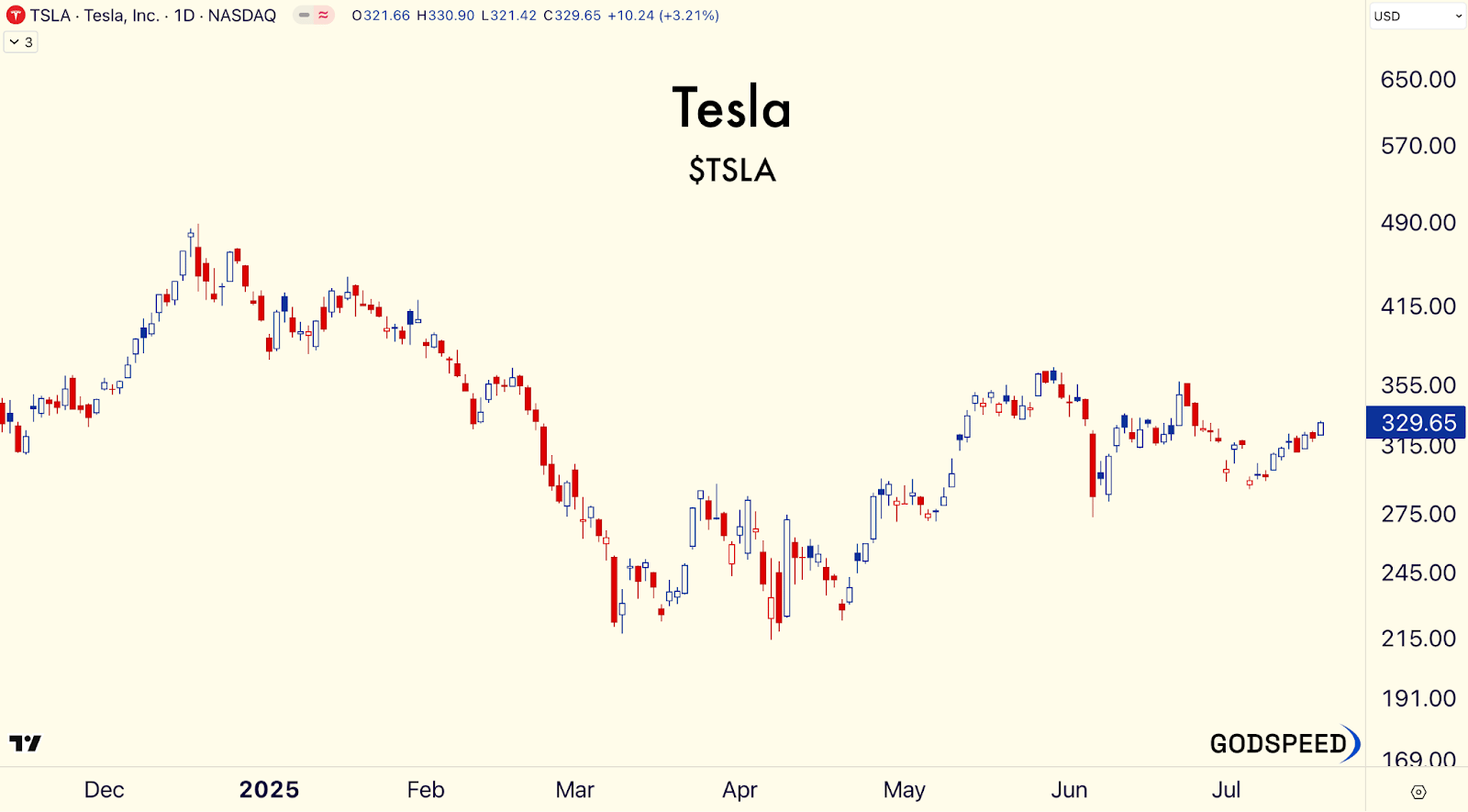

On Friday, while the S&P 500 was flat, Tesla closed up +3.21%. That’s relative strength.

The Negative Narrative

Elon’s critics have plenty to work with — political rants, third-party talk, and more.

But ask yourself: is this a guy you want to bet against?

He’s building Tesla, SpaceX, Starlink, xAI, Grok, Neuralink, and The Boring Company — and somehow finds time to be a top Diablo IV player.

Elon is crushing it.

Earnings Preview

Tesla reports earnings this Wednesday after the close.

Earnings are an event — a potential external force that shifts the primary trend.

What matters isn’t just the numbers. It’s the reaction.

I follow the PEAD theory — Post Earnings Announcement Drift — which says stock prices tend to drift in the direction of the earnings surprise as investors digest new info.

It reminds me of Newton’s First Law:

An object in motion stays in motion.

An object at rest stays at rest — unless acted upon by an external force.

We’ve seen earnings act as that force before. LULU’s Q3 2017 breakout is a textbook example.

For my fundamental friends — I asked Perplexity for 5 KPIs to watch for in its upcoming report, it said,

-

Earnings Per Share (EPS): Analysts expect Q2 2025 adjusted EPS around $0.43

-

Automotive Gross Margin: Tesla’s automotive gross margin dropped to 16.3% in Q1 2025

-

Vehicle Deliveries: Q2 deliveries fell 13.5% year-over-year to 384,122 vehicles, marking the steepest decline in Tesla’s history.

-

Free Cash Flow: There is concern Tesla may post negative free cash flow for the quarter, which would signal cash strain and reduce financial flexibility for investments in new products or AI initiatives

-

Guidance and Robotaxi/AI Updates: Investors are looking for management’s outlook on 2025 full-year deliveries and any specific updates about the launch and revenue potential of Tesla’s robotaxi and AI initiatives

Getting Technical

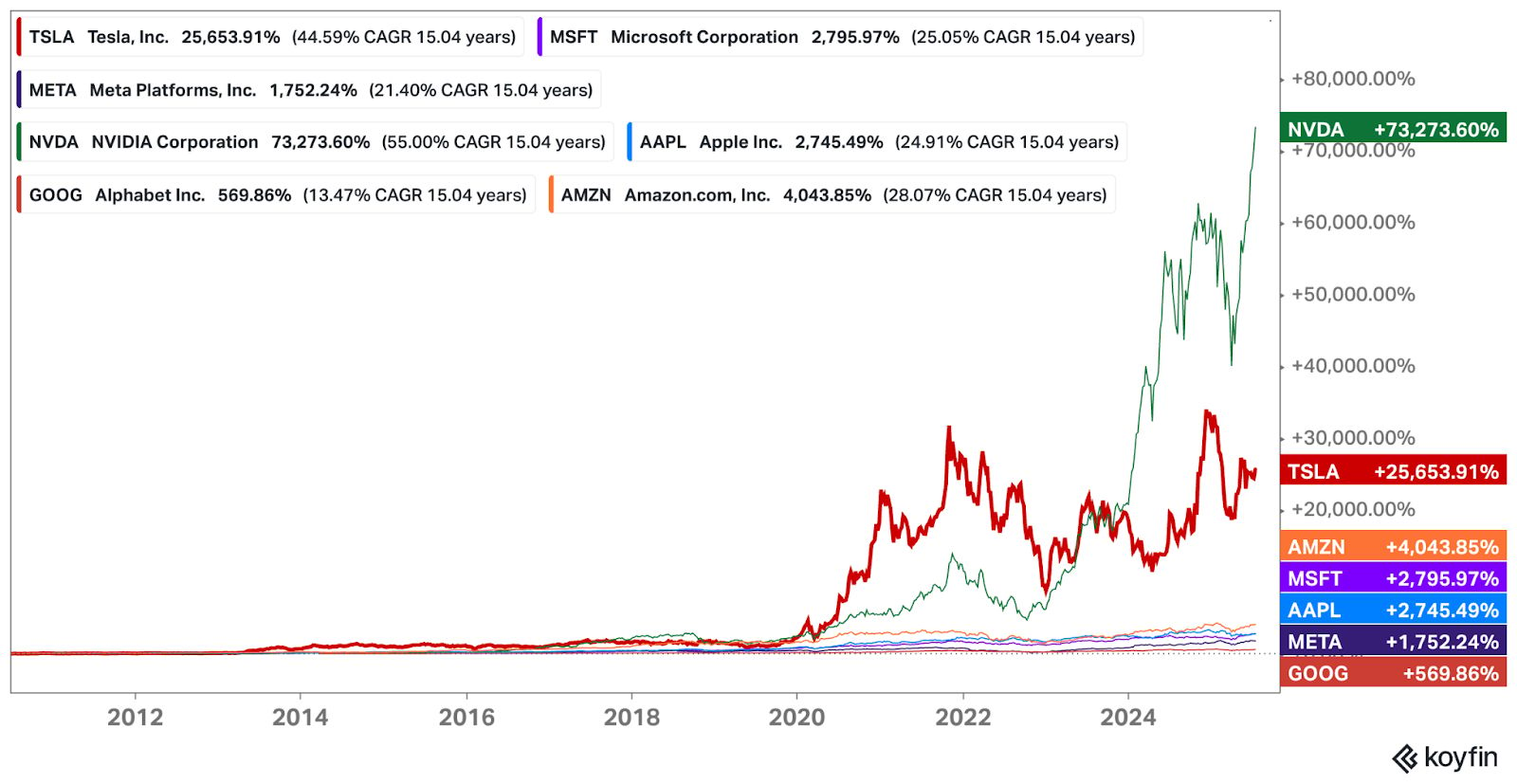

Tesla’s up nearly 26,000% since its IPO. Second-best among the Mag 7.

Our job as asset allocators is to position ourselves in winning stocks.

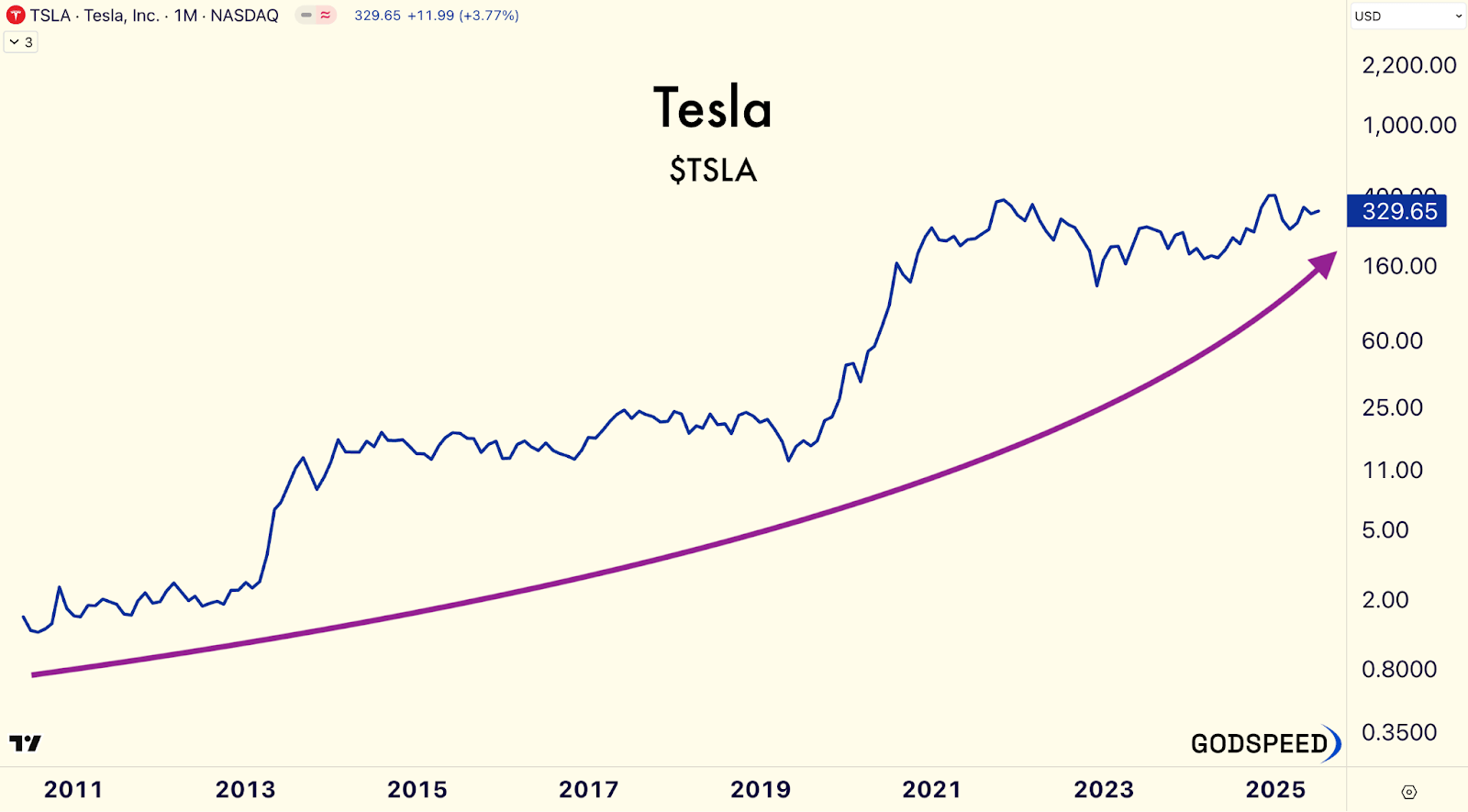

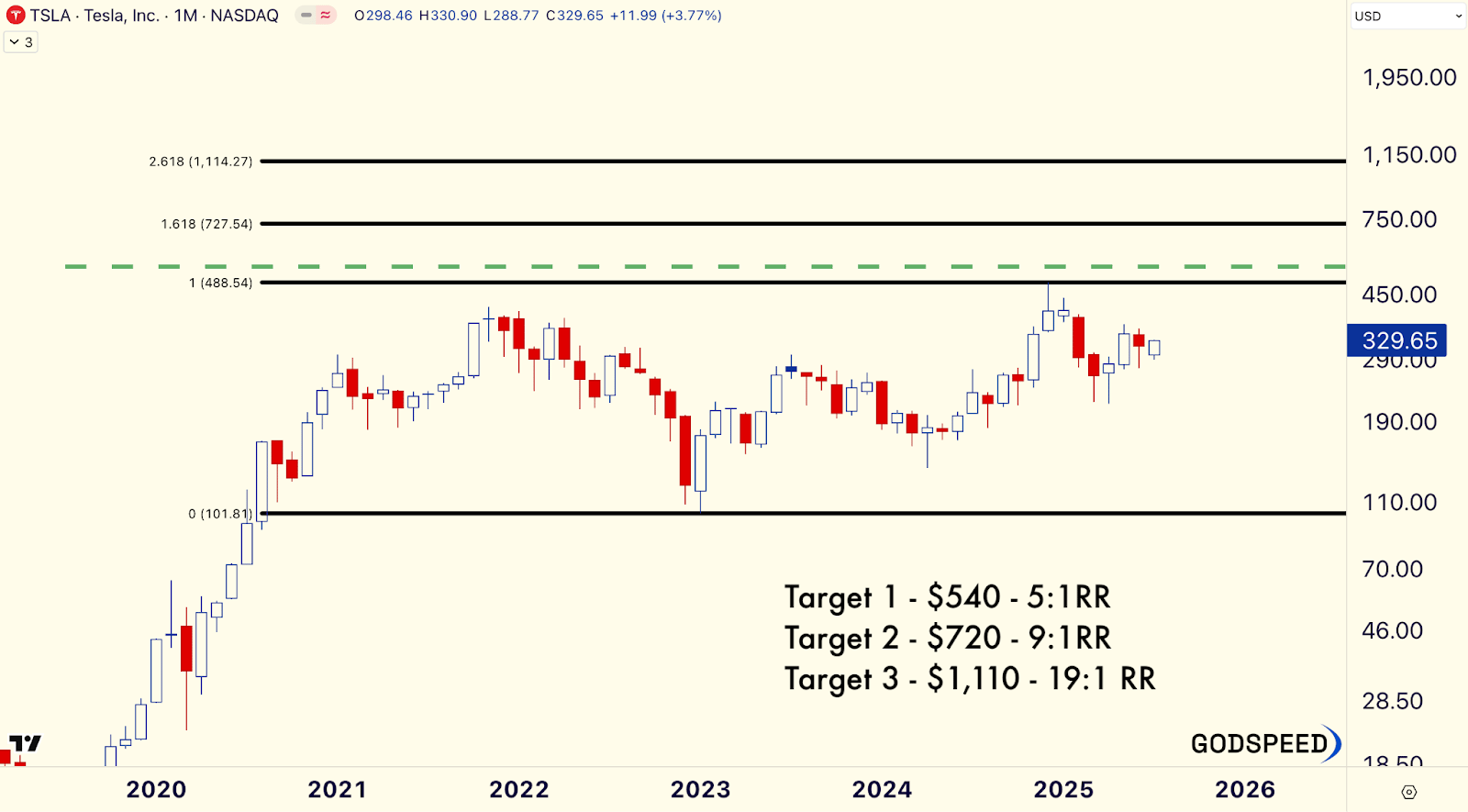

Tesla has a history of being a massive winner. Here’s its monthly chart.

But look at the last four years: a massive sideways range between $101 and $488.

At some point, that range breaks.

Since asset prices trend, odds favor a resolution higher.

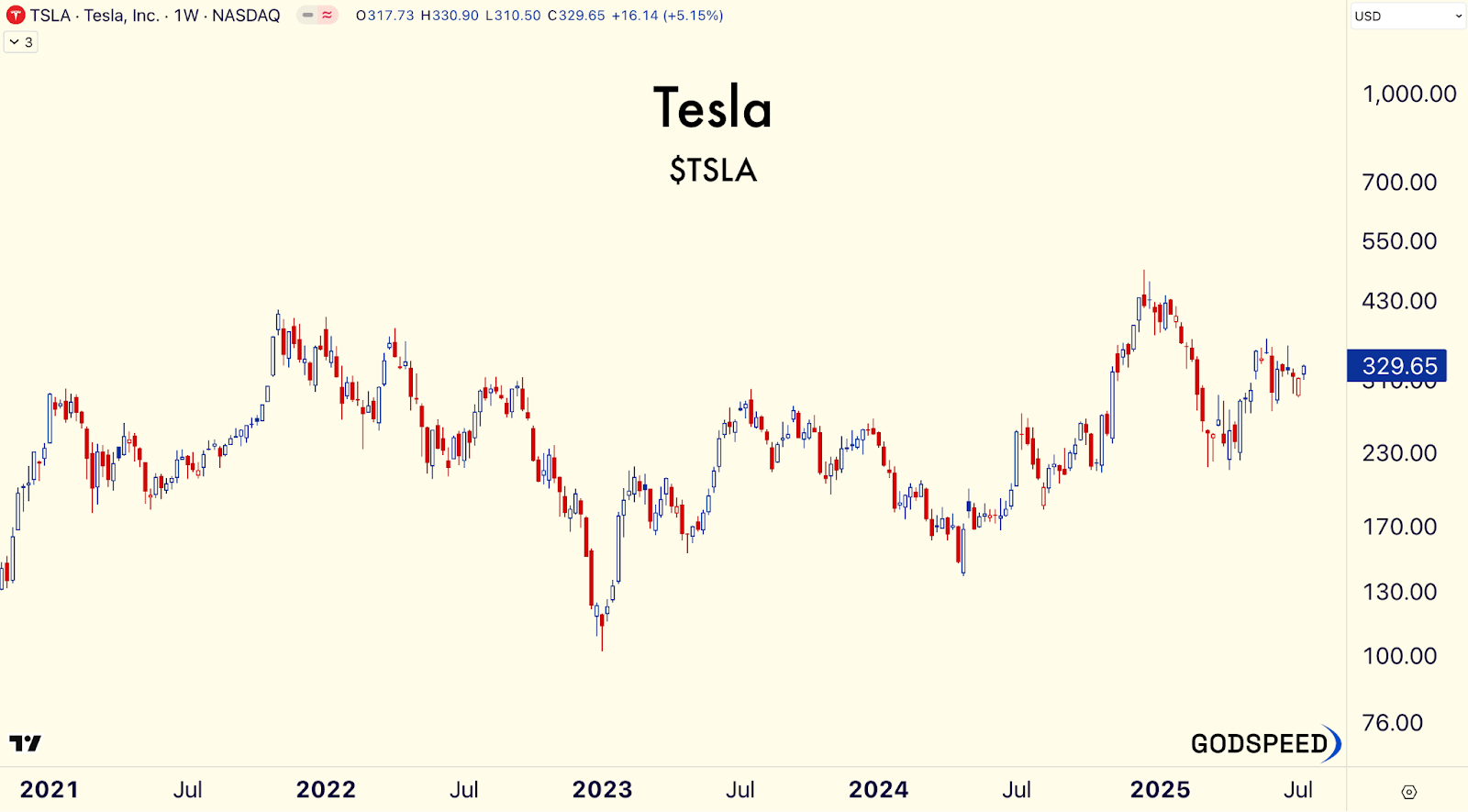

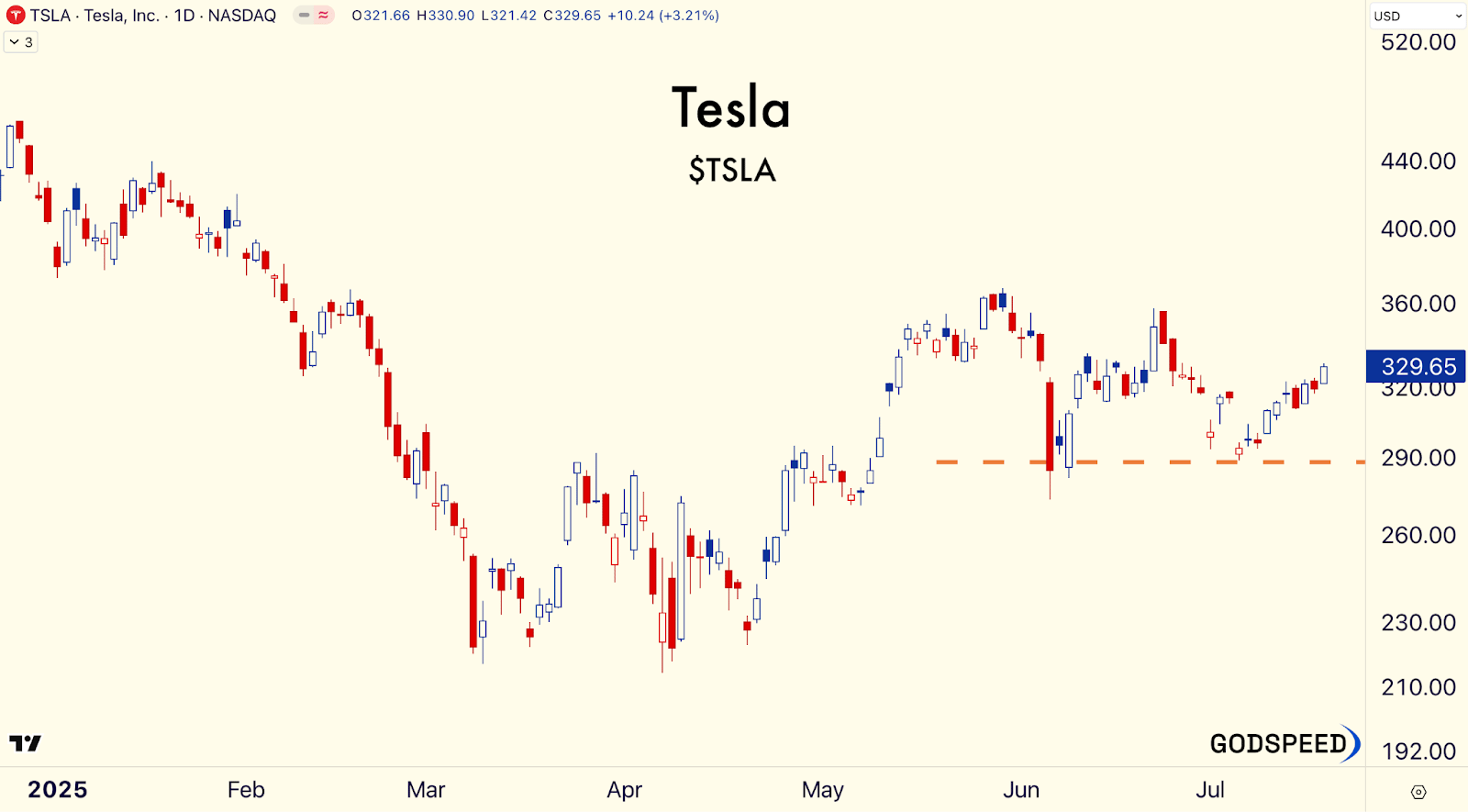

Zoom in on the weekly — the range becomes clearer.

Zoom in again — and the daily is pure chop.

Risk:Reward Profile

Here’s how I see it: Entry: ~$330 | Stop: ~$288 | Risk: $42

For a 5:1 opportunity, Tesla needs to reach ~$540 (+60%).

If it breaks the range, the 1.618 Fibonacci extension = $720, marking a 9:1 risk/reward profile.

The 2.618 extension = $1,105, registering a 19:1 risk/reward profile.

The Sum Of The Parts

We can’t quantify the odds, but we can stack layers of probabilities:

Negative sentiment around Elon? ✅ Contrarian edge.

Robotaxi narrative gaining steam? ✅ Big market.

Long base ready to break? ✅ Technically strong.

Earnings catalyst on deck? ✅ Timely.

This is the layers of probability approach.

The Trade

If Tesla stays above $288, I’m adding.

Not all at once — I’m wading in.

Buying small, staying nimble. Dissolving FOMO without overcommitting. Steadily increasing exposure.

At some point, we may have the green light to hit the gas.

But not yet.

Right now, it’s about patience and positioning.

This week brings clarity. Let’s use it wisely.

I’ll provide updates as the trade evolves.

Until then — Godspeed.

If you enjoy this post, please share it with a friend.

Godspeed – Rosebee

Disclosure: For informational purposes only. Not financial advice.