Tuesday's ‘Whack-a-Mole Market’

CLOSING BELL

Tuesday’s ‘Whack-a-Mole Market’

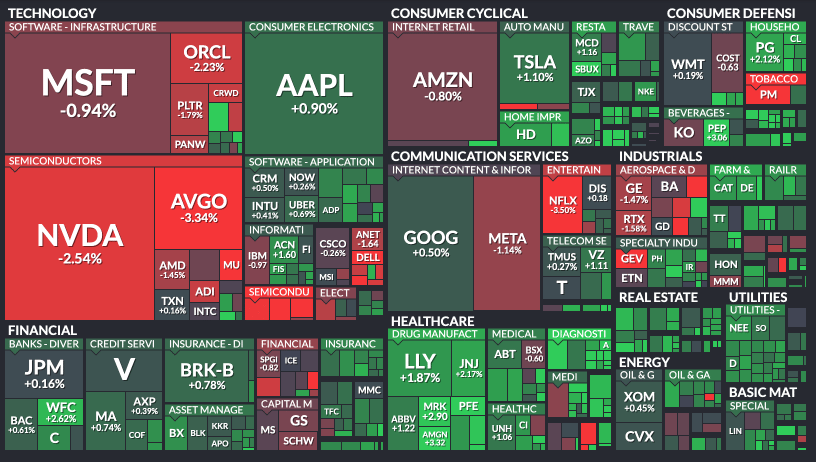

The S&P 500 hit a fresh record high after the White House announced two trade pacts with the Philippines and Indonesia, while earnings came in rough for blue-chip stocks.

RTX fell after slicing its outlook on tariff headwinds, Lockheed Martin fell and said it had to write off $1.7B in classified contract charges, GM said tariffs hurt its bottom line, Equifax fell despite topping forecasts, and Phillip Morris dropped 8% after Zyn shipments declined.

Smaller stocks were still moving like internet memes, though Opendoor fell back while retail store Kohl’s climbed. Tomorrow is the first two massive stock reports; let’s review at what Wall Street wants to see them report. 👀

Today’s issue covers: OPEN fell at open, but KSS replaced its climb, Tesla and Google face high expectations, and more. 📰

With the final numbers for indexes and the ETFs that track them, 10 of 11 sectors closed green, with health care $XLV ( ▲ 1.86% ) leading and technology $XLK ( ▼ 0.93% ) lagging.

S&P 500 $SPY ( ▲ 0.01% ) 6,309

Nasdaq 100 $QQQ ( ▼ 0.52% ) 23,063

Russell 2000 $IWM ( ▲ 0.83% ) 2,248

Dow Jones $DIA ( ▲ 0.34% ) 44,502

STOCKS

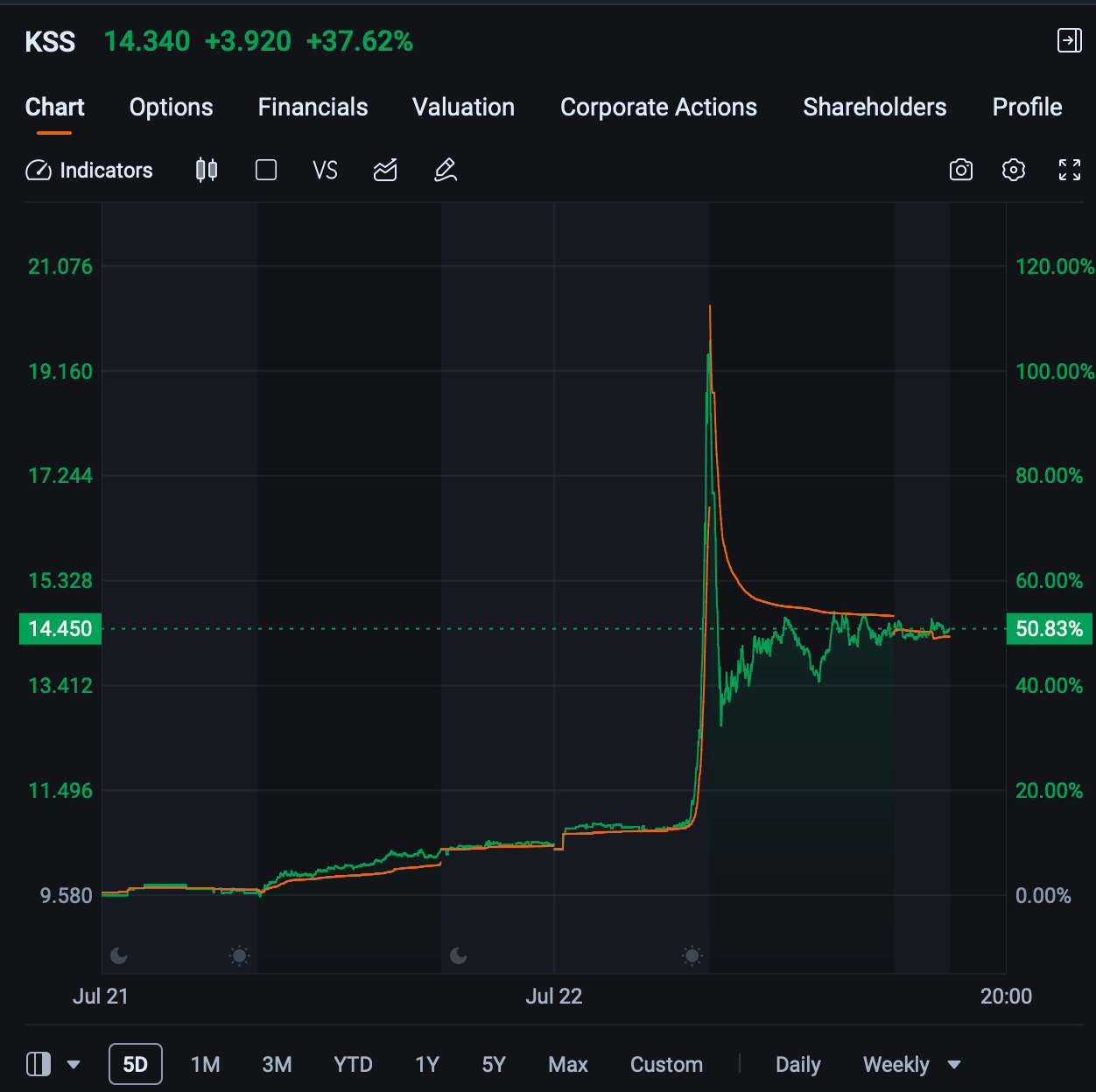

OPEN Fell Right At Open, But These Other Meme Stocks Got The Chefs KSS 👩🍳

One day after Opendoor swung for the bleachers and climbed 120%, then crashed back to 40%, the stock dumped at open. Retail traders, for better or worse, have a wealth of choices for low-value, highly shorted stocks competing for their attention.

Shares of retail store $KSS ( ▲ 37.62% ) Kohl’s was the next target, reaching the top three most active spots on Stocktwits, despite a lack of major news. The stock jumped from near $10 to almost $20, before rapidly dropping back. It was not even featured in a hedge fund twitter post, like $OPEN ( ▼ 10.28% ), which petered out all day.

Kohl’s had its best single day of trading in years, and though Opendoor soaked up the most trading volume on the Nasdaq for the second day, it was no longer the apple of retail investors’ eyes.

So what made Kohl’s a perfect target? For one thing, it’s heavily shorted, with an estimated 40% or more of the firm’s 112M share float held in short interest.

Behavioral finance expert Victor Ricciardi told MarketWatch that the sudden small stock blowups this week reminded him of the 1990s. He said the retail-based momentum market was creating microbubbles for individual stocks.

Another aspect of Kohl’s that fits the GME, AMC retail excitement format, is the name recognition power of a large retail brand. $WOOF ( ▲ 29.01% ) also climbed 29% Tuesday, as Petco reprised its role as a meme stock hopeful. Last year, Petco was rumored to be a new pick of Keith Roaring Kitty Gill, and the stock climbed 35% in one day after missing earnings results.

$DNUT ( ▲ 26.69% ) climbed 26%, and 24% after market as another meme name, KrispyKreme, flew on little news. $NXDR ( ▼ 0.49% ) Nextdoor was climbing, as if retail was looking for something like Opendoor, but ya know, nextdoor. 🏘️

Stocktwits’ Editor In Chief Tom Bruni has called the new trading trend a ‘Whack-a-mole market.’

SPONSORED

Get Fast ETF Updates, Market Moves, and Strategy Ideas—Free to Your Inbox

Markets move fast—and serious traders don’t wait for the news to catch up. When you subscribe to Direxion’s Xchange enewsletter, you’ll get direct access to timely updates on our Leveraged and Inverse ETFs, strategy tips, market insights, and alerts on stocks & indexes that matter to active traders. Whether you’re looking to play short-term momentum or hedge with precision, this is where the pros stay informed. It’s free, fast, and designed to for those who love risk.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

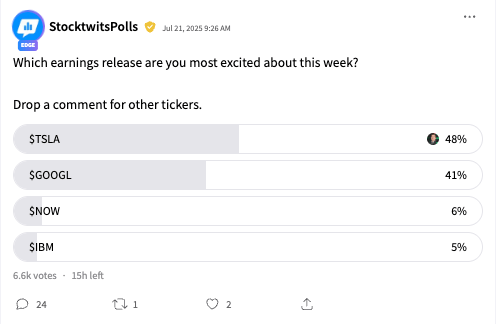

Mag 7 Names Are Here To Report: What To Expect From Tesla And Google

Tesla is scheduled to report its second-quarter earnings after the closing bell on Wednesday. It has been a rocky past couple of months for Tesla, following low monthly delivery numbers, and analysts expect a 10% drop in revenue compared to last year.

Revenue is expected to come in at around $22.12 billion, down from $25.5 billion, according to analysts. Analysts on average expect the company to report an earnings per share of $0.49, below the $0.52 from last year.

As part of the Mag 7, Tesla may face a strict reaction to its forward-looking guidance. Especially for an import-reliant manufacturing firm, forward-looking expectations are just as important as the well-trodden current quarter results. Analysts are expecting an average revenue estimate of $24.5 billion in the upcoming quarter and an average earnings per share of $0.48.

Alphabet is much more straightforward. The stock, or both stocks, received price target boosts before its earnings, expected at $2.2/share with revenue at $93.98B. The firm will also face the Mag 7’s expectation of forward-looking guidance perfection, especially as a digital ad revenue business, with revenue at $95.67B according to analysts compiled by Yahoo Finance.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors’ portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset’s no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

Palo Alto, SentinelOne, and Sea dominated Stocktwits retail chatter amid rising cybersecurity demand and strong regional growth signals. Read more

Retail followers of Chipotle and Mattel are closely watching Wednesday’s earnings and tariff-related commentary, anticipating key signals on trade impact and consumer strength. Read more

GM CEO Mary Barra highlighted plans to mitigate future tariff impacts after Q2 earnings took a $1B hit, absorbing tariff costs in the quarter. The stock fell nearly 7%, after profit sank. Read more

Scott Bessent offered support to Federal Reserve Chair Jerome Powell, contrasting recent political criticism with a vote of confidence in central bank leadership. Read more

Philip Morris saw a surge in retail hype as strong demand for its smoke-free products reinforced its pivot from traditional tobacco. Read more

Solana surged to a four-month high while Bitcoin moved sideways and Ethereum and Cardano posted declines, reflecting diverging momentum across major cryptocurrencies. Read more

Coca-Cola switched to cane sugar for its U.S. Coke brand, driving retail sentiment to a nine-month high as consumers cheered the move toward more natural ingredients. Read more

Oscar Health revised its 2025 outlook to reflect an expected operational loss between $200 million and $300 million, signaling deeper financial strain. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Stocktwits Community Spotlight: Michael Parekh, Former Goldman Head of Global Internet Research

In this episode of Stocktwits Community Spotlight, we sit down with Michael Parekh, a pioneering internet analyst and global investor with a remarkable story. From helping Goldman expand into the Middle East to leading internet research during the dot-com boom, Michael shares a front-row view of how past tech revolutions mirror today’s AI surge. He reflects on what it takes to navigate exponential change, the importance of remaining intellectually curious, and why global context matters more than ever.

Watch now to hear from one of the original internet whisperers.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Existing Home Sales (10:00 AM), 20-Year Bond Auction (1:00 PM) 📊

Pre-Market Earnings: AT&T ($T), Freeport-McMoRan ($FCX), NextEra Energy ($NEE), General Dynamics ($GD) 🛏️

After-Hour Earnings: Tesla ($TSLA), Alphabet ($GOOG, $GOOGL), QuantumScape ($QS), Chipotle ($CMG), IBM ($IBM), Viking Therapeutics ($VKTX), T-Mobile US ($TMUS), ServiceNow ($NOW), Las Vegas Sands ($LVS), Alaska Air Gr ($ALK) 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

👀 Why Are Stocks Up? Nobody Knows

😨 Coinbase and PNC to work together as crypto reaches for Main Street

🏠️ Wall Street is upbeat on tech megacaps, but big questions loom on AI spending, China, Trump tariffs

Ozzy Osbourne, pioneering heavy metal singer and Black Sabbath frontman, dies at 76

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋