Who’s Buying Bonds With Me?

From the desk of Steve Strazza @sstrazza

For the first time in my career, I’m buying bonds.

It has less to do with positioning defensively and more to do with making a call on lower interest rates.

But what it really comes down to, more than anything, is the chart pattern.

Bond funds are completing bearish-to-bullish reversals for the first time in years.

This is the same exact pattern we’ve gone back to time and again this cycle… and every cycle, really.

Rounding bottoms are some of the most reliable patterns we have as technicians.

And we’re seeing them across the board in bond funds right now.

Let’s dive in and talk about some of them.

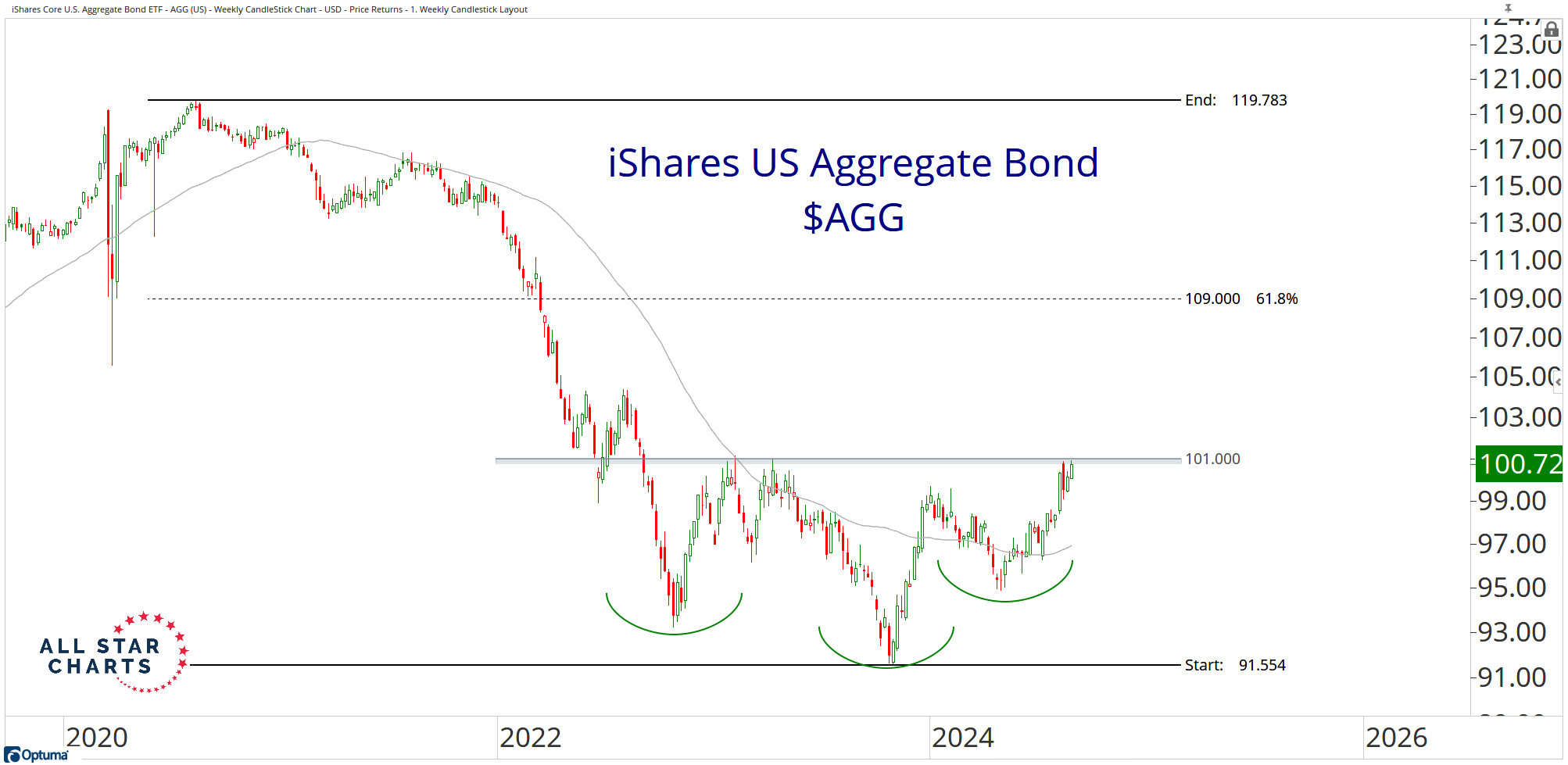

Here’s the US Aggregate Bond ETF $AGG:

This fund holds treasury securities, corporate bonds, mortgage-backed securities, and municipal bonds. It is exactly what it sounds like. A diversified bond fund. It also offers investors a 3.4% yield.

The US Aggregate Bond ETF is pressing against the upper bounds of a multi-year accumulation pattern. With the 200-day moving average curling higher, we expect this base to resolve in the near future.

We’re buying AGG on strength above 101, with a target of 109 and 119.75.

Next is the Investment Grade Corporate Bond ETF $LQD, which holds over 2,000 different corporate bonds and pays a 4.2% dividend:

LQD is resolving a multi-year consolidation to the upside. Notice the 200-day moving average has started to curl higher, indicating a new uptrend is underway.

We want to own LQD above 111.50, with a target of 123.70 and 139.50.

Our final setup is the High Yield Bond ETF $HYG, which holds a variety of junk bonds and yields 5.86%:

HYG is printing fresh multi-year highs after whipsawing traders around the breakout level earlier this month.

If HYG is above 78, the path of least resistance is higher and we want to be long with a target of 88.

As more and more primary trend reversals are completed in the bond market, we will have a growing level of conviction that rates will continue to fall.

At first glance, buying bonds or bond funds may not sound all that enticing. However, these multi-year bases excite me, and 3-5% yields ain’t too shabby, either.

I’m going back to the well on the same pattern that has paid us over and over again this cycle.

Why should we treat bonds any differently from the others?

I don’t think we should.

And if you think the upside potential isn’t enough, well, that’s what the options market is for.

At least, that’s how I plan on expressing this thesis.

-Allstarcharts Team

Thanks for reading.

As always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

The post Who’s Buying Bonds With Me? appeared first on All Star Charts.