ZEC Just Made A New 7.7 Year High 🚀

OVERVIEW

ZEC Just Made A New 7.7 Year High 🚀

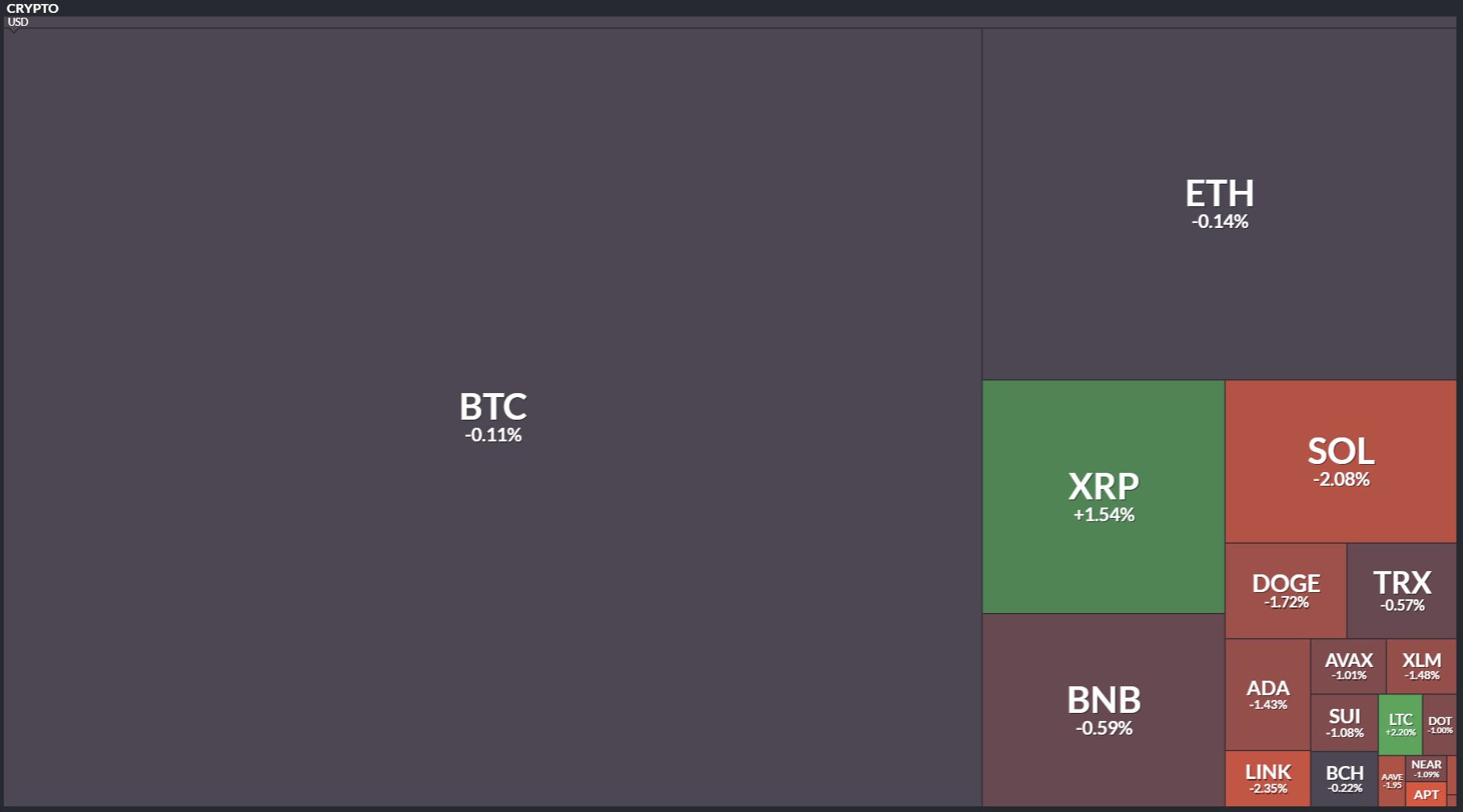

Before we dive in, here’s today’s crypto market heatmap:

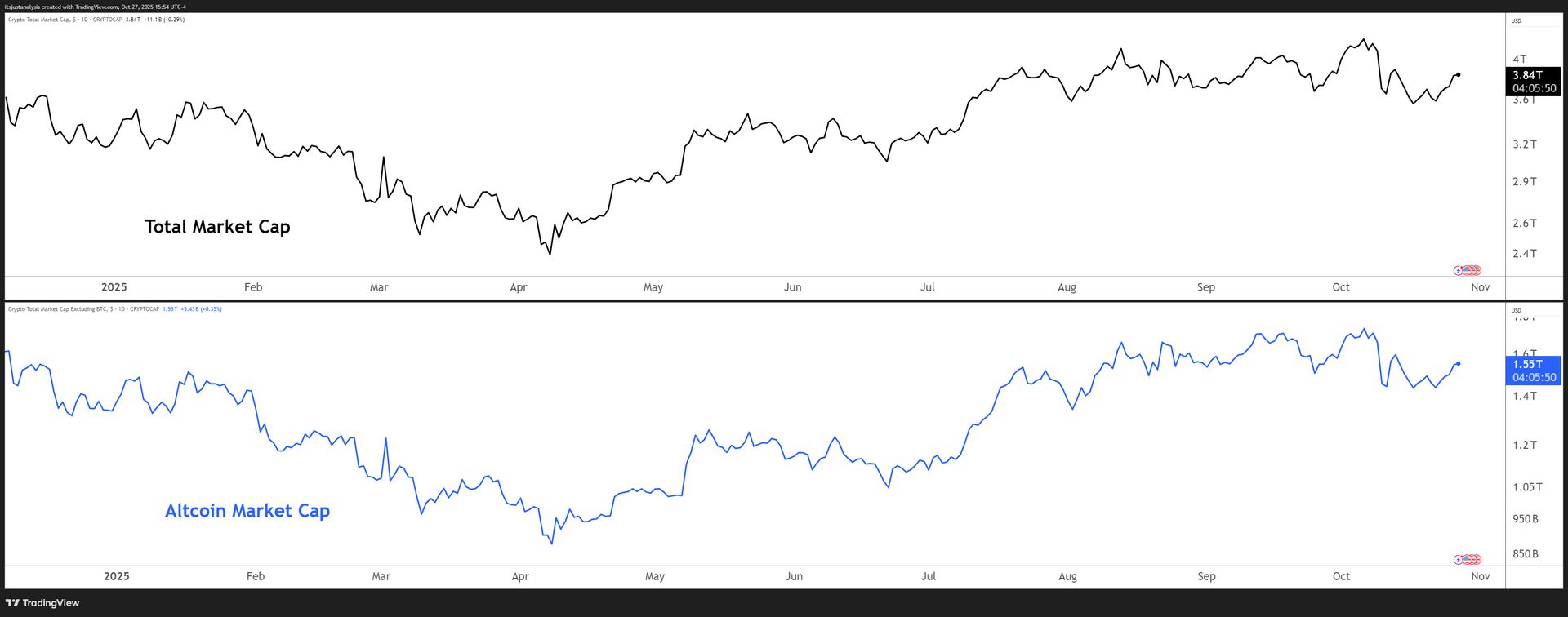

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

The Top 20 Mind-Blowing Zcash Stats For October 📆

Zcash just hit a new 7.7 year high today. Which is just nuts because this drive keeps getting more unbelievable and stronger as it goes on. 🤯

Let’s go into some of the insanity that is $ZEC.X ( ▼ 2.05% ) this month. Because if October were to end today, these are the kinds of insane results we’d get.

Note: the historical data used for this analysis is taken from the aggregated investing.com data. Some exchanges, like Kraken, have different initial opening price ranges and others, like Binance, have different historical starts/beginnings.

The Ultimate Crazy Stats List

404% Volatility

-

October’s price range = 404.98% of its opening price. If you bought at open ($74.23), you saw 5x potential in 30 days

-

1.77x MORE volatile than the #2 most volatile month ever

86% of 2025 in One Month

-

October captured 86% of ALL 2025 gains

-

Total 2025 gains: 452.5%

-

October alone: 387.3%

-

Other 9 months combined: 65.2%

-

Miss October = miss the entire year

Still Down 78% From Launch

-

November 2016 opening price: $1,644.62

-

October 2025 closing: $360.80

-

Despite the best month EVER, still -78.06% from day 1

-

Reframes everything: recovery, not breakout (some might debate that)

One Month = 20 Average Months

-

October 2025 represents 18.9% of ALL historical positive gains

-

One month achieved what typically takes 20 months

-

If every month was like October: 10x in 2.5 months, Pareto principle on steroids

50.6X The Average Gain

-

Average monthly gain: 7.7%

-

October gain: 387.3%

-

October is 50.6x the typical month

6.08X Above Median

-

All-time median price: $59.34

-

October 2025: $360.80

-

6.08x above long-term median

Acceleration Went Nuts

-

Aug to Sep: Gain was 8.37x faster

-

Sep to Oct: Gain was 4.65x faster

-

3-month combined: 882% (nearly 10x in 90 days)

7.7 Years Since It Was This High

-

Last time price was at $360 level: 2,799 days ago (this number might be different depending on the exchange data you’re looking at, chill)

-

That’s 7.7 YEARS of history bypassed

-

October teleported through 96% of ZEC’s recent history

1.33% Of All-Time Volume

-

October = 1.33% of ZEC’s ENTIRE historical volume

-

One month grabbed more than 1% of 108-month series

-

Expected share: 0.93%

-

Got 1.43x its “fair share”, but gain was 50x fair share

Helps That These Kinds Of Things Are Happening

Arhur Hayes is, in my opinion, one of the most accurate crypto people to watch when it comes to ‘what happens next’. And I’m not the only one.

Vibe check

$ZEC to $10k

— Arthur Hayes (@CryptoHayes)

8:57 AM • Oct 26, 2025

So when he posts about going into Zcash big, people pay attention biggly.

Oh, and Grayscale posting about it’s Zcash trust like it’s not been around for almost 10 years already:

Privacy matters 🔐

@Zcash $ZEC helps make private, on-chain transactions possible.

Grayscale Zcash Trust (Ticker: $ZCSH) is the only U.S publicly listed fund providing exposure solely to @Zcash $ZEC through certain brokerage accounts.

See important disclosures and learn more

— Grayscale (@Grayscale)

6:51 PM • Oct 27, 2025

And as much as I hate being that guy, there are four more days left in October and a whole lot of shite can hit the fan in just four days. Case in point: Sucktober the 10th.

But unless something horrific happens, October 2025 is Zcash’s month.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

TECHNICAL ANALYSIS

Trading Tip: Volume Profile 📊

Voz does a breakdown of the Volume Profile, useful in any market. 📺️

If there’s more you want to know about the Volume Profile, I’d highly recommend Anna Couling’s book on Volume-At-Price analysis, it’s one of the best. 👍️

AVALANCHE

Ulta, ASICS, and Avalanche Walk Into a Loyalty Program… 🤔

Loyalty programs feel like hoarding. The average U.S. consumer sits in more than 15 of them. Participation keeps sliding. 44% walk due to weak personalization. More than half of the 18–34 demo plan to cancel within a year.

Points stack up like dryer lint but someone thinks they have a fix for that.

Well, Just Hang On

Hang is a marketing and customer data suite with its own $AVAX.X ( ▼ 0.4% ) L1 called the Brand Protocol. Data unification, identity resolution, AI segmentation, gamified engagement, and on-chain transparency live in one place. Brands keep control of their data and still get network effects across partners.

Think real-time offers, personalized perks, and rewards you can use across different brands – all tracked on-chain so no one’s faking redemptions or losing data.

Instead of more plastic cards and promo spam, Hang connects your activity directly to verifiable rewards. Companies like $ULTA ( ▲ 1.0% ), ASICS , and $CNK ( ▲ 2.42% ) already use it. They get cleaner data, faster payouts, and better engagement.

Avalanche keeps it quick and cheap. Sub-second finality means instant redemptions and no middlemen eating fees. Everything’s automated, transparent, and built for scale.

Hooray for crypto/blockchain being used without users even knowing they’re using it. Because that’s how adoption grows. 👍️

STOCKTWITS

Watch Our Very Own Tom Bruni On WTF Happened With The AWS Crash 📺️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🌍 Dash Dusts Itself Off, Aims at Three Billion Users

Remember Dash? They’re pushing InstantSend payments, tiny fees, and mobile-friendly wallets across emerging markets. They want to turn their dust off their 2015 ass into actual “digital cash” for people who need it. It’s ambitious. Maybe delusional. Dash.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏦 LayerZero’s Pitch to Wall Street: Cross-Chain, But Make It Boring (and Legal)

LayerZero’s new paper reads like the lovechild of TradFi compliance and DeFi composability. Their thesis: institutions want better plumbing, not memes. They’re building the rails for “programmable money” across chains. It’s clean, regulatory-friendly, and so practical it’s almost unsexy. Which is exactly what banks like. LayerZero.

🌱 Plume’s Ascend Accelerator Launches Its First RWA Class

Plume’s Ascend Accelerator is live, onboarding a fresh batch of startups turning real-world assets – bonds, gold, carbon credits – into on-chain financial primitives. It’s basically DeFi’s version of Shark Tank, minus the shouting and with way better tokenomics. Plume.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏛️ MultiversX Wants Blockchain to Preserve Culture, Not Just Tokens

While everyone else is arguing about memecoins and ETFs, MultiversX is out here using blockchain to protect cultural heritage. Think onchain archives, provenance trails, and verifiable authenticity for art and history – not just JPEGs. MultiversX.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💸 Curve’s Low on Juice, Wants to Print 5M crvUSD to Top Up

Curve DAO’s floating a plan to mint five million more crvUSD – a controlled top-up to refuel liquidity pools and keep the gears turning. Think of it as a DeFi stimulus check, but for LPs instead of landlords. The tokens go straight to protocol-controlled liquidity, not someone’s yacht fund. The vote decides whether Curve’s deflationary purists or its pragmatic “don’t let the car stall” crowd wins this round. Curve Finance.

💀 1inch Says Most Crypto Projects Die Because They Deserve To

1inch’s latest blog post is so brutally honest it might as well be a eulogy. TL;DR – projects don’t implode because of “the bear market”; they implode because they were built on fumes, hype, and delusion. Lack of product-market fit, clueless founders, no treasury discipline, and the ol’ “community rug.” 1inch’s advice? Don’t start a protocol if you can’t outlast a bad quarter. 1inch.

💱 Uniswap’s Tired of You Complaining About Slippage

Uniswap just published a masterclass on how not to wreck your own trades. Slippage – the silent portfolio killer – is 90% user error. Their guide breaks down how to route smarter, set realistic limits, and stop getting robbed by bots in broad daylight. If you’ve ever wondered why your swap cost more than a beer at a Yankee’s game, spoiler: it’s because you didn’t read this. Uniswap.

🚀 YieldFi Moves Into Saga – Because Idle Capital Is Dead Capital

Borrow, lend, and earn yield across multiple ecosystems without touching a bridge. Saga’s adding YieldFi to its growing DeFi war chest, bringing more cross-chain yield strategies straight into its Velocity DeFi layer. The chain’s turning into a liquidity freeway, and YieldFi’s the latest car on it – except this one actually prints gas. Saga.

NEWS IN THREE SENTENCES

Protocol News 🏦

☁️ AWS Took a Nap. Storj Didn’t Blink.

I was wondering when these digs at AWS would starting popping out. Here’s one from Storj about how Amazon’s cloud tripped over its own shoelaces and killed half the interwebz. Storj? Still up. Storj’s decentralized nodes just… worked. That’s the point. No single region, no single point of failure, no multimillion-dollar outage apology email. Storj.

🔌 Kaspa Opens the Floodgates with IGRA’s Public Node Rollout

Kaspa’s public node expansion just went live thanks to IGRA Labs, and it’s a big deal for one reason: more nodes = less bottleneck. Anyone can now spin up a node, plug into the network, and stop pretending decentralization means “five guys on Discord.” Kaspa.

⚡ Pocket Network Reminds You That “Decentralized” Isn’t a Buzzword

And here’s another AWS-Is-Bad from Pocket Network in a blog titled “Wake Up Call: Decentralization Is Not a Meme,” and it’s exactly that – a slap. They call out the hypocrisy of “decentralized” protocols still running on AWS while preaching sovereignty. Their message: decentralization isn’t marketing; it’s survival. And if your node count fits in a group chat, you’re not it. Pocket Network.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, ZEC, AVAX, XLM, LTC, LINK, INJ, ALGO, XTZ, IMX, HBAR, . 📋