2021 Is Calling

Presented by

CLOSING BELL

It Wants Its Jobs Back

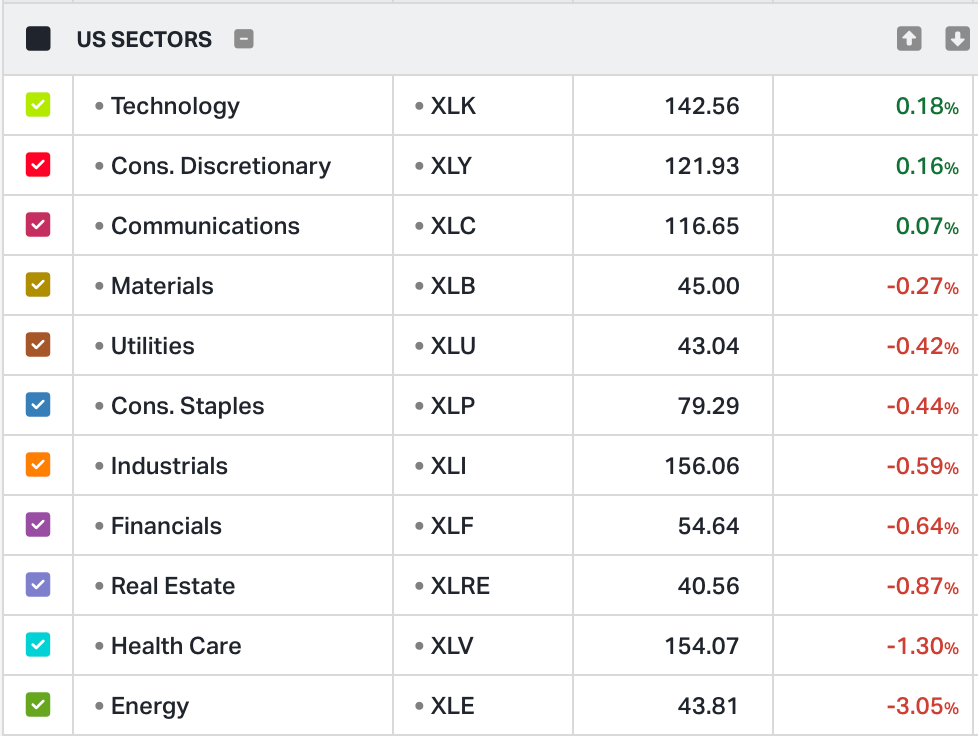

The overall market continued to fall on Tuesday, but select tech names helped the Nasdaq climb. Investors watched as the worst unemployment rate peeked its ugly head in the delayed jobs data. November’s labor market saw 64,000 job additions, well above October’s 105,000 job losses that the BLS also released Tuesday, but the most recent unemployment rate of 4.6% was the highest since May of 2021.

“The U.S. Economy is in a hiring recession,” Heather Long, Navy Federal Credit Union, said. She pointed out 710,000 more people are unemployed compared ot a year ago.

Broken down by demographic, some segments were even worse; 10%+ of 16-24 year olds were unemployed in November. The bad data comes before inflation data later this week, but is used as a tell for traders to bet on more rate cuts coming next year.

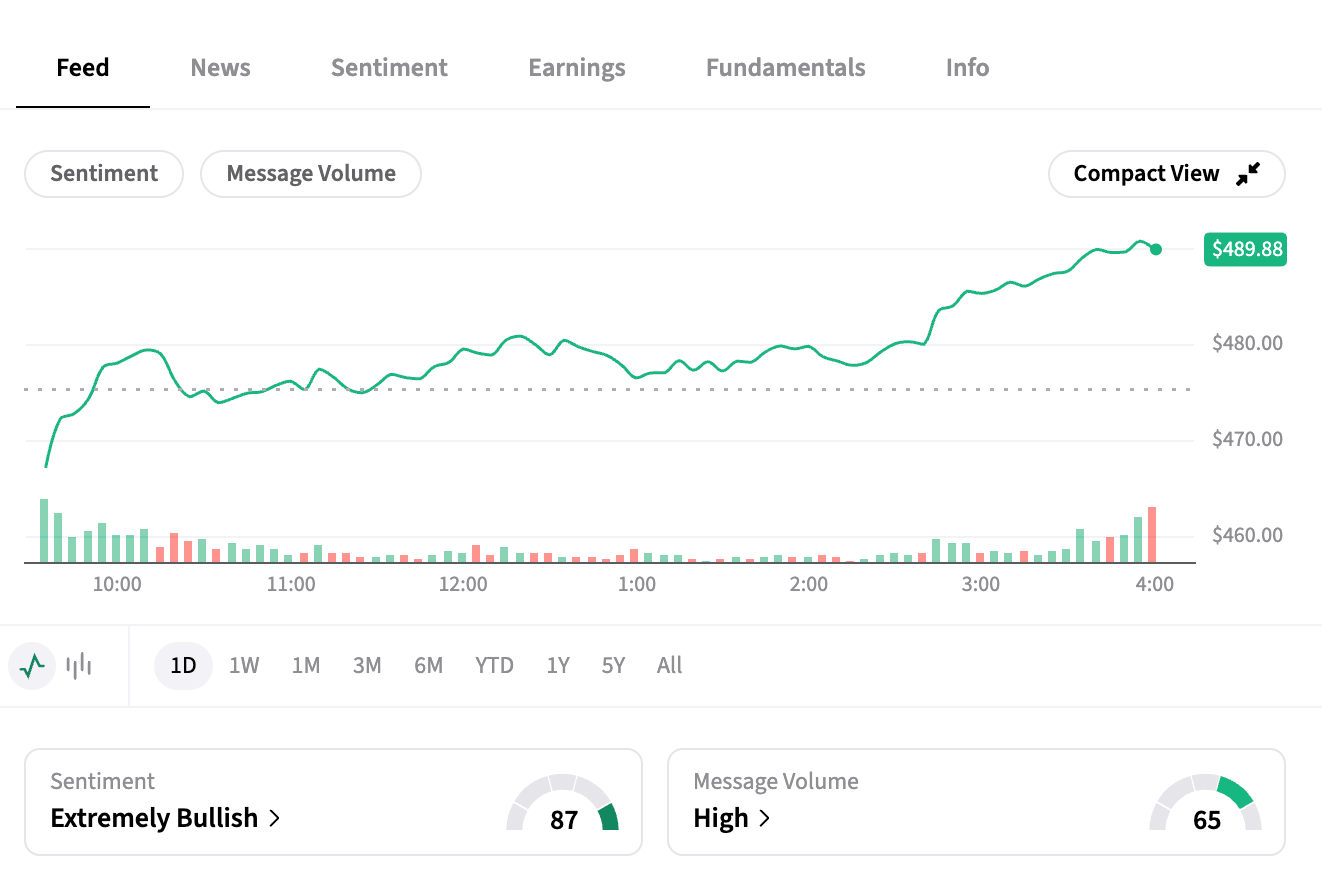

It wasn’t all bad news. Tesla climbed to a fresh all-time high past $489, after someone filmed a Model Y driving on the Austin Highway, with no one in the car. 💀

In non-invading Venezuela White House news, Fed Chair interviews are underway, as the two Kevins are joined by Current Fed Gov Waller, who is set to appear in an interview with Trump on Wednesday.

$SPY ( ▼ 0.27% ) $QQQ ( ▲ 0.2% ) $IWM ( ▼ 0.47% ) $DIA ( ▼ 0.66% )

AFTER THE BELL

Times Are Tough For Homebuilders Too 🏘️

Lennar $LEN ( ▼ 1.8% ) fell after its post-market report, down 4% at the time of writing. It’s a nationwide home builder that reported a challenging quarter for building domiciles in the U.S., painting a picture of weak consumer confidence and a government shutdown that hurt everyone’s feelings.

“Even as market conditions softened, we prioritized providing supply for a healthier housing market, while driving down costs to support affordability,” Co-CEO Stuart Miller said. “We have focused on adapting to a new normal as the market finds its footing.”

Earnings Miss: The adjusted earnings per share of $2.03 fell short of the $2.21 consensus. But worse than that was a contraction in margins.

Contracting Margins: The gross margin on home sales fell significantly, contracting to 17.0% from 22.1% in the year-ago quarter. This indicates the company is using deeper incentives and absorbing higher costs to maintain the sales volume, which cuts directly into profit.

Falling Prices: The average sales price declined 10% year-over-year to $386,000, reflecting the use of incentives and the need to increase housing supply to combat affordability challenges, as noted by Executive Chairman Stuart Miller.

Lennar’s guidance for the first quarter of fiscal 2026 underscored the profit pressure:

Q1 2026 Deliveries: Expected between 17,000 and 18,000 homes.

Lower Average Price: The projected average sales price is expected to fall further to $365,000 to $375,000 (down from $386,000 in Q4).

Worse Margins: The company anticipates Q1 gross margins to drop again to 15% to 16%, signaling that the high cost of incentives and lower prices will continue to squeeze profitability into the new year. 🏚️

SPONSORED

What Most Investors Don’t Realize About Apple’s Newest Must-Have Device

If you own Apple stock or have considered buying it… you need to see this.

Whispers from Silicon Valley suggest Apple is quietly working on something even bigger than the iPhone. It’s a quiet initiative known as Project J595.

Some believe it’s Apple’s leap into robotics, a market projected to grow from $50.8 billion to $24 trillion.

Apple spent $32.5 billion on R&D last year alone, 10X what they spent the year before launching the iPhone.

They’ve filed over 70 robotics patents and are hiring engineers to build “robotic solutions.”

What most people don’t know is there’s a tiny company, 590 times smaller than Apple, that makes the machine vision tech used in Apple’s factories.

This company, already helping over a million machines navigate the world, could be one of the biggest winners as robots become more prevalent.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Tesla Self–Drives To All-Time High: Robotaxi Optimism & €1B European Battery Push

Tesla shares $TSLA ( ▲ 3.07% ) hit a record high on Tuesday, driven by intense optimism surrounding its autonomous driving strategy, especially after confirming significant plans to ramp up battery production.

Robotaxi Catalyst: CEO Elon Musk confirmed over the weekend that the company has begun testing fully autonomous robotaxis with no occupants in the front seat in Austin. Tesla reporter and fan Sawyer Merritt reposted a self-driving Tesla with no one in the cabin on the roads of Austin, a horrifying vision seen even four years ago. 🥴

Analysts at Wedbush believe this pivot could push the company’s market capitalization to $3 trillion by the end of 2026 in a bull case scenario. Dan Ives went on the pump Tesla shares campaign again Monday, telling reporters across media sites that his favorite car company is set to take advantage of the AI fad boom.

Tesla also announced plans to start producing 8 gigawatt hours of battery cells annually at its Gruenheide Gigafactory near Berlin by 2027, Stocktwits reported.

Market Action: Tesla stock closed 3% higher after hitting an all-time high of $489.88, leading retail sentiment on Stocktwits to jump to “extremely bullish.”

DEAL NEWS

WBD Said, ‘That’s All Folks’ To PSKY Daddy Deal

Warner Bros Discovery $WBD ( ▼ 2.73% ) is planning to reject Paramount $PSKY ( ▼ 1.0% ) Skydance’s hostile and giant bag of money-sized bid to buy out the firm, according to Bloomberg reporting late Tuesday. The news sent shares of PSKY slightly lower in the post-market. News also dropped that Jared Kushner, Trump’s law and man who makes deals with everyone, is dropping out of the hostile takeover attempt.

The board took a second to think about the offer and plans to recommend that shareholders say no to the giant bag of money, earmarked by Oracle tech heir and Middle Eastern Oil money. Kushenr’s VC involvement was seen as a plus for ParaSky, with the idea being he could suck up to Ivanka Trump’s daddy to help squeeze the deal past regulators. But his firm said, screw it, it’s Christmas, we’ve all got our hands full with family stuff, why go through all that work?

“With two strong competitors vying to secure the future of this unique American asset, Affinity has decided no longer to pursue the opportunity,” Kushner’s private-equity firm, Affinity Partners, said.

This could be a 4D chess move, but it’s more likely to mean a Netflix mate in 3. WBD stakeholders were also concerned about Paramount’s other deal backers, the Ellisons. Paramount boss David Ellison would have used a revocable trust from his dad’s Oracle $ORCL ( ▲ 2.02% ) tech fortune, and Bloomberg reported the WBD board didn’t want to be anywhere near the term ‘revocable.’

Paramount also took back a $1B financing share it had pledged to Tencent, fearing regulators would draw the line at Chinese tech giant ownership of Bugs Bunny. 🐇

Even Trump himself criticised Paramount Tuesday, saying he was treated badly despite CBS’s recent takeover by the more right-leaning Ellison faction. Finally, remember that WBD already agreed to sell out to Netflix for $27.75/share, or upwards of $83B, so of course it’s telling shareholders to ‘ignore the other date proposals to the Christmas ball.’ 🎅

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

AMC Robotics is generating retail discussion following its AlphaVest merger.

-

Iris Energy stock is down 50% from Nov highs.

-

Dragonfly Energy shares plunged 38% today due to undisclosed reasons in the summary.

-

Tilray stock is climbing again on Trump cannabis order buzz.

-

Michael Burry claims he didn’t know “Roaring Kitty” existed before GameStop squeeze.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

The report is out and Burry missed the big short squeeze on GameStop 👀‼️

Instagram post

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Business Inventories MoM (10:00 AM), Retail Inventories Ex Auto (10:00 AM), Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM), Atlanta Fed GDPNow (12:00 PM). 📊

Pre-Market Earnings: Veru ($VERU), General Mills ($GIS), Spire Global ($SPIR), and Jabil ($JBL). 🌞

After-Market Earnings: Micron Technology ($MU). 🥮

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

😨 Fed’s Bostic: No rate cuts next year

🏠️ Warner Bros. plans to reject Paramount bid on funding, terms

❤️🩹 Speaker Refuses Moderates’ Pleas to Vote on Health Subsidies

📺️ Unemployment rate hit 4-year high in November even as economy added jobs

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍