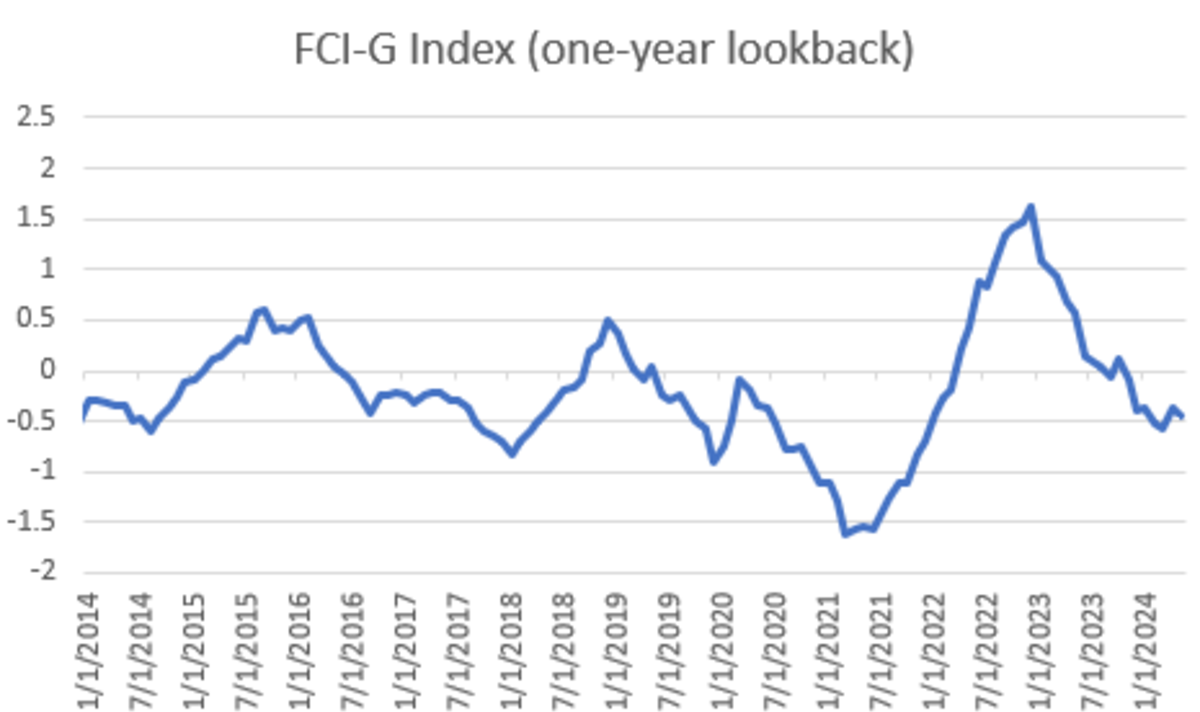

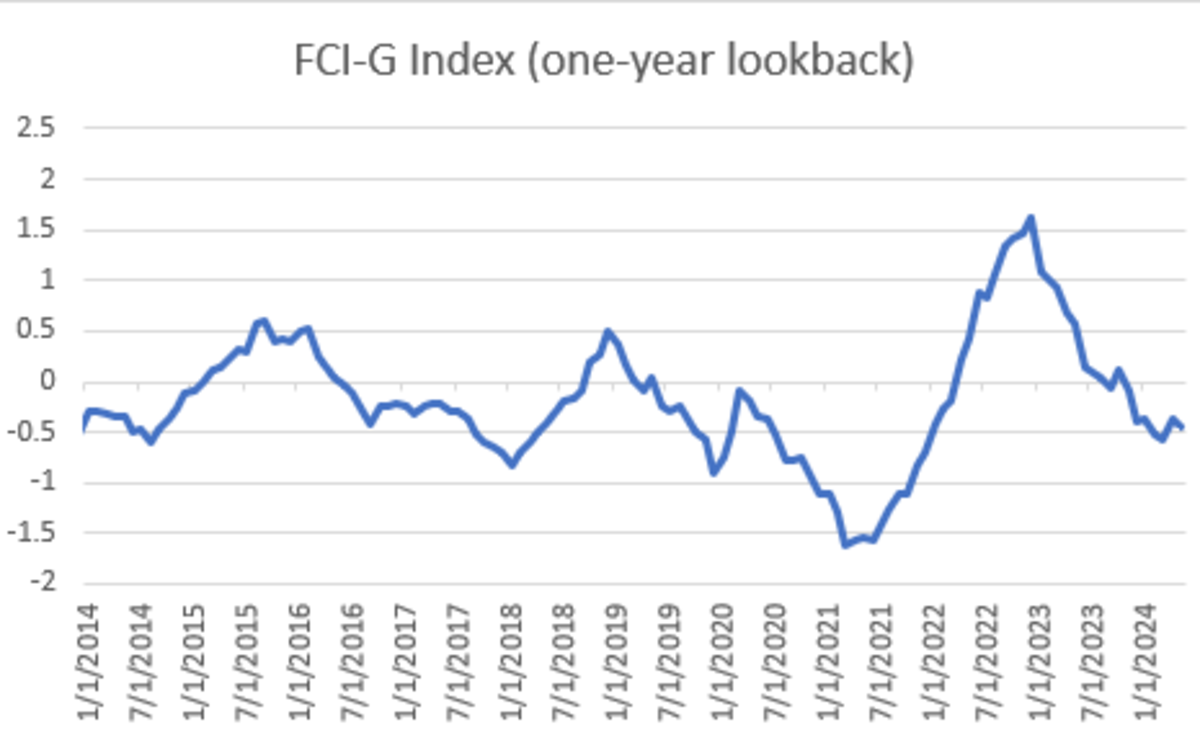

Chart of the Day: Fed's Own Measure of US Financial Conditions Shows Policy Not Restrictive

The Fed has its own new measure of US financial conditions which gets updated on a monthly basis. They refer to it as FCI-G. Here is what they have in their indicator:

“In the spirit of model-based FCIs, the index introduced in this note aggregates changes in seven financial variables—the federal funds rate, the 10-year Treasury yield, the 30-year fixed mortgage rate, the triple-B corporate bond yield, the Dow Jones total stock market index, the Zillow house price index, and the nominal broad dollar index—using weights implied by the FRB/US model and other models in use at the Federal Reserve Board. These models relate households’ spending and businesses’ investment decisions to changes in short- and long-term interest rates, house and equity prices, and the exchange value of the dollar, among other factors.”

“While existing FCIs typically measure whether financial conditions are tight or loose relative to their historical distributions, the new index assesses the extent to which financial conditions pose headwinds or tailwinds to economic activity.”

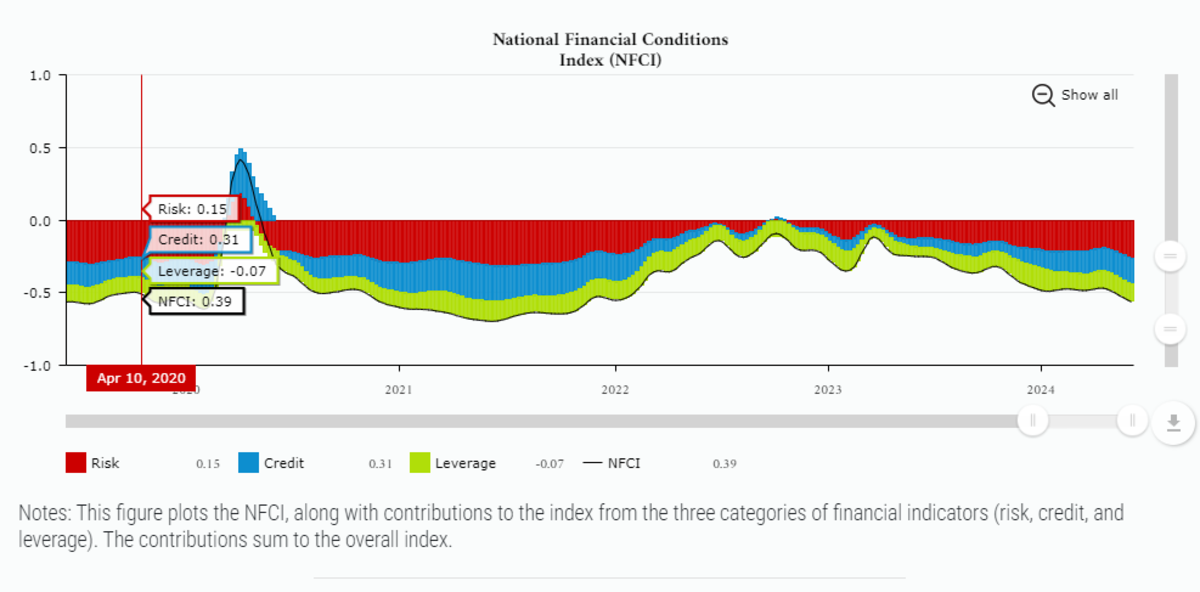

The reading for the month of May is just out and shows another loosening of financial conditions took place in the month of May. Negative figures suggest that financial conditions are tailwinds to GDP growth while positive figures are headwinds to growth. We have been in negative territory every month this year (positive tailwind to GDP growth). Given performance of assets in the month of June so far, conditions are even less restrictive today than they were for the month of May. The Chicago Fed has its own metric of over 100 variables which would confirm the same, as conditions today are looser than they were back before the tightening cycle began.

The Fed keeps saying monetary policy is restrictive enough to return inflation to 2%. They are lying. It is not. While it is the case that current monetary policy is hurting various segments of the economy and more and more every day, current financial conditions are simply too loose to assure a return to the 2% inflation target. Maybe the Fed could start looking at its own numbers to help them out.

For more real-time market color and an idea of how I am trading this, consider subscribing to my paid service where you will get access to the Private Discord Channel where I am communicating with folks throughout the trading day.

Important Disclaimer: This website is for educational purposes only. The Alethea Narrative and its authors are not financial advisors and nothing posted should be considered investment advice. The securities discussed are considered highly risky so do your own due diligence.