Markets Slip Slightly After Fresh Records

CLOSING BELL

Markets Slip Slightly After Fresh Records

The market tried its best to close positively on Friday, but finished just below the mark despite setting fresh records. Overall, it was a successful first week of earnings. Trump signed the GENIUS Act, precipitating a public crypto firm sell-off while ETH climbed.

The market faltered, though, as the President considered higher baseline tariffs on the EU on Friday, up to 20% from the current 10% baseline, according to the Financial Times. Still, Consumer sentiment from the University of Michigan came in at a five-month high in July, and next year inflation expectations fell yet again.

Fed Speak Friday was divided, as Fed Gov Kugler said she wanted to keep rates up for some time, while Gov Waller, a contender for the Powell replacement seat, said he could recommend a cut in two weeks. 👀

Today’s issue covers: QQQ might get cheaper for investors to own, Block gets an S&P 500 spot, and much much more. 📰

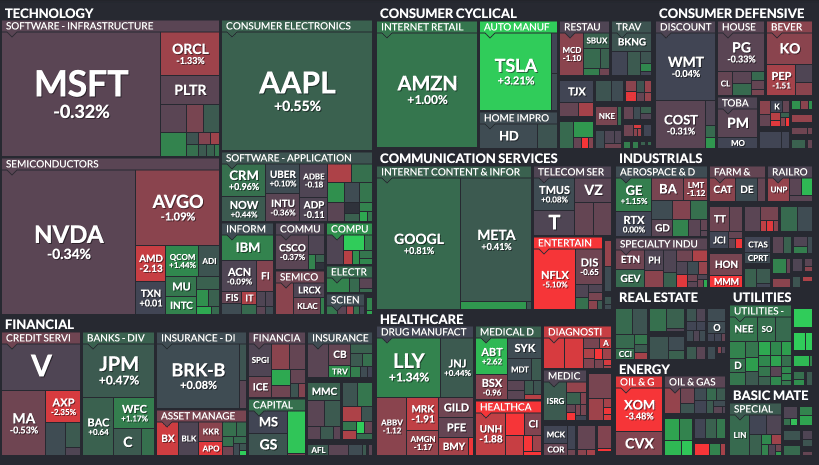

With the final numbers for indexes and the ETFs that track them, 6 of 11 sectors closed green, with utilities $XLU ( ▲ 1.68% ) leading and energy $XLE ( ▼ 0.81% ) lagging.

S&P 500 $SPY ( ▼ 0.07% ) 6,296

Nasdaq 100 $QQQ ( ▼ 0.1% ) 23,065

Russell 2000 $IWM ( ▼ 0.71% ) 2,240

Dow Jones $DIA ( ▼ 0.4% ) 44,342

STOCKS

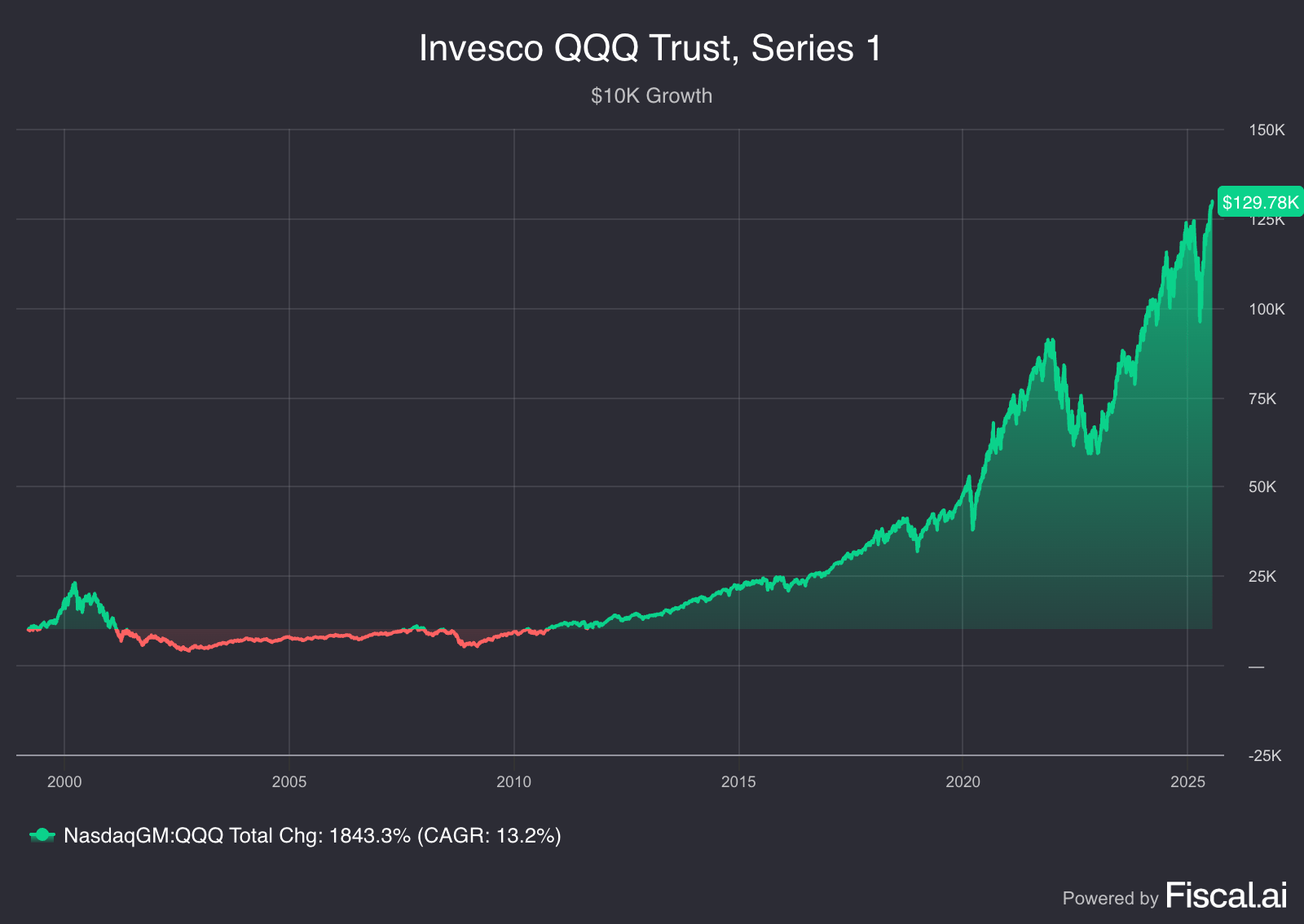

Top Tech Stock Tracking QQQ Might Get Even Cheaper To Own 🤑

Invesco was the highest gainer on the S&P 500, climbing $IVZ ( ▲ 15.28% ) after a move that benefits investors who love its famous QQQ Nasdaq 100 ETF. The firm applied to convert its famous QQQ Trust into an open-ended fund. It would bring the servicing fee lower for investors, and give Invesco the role of appointed investment advisor. Currently, the $700M+ annual fees QQQ racks up with a 0.20% fee go to the Bank of New York Mellon and Nasdaq, while Invesco receives little. 😢

Nasdaq fell slightly on the news. Launched in 1999, the famous QQQ has climbed over 1,200% and has tracked the top-performing stocks on the Nasdaq, typically holding all 100.

If approved by shareholders, the new fee for investors is 18 basis points.

According to Finscal.ai data, $10K invested in QQQ at inception would be a slim $130k today 👀

SPONSORED

$FFAI | Faraday Future Debuts FX Super One EAI-MPV in LA Unveil

Meet the FX Super One, Faraday Future’s all-new first-class EAI-MPV. Built on the FF 91’s DNA, it redefines TechLuxury with advanced AI, bold design, and unmatched performance.

Pre-orders are now open. Reserve yours today for just $100 and become a Co-Creator of the next mobility revolution.

Are you a $FFAI stockholder? Get verified now to unlock exclusive benefits—including up to $3,500 toward your FX Super One* and more.

Act fast – Limited slots available! Your future ride is just a click away.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Disclaimer: This benefit is available to stockholders who hold FFAI stock at the close of business on July 10, 2025 and applies only to the purchase of one (1) new FX Super One vehicle from FFAI by the named individual stockholder redeeming the benefit. Availability and timing of vehicle delivery is not guaranteed. Benefit may not be exchanged for cash. FFAI reserves the right, at its sole discretion, to change, modify or cancel this benefit or any of the terms and conditions at any time without notice. FFAI reserves the sole and exclusive right to interpret and modify the terms at its discretion.

ETF NEWS

New S&P 500 Addition Rumored For Friday, $XYZ ( ▲ 2.96% ) Won

$HOOD ( ▲ 4.07% ) and other contenders for the S&P 500 throne climbed Friday after news that Chevron had completed its acquisition of $HES ( ▲ 0.96% ) to make room for a new name.

Alongside Robinhood, were other fan favorites. CashApps parent $XYZ ( ▲ 2.96% ) ended up winning the position, according to Bloomberg News. The stock climbed 10% in after-hours, while contenteders turned red.

$CVNA ( ▲ 0.41% ), $ARES ( ▼ 0.03% ), $LNG ( ▲ 5.44% ) were all on the short list, meeting S&P Global’s criteria. $APP ( ▲ 0.19% ) could also join, though it sometimes has a love-hate relationship with investors.

$TTD ( ▼ 1.51% ) joined the S&P 500 most recently, trading lower on its first day Friday.

Freshly groomed HOOD Chief Vlad Tenev, appearing at the GENIUS act signing Friday, was not enough to win the new spot

The seat opened up for a heaft $53B purchase. Chevron successfully beat a competing claim that Exxon had a right to bid for Hess assets in Guyana, according to the WSJ.

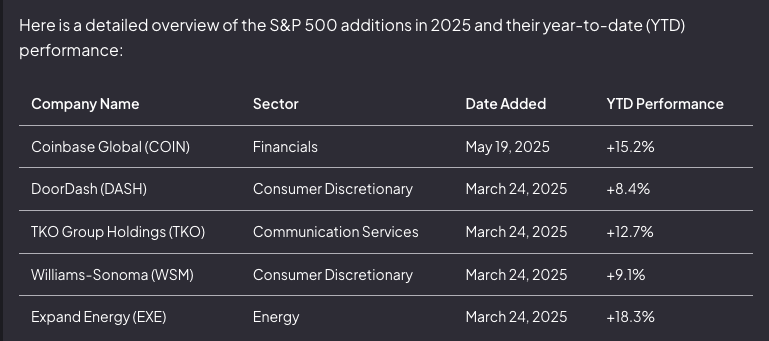

According to fiscal.ai, YTD returns on S&P 500 stocks are pretty great

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → https://event.tixologi.com/event/5863

#Stocktoberfest25

POPS & DROPS

Top Stocktwits News Stories 🗞️

Humana lost a lawsuit over Medicare bonus cuts and fell alongside other insurers. Molina Healthcare, Elevance Health, Centene, and other med stocks also fell after a WSJ report that Obamacare plans would see rate increases next year, upwards of 18%. Read more

The FDA is closely reviewing whether Sarepta’s gene therapy Elevidys should remain on the market, raising questions about efficacy and regulatory oversight. Read more

Stocks versus crypto has retail traders split in a bullish tug-of-war, as sentiment surges across both traditional equities and digital assets. Read more

3M drew support from retail investors after revising its guidance to reflect a reduced impact from Trump’s newly imposed tariffs. Read more

Meta refused to sign the EU’s AI code, calling it an overreach that risks stifling innovation and diverging from global standards. Read more

Interactive Brokers stock gained following a Q2 earnings beat that reflected strong trading volumes and cost efficiency. Read more

Oil prices rose following new EU sanctions on Russian exports and fresh attacks on Iraqi oilfields, intensifying supply-side concerns. Read more

Netflix thrilled retail traders with its Q2 beat and raise for 2025, though some investors remain cautious about long-term momentum. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

WEEKEND RIP JAM SESSION WITH BEN, EMIL & CEM KARSAN: BURNING DOWN THE $VIX ( ▼ 0.67% )

It’s another Weekend Rip Jam Session with Ben, Emil & Cem Karsan! The Summer of George rages on, but is this a blow-off top or just the beginning? Cem Karsan of Kai Volatility joins Ben and Emil for a deep jam session on the pain trade, market structure, vol compression, and hedge fund positioning.

Cem lays out the likely paths ahead, from August volatility to the political timing dance that could shape markets into 2025.

Links That Don’t Suck 🌐

👀 Crypto Market Value Tops $4 Trillion as Stablecoin Bill Passes

📺️ AI mania is worse than 1999’s tech bubble, Apollo’s top economist warns

😨 Trump Aims Tariff Double Whammy at Industries, Nations by Aug. 1

🏠️ Waller makes strongest call yet for rate cut in July, underscoring Fed divide

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋