MOVE-ing On Up For the QRA

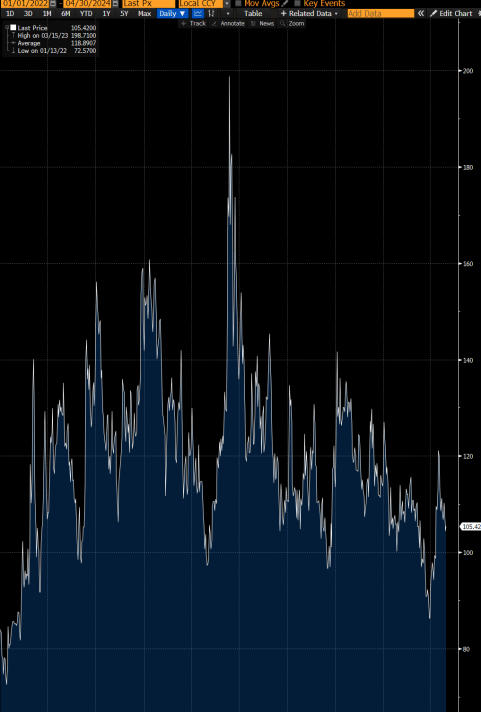

As we head into part 2 of the Treasury Quarterly Refunding Announcement tomorrow, I thought it may be interesting to look at the level of volatility that existed in the UST market heading into the event over the last 2 years.

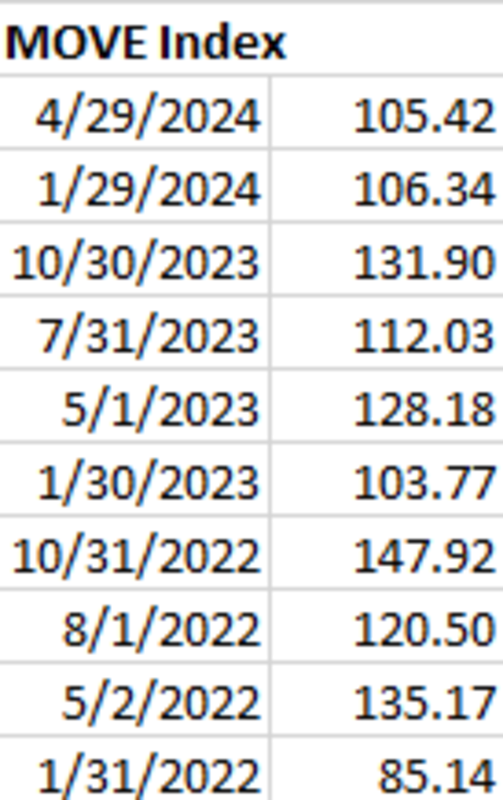

Below is a table of what the MOVE Index looked like on the close of business on the Monday that Treasury gave Part 1 of its QRA announcement which gives total borrowing expectations for current quarter and next quarter as well as closing levels for the TGA in both periods.

As we head into tomorrow, you can see how the MOVE index is at the low end of the range that has existed in the UST markets since the Fed started to reduce the size of its balance sheet via QT in 1Q22. The shrinking of the Fed’s balance sheet did move the range up of rates volatility from what we had been seeing prior to 2022 as liquidity has been withdrawn from the system.

I think there are folks who believe that Yellen tomorrow will deliver a dovish message on duration issuance (less notes/bonds, more bills) for a variety of reasons which center around politics and getting Biden re-elected, but if we are looking for elevated rates volatility as a precursor for dovish actions, we are not going to find that those conditions exist for tomorrow. This is very different from the setups in both October 2023 and October 2022 when Yellen (and the Fed) delivered dovish pivots about the outlook for future liquidity.

Heading into tomorrow, with the MOVE index at the low end of a two year range, it just doesn’t seem like an appropriate time for the Treasury or the Fed to be looking to sell volatility, if the result is just going to be a further loosening of financial conditions, a resurgence of animal spirits, an unanchoring of inflation expectations and a continuation of inflation running abovet target.

Janet and Jerry need to stay the course, allow markets to continue tightening financial conditions to assist the return of inflation back down to 2%. This is the way.

Source: Bloomberg