Two Days Of Green Has Me Feeling Like I Won The Lottery, But Lost The Ticket 😶

OVERVIEW

Two Days Of Green Has Me Feeling Like I Won The Lottery, But Lost The Ticket 😶

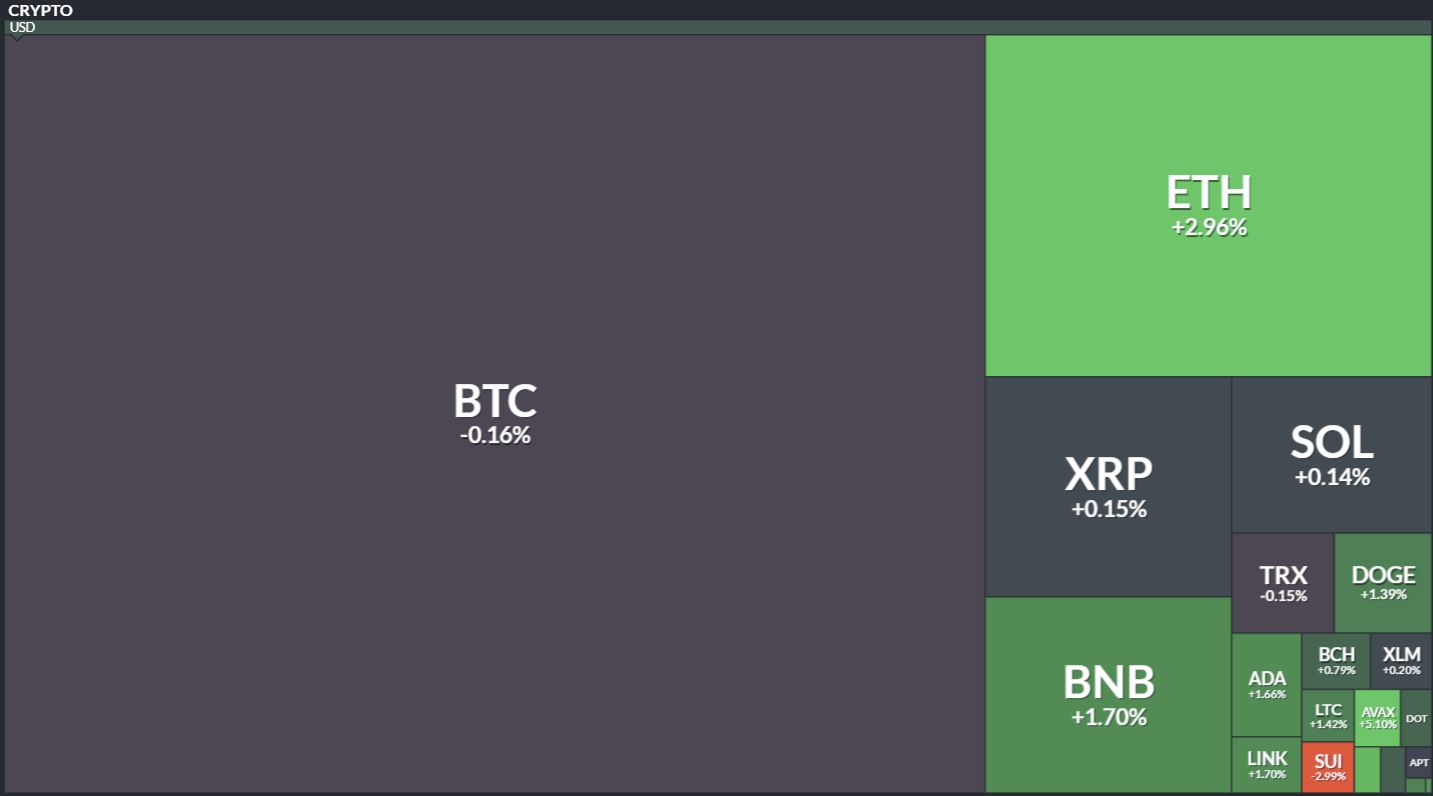

Before we dive in, here’s today’s crypto market heatmap:

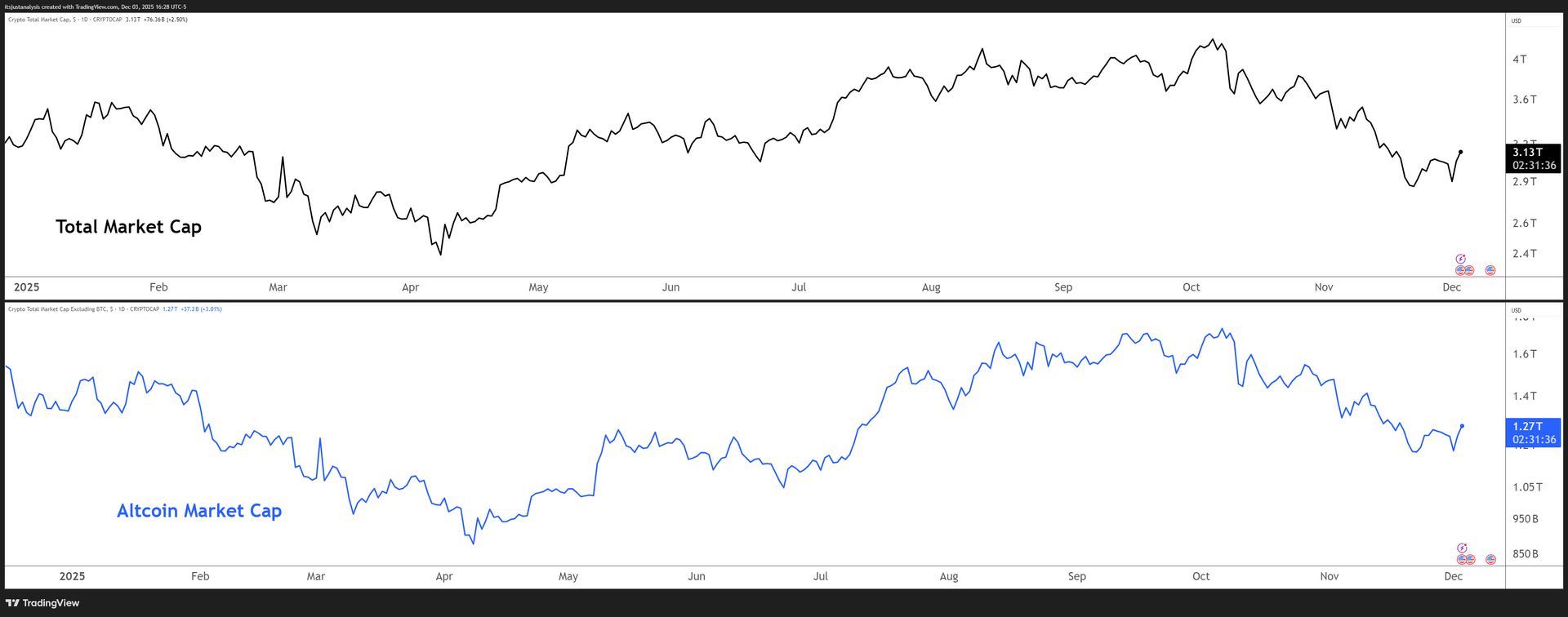

And here’s a look at crypto’s total market and altcoin market cap charts:

RWA TOKENIZATION

ETHZilla Tokenizes Auto Loans Because 2008 Wasn’t Enough 🚗

I see nothing bad happening here. Subprime debt meets blockchain.. 😐️

$ETHZ ( ▲ 6.49% ) just dropped $10 million ($3M cash, $7M in stock) for a 20% stake in Karus, an AI platform for auto loan underwriting. The plan? Tokenize AI-modeled, risk-adjusted auto loans and sell them on-chain.

Let’s break down this absolutely bulletproof strategy:

-

Take one of the worst-performing asset classes in consumer credit (auto loans)

-

Add AI models trained on historical data that may or may not predict future defaults

-

Tokenize them on a blockchain

-

Sell them as “transparent, on-chain securitization” to institutional investors

Karus claims their AI analyzes 1,000+ variables across credit, vehicle, and macro data, trained on 20 million historical auto loan outcomes. They’ve processed $5 billion in volume. They say tokenization will enable “highly predictive borrower and collateral risk segmentation” with “institutional-grade risk forecasting.”

The press release says for every $100M deployed, ETHZilla expects $9-12M in adjusted EBITDA. That’s a 9-12% margin on what is essentially securitized auto debt – an asset class notorious for high default rates, especially in economic downturns.

ETHZilla also gets access to Karus’s network of 20,000+ car dealerships, credit unions, and banks as “potential portfolios for tokenization.” In other words, loan originators who want to offload risk by securitizing questionable debt and selling it to yield-hungry crypto investors.

The tokenized portfolios will trade exclusively on Liquidity.io (ETHZilla owns 15% of its parent company). First launch expected early 2026. 🤔

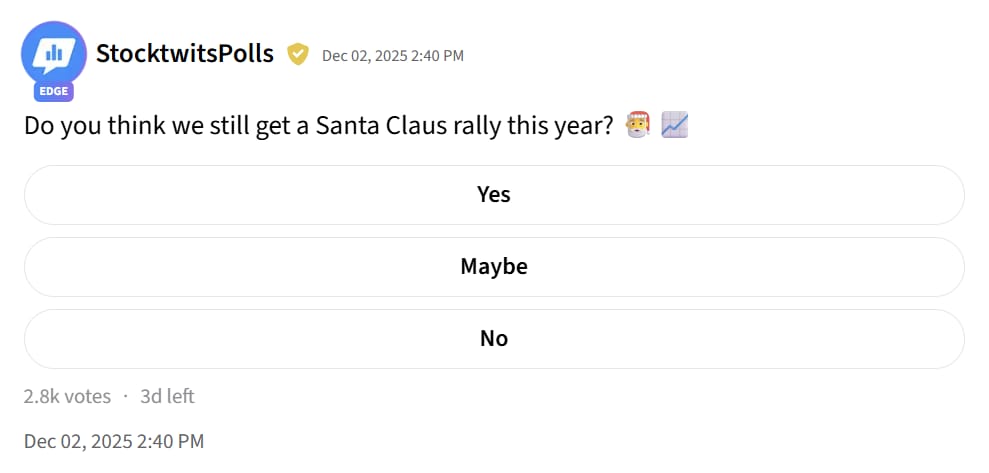

POLL

Santa Rally This Year? 🎅

Take this poll, then tell us what you think. 👇️

STABLECOINS

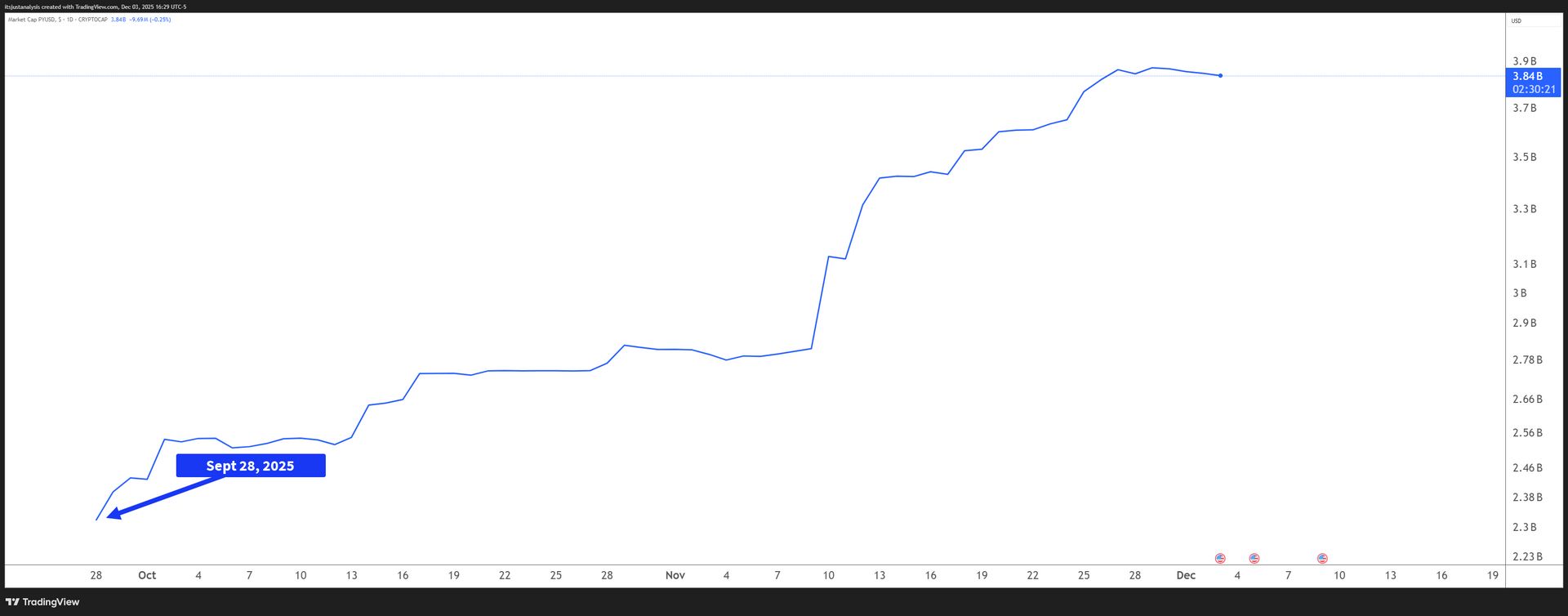

PayPal’s PYUSD Triples to $3.8B: Small but Growing Fast 💸

Not quite $USDT.X ( ▼ 0.02% ) territory, but that’s one hell of a Q4 run. 🏃

$PYPL ( ▼ 2.64% )’s PYUSD stablecoin has tripled its market cap from $1.2 billion in early Fall to $3.8 billion now, according to DeFiLlama data. That 36% monthly increase pushed it to the sixth-largest stablecoin by circulation.

-

$USDT.X ( ▼ 0.02% ) sits around $140 billion

-

$USDC.X ( ▼ 0.0% ) is north of $40 billion

-

$USDS.X ( ▼ 0.42% ) (formerly DAI) and $FDUSD.X ( ▲ 0.02% ) are both above $5 billion.

At $3.8B, $PYUSD.X ( ▲ 0.02% ) is still a rounding error compared to the big two. But tripling in three months? Big win.

The growth makes sense when you consider the starting advantages. PYUSD didn’t launch from zero like most stablecoins. It came pre-loaded with PayPal’s global brand recognition and existing user base.

As PayPal integrates PYUSD deeper into its Web3 features, payment tools, and user-facing products, the token gets built-in distribution that no startup could replicate.

The DeFi integration is the other growth engine. Lending protocols, liquidity pools, and DEX markets are adding PYUSD support, giving it utility beyond simple payments. That’s critica – —stablecoins that only work inside one ecosystem tend to stall. PYUSD is becoming tradable and usable across on-chain markets, which creates legitimate demand.

$3.8 billion isn’t USDT. But it’s real growth in a market that’s notoriously hard to break into. Anyone see if there’s a Polymarket spread on whether PYUSD hits top 5 in market cap for 2026? Top 3? 🔢

NEWS

Another Biotech Reverse-Merges Into Crypto: Hyperliquid Edition ◀️

Sonnet BioTherapeutics becomes Hyperliquid Strategies. Ticker: PURR. Yes, really. 😺

$SONN ( ▼ 59.36% ) just completed a reverse merger to become Hyperliquid Strategies Inc (ticker: PURR), a “$HYPE.X ( ▲ 8.09% ) digital asset treasury reserve company” focused on the Hyperliquid blockchain. Trading began today.

Hyperliquid itself is a high-performance decentralized exchange for perpetual futures and spot trading, processing billions in daily volume with hundreds of thousands of users.

It’s where the famous/infamous trader James-Wynn makes, losses, makes again, losses again, his millions.

And a place where luck SOBs like this guy turn $12 (yes, just twelve bucks) into $30,000.

Twitter tweet

Let’s see if this DAT turns out to be trash like all the other DATs. 🤦

NEWS

Stonkmarket News 📰

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💸 Saga Dollar + x402 Makes AI Agents Actually Pay Their Own Bills

This could be one of the missing payment primitives for the machine economy – and it’s finally real. The x402 standard activates the long-ignored HTTP 402 code and lets AI agents send instant on-chain microtransactions at web speed using Saga Dollar. Agents can now buy data, pay APIs, transact globally, and basically operate like autonomous economic organisms. Saga.

🔒 Verifiable AI Agents Are Coming, And DeXe Wants Proof for Every Decision

AI that can prove it didn’t go all Cylon on us – not a bad idea. DeXe outlines a “trust-native” AI stack where agents identify themselves, commit to policies, sign every action, and anchor proofs to verifiable ledgers. It replaces “just trust the model” with cryptographic accountability that regulators, DAOs, and enterprises can all audit. DeXe.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💳 Uniswap + Revolut Makes Buying Crypto Feel Like… Normal Finance?

This is how DeFi wins: by removing the five-click purgatory every newcomer hates. Uniswap integrated Revolut so 65M users can go from fiat to ETH, USDC, and POL in a couple taps without switching apps or dealing with new KYC. Zero fees from Revolut Pay, dozens of supported currencies, and direct delivery into your wallet makes on-ramping finally feel less like a chore and more like onboarding. Uniswap.

🌀 ZRO Buybacks Tie LayerZero Directly to Stargate Revenue Like a Real Business

LayerZero is buying ZRO every month using Stargate fees, creating an actual revenue-backed operation instead of a vibes token economy. For now, 50% of Stargate fees go to buybacks; after the transition period, it jumps to 100%, making ZRO stakers the direct beneficiaries of cross-chain liquidity demand. LayerZero.

⚙️ Injective’s DeFi Stack Turns Into a Full Financial Super-App Ecosystem

This might be the closest thing crypto has to a full-stack, production-grade Wall Street built entirely onchain. Injective now has everything: orderbook DEXs for real equities, meta-routers, LSTFi hubs, isolated lending markets, omnichain liquidity engines, option yield vaults, and even tokenized emerging-market bonds. Every app plugs into Injective’s zero-gas, ultra-fast MultiVM architecture like it’s financial Legos on steroids. Injective Protocol.

NEWS IN THREE SENTENCES

Protocol News 🏦

🪫 Reactivate Keeps Reactive Contracts Alive So Your dApps Stop Randomly Dying

Reactive wants you to know their the DevOps team you wish you had, except it never sleeps, never misses alerts, and costs less than one production outage. Reactive Contracts burn through funds like a bad weekend in Vegas, and when balances hit zero, everything stops – logic, integrations, the whole app. Reactivate babysits your contracts, monitors thresholds, refills balances, clears debt, and resurrects anything that goes dark before your users even notice. Reactive Network.

💧 Curve’s November Recap: Liquidation Zen, Monad Launch, and crvUSD Going Parabolic

Curve spent November flexing: deeper liquidation protection, stUSDS pool corrections, and YieldBasis leverage routes that make BTC markets actually usable. Curve’s Emergency DAO got more power, crvUSD volume ripped to new highs, and Curve deployed on Monad to bring high-performance stables to a low-latency chain. Oh, and Curve joined the Ethereum Protocol Advocacy Alliance to help keep L1 neutral and sane. Curve Finance.

LINKS

Links That Don’t Suck 🔗

🎰 Polymarket opens US app to waitlisted users after CFTC green light

🚓 DOJ Seizes Burma Crypto Scam Domain After Victims Lost Millions in Fake Trading Scheme

🌍️ WLF to launch real-world asset products in January, co-founder says

🥈 Silver Extends Blistering Rally With Yet Another Record High

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋